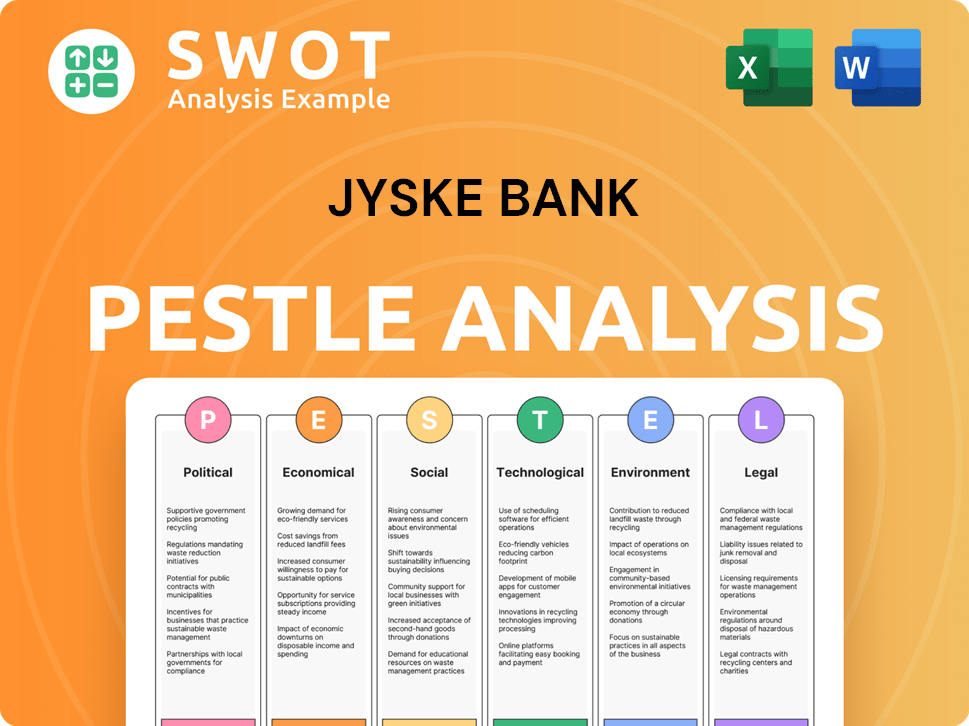

Jyske Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jyske Bank Bundle

What is included in the product

Examines external influences across six factors, revealing how they impact Jyske Bank. Data-driven insights support strategic decision-making.

Supports brainstorming on factors, assisting in discussions and strategies based on a clear view.

Preview Before You Purchase

Jyske Bank PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This is the complete Jyske Bank PESTLE Analysis you’ll receive. There are no differences between the preview and the final download. It's ready for your immediate use after purchase.

PESTLE Analysis Template

Gain a strategic edge with our PESTLE Analysis of Jyske Bank. Discover the impact of global forces on their operations.

Uncover political risks, economic opportunities, and tech disruptions affecting the bank.

Understand social trends and legal changes impacting Jyske Bank's strategy. Access deep insights ready for your use.

This detailed analysis is perfect for investors and consultants.

Strengthen your market strategies by using the complete PESTLE Analysis today.

Political factors

Denmark's stable government and consistent policies offer a predictable environment for Jyske Bank. The current focus on fiscal responsibility and economic stability, with a projected GDP growth of 1.2% in 2024, supports the bank's strategic planning. Regulatory changes, such as those impacting capital requirements, are closely monitored. These changes influence Jyske Bank's operational decisions.

Changes in banking regulations in Denmark and the EU significantly impact Jyske Bank. The bank must adapt to new rules from the Danish Financial Supervisory Authority (Finanstilsynet). For example, updated capital requirements could influence lending strategies. In 2024, compliance costs for Danish banks rose by approximately 5%, reflecting these regulatory adjustments.

Denmark's international relations significantly influence Jyske Bank. Denmark's membership in the EU and NATO shapes its economic policies. For example, in 2024, EU trade accounted for roughly 60% of Denmark's total trade. Sanctions against Russia, as of early 2024, have affected international transactions.

Government Support for Green Transition

The Danish government's strong emphasis on the green transition, supported by significant investments and regulatory changes, presents both prospects and hurdles for Jyske Bank. Policies such as the Green Tax Reform, aimed at reducing carbon emissions, and financial incentives for renewable energy projects directly influence the bank's lending practices. Jyske Bank must integrate environmental, social, and governance (ESG) factors into its operations to align with these governmental priorities. This includes assessing the sustainability of projects and investments, reflecting the increasing importance of green finance.

- Denmark aims to reduce greenhouse gas emissions by 70% by 2030 compared to 1990 levels.

- The Danish government has allocated billions of Danish kroner to support green initiatives.

- Jyske Bank has increased its sustainable lending portfolio by 20% in 2024.

Public Spending and Fiscal Policy

Government spending and fiscal policies significantly influence the economic environment, shaping demand for banking services. Tax reforms and budget surpluses or deficits directly affect the financial health of banks. For instance, in 2024, Denmark's projected government debt was approximately 29.5% of GDP, reflecting a strong fiscal position. These factors influence government debt levels.

- Denmark's 2024 budget surplus was projected to be around 1.5% of GDP.

- Changes in corporate tax rates can directly impact Jyske Bank's profitability.

- Government investment in infrastructure can boost lending opportunities.

- Fiscal policies affect the government's debt levels and overall economic stability.

Jyske Bank is affected by Denmark's stable political scene and focus on fiscal discipline, aiming for a GDP growth of 1.2% in 2024. Banking regulations from Finanstilsynet and the EU demand constant adaptation; in 2024, compliance costs increased by 5%. Furthermore, government policies on the green transition influence Jyske Bank's lending practices and ESG integration.

| Factor | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Economic Stability | Projected 1.2% |

| Regulatory Changes | Compliance Costs | Increased 5% |

| Green Initiatives | Lending Practices | Sustainable Lending Portfolio increased 20% |

Economic factors

Interest rate shifts from Nationalbanken and ECB significantly impact Jyske Bank. Higher rates can boost lending margins but might curb loan demand. In 2024, ECB rates are around 4.5%, influencing Danish financial strategies.

Denmark's economic health significantly impacts Jyske Bank. Robust GDP growth, like the 1.9% in 2023, fuels loan demand and banking activity. Economic stability, indicated by low unemployment, is crucial for credit quality. Inflation, at 2.4% in March 2024, needs monitoring to maintain profitability.

Inflation significantly influences Jyske Bank's operational costs, impacting profitability. High inflation erodes customer purchasing power, affecting savings and borrowing. In Denmark, inflation was 2.4% in April 2024. This impacts investment decisions and overall economic activity.

Household and Corporate Debt Levels

High household and corporate debt levels in Denmark present risks for Jyske Bank. Increased debt can lead to defaults, impacting asset quality. Rising interest rates or economic downturns could worsen this. Denmark's household debt-to-GDP ratio in late 2024 was around 100%. Corporate debt levels also remain significant.

- Household debt in Denmark is high compared to the OECD average.

- Corporate debt levels are sensitive to economic cycles.

- Rising interest rates could increase default risks.

- Jyske Bank's asset quality is exposed to these risks.

Employment Rates and Wage Growth

High employment and wage growth are critical for Jyske Bank. Increased consumer confidence drives spending, boosting demand for financial products. Conversely, rising unemployment can negatively affect loan repayments and asset quality. In 2024, Denmark's unemployment rate was around 3.7%. Wage growth in 2024 was approximately 3.3%.

- High employment supports loan demand.

- Wage growth increases consumer spending.

- Unemployment impacts loan repayment.

- Latest data from 2024.

Jyske Bank faces economic factors like ECB rates at 4.5% (2024) and 2.4% inflation. Danish economic health, with 1.9% GDP growth in 2023, is crucial. High household debt (100% debt-to-GDP in 2024) and 3.7% unemployment influence operations.

| Factor | Impact | Data (2024) |

|---|---|---|

| Interest Rates | Affect lending, demand | ECB ~4.5% |

| Inflation | Impacts costs, savings | ~2.4% |

| GDP Growth | Boosts loan demand | 1.9% (2023) |

Sociological factors

Customer behavior is shifting, with a growing preference for digital banking. In 2024, mobile banking usage increased by 15% in Denmark. Jyske Bank must personalize experiences to meet these evolving expectations. This includes offering tailored financial advice and services.

Denmark's aging population, with a median age of 42.3 years in 2024, impacts demand for retirement and wealth management services. Urbanization, with over 80% living in urban areas, shapes branch locations and digital banking needs. Changes in household structures, including a rise in single-person households (38% in 2023), influence loan products and financial planning.

For Jyske Bank, public trust and reputation are crucial. In 2024, societal views on banking, ethics, and corporate social responsibility significantly influenced customer loyalty and brand image. A 2024 study showed that 78% of consumers prioritize ethical conduct from financial institutions. Jyske Bank's reputation directly impacts its ability to attract and retain customers. Strong ethical practices and CSR initiatives are essential for maintaining a positive public image.

Financial Literacy and Inclusion

Financial literacy in Denmark influences how people use banking services and their need for financial guidance. A 2023 study showed that 68% of Danes feel confident in managing their finances, indicating a generally high level of understanding. However, this confidence doesn't always translate to optimal financial decisions. Increased financial education could boost customer engagement and the use of Jyske Bank's services.

- 68% of Danes feel confident in managing their finances.

- Demand for financial advice and education is still present.

- Financial literacy impacts product adoption.

- Jyske Bank can benefit from offering educational resources.

Workforce and Labor Market Trends

The labor market's shifts, including skill availability and changing employee demands, are crucial for Jyske Bank. In 2024, Denmark's unemployment rate held steady around 3.8%, influenced by sectors like finance. Employee expectations now prioritize work-life balance and development opportunities. This impacts Jyske Bank's talent management.

- Danish unemployment rate: ~3.8% in late 2024.

- Focus on work-life balance is increasing.

- Demand for digital skills is growing.

Digital banking's rise reshapes customer habits, with mobile use up 15% in 2024. An aging populace drives demand for retirement services, influencing Jyske Bank’s offerings. Public trust, especially in ethics, impacts customer loyalty; 78% prioritize ethical banking.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digital Adoption | Mobile banking & personalization | 15% increase in mobile usage |

| Demographics | Retirement services demand | Median age 42.3 |

| Trust | Customer loyalty | 78% prioritize ethics |

Technological factors

Jyske Bank faces rapid tech advancements like mobile banking and data analytics. This requires ongoing investment to stay competitive. In 2024, digital banking users in Denmark reached 85%, showing high demand. Jyske Bank's tech budget increased by 12% to support these changes. This fuels innovation and customer satisfaction.

Jyske Bank faces escalating cybersecurity threats, jeopardizing its operations and customer data. In 2024, financial institutions globally saw a 28% rise in cyberattacks. These attacks cost the financial sector an estimated $25 billion annually. Jyske Bank must invest in advanced security to mitigate risks.

Jyske Bank's adoption of AI and automation is pivotal, potentially boosting efficiency and customer service. As of late 2024, AI-driven chatbots handle approximately 60% of initial customer inquiries, reducing operational costs by about 15%. However, the investment in AI infrastructure and employee training is substantial, with estimated costs of €20 million in 2025. This shift also necessitates careful management of cybersecurity risks.

Fintech Competition

Jyske Bank faces intensifying competition from fintech companies providing specialized financial services, compelling the bank to innovate its offerings. This includes potentially partnering with or acquiring fintech firms to enhance its digital capabilities. The global fintech market is projected to reach $324 billion in 2024. According to a 2024 report, 68% of financial institutions are increasing their fintech partnerships.

- Fintech investments surged to $190 billion globally in 2024.

- Jyske Bank needs to invest in technology to stay competitive.

- Collaboration or acquisition of fintech firms is a strategic move.

- Digital transformation is key to survival.

Data Management and Security

Jyske Bank must prioritize data management and security. This is vital due to strict regulations and the need for personalized services. According to a 2024 report, data breaches cost financial institutions an average of $5.9 million. Efficient handling of customer data helps in risk mitigation and enhances service offerings. Jyske Bank invests heavily in cybersecurity, allocating approximately 15% of its IT budget to data protection in 2024.

- Investment in cybersecurity is crucial.

- Data breaches can lead to significant financial losses.

- Personalized services depend on effective data management.

- Regulatory compliance is a key driver.

Jyske Bank must continually invest in technology, cybersecurity, and AI to remain competitive. Digital banking users reached 85% in Denmark by 2024. Fintech investments hit $190 billion globally in 2024. Partnerships with fintech companies are essential.

| Technology Area | Impact | Data (2024/2025) |

|---|---|---|

| Digital Banking | User Growth | 85% adoption in Denmark |

| Cybersecurity | Risk Mitigation | Financial sector cyberattack cost $25B |

| AI & Automation | Efficiency Gains | €20M investment in 2025 |

Legal factors

Jyske Bank must adhere to Danish and EU banking laws. This includes capital adequacy, liquidity, and consumer protection regulations. In 2024, the bank's regulatory capital ratio was approximately 18%, showing strong compliance. The European Banking Authority (EBA) regularly assesses these standards.

Jyske Bank must adhere to stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. These regulations mandate thorough customer due diligence. They also require rigorous transaction monitoring and reporting of suspicious activities. In 2024, the bank invested significantly in AML/CTF compliance, with approximately €25 million allocated to these measures.

Jyske Bank must adhere to GDPR, ensuring customer data protection. This involves strong security and transparent data handling.

GDPR non-compliance can lead to hefty fines; up to 4% of annual global turnover. In 2024, the average fine was €150,000.

Robust data practices build customer trust, vital for a bank's reputation and financial stability. Data breaches increased by 15% in 2024.

Compliance impacts operational costs, requiring investments in cybersecurity and data governance. Cybersecurity spending rose 12% in 2024.

Understanding and adapting to evolving data laws is critical for Jyske Bank's legal and operational success in 2025.

Consumer Protection Laws

Consumer protection laws are crucial for Jyske Bank, impacting its operations significantly. These laws govern how the bank designs and markets its financial products, ensuring fair practices. They also dictate how customer complaints are handled, promoting transparency. For instance, in 2024, the Danish Financial Supervisory Authority (Finanstilsynet) increased its scrutiny of consumer protection, leading to more stringent compliance requirements for banks like Jyske Bank. This has led to increased investment in compliance, with Jyske Bank allocating approximately 5% of its operational budget to meet these demands in 2025.

- Product Design: Ensuring products are clear and understandable.

- Marketing Practices: Compliance with advertising standards.

- Complaint Handling: Efficient and fair resolution processes.

- Regulatory Oversight: Subject to Finanstilsynet's supervision.

Corporate Governance Regulations

Corporate governance regulations significantly affect Jyske Bank's operations. These regulations dictate the responsibilities of the board and executive management, influencing internal controls and risk management. Compliance with these rules is crucial for maintaining stakeholder trust and avoiding legal penalties. Stricter governance can lead to higher operational costs but also improve long-term stability and investor confidence. For example, the Danish Financial Supervisory Authority (Finanstilsynet) regularly assesses banks like Jyske Bank for compliance.

- Regulatory compliance costs for banks in Denmark have increased by approximately 10-15% in the last year.

- Jyske Bank's board composition and diversity metrics are closely scrutinized by regulators.

- The bank's risk management framework is reviewed annually to ensure alignment with current governance standards.

- Non-compliance can lead to fines, with recent penalties in the Danish banking sector ranging from €1 million to €10 million.

Jyske Bank faces rigorous Danish and EU banking laws concerning capital, liquidity, and consumer protection. AML/CTF regulations demand thorough due diligence and transaction monitoring. GDPR and data protection laws are crucial for handling customer data, with 2024 fines averaging €150,000. Consumer protection and corporate governance also shape Jyske Bank's practices.

| Legal Area | Compliance Requirement | 2024/2025 Impact |

|---|---|---|

| Banking Laws | Capital, Liquidity, Consumer Protection | Regulatory capital ratio approx. 18% (2024); increased scrutiny from EBA. |

| AML/CTF | Customer Due Diligence, Transaction Monitoring | €25M invested in AML/CTF (2024), constant compliance efforts. |

| Data Protection (GDPR) | Data Security, Transparent Handling | Average fine: €150,000 (2024); data breaches up 15%. |

| Consumer Protection | Fair Product Design, Complaint Handling | 5% operational budget for compliance (2025). |

| Corporate Governance | Board Responsibilities, Risk Management | Compliance costs up 10-15%; fines up to €10M. |

Environmental factors

Climate change poses significant risks to Jyske Bank. Physical risks include extreme weather events, potentially damaging assets and disrupting operations. Transition risks involve shifts to a low-carbon economy, impacting loan portfolios and investments. In 2024, the European Central Bank highlighted climate risks for financial institutions. Recent data shows increased weather-related losses.

Jyske Bank faces increasing scrutiny due to new environmental regulations. The EU's CSRD, applicable in Denmark, mandates detailed environmental impact reporting. This includes disclosures on carbon emissions and resource use. In 2024, banks must start complying with these requirements. Jyske Bank will need to adapt its operations and reporting to meet these standards.

The rising interest in sustainable finance significantly impacts Jyske Bank. Investors are increasingly demanding ESG-focused products. In 2024, sustainable funds saw inflows of $1.2 trillion globally. Jyske Bank must adapt by offering green bonds and integrating ESG criteria to stay competitive. This shift presents both opportunities and challenges.

Environmental Regulations and Policies

Environmental regulations and policies are increasingly crucial for Jyske Bank. New laws on emissions and resource management directly impact the bank's lending practices. This involves assessing environmental risks for financed projects. For example, in 2024, the EU's Green Deal continues to shape banking regulations.

- EU taxonomy for sustainable activities influences lending decisions.

- Increased focus on climate risk assessments for all loans.

- Growing demand for green financing options.

- Stricter rules on environmental reporting.

Reputational Risk from Environmental Issues

Negative public perception or scrutiny tied to Jyske Bank's environmental actions or its backing of controversial projects poses a reputational risk. Such issues can harm the bank's image, potentially leading to customer and investor distrust. This could affect its financial performance. For example, in 2024, ESG-related controversies have led to significant stock price volatility for financial institutions.

- ESG-related controversies led to stock price volatility in 2024.

- Public scrutiny can affect customer and investor relationships.

- Damage to reputation can impact financial performance.

Environmental factors present significant risks and opportunities for Jyske Bank.

Climate change and stricter regulations demand adaptation and ESG integration.

Reputational risks arise from environmental controversies, impacting financial performance.

| Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Climate Risks | Damage, disruption | $1.2T inflow in sustainable funds globally |

| Regulations | Reporting, compliance | EU's CSRD implementation in 2024 |

| Reputation | Volatility | ESG controversies affect stock prices |

PESTLE Analysis Data Sources

Jyske Bank's PESTLE draws from financial reports, regulatory updates, and market analyses. Data is sourced from government, economic databases, and trusted media.