Kajima SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kajima Bundle

What is included in the product

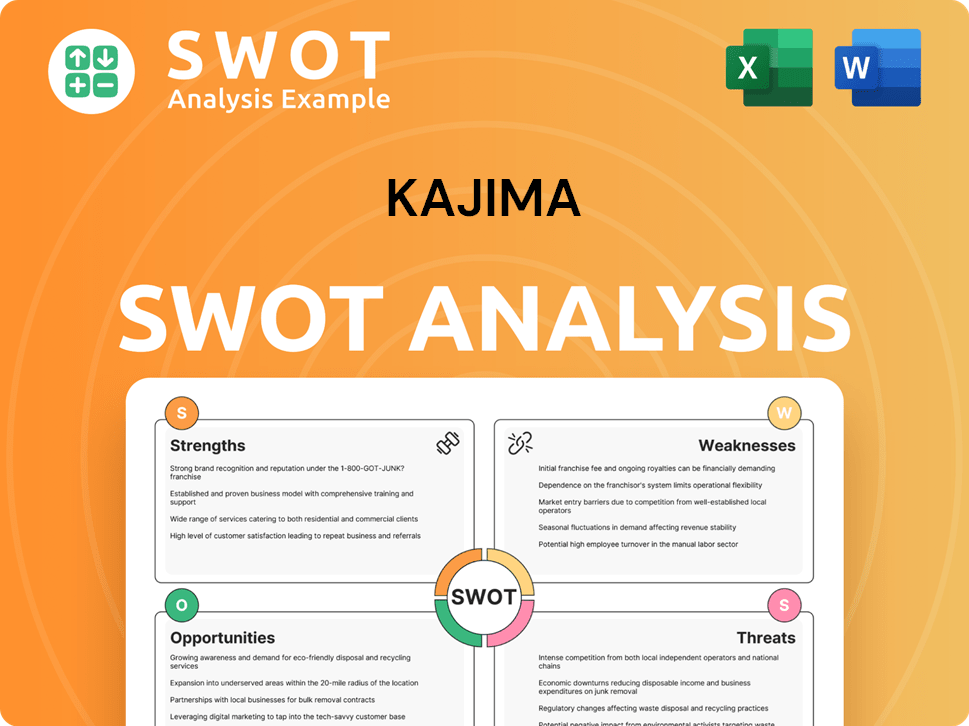

Analyzes Kajima’s competitive position through key internal and external factors

Provides a concise SWOT matrix for fast, visual strategy alignment.

Same Document Delivered

Kajima SWOT Analysis

This preview shows the real Kajima SWOT analysis document. What you see here is identical to the file you will receive. Purchasing unlocks the complete and comprehensive SWOT report. Get the full analysis instantly!

SWOT Analysis Template

Our Kajima SWOT analysis reveals a glimpse into the company's core strengths, opportunities, and potential pitfalls. It uncovers key market dynamics and competitive advantages at play. This preview barely scratches the surface of Kajima's full business landscape.

Purchase the complete SWOT analysis and get a dual-format package: a detailed Word report and a high-level Excel matrix. Built for clarity, speed, and strategic action.

Strengths

Kajima Corporation has a strong global presence, with operations in Asia Pacific, Europe, Oceania, and North America. Their diverse business includes civil engineering, building construction, and real estate. This diversification helped Kajima achieve ¥2,363.8 billion in revenue for fiscal year 2024. This broad scope helps manage risks.

Kajima's technological strengths are evident through its R&D and innovation. The company uses technologies like BIM, AI, and robotics. This focus boosts efficiency and tackles issues like labor shortages. In fiscal year 2024, Kajima invested ¥20 billion in R&D.

Kajima's recent financial reports show robust performance, especially in construction, with revenue growth in civil engineering both locally and internationally. For the fiscal year ending March 31, 2025, the company has updated its financial outlook. In Q3 2024, the construction segment saw a 7% rise in revenue.

Extensive Experience and Project Track Record

Kajima's 180+ years in business signify unmatched experience in diverse global projects. This rich history, encompassing civil engineering, construction, and real estate, underlines its proven project capabilities. The company's strong track record enhances credibility, crucial for securing future ventures. In 2024, Kajima's revenue reached ¥2.2 trillion, reflecting its robust market position.

- Experience in large-scale projects.

- Global presence and project diversity.

- Strong reputation and client trust.

- Financial stability and market leadership.

Strategic Alliances and Collaborative Ventures

Kajima's strategic alliances and joint ventures boost its market presence. Collaborations, like those in real estate, share resources and enable complex projects. For instance, in 2024, Kajima partnered on several international construction projects. These ventures often lead to increased revenue streams.

- Partnerships expand market reach.

- Shared resources improve efficiency.

- Joint ventures enable larger projects.

- Increased revenue is a common outcome.

Kajima’s global footprint and varied business operations provide robust strengths. Its diversification and 180+ years in business translate into substantial revenue and resilience. R&D investments and tech integrations like BIM highlight the company’s commitment to innovation and operational excellence, reflected by a 7% revenue rise in Q3 2024 within its construction segment.

| Strength | Description | Impact |

|---|---|---|

| Global Presence | Operations in Asia, Europe, and North America. | ¥2.3T revenue in 2024 |

| Tech Integration | BIM, AI, and robotics usage. | Improved efficiency & innovation |

| Financial Stability | Robust revenue & market position | Q3 2024 Construction +7% revenue |

Weaknesses

Kajima's real estate and "other" segments saw a gross profit decrease recently. Overseas net income forecasts were cut due to property sale delays. This reveals vulnerabilities in certain business areas. For example, in the last reported quarter, the real estate division experienced a 12% drop in profitability.

Kajima's large projects face heightened risks due to their scale and intricacy. The extended timelines from project start to construction pose financial uncertainties. For instance, material cost fluctuations can significantly impact profitability. In 2024, raw material price volatility increased by 7%, affecting project budgets.

Kajima faces weaknesses in its exposure to price fluctuations and labor shortages. The construction sector is vulnerable to material price swings and labor availability issues. In 2024, material costs increased by 5-10% due to supply chain disruptions.

For long-term projects, Kajima must hedge against rising costs and secure labor. Labor shortages, with a 15% vacancy rate in some areas, can delay projects. These factors can negatively impact profitability and project timelines.

Significant Net Debt Position

Kajima's high net debt is a concern. Their balance sheet indicates liabilities surpassing liquid assets. This could restrict financial flexibility. Rising interest rates could amplify this risk.

- Net debt levels are a key financial health indicator.

- High debt can limit investment in growth.

- Kajima's debt could impact its credit rating.

Challenges in Standardizing Global IT Security

A major weakness for Kajima lies in standardizing IT security across its global operations. With numerous overseas subsidiaries, ensuring consistent security is tough. The increasing frequency of cyber threats demands constant vigilance and resources to maintain strong controls. This is especially critical as cyberattacks cost businesses globally $8.44 million on average in 2024, according to IBM.

- Cybersecurity Ventures predicts global cybercrime costs will reach $10.5 trillion annually by 2025.

- Kajima must allocate substantial financial and human resources to address this challenge.

- Inconsistent security protocols can create vulnerabilities.

- The global IT security market is expected to reach $262.4 billion by 2025.

Kajima's weaknesses include profitability declines in real estate. Large, complex projects increase risks, impacted by material and labor costs. High net debt and inconsistent global IT security protocols also pose financial and operational challenges. Rising interest rates and cybercrime threats exacerbate these vulnerabilities.

| Weakness Category | Impact | Data/Statistic |

|---|---|---|

| Real Estate Profitability | Decline in earnings | Real estate division profit fell 12% (latest quarter). |

| Project Risks | Financial Uncertainty | Material cost volatility up 7% in 2024; labor shortage at 15% in some areas. |

| High Net Debt | Reduced Financial Flexibility | Liabilities surpass liquid assets. |

Opportunities

Kajima is strategically expanding in real estate and overseas markets. The company plans to boost investments in these areas for future growth. This expansion leverages Kajima's existing strengths, opening doors to new markets. In 2024, overseas sales increased, showing growth potential. This move also allows Kajima to engage in higher-value activities.

Kajima benefits from rising construction investment globally, especially in infrastructure. This demand allows Kajima to bid for new contracts and boost revenue. For example, Japan's construction market is projected to reach ¥70 trillion in fiscal year 2024. The global construction market is expected to reach $15.2 trillion by 2030.

Kajima can capitalize on the growing global focus on sustainable construction, backed by government incentives. Their environmental vision and carbon-negative concrete tech uniquely position them. This aligns with the increasing demand for green building solutions. The global green building materials market is projected to reach $476.6 billion by 2027.

Further Integration of Digital and Advanced Technologies

Kajima can capitalize on digital and advanced technologies like AI, robotics, and BIM to boost efficiency and safety. These technologies are transforming construction, offering significant improvements in productivity. The global construction robotics market is projected to reach $2.8 billion by 2025. Further integration of these technologies enhances Kajima's competitive edge.

- Increased Efficiency: Automation can reduce project timelines by up to 20%.

- Enhanced Safety: Robotics can minimize worker exposure to hazardous conditions.

- Improved Productivity: BIM facilitates better project planning and execution.

- Competitive Advantage: Early adoption positions Kajima as an industry leader.

Forming Strategic Partnerships for New Business Areas

Kajima actively forms strategic partnerships to tap into new business opportunities. Collaborating with diverse partners, like IHG Hotels & Resorts for hotel development, opens doors to new markets. These ventures create new revenue streams and broaden Kajima's value chain.

- In 2024, Kajima's construction revenue was JPY 1,973.7 billion.

- The company's overseas construction revenue in FY2024 was JPY 200.5 billion.

- Kajima's operating income for FY2024 was JPY 124.6 billion.

Kajima's expansion in real estate and overseas markets presents significant growth prospects. This strategy is supported by rising global construction investment, creating more opportunities for Kajima. Capitalizing on sustainable construction and digital tech like AI boosts Kajima’s efficiency and competitiveness.

| Opportunity | Details | Data |

|---|---|---|

| Market Expansion | Real estate & overseas investment increase. | Overseas sales increased in 2024. |

| Construction Growth | Global infrastructure demand drives revenue. | Global construction market by 2030 is expected to reach $15.2 trillion. |

| Sustainable Building | Green building focus; carbon-negative tech. | Green building materials market projected to reach $476.6B by 2027. |

Threats

Kajima faces threats from the volatile global construction market. Economic downturns and investment shifts can reduce project availability. For instance, global construction output growth slowed to 1.7% in 2023, impacting major players. This volatility demands agile strategies. 2024 projections indicate continued uncertainty, necessitating proactive risk management.

Kajima faces threats from escalating costs and inflation, impacting profit margins. The construction sector is sensitive to rising material prices and labor costs. For instance, construction material costs increased by 5.2% in 2024. Fixed-price contracts amplify this risk. These pressures can squeeze profitability, especially on lengthy projects.

Kajima contends with fierce rivals in construction and real estate, both at home and abroad. This competition intensifies pricing pressures, potentially squeezing profit margins. Significant investments in tech and skilled personnel are essential to stay competitive. Securing new contracts becomes more challenging in this environment.

Geopolitical Risks and Supply Chain Disruptions

Kajima's global presence makes it vulnerable to geopolitical risks, including regional conflicts and supply chain disruptions. These external factors can lead to project delays and increased costs, impacting profitability. For example, in 2024, global construction material costs rose by an average of 5-7% due to these issues. Uncertainty in operating regions poses significant challenges.

- Geopolitical instability can increase project insurance costs by up to 10%.

- Supply chain disruptions have caused delays of 2-4 months on average for construction projects.

- Currency fluctuations add financial risk.

Increasing Cybersecurity

Kajima faces rising cybersecurity threats as its digital footprint expands globally. Cyberattacks, such as ransomware, pose significant risks to sensitive data and operations. Continuous investment in security measures is crucial to protect against these evolving threats. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the urgency.

- Cybersecurity breaches cost companies an average of $4.45 million in 2023.

- Ransomware attacks increased by 13% in 2023.

- Global cybersecurity spending is expected to exceed $210 billion in 2025.

Kajima confronts significant external threats impacting operations and profitability.

These include global market volatility, escalating costs, and intense competition. Geopolitical instability and cyber threats further compound these risks.

| Threats | Impact | Data |

|---|---|---|

| Economic Downturns | Reduced project volume | Global construction growth: 1.7% in 2023. |

| Rising Costs | Margin pressure | Material cost increase: 5.2% in 2024. |

| Geopolitical Risk | Project delays/costs | Insurance costs up 10%. |

SWOT Analysis Data Sources

This SWOT relies on Kajima's financial reports, market analysis, and expert evaluations for a comprehensive assessment.