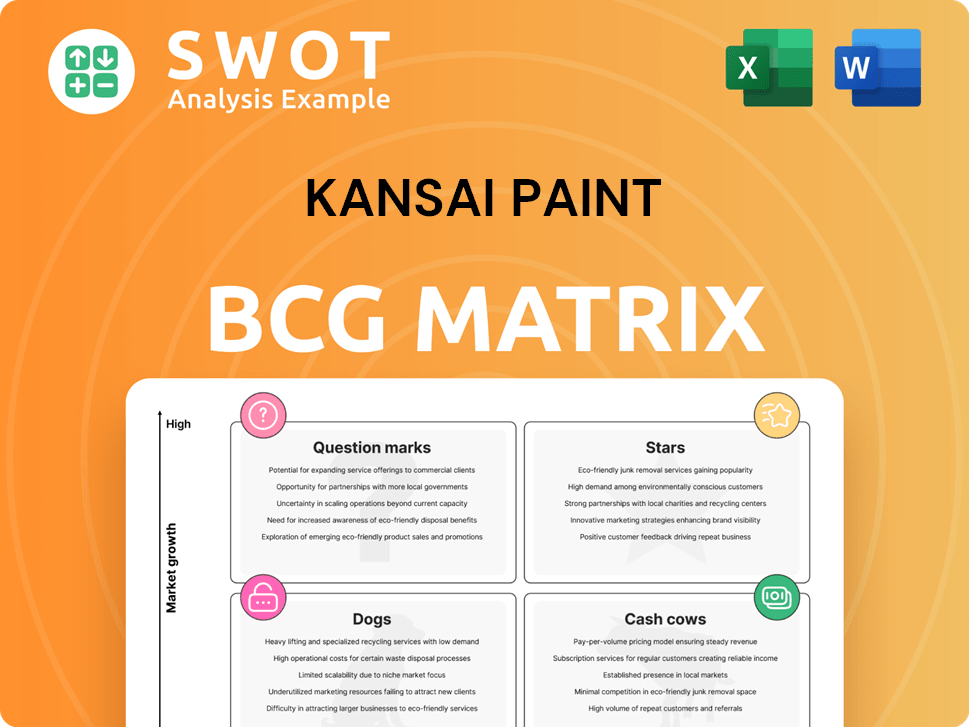

Kansai Paint Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kansai Paint Bundle

What is included in the product

Strategic review of Kansai Paint's business units, detailing optimal investment, hold, or divest strategies.

Clean and optimized layout for sharing or printing of the BCG Matrix, enabling immediate analysis.

Full Transparency, Always

Kansai Paint BCG Matrix

The displayed preview showcases the identical Kansai Paint BCG Matrix report you'll receive after buying. This detailed document is formatted for strategic planning, ready for immediate download, and completely free of watermarks or sample content.

BCG Matrix Template

Kansai Paint's product portfolio likely spans various market positions. Stars, high-growth market leaders, and Cash Cows, generating steady profits, are key indicators. Dogs and Question Marks reveal potential challenges and opportunities.

This overview provides a glimpse into their strategy. Purchase the full BCG Matrix for a deep dive into each product's quadrant placement and strategic implications.

Stars

Kansai Paint's automotive coatings in Asia-Pacific are a star due to the region's booming automotive sector. China and India drive demand, with vehicle sales in China reaching 26.9 million units in 2023. The rising EV market boosts demand for advanced coatings. Kansai Paint should invest in R&D for sustainable solutions.

Kansai Paint strategically grows its industrial coatings in Europe, focusing on acquisitions and partnerships. They're targeting sectors like railway and powder coatings. The European industrial coatings market was valued at approximately $17 billion in 2024. Their success hinges on innovation and customer-focused solutions in this competitive landscape.

The marine coatings market is growing, fueled by new ships and maintenance needs. Kansai Paint, a top producer, can expand its market share globally. In 2024, the market was valued at roughly $8.5 billion. Developing fuel-efficient, eco-friendly coatings is key for Kansai Paint's competitive advantage. The Asia-Pacific region accounted for over 40% of the global market share in 2024.

Sustainable Coatings

Kansai Paint's "Stars" are its sustainable coatings, reflecting a commitment to eco-friendly products. The market is driven by stricter regulations and growing consumer demand for green solutions. Kansai Paint's investment in sustainable coatings positions it well for future growth. In 2024, the global green coatings market was valued at $10.1 billion.

- Eco-friendly product development is key.

- Demand for sustainable coatings is rising.

- Kansai Paint's investments are strategic.

- The green coatings market is significant.

Emerging Markets in Africa

Kansai Paint views emerging markets in Africa as a significant growth area. The company is actively working to boost its competitive edge in the region. Expanding sales in decorative coatings and optimizing prices are key strategies to tap into Africa's rising demand for paints and coatings. In 2024, the African paint and coatings market is estimated to be worth over $3 billion.

- Focus on expanding sales in decorative coatings.

- Improve selling prices in the region.

- Invest in local manufacturing and distribution networks.

- Capitalize on the growing demand for paints and coatings.

Kansai Paint's "Stars" include its sustainable coatings and automotive coatings in the Asia-Pacific region. They also strategically grow industrial coatings in Europe. The marine coatings market is also a growing "Star." The company focuses on eco-friendly development.

| Category | Market Value (2024) | Key Strategy |

|---|---|---|

| Sustainable Coatings | $10.1B | R&D, eco-friendly products |

| Automotive Coatings (Asia-Pac) | Significant | Target EV, innovation |

| Industrial Coatings (Europe) | $17B | Acquisitions, partnerships |

| Marine Coatings | $8.5B | Fuel-efficient coatings |

Cash Cows

In established markets, decorative coatings act as cash cows for Kansai Paint, offering steady cash flow despite low growth. These products hold a high market share, ensuring consistent revenue. Kansai Paint should focus on maintaining its position through brand recognition and efficient distribution. For example, in 2024, the decorative coatings segment contributed significantly to overall revenue.

Automotive refinish coatings, essential for vehicle repair, are cash cows for Kansai Paint. This segment sees stable demand, ensuring consistent revenue streams. Kansai Paint's focus on quality and service is crucial for market share. In 2024, the global automotive refinish coatings market was valued at $14.2 billion.

Protective coatings for infrastructure are a stable revenue source for Kansai Paint. These coatings, essential for bridges and power facilities, shield against environmental damage. Kansai Paint should focus on maintaining relationships and providing reliable products. The global protective coatings market was valued at $16.89 billion in 2023.

Industrial Coatings in Specific Niches

Kansai Paint might find itself with cash cows in industrial coatings, especially in niche areas. These segments, like specialized equipment coatings, likely show slow growth but high market share. This steady revenue stream allows Kansai Paint to generate profit. The focus should be on maintaining existing expertise and customer relationships.

- Industrial coatings market was valued at USD 85.8 billion in 2023.

- Expected to reach USD 110.8 billion by 2028.

- Kansai Paint's revenue in 2024 was approximately $3.5 billion.

Marine Coatings for Specific Vessel Types

Marine coatings for specific vessel types can be cash cows for Kansai Paint, offering stable revenue streams. These segments, like coatings for tankers or container ships, require minimal new product development. The focus should be on preserving market share and nurturing customer relationships in these profitable niches. Kansai Paint's marine coatings segment reported approximately $1.2 billion in revenue in 2024.

- Stable Revenue: Specialized coatings provide consistent income.

- Limited Investment: Requires less R&D than other areas.

- Market Focus: Maintain position and customer loyalty.

- Financial Data: Marine coatings brought in $1.2B in 2024.

Cash cows for Kansai Paint include decorative, automotive refinish, protective, and industrial coatings, along with specific marine applications, all generating stable revenue.

These segments have a high market share and predictable demand. Kansai Paint should focus on maintaining their position through brand loyalty and efficient operations. In 2024, overall revenue was about $3.5 billion.

For instance, the industrial coatings market, valued at $85.8 billion in 2023, is predicted to reach $110.8 billion by 2028, showing steady growth and profitability.

| Segment | Market Share | Revenue (2024 est.) |

|---|---|---|

| Decorative Coatings | High | $700M |

| Automotive Refinish | Medium | $500M |

| Protective Coatings | High | $800M |

Dogs

Kansai Helios' high-temperature coatings in Europe could be a 'dog' within Kansai Paint's BCG matrix if growth and market share are low. This segment requires careful evaluation due to its potential impact on the overall group's performance. In 2024, the high-temperature coatings market showed varied growth across Europe. A strategic review is crucial to assess turnaround possibilities or consider divestiture.

In intensely competitive markets, Kansai Paint might face "dogs" in decorative paints. These products, with low market share and growth, need careful evaluation. Consider divestiture or discontinuation to improve overall business performance. For example, in 2024, the decorative paints segment saw a 2% decline in certain regions.

Low-performance marine coatings can be 'dogs' for Kansai Paint if they fail to meet current environmental or performance standards. These products might see dwindling sales and profits, demanding hefty investments for upgrades. In 2024, the marine coatings market faced stricter regulations, impacting product viability. Kansai Paint's decision involves investing in improvements or discontinuing these offerings.

Coatings for Declining Industries

Coatings for declining industries, like those in stagnant manufacturing or construction sectors, could be 'dogs' for Kansai Paint, as per BCG Matrix. These coatings may exhibit limited growth potential. Kansai Paint should assess the financial implications of these segments. Consider redirecting resources towards more promising areas.

- Declining industries often show negative or slow growth, such as a 2.3% decrease in global construction output in 2023.

- Investment in 'dog' products might not yield high returns, impacting overall profitability.

- Kansai Paint's focus might shift to sectors like automotive coatings, which showed a 7.6% growth in 2024.

Underperforming Regional Businesses

Kansai Paint might face 'dogs' in regions with slow growth and low market share. These underperformers need careful assessment. In 2024, consider restructuring or divesting these units. This refocuses resources on profitable areas. Focus on markets with higher potential.

- Evaluate regional profitability.

- Assess market share in each area.

- Consider divestiture options.

- Restructure underperforming units.

In the BCG matrix, "dogs" represent low-growth, low-share products. These require strategic decisions like divestiture to enhance profitability. Evaluating these segments is critical for Kansai Paint's overall strategy.

| BCG Matrix | Characteristics | Kansai Paint Example |

|---|---|---|

| Dog | Low growth, low market share. | Underperforming marine coatings. |

| Investment Strategy | Consider divest or restructure. | Assess viability vs. upgrade costs. |

| Financial Impact | May drag down profitability. | Focus resources on high-growth areas. |

Question Marks

Powder coatings are a growing segment, driven by demand for eco-friendly and long-lasting finishes. Kansai Paint might have a smaller market share in some emerging markets for these coatings. Focusing on growth in these areas could significantly boost Kansai Paint's position, potentially turning it into a star. The global powder coatings market was valued at $13.78 billion in 2024.

Waterborne automotive coatings are becoming popular due to stricter environmental rules. Kansai Paint might have a smaller market share here. Investing in R&D could boost its position in this growing area. The global automotive coatings market was valued at USD 20.6 billion in 2023.

The EV market's expansion offers chances for specialized industrial coatings. Kansai Paint might have a small share now. Investing in coatings for EV batteries and motors can elevate its position. The global EV coatings market was valued at $2.2 billion in 2024, and it is projected to reach $4.8 billion by 2029.

High-Performance Coatings for Renewable Energy Infrastructure

The renewable energy sector, including wind and solar power, is experiencing significant growth, which drives the need for high-performance coatings. Kansai Paint currently might have a smaller market share in this area, but investing in specialized coatings for renewable energy could lead to substantial growth. This strategic move aligns with the global shift towards sustainable energy solutions and offers significant market potential.

- The global renewable energy market was valued at $881.1 billion in 2023.

- Wind power capacity additions increased by 13% in 2024.

- Solar energy capacity additions grew by 30% in 2024.

Smart Coatings with Advanced Functionalities

Smart coatings, featuring self-healing and anti-corrosion properties, represent a high-growth segment. Kansai Paint may have a low market share here. Investing in R&D and partnerships can shift this. The global smart coatings market was valued at USD 42.1 billion in 2023.

- Market growth is projected, with a CAGR of 9.2% from 2024 to 2032.

- Self-healing coatings are gaining traction due to their durability.

- Demand is driven by the automotive and construction industries.

- Kansai Paint can leverage innovation to increase its market share.

Question Marks represent markets with high growth but low market share for Kansai Paint. These segments require strategic investment and focus to increase market presence. Success could transform them into Star products. The challenge lies in navigating uncertain market dynamics.

| Segment | Market Growth Rate (2024) | Kansai Paint's Market Share |

|---|---|---|

| Powder Coatings | Approx. 7% | Low |

| Waterborne Automotive Coatings | Approx. 8% | Low |

| EV Coatings | Approx. 10% | Low |

| Renewable Energy Coatings | Approx. 9% | Low |

| Smart Coatings | 9.2% (CAGR) | Low |

BCG Matrix Data Sources

The BCG Matrix utilizes data from financial statements, market research, and competitor analysis, ensuring strategic precision.