Kasikornbank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kasikornbank Bundle

What is included in the product

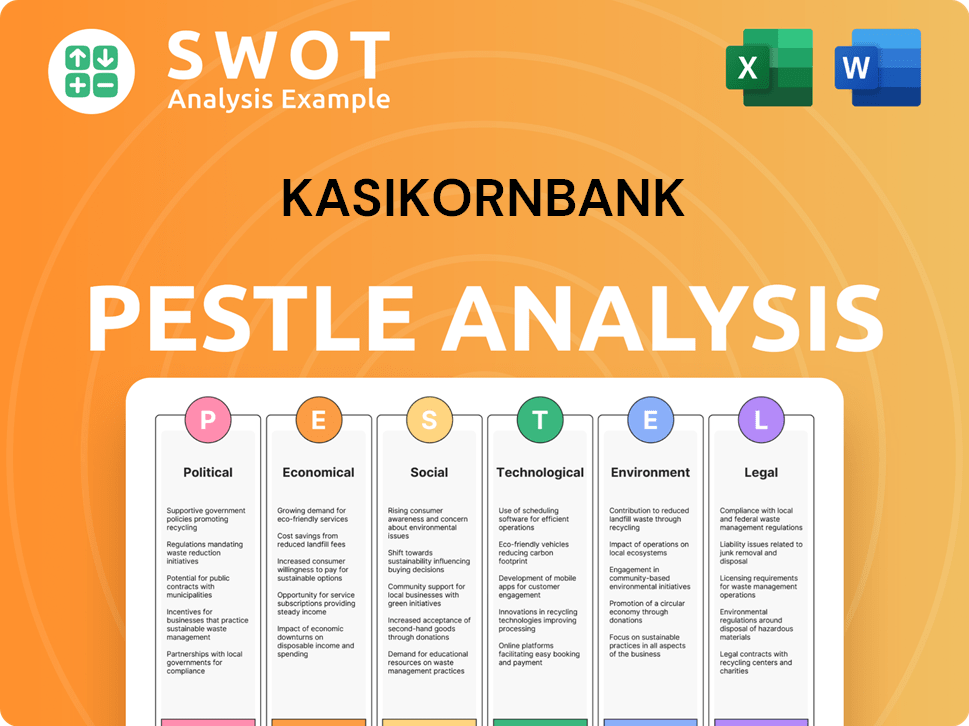

Analyzes external factors impacting Kasikornbank across six areas: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Kasikornbank PESTLE Analysis

Preview this Kasikornbank PESTLE Analysis, a real look at the final document. The structure and content in the preview mirror the file you’ll get post-purchase.

PESTLE Analysis Template

Discover the external forces shaping Kasikornbank's path. Our PESTLE Analysis offers a strategic view, examining political, economic, social, technological, legal, and environmental impacts. Uncover how these factors influence the bank's operations and strategies. From regulatory changes to emerging technologies, gain critical insights. Equip yourself with the knowledge to navigate challenges and seize opportunities. Download the full PESTLE Analysis and gain a competitive edge today!

Political factors

Government policies and stimulus measures are pivotal for the banking sector. For instance, Thailand's economic stimulus packages in 2024, including measures to support SMEs, directly affected KBank's lending portfolios. These initiatives can boost domestic spending and debt relief. In Q1 2024, KBank reported a 3.5% increase in loans. Such policies impact loan demand and asset quality.

Political stability in Thailand and global events introduce uncertainty. Investor confidence, trade policies, and economic growth are impacted. For KBank, this affects operations and international business. Thailand's GDP growth forecast for 2024 is 2.7%, influenced by these factors. Geopolitical risks thus require careful monitoring.

KBank faces evolving banking regulations and financial reporting standards. These changes, including updates to Basel III and potential impacts from new digital asset rules, influence its operational strategies. For example, in 2024, compliance costs for Thai banks rose by approximately 5%, reflecting increased regulatory scrutiny. Adapting to these shifts is essential for sustained profitability and market competitiveness.

International Trade Policies

Uncertainty in global trade policies, especially between the US and China, poses risks for Thailand's export-dependent economy, impacting KBank. Trade tensions can disrupt supply chains and reduce export volumes, affecting corporate profitability and loan repayment abilities. This can lead to increased non-performing loans (NPLs) and slower economic growth, directly influencing KBank's financial performance.

- Thailand's exports in 2024 were valued at approximately $285 billion.

- China and the US are among Thailand's top trading partners, accounting for about 25% and 10% of total exports, respectively.

- KBank's loan portfolio includes significant exposure to export-oriented businesses.

Government Initiatives in Financial Sector

Government initiatives significantly influence KBank's trajectory. Thailand's push to become a financial hub and digital transformation initiatives present growth prospects. These efforts encourage innovation and offer chances for KBank's expansion. Aligning with these strategies is crucial for the bank's future success. The Thai government allocated approximately $6.5 billion towards digital economy initiatives in 2024.

- Digital Economy Initiatives: $6.5 billion allocated in 2024.

- Financial Hub Promotion: Key government focus for sector growth.

- Innovation Opportunities: Driven by digital transformation.

- Strategic Alignment: Crucial for KBank's growth.

Government policies and stimulus are critical; 2024's packages, like SME support, shaped KBank's loans, boosting domestic spending.

Political stability and global events introduce volatility, affecting investor confidence, trade, and growth, with Thailand's 2024 GDP growth projected at 2.7%.

Evolving banking rules and financial reporting standards, including Basel III updates, influence KBank’s strategies, increasing compliance costs in 2024.

| Aspect | Details |

|---|---|

| Export Value (2024) | $285 Billion |

| Digital Economy Allocation (2024) | $6.5 Billion |

| Compliance Cost Increase (2024) | 5% approx. |

Economic factors

Thailand's economic growth rate is crucial for KBank. In 2024, GDP growth is projected around 2.7%, influencing loan demand. Higher growth, like the anticipated 3.0-4.0% in 2025, boosts KBank's profitability. This growth impacts asset quality and overall banking performance.

The Bank of Thailand's policy rate directly impacts KBank's financial performance, particularly its net interest margin (NIM). Higher interest rates can increase KBank's lending rates, potentially boosting profitability. Conversely, rising rates might also elevate funding costs. In 2024, the central bank has maintained a steady rate. KBank's financial strategies are heavily influenced by these interest rate dynamics.

High household and corporate debt in Thailand presents challenges for KBank. Elevated debt levels can hurt asset quality and slow loan growth. Increased borrower fragility might lead to more non-performing loans (NPLs). In 2024, household debt reached about 90% of GDP. Corporate debt levels are also substantial.

Inflation and Deflation Risks

Inflation and deflation significantly influence KBank's operations. High inflation erodes purchasing power, potentially decreasing loan demand, as seen in Thailand's 2023 inflation rate of 1.23%. Deflation, while less common, can reduce profitability and lending activity. These economic shifts directly impact KBank's financial product demand and investment strategies.

- Thailand's 2023 inflation: 1.23%

- Impact on loan demand and profitability

Global Economic Conditions

Global economic conditions significantly influence KBank's performance. Trade wars and economic slowdowns, particularly in major economies like the US and China, can impact Thailand's exports and tourism, vital sectors for KBank. These external pressures directly affect domestic economic activity, impacting loan demand and asset quality. Recent data indicates a slight slowdown in global trade, with the World Bank projecting global GDP growth of 2.6% in 2024 and 2.7% in 2025, influencing Thailand’s economic outlook.

- Thailand's exports grew by 2.5% year-on-year in Q1 2024.

- Tourism contributed significantly to Thailand's GDP, accounting for approximately 12% in 2023.

- China's economic growth is projected to be around 4.6% in 2024.

Thailand's GDP growth, projected at 2.7% in 2024 and 3.0-4.0% in 2025, is vital for KBank. The Bank of Thailand's interest rate decisions, steady in 2024, influence profitability and NIM. High household debt (90% of GDP) and inflation (1.23% in 2023) pose challenges, affecting loan demand.

| Economic Factor | Impact on KBank | Data/Statistics |

|---|---|---|

| GDP Growth | Affects loan demand and profitability | 2024: 2.7%, 2025: 3.0-4.0% (projected) |

| Interest Rates | Influences NIM, lending, and funding costs | Steady in 2024 |

| Household Debt | Impacts asset quality and loan growth | Approx. 90% of GDP (2024) |

| Inflation | Erodes purchasing power; impacts loan demand | 2023: 1.23% |

| Global Economic Conditions | Impacts exports, tourism, and loan demand | World Bank projects global GDP growth 2024: 2.6%, 2025: 2.7%; Thailand's exports grew by 2.5% y-o-y in Q1 2024 |

Sociological factors

Evolving consumer preferences, especially the shift to digital banking, are crucial for KBank. In 2024, over 80% of Thai adults used online banking. KBank must adapt its services to meet these digital demands. This includes enhancing its mobile app and online platforms for user-friendliness and functionality.

Thailand's aging population, with a median age of 40.5 years in 2024, presents challenges and opportunities for KBank. Urbanization continues, with over 50% of Thais living in cities, impacting banking service needs. Income inequality, where the top 10% hold nearly 50% of the wealth, necessitates tailored financial products.

Financial literacy rates and financial inclusion initiatives shape KBank's customer reach. In Thailand, financial literacy is growing, with 63% of adults understanding basic financial concepts as of late 2024. KBank's financial education programs are crucial, especially for underserved communities. These efforts align with the national drive for greater financial inclusion, boosting KBank's market potential.

Social Responsibility and ESG Expectations

KBank faces rising demands for corporate social responsibility and ESG integration. This impacts its brand image and daily operations. Stakeholders increasingly value sustainability and ethical conduct. In 2024, ESG-linked assets grew substantially, reflecting this trend.

- KBank's sustainability efforts are crucial for attracting and retaining customers.

- ESG performance affects investment decisions and access to capital.

- The bank must meet evolving expectations to maintain a strong market position.

- Failure to adapt can lead to reputational damage and financial risks.

Employment and Income Levels

Employment rates and income levels are crucial for Kasikornbank (KBank). Higher employment and income boost loan repayment capacity and investment potential, benefiting KBank's retail banking. Conversely, economic downturns can increase loan defaults, impacting asset quality. For example, Thailand's unemployment rate was around 1.03% in Q1 2024, a key indicator. These factors directly shape KBank's financial performance and risk profile.

- Thailand's GDP growth in 2024 is projected around 2.5-3.5%, influencing income levels.

- KBank's loan portfolio performance is directly linked to consumer income stability.

- Changes in employment rates affect KBank's asset quality and risk management strategies.

Consumer digital banking is crucial; in 2024, over 80% of Thai adults used online banking. Aging population (median age 40.5) and urbanization influence service needs. Growing financial literacy, with 63% understanding basics by late 2024, impacts KBank’s reach.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digital Adoption | Service demands | 80%+ use online banking |

| Demographics | Service adaptation | Median age 40.5 years |

| Financial Literacy | Customer reach | 63% understanding basics |

Technological factors

Digital transformation is reshaping finance. KBank focuses on AI, cloud, and mobile banking. In 2024, KBank saw a 30% increase in digital transactions. Their tech investments aim to boost customer engagement and operational efficiency. This strategic pivot is vital to stay ahead.

Cybersecurity is crucial for KBank, given its digital focus. The bank needs to protect against threats and safeguard customer data. In 2024, global cybersecurity spending hit $214 billion. KBank must invest to ensure customer trust. Compliance with data protection laws is vital.

KBank leverages AI to boost productivity and enhance customer experiences, recognizing its potential. Blockchain is utilized for cross-border payments and digital assets, aiming for efficiency. In 2024, the global AI market was valued at $196.63 billion, growing substantially. KBank's strategic tech adoption aligns with these trends, aiming for innovation and competitiveness.

Fintech Competition

The rise of financial technology (Fintech) companies is intensifying competition within the banking sector, creating challenges and opportunities for KBank. To stay ahead, KBank must embrace innovation and consider strategic collaborations with Fintech firms. In 2024, Fintech investments globally reached $191.7 billion. KBank needs to offer new services.

- Fintech investment reached $191.7B globally in 2024.

- KBank must innovate to stay competitive.

- Collaboration with Fintechs is a key strategy.

IT Infrastructure and Investment

Kasikornbank (KBank) must prioritize substantial investments in its IT infrastructure to remain competitive. This includes updating its systems to handle growing digital transactions and increasing cybersecurity threats. In 2024, KBank allocated approximately $1 billion to its digital transformation initiatives, aiming for enhanced customer experience and operational efficiency.

- KBank's IT spending is projected to increase by 15% in 2025.

- The bank aims to integrate AI-driven solutions across its operations.

- KBank is focusing on cloud computing to improve scalability and reduce costs.

KBank faces rapid digital transformation in finance. It heavily invests in AI, cloud, and mobile banking. Fintech investment globally hit $191.7 billion in 2024. Cybersecurity, with $214 billion in global spending in 2024, is a key focus.

| Technology Factor | Impact on KBank | Data Point (2024/2025) |

|---|---|---|

| Digital Transformation | Enhanced customer experience | KBank digital transaction growth: 30% |

| Cybersecurity | Protect data & trust | Global cybersecurity spending: $214B (2024) |

| AI and Fintech | Innovation & efficiency | Fintech investment: $191.7B (2024) |

Legal factors

Kasikornbank (KBank) faces stringent banking regulations from the Bank of Thailand. The bank must adhere to capital adequacy ratios, and lending practices. In 2024, KBank's capital adequacy ratio was approximately 18.94%, exceeding the regulatory minimum, ensuring financial stability. Non-compliance can lead to significant penalties.

Data privacy laws like Thailand's PDPA (Personal Data Protection Act) significantly influence KBank. These regulations mandate stringent data handling practices. For instance, KBank must secure customer data, facing potential fines for breaches. In 2024, global data breach costs averaged $4.45 million. KBank's compliance involves substantial investment in cybersecurity and data governance.

Kasikornbank (KBank) must comply with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. This includes KYC procedures and transaction monitoring. In 2024, financial institutions faced increased scrutiny, with penalties reaching billions globally. KBank's compliance ensures it avoids such penalties and maintains operational integrity. These measures are vital for financial stability.

Consumer Protection Laws

Consumer protection laws significantly shape KBank's operations by mandating transparent and ethical customer interactions. These laws ensure that KBank provides clear product details, adheres to fair lending practices, and offers accessible dispute resolution channels. Compliance with these regulations is crucial for maintaining customer trust and avoiding legal penalties, directly impacting KBank's reputation and financial stability. In 2024, the Consumer Protection Board in Thailand handled over 20,000 complaints related to financial services.

- Transparency in financial product disclosures is a key focus.

- Fair lending practices are closely scrutinized to prevent predatory behavior.

- Efficient dispute resolution mechanisms are essential for customer satisfaction.

- Compliance failures can lead to significant financial and reputational damage.

International Sanctions and Regulations

Kasikornbank (KBank) faces legal challenges from international sanctions and regulations. These rules, especially post-2022 due to geopolitical events, affect KBank's international transactions. Compliance costs have risen, with penalties possible for violations. For instance, in 2024, banks globally paid billions in fines for non-compliance. KBank must navigate these complexities to maintain global operations.

- 2023: Over $3 billion in fines paid by global banks for sanctions violations.

- 2024: Compliance spending increased by 15% for international banks.

- Post-2022: Cross-border transaction scrutiny intensified.

Kasikornbank (KBank) must comply with Thailand's banking regulations and international standards to maintain financial stability. These include capital adequacy, data privacy, and AML/CTF measures, alongside consumer protection. In 2024, banking regulations were updated.

| Regulation | Impact on KBank | 2024 Stats |

|---|---|---|

| Capital Adequacy | Ensure Financial Stability | CAR ~18.94% |

| Data Privacy (PDPA) | Cybersecurity and Data Governance | Avg. Breach Cost $4.45M |

| AML/CTF | KYC and Transaction Monitoring | Penalties in Billions Globally |

Environmental factors

Climate change presents both physical risks, such as extreme weather potentially damaging assets, and transition risks. Transition risks include policy shifts and market adjustments towards a low-carbon economy. KBank is actively incorporating climate change considerations into its strategic planning and risk management processes. In 2024, climate-related disasters cost the world an estimated $250 billion. KBank's efforts are crucial.

KBank faces stricter environmental rules, especially on emissions and sustainable finance. This necessitates changes in how KBank operates and lends. For example, in 2024, Thailand's government set goals for renewable energy, impacting KBank's investments. KBank must help businesses shift to eco-friendly practices.

Kasikornbank (KBank) actively promotes sustainable finance and green investments. KBank has allocated over $2 billion to green projects. This includes renewable energy and eco-friendly initiatives. The bank aims to increase its sustainable financing portfolio by 30% by 2025.

Resource Management and Environmental Footprint

Kasikornbank's (KBank) environmental footprint, covering energy use and waste from its operations and branches, is a key environmental factor. The bank actively aims to cut emissions and boost resource efficiency across its business. KBank's initiatives include green building practices and promoting digital banking to lessen paper use. These efforts reflect a broader move towards sustainable banking practices.

- KBank has a target to reduce its carbon footprint by 20% by 2030.

- The bank is investing in renewable energy sources for its operations.

- KBank promotes electronic statements to reduce paper consumption.

Stakeholder Expectations on Environmental Issues

KBank faces growing demands from customers, investors, and regulators regarding environmental responsibility. Addressing these expectations is crucial for maintaining KBank's reputation and fostering strong stakeholder relationships. Failure to meet these demands could lead to reputational damage and financial risks. KBank's commitment to environmental sustainability is now a key factor in its long-term success. Recent data shows that sustainable investments are on the rise, with ESG assets expected to reach $50 trillion by 2025.

- Reputational Risk: Failure to meet environmental expectations can damage KBank's brand.

- Financial Risk: Non-compliance with environmental regulations may lead to penalties.

- Growth Opportunity: Focusing on sustainability can attract investors and customers.

Kasikornbank (KBank) confronts environmental factors like climate risks, needing green strategies.

Stricter regulations on emissions and the shift to renewable energy sources impacts its operations and investments, in 2024.

KBank targets sustainable financing and operational efficiency, reducing carbon footprint to maintain stakeholders' trust, with ESG assets hitting $50T by 2025.

| Aspect | Details | Data/Impact |

|---|---|---|

| Climate Risk | Extreme weather impacts assets. | $250B global cost in 2024. |

| Regulations | Emission rules, renewable energy. | Affects lending, investments. |

| Sustainability | Green projects, reduced footprint. | $2B+ allocated, 20% carbon cut by 2030. |

PESTLE Analysis Data Sources

Our Kasikornbank PESTLE analysis is fueled by IMF, World Bank data and Thai government sources, ensuring robust economic insights.