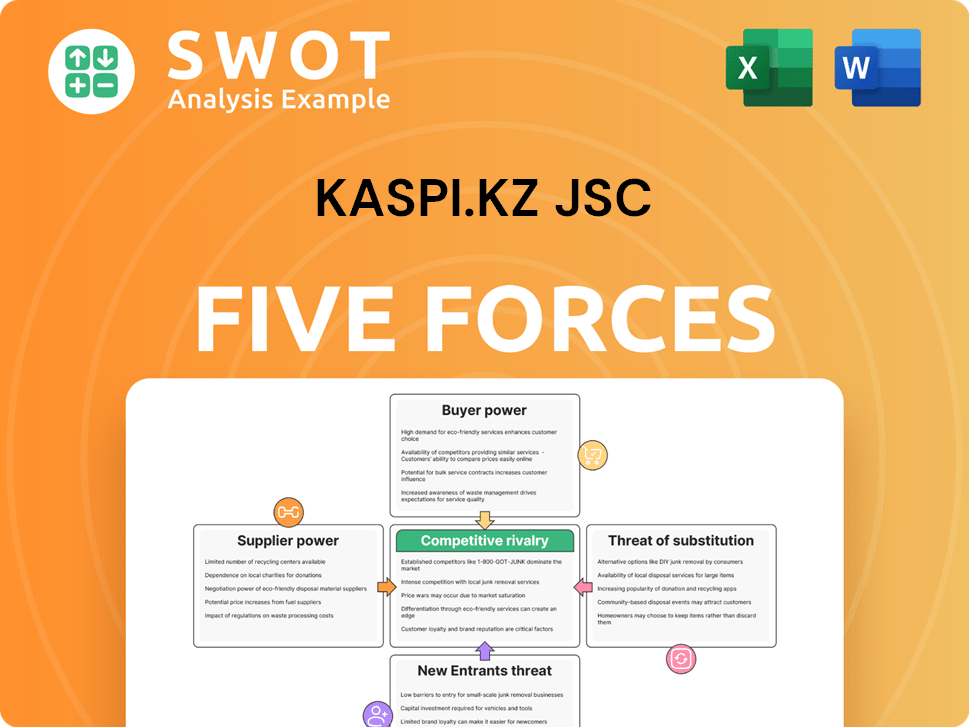

Kaspi.kz JSC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kaspi.kz JSC Bundle

What is included in the product

Kaspi.kz's competitive landscape is analyzed, focusing on its unique position within the financial and e-commerce sectors.

Swap in custom data and notes reflecting Kaspi.kz's dynamic business landscape.

Preview Before You Purchase

Kaspi.kz JSC Porter's Five Forces Analysis

This preview showcases Kaspi.kz JSC's Porter's Five Forces analysis in its entirety. The document comprehensively examines the company's competitive landscape. You'll receive this fully formatted report immediately after purchase, ready for your review. No alterations or substitutions will occur. The analysis displayed here is exactly what you’ll obtain.

Porter's Five Forces Analysis Template

Kaspi.kz JSC faces a dynamic competitive landscape. Buyer power is significant, fueled by consumer choice. Supplier power is moderate, with tech dependencies. New entrants pose a notable threat, given fintech's growth. Substitute products and services are ever-present. Intense rivalry within Kazakhstan's fintech sector also exists.

The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Kaspi.kz JSC.

Suppliers Bargaining Power

Kaspi.kz benefits from limited supplier concentration due to its tech-platform model. The company's focus on software and digital infrastructure reduces dependency on traditional suppliers. Kaspi.kz's strategy of building a broad ecosystem dilutes supplier influence. In 2024, Kaspi.kz reported a 40% increase in the number of active merchants, showcasing this diversification.

Kaspi.kz relies on external tech and software providers, giving suppliers moderate bargaining power. In 2024, the IT services market in Kazakhstan was valued at approximately $700 million. Their in-house tech development limits this, as does vendor diversification. Kaspi.kz’s strategy includes both in-house and external solutions.

Kaspi.kz relies heavily on telecommunications infrastructure, making telecom providers key suppliers. These suppliers wield considerable bargaining power, especially where options are limited. Kaspi.kz likely mitigates this via long-term contracts and multiple providers. In 2024, Kazakhstan's telecom market saw $1.5 billion in revenue. This scale gives Kaspi.kz negotiating strength.

Financial Institutions as Partners

Kaspi.kz collaborates with financial institutions for services like payment processing and lending. These institutions can influence Kaspi.kz, particularly if they control essential financial infrastructure components. However, Kaspi.kz's banking capabilities and fintech platform decrease reliance on external partners. Its strong market position makes it an attractive partner, balancing the power.

- Kaspi.kz processed 1.4 billion transactions in 2023.

- Kaspi.kz's net income for 2023 was 807 billion KZT.

- Kaspi.kz's payments segment revenue grew by 48% in 2023.

Data Providers and Analytics Services

Kaspi.kz relies on data and analytics for understanding customer behavior and optimizing services. Suppliers of data and analytics services possess moderate bargaining power, contingent on the uniqueness of their offerings. The company invests in its own data analytics and maintains relationships with multiple providers to ensure insights. In 2024, the global data analytics market was valued at approximately $274.3 billion, showcasing the significance of these services. Kaspi.kz's AI-powered services further highlight this importance.

- Data analytics market size in 2024: ~$274.3 billion.

- Kaspi.kz's investment in internal data analytics capabilities.

- Kaspi.kz's strategy to mitigate supplier power.

- Importance of AI-powered services.

Kaspi.kz faces varying supplier bargaining power. Its tech platform and in-house development reduce supplier dependence. The telecom market in Kazakhstan reached $1.5 billion in 2024, influencing supplier dynamics. Kaspi.kz balances power through diversification and strong market position.

| Supplier Type | Bargaining Power | Mitigation Strategies |

|---|---|---|

| Telecom Providers | High | Long-term contracts, multiple providers |

| IT/Software Providers | Moderate | In-house development, vendor diversification |

| Financial Institutions | Moderate | Banking capabilities, fintech platform |

| Data/Analytics | Moderate | Internal analytics, multiple providers |

Customers Bargaining Power

Kaspi.kz's 'Super App' significantly boosts customer retention. The platform's integrated services—payments, marketplace, and fintech—create a convenient ecosystem. This integration makes it harder for users to switch. In 2024, Kaspi.kz reported over 13 million monthly active users, highlighting strong customer loyalty.

Kaspi.kz benefits from a large, growing customer base, including 13.5 million mobile users. Almost 9 million users are active daily, reducing individual customer bargaining power. The company's size strengthens its negotiation position with users. Kaspi.kz's scale is a key advantage in its market strategy in 2024.

Kaspi.kz operates in price-sensitive markets like fintech and e-commerce. Customers can switch to competitors, giving them bargaining power. In 2024, the e-commerce sector saw intense competition. Kaspi.kz uses promotions and loyalty programs to maintain customer loyalty. This helps justify its pricing despite market pressures.

Access to Information and Alternatives

Customers of Kaspi.kz have significant bargaining power due to easy access to information and alternatives. Digital platforms and reviews enable informed decisions, increasing the ability to compare and switch service providers. This power is evident in the competitive landscape where customers can readily find alternatives. Kaspi.kz aims to mitigate this by focusing on brand recognition and innovation.

- Customer reviews and ratings significantly influence purchasing decisions in the FinTech sector.

- Kaspi.kz's customer satisfaction scores are closely monitored to maintain its competitive edge.

- The company invests heavily in user experience to reduce customer churn.

- Data from 2024 shows a 15% increase in customers using comparison tools before making financial decisions.

Demand for Value-Added Services

Customers are increasingly demanding more from financial services, seeking personalized experiences and integrated solutions. This trend gives customers some power, as they can switch to providers that better meet their needs. Kaspi.kz responds by investing in AI-driven advisory services and loyalty programs to boost engagement. In 2024, Kaspi.kz reported a 41% increase in active users.

- Personalized offers and seamless experiences are key.

- Customers can choose providers based on specific needs.

- Kaspi.kz uses AI and loyalty programs.

- Kaspi.kz's active user base grew significantly in 2024.

Kaspi.kz faces customer bargaining power due to market competition. Customers can easily compare and switch services. The company uses strategies like loyalty programs to maintain user engagement.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Switching Costs | Low, due to digital alternatives | 15% of customers used comparison tools |

| Customer Loyalty | Moderate, influenced by brand | 41% increase in active users |

| Pricing Sensitivity | High, especially in e-commerce | Intense market competition |

Rivalry Among Competitors

Kaspi.kz dominates Kazakhstan's fintech and e-commerce sectors. Its strong brand and large user base create a significant barrier. This market position gives it a competitive edge. In 2024, Kaspi.kz held roughly 60% of the fintech market share.

The fintech sector is highly competitive, with many firms striving for dominance. Kaspi.kz competes with established banks and innovative fintech startups. In 2024, the fintech market saw over $100 billion in investments globally. To lead, Kaspi.kz must constantly innovate and adjust to maintain its position.

The e-commerce sector in Kazakhstan is intense, with Kaspi.kz facing off against both domestic and global competitors. Kaspi.kz must continually invest in marketing, logistics, and customer support to stay ahead. Local companies, including Kaspi.kz, often have an edge in delivery speed and returns, crucial for Kazakh consumers. In 2024, the e-commerce market in Kazakhstan grew by approximately 25%, highlighting the fierce competition. Kaspi.kz reported a 40% increase in e-commerce transactions in the first half of 2024.

Focus on Super App Model

Kaspi.kz's 'Super App' strategy, integrating diverse services, differentiates it from rivals. This approach enhances user experience, boosting loyalty and lowering rivalry threats. Network effects within the super app create a competitive edge, fostering growth across platforms. In 2024, Kaspi.kz reported significant growth in its ecosystem, with a 24% increase in monthly active users. This showcases the effectiveness of its integrated model.

- Super App Integration: Combines various services.

- Enhanced User Experience: Boosts customer loyalty.

- Network Effects: Supports platform growth.

- Growth in 2024: 24% increase in active users.

Acquisitions and Expansion

Kaspi.kz leverages acquisitions and partnerships to bolster its competitive edge and broaden its market presence. The acquisition of Hepsiburada in Turkey demonstrates this strategy, aiming for growth beyond its primary market. This expansion significantly increases its addressable market and medium-term growth opportunities.

- Kaspi.kz's revenue for 2024 is expected to exceed $3 billion.

- The Hepsiburada acquisition is valued at over $1 billion.

- Kaspi.kz's market capitalization in late 2024 is approximately $20 billion.

Kaspi.kz's dominance in Kazakhstan's fintech and e-commerce creates a competitive edge, though the sectors are highly competitive. The Super App strategy and acquisitions like Hepsiburada enhance its market presence. In 2024, e-commerce in Kazakhstan grew by about 25%, with Kaspi.kz reporting a 40% increase in transactions.

| Aspect | Details |

|---|---|

| Market Share (Fintech, 2024) | Approx. 60% |

| E-commerce Growth (Kazakhstan, 2024) | 25% |

| Kaspi.kz E-commerce Transaction Growth (H1 2024) | 40% |

SSubstitutes Threaten

Traditional banking services pose a threat to Kaspi.kz, as some customers still favor physical branches and established payment methods. In 2024, despite the growth of digital banking, a significant portion of the population, about 30%, still relies on traditional banking services. This preference limits the full adoption of Kaspi.kz's digital solutions. Kaspi.kz addresses this by enhancing its user-friendly digital platform and collaborating with traditional banks to integrate services.

Kaspi.kz faces threats from alternative payment systems. Competitors include fintech firms and mobile wallets. Customers might switch for specific transactions. In 2024, digital payments grew significantly. Kaspi.kz offers diverse payment options and rewards.

E-commerce platforms pose a threat to Kaspi.kz. Competitors like Wildberries and AliExpress offer alternatives for consumers. In 2024, e-commerce in Kazakhstan grew, increasing the competition. Kaspi.kz competes by focusing on local merchants and integrated services.

Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms and other alternative financing options serve as substitutes for Kaspi.kz's lending products. Borrowers might choose these platforms for potentially more flexible terms or lower interest rates. In 2024, the P2P lending market in Kazakhstan saw growing activity, with platforms like Zaimer and Moneyman expanding their services. Kaspi.kz combats this threat by offering a diverse array of loan products, a convenient application process, and competitive interest rates, aiming to retain its customer base.

- P2P lending platforms offer alternative financing.

- Borrowers seek flexible terms and rates.

- Kaspi.kz provides diverse loan options.

- Competitive rates and ease of use are key.

Cash Transactions

Cash transactions pose a threat to Kaspi.kz, especially for small-value purchases. While digital payments are growing, cash retains appeal due to its anonymity and ease of use for some consumers in Kazakhstan. Kaspi.kz actively promotes digital payment advantages to reduce cash dependency. They highlight convenience, security, and reward programs to encourage adoption.

- In 2024, cash usage is still significant, with approximately 30% of retail transactions in Kazakhstan involving cash.

- Kaspi.kz's payment volume in 2024 reached over $100 billion, yet a portion still involves cash-based alternatives.

- Kaspi.kz's strategy includes offering cashback and promotions to incentivize digital payments, aiming to capture a larger share of the market.

P2P platforms and alternative financing options compete with Kaspi.kz's lending products. These platforms offer flexible terms and potentially lower rates. In 2024, the P2P lending market in Kazakhstan expanded, with platforms like Zaimer and Moneyman increasing services. Kaspi.kz responds with varied loan options, a simple application process, and competitive rates.

| Substitute | Description | 2024 Data |

|---|---|---|

| P2P Lending | Offers alternative financing options. | Market growth, Zaimer/Moneyman expansion. |

| Cash | Used for small transactions, offers anonymity. | ~30% of retail transactions in cash. |

| Traditional Banks | Provide established financial services. | ~30% still use traditional banking. |

Entrants Threaten

Entering fintech and e-commerce demands substantial capital, a major barrier. New entrants face high costs for tech, marketing, and customer acquisition. Kaspi.kz, with a market cap of ~$19.6 billion as of late 2024, holds a significant advantage due to its financial strength. Competitors need vast resources to compete effectively. Kaspi.kz's profitability, with a net income of ~$1.2 billion in 2023, underscores its strong position.

The financial services sector is tightly regulated, demanding new entrants to comply with intricate rules. Securing licenses is a time-consuming and expensive undertaking. Kaspi.kz benefits from its regulatory expertise, giving it an edge. In 2024, regulatory compliance costs rose by 15% for fintechs, increasing barriers.

Kaspi.kz leverages strong network effects, boosting its platform's value with each new user and merchant. This interlocks its payment, marketplace, and finance services. New entrants face high hurdles to amass a critical user base, a key barrier. In 2024, Kaspi.kz's ecosystem included over 13 million monthly active users.

Brand Recognition and Trust

Kaspi.kz benefits from strong brand recognition and customer trust. New competitors struggle to match this, needing time and resources to build a similar reputation. Kaspi.kz's Super App enjoys significantly higher brand recognition than its rivals. This brand advantage acts as a barrier against new entrants. The established trust makes it harder for new players to attract users.

- Kaspi.kz's brand recognition is 5x higher than the nearest competitor.

- Building brand trust requires substantial investment and time.

- Established brands often retain customer loyalty.

Technological Expertise

Kaspi.kz's robust technology platform presents a significant barrier to entry. Building and maintaining such a system demands substantial investment in specialized expertise. New entrants face challenges in replicating Kaspi.kz's technological prowess, particularly in areas like AI and data analytics. Kaspi.kz's culture thrives on innovation, constantly seeking new solutions.

- Kaspi.kz invested approximately $160 million in technology and software development in 2023.

- Kaspi.kz's tech team comprised over 2,000 employees as of late 2024.

- Kaspi.kz's AI-driven fraud detection system reduced fraudulent transactions by 70% in 2024.

New entrants to fintech and e-commerce face high capital requirements, including tech and marketing costs. Strict regulations, such as increased compliance costs, present another barrier. Kaspi.kz's strong brand and tech platform create significant advantages.

| Factor | Impact on New Entrants | Kaspi.kz Advantage |

|---|---|---|

| Capital Needs | High initial investment | ~$19.6B market cap, 2023 net income ~$1.2B |

| Regulatory Hurdles | Compliance is costly and time-consuming | Established expertise, 15% compliance cost increase in 2024 |

| Brand Recognition | Difficult to build trust | 5x brand recognition vs. rivals, over 13M monthly active users |

Porter's Five Forces Analysis Data Sources

Kaspi.kz's analysis uses financial statements, market research, and industry reports, enriched by expert assessments, for competitive force scoring.