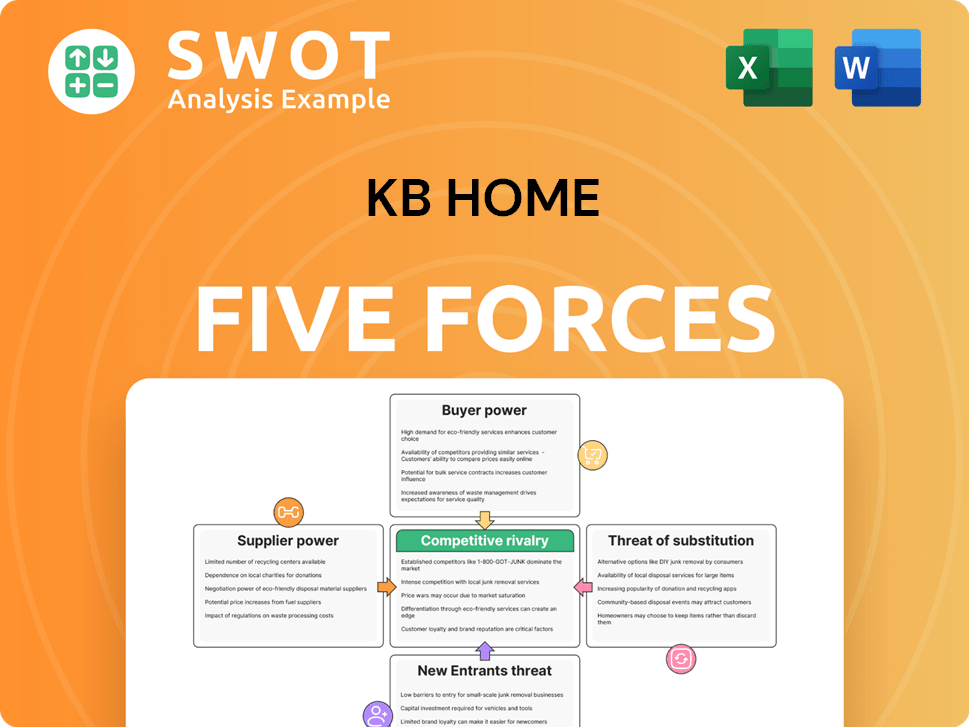

KB Home Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KB Home Bundle

What is included in the product

Analyzes KB Home's competitive forces: rivalry, suppliers, buyers, new entrants, and substitutes.

Swap in data, labels, and notes to reflect KB Home's current business conditions and strategic insights.

Preview Before You Purchase

KB Home Porter's Five Forces Analysis

This preview offers the exact Porter's Five Forces analysis of KB Home you'll receive. It's a complete, ready-to-use document with no alterations needed.

Porter's Five Forces Analysis Template

KB Home navigates a housing market shaped by strong buyer power, particularly influenced by interest rates and economic outlook. Competition is intense, with numerous national and local builders vying for market share. Suppliers of materials like lumber and labor also exert significant influence on KB Home's costs and profitability. The threat of new entrants is moderate, balanced by high capital requirements. Substitute products, such as existing homes, present a persistent challenge.

Unlock key insights into KB Home’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

The building materials sector has high supplier concentration. KB Home depends on a few key suppliers for crucial materials. Disruptions or price hikes from suppliers significantly affect KB Home’s costs. For instance, West Fraser Timber holds a significant market share in lumber. Understanding supplier concentration is vital for assessing KB Home’s vulnerabilities.

Fluctuations in lumber and steel costs significantly impact KB Home's profits. In 2024, lumber prices saw volatility due to supply chain issues and demand changes. Steel prices also fluctuated, influenced by global economic factors and trade policies. KB Home must actively manage these costs to protect margins. For example, in Q3 2024, KB Home's cost of sales was $1.64 billion.

KB Home utilizes long-term contracts to manage supplier power, aiming to stabilize material costs. The efficacy of these contracts hinges on terms and market dynamics. In 2024, lumber prices, crucial for homebuilding, saw fluctuations; index-based pricing in contracts is important. Assessing average contract duration and price lock mechanisms is key to protecting against price hikes.

Supplier Switching Costs

Switching costs significantly impact KB Home's bargaining power with suppliers. These costs, encompassing expenses like retooling and retraining, can restrict KB Home's ability to seek more favorable terms. Assessing the estimated switching costs for key materials, such as lumber, concrete, and steel, is crucial for strategic decision-making. High switching costs reduce flexibility, potentially increasing expenses and decreasing profitability for the company.

- Material costs, particularly for lumber and steel, have fluctuated significantly in 2024, impacting switching cost considerations.

- The average cost of lumber increased by 10% in Q3 2024, influencing supplier negotiations and the need for cost-effective alternatives.

- Steel prices also saw volatility, with a 7% increase in Q2 2024, affecting the feasibility of changing steel suppliers.

- KB Home should explore strategies like pre-negotiated contracts and supplier diversification to mitigate high switching costs.

Regional Supply Dynamics

Regional supply dynamics significantly impact supplier power for KB Home. Market concentration and average home prices vary considerably across regions like the Southwest and West Coast. In 2024, the Southwest saw a median home price of approximately $400,000, while the West Coast reached around $700,000. KB Home must tailor its supply chain to these regional specifics to manage supplier power effectively.

- Supply chain strategies must adjust to regional differences in material costs and availability.

- The West Coast's higher home prices may give suppliers greater leverage due to increased project values.

- KB Home should diversify suppliers to reduce dependence and negotiate better terms across different regions.

- Analyzing regional market concentrations of key building materials is crucial.

KB Home faces supplier power challenges due to concentration in the building materials sector. Fluctuating lumber and steel prices in 2024, impacted profitability. Long-term contracts and regional supply dynamics are key management strategies.

| Metric | 2024 Data | Impact |

|---|---|---|

| Lumber Price Increase (Q3) | 10% | Higher Costs |

| Steel Price Increase (Q2) | 7% | Margin Pressure |

| West Coast Median Home Price | $700,000 | Supplier Leverage |

Customers Bargaining Power

Homebuyers' price sensitivity is high, particularly given 2024's interest rate volatility and economic concerns. KB Home must balance pricing with value to attract customers. Consider the median new home sale price, which was around $436,700 in March 2024. Adjust pricing strategies to stay competitive.

KB Home's personalized approach, where customers select design and floor plans, can lower buyer power. Customization differentiates KB Home, potentially supporting higher prices. In 2024, the average number of customization requests per customer could be a key metric. This strategy helps KB Home compete effectively.

Location significantly influences customer bargaining power, with homebuyers prioritizing desirable areas. KB Home must strategically choose locations to attract its target market and offer value. For instance, in 2024, neighborhood quality influenced over 60% of homebuyer decisions. Proximity to urban centers can elevate home values, affecting customer negotiation leverage.

Energy Efficiency Demands

Customers' focus on energy efficiency affects KB Home. Increased awareness and sustainability influence home-buying choices. KB Home's ENERGY STAR homes can be a competitive edge. Assessing customer preferences is essential. Solar panel interest is growing.

- In 2024, around 90% of homebuyers consider energy efficiency.

- KB Home saw a 15% increase in demand for homes with solar panels in Q3 2024.

- ENERGY STAR homes save homeowners about $400-$600 annually on energy bills.

- Customer satisfaction with energy-efficient features hits 85%.

Resale Market Alternatives

The resale market presents a robust alternative, strengthening customer bargaining power. KB Home must differentiate itself through features and value. In 2024, existing home sales were significant. Comparing median prices is crucial for competitive analysis.

- Resale Market: Provides immediate housing options.

- Differentiation: Key to attracting buyers over resales.

- Competitive Pricing: Analyze median existing home prices.

- Customer Choice: Empowers buyers with options.

Customer bargaining power with KB Home is shaped by price sensitivity, influenced by interest rates and economic conditions. In 2024, the median new home price was approximately $436,700. Customization options reduce buyer power by differentiating KB Home and offering value.

Location is crucial; in 2024, neighborhood quality drove over 60% of homebuyer decisions, impacting negotiation leverage. Energy efficiency also affects choices, with around 90% of homebuyers considering it in 2024. KB Home's ENERGY STAR homes offer an advantage.

The resale market is a viable alternative, increasing customer options. KB Home must differentiate to attract buyers effectively. Comparing median existing home prices is critical for competitive analysis and pricing strategy.

| Factor | Impact on Power | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Median new home price: ~$436,700 |

| Customization | Lowers Power | Avg. custom requests per customer is a key metric. |

| Location | Influential | Neighborhood quality: 60%+ influence |

| Energy Efficiency | Increases | 90% of buyers consider it |

| Resale Market | Increases Power | Existing homes provide choices |

Rivalry Among Competitors

The residential homebuilding market is fiercely competitive, with many firms competing for customers. KB Home battles giants like D.R. Horton and Lennar. In 2024, D.R. Horton's revenue was around $36 billion, and Lennar's was roughly $34 billion, underscoring the pressure on KB Home. To compete, KB Home must constantly analyze rivals' strategies and market share.

KB Home's market share is modest versus industry leaders, signaling a need to boost its competitive stance. Keeping tabs on market share shifts and spotting expansion opportunities is crucial. In 2024, the top 10 homebuilders controlled about 50% of the market. KB Home's specific percentage requires close monitoring for strategic insights.

Competitive intensity for KB Home fluctuates regionally due to market concentration and home prices. Regions with high concentration and elevated prices may pose greater challenges. In 2024, the median existing home price in the U.S. was around $400,000, with regional variations. KB Home must tailor strategies to each region's competitive environment, as seen in areas with high housing demand.

Differentiation Strategies

KB Home's competitive edge is shaped by differentiation, particularly through custom home design and energy-efficient features. These strategies aim to attract and retain customers in a competitive market. To assess effectiveness, consider the proportion of offerings with these features. Customization and energy efficiency can drive sales and brand loyalty.

- Customization: KB Home offers extensive design options, with around 80% of homes allowing for some level of customization in 2024.

- Energy Efficiency: Approximately 95% of KB Home's homes feature energy-efficient designs, reflecting a strong commitment to sustainability in 2024.

- Customer Attraction: These features contribute to higher customer satisfaction and potentially increased market share.

- Competitive Advantage: Differentiation helps KB Home stand out from competitors.

Gross Margin Pressures

Competitive pressures significantly influence KB Home's gross margins, forcing a delicate balance between pricing and profitability. In 2024, the average gross margin for homebuilders like KB Home was around 20-25%, according to industry reports. KB Home must closely monitor its margins and seek efficiency improvements to maintain its financial health. Incentives and price reductions can erode margins; thus, KB Home needs effective strategies to counter these pressures.

- Margin pressures are a key concern for KB Home.

- Average gross margin for homebuilders was 20-25% in 2024.

- KB Home must improve efficiency.

- Incentives impact margins negatively.

Rivalry in homebuilding is intense, with major players like D.R. Horton and Lennar. KB Home competes with giants; their 2024 revenues were about $36B and $34B, respectively. KB Home needs to watch its market share, customize offerings, and focus on energy-efficient features to stand out.

| Factor | Details | Impact on KB Home |

|---|---|---|

| Market Share | Top 10 builders control ~50% in 2024. | Requires strategic focus on expansion. |

| Customization | ~80% homes allow customization (2024). | Differentiates KB Home from competitors. |

| Energy Efficiency | ~95% homes feature energy-efficient designs (2024). | Attracts customers, supports sustainability. |

SSubstitutes Threaten

The existing home resale market presents a major threat to KB Home. These homes are immediate alternatives for buyers. Price and location often sway choices. In 2024, existing home sales volume and median prices are key indicators of this competition. For example, in April 2024, existing home sales decreased 1.9% monthly to a seasonally adjusted annual rate of 4.19 million.

Rental apartments and single-family rentals are key substitutes for potential homebuyers. Economic downturns or high-interest rates make renting more appealing than buying. Monitor rental vacancy rates and rent growth to assess the competitive landscape. In 2024, the national average rent was about $1,375.

Home renovation and remodeling pose a significant threat to KB Home. High interest rates in 2024 make remodeling a more appealing option than purchasing a new home. According to the Joint Center for Housing Studies of Harvard University, home improvement spending reached $495 billion in 2023. This highlights the ongoing competition for consumer spending.

Alternative Housing Options

Alternative housing options pose a threat to KB Home. Manufactured homes, tiny homes, and co-living spaces offer alternatives, particularly for budget-conscious buyers. Shifting consumer preferences and affordability pressures fuel this substitution trend. The manufactured housing market saw over 100,000 homes shipped in 2024. Monitoring these options' growth is crucial.

- Manufactured homes: 100,000+ units shipped in 2024.

- Tiny homes: Growing market, but limited data.

- Co-living: Rising in urban areas.

- Affordability: Key driver for alternatives.

Delayed Home Purchases

The threat of substitutes for KB Home includes delayed home purchases. Potential homebuyers might postpone buying due to economic uncertainty or high interest rates, essentially substituting homeownership with waiting. Economic forecasts and consumer confidence are vital indicators to watch. Assess consumer sentiment and economic forecasts to anticipate shifts in buyer behavior. In 2024, rising mortgage rates and inflation have already led to a slowdown in the housing market, indicating this substitution is in effect.

- Mortgage rates reached over 7% in late 2023, impacting affordability.

- Consumer confidence levels have fluctuated, reflecting economic anxieties.

- Housing starts and sales data reveal market contractions.

- Rental markets may become more attractive substitutes.

KB Home faces substitution threats from various sources. These include existing homes, rentals, renovations, and alternative housing. Economic factors and consumer preferences significantly influence these choices.

The housing market's performance, such as in 2024, shows how these substitutes affect KB Home's sales. Monitoring trends and consumer behavior is key.

This data informs investment decisions and strategic planning. Consider the detailed table below:

| Substitute | 2024 Market Impact | Key Metrics |

|---|---|---|

| Existing Homes | Sales volume down | April sales down 1.9% to 4.19M |

| Rentals | Demand increase | Avg. rent ~$1,375 |

| Home Renovation | Spending up | $495B in 2023 |

Entrants Threaten

Homebuilding is capital-intensive, demanding substantial funds for land, construction, and operations, thus creating a barrier. In 2024, KB Home's total assets were around $7.7 billion, showing the scale of capital needed. New entrants face hurdles securing financing, further limiting competition.

Regulatory hurdles significantly impact new entrants in the homebuilding industry. Complex regulations and permitting processes create barriers. In 2024, compliance costs rose 7% due to stricter zoning and environmental rules. New builders often struggle with these costs.

Established homebuilders like KB Home benefit from brand loyalty, a significant barrier for new entrants. Building a strong brand is key in the homebuying process, where trust matters. KB Home's brand strength, reflected in its 2024 revenue of approximately $6.4 billion, showcases its market position. New entrants must focus on innovative marketing and unique value propositions to build brand awareness and compete effectively.

Land Availability

Land availability significantly impacts new home builders like KB Home. Securing prime land in desirable areas is crucial yet challenging. High land costs and limited supply form a major barrier. In 2024, land prices in many metro areas rose, increasing entry costs. New entrants must strategize land acquisition to compete.

- Land costs in major US cities rose by 5-10% in 2024.

- KB Home's land and land development spending was $1.13 billion in fiscal 2024.

- New entrants often use options or joint ventures to secure land.

- Zoning regulations and permitting delays add to land acquisition hurdles.

Economies of Scale

The threat of new entrants for KB Home is influenced by economies of scale. Established homebuilders like KB Home gain cost advantages through bulk purchasing of materials, efficient construction processes, and large-scale marketing campaigns. New entrants often struggle to match these efficiencies, leading to higher costs and potentially lower profitability.

This cost disadvantage makes it difficult for new companies to compete on price, a critical factor in the housing market. Major players can leverage their size to negotiate better deals and spread fixed costs, creating a significant barrier. In 2024, KB Home's gross profit margin was around 21.1%, showcasing its ability to manage costs effectively.

The challenge for new entrants is to find ways to compete effectively, whether through niche markets, innovative construction techniques, or superior customer service. The cost structure of large players is often complex, involving land acquisition, labor, materials, and marketing expenses. New entrants must carefully evaluate these costs to determine their ability to be competitive.

- Established homebuilders like KB Home benefit from bulk purchasing of materials, creating cost advantages.

- New entrants often struggle to achieve similar efficiencies initially.

- KB Home's 2024 gross profit margin was around 21.1%, demonstrating its ability to manage costs.

- New entrants must find ways to compete effectively to overcome cost disadvantages.

New entrants face significant hurdles in the homebuilding market, influenced by high capital requirements. KB Home's $7.7 billion in assets in 2024 highlights this barrier. Regulatory compliance and land acquisition costs further impede newcomers.

Brand loyalty and economies of scale favor established builders like KB Home, making it tough for new competitors. New entrants must overcome these obstacles through innovative strategies.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Needs | High Initial Investment | KB Home assets: $7.7B |

| Regulations | Increased Costs | Compliance cost rise 7% |

| Economies of Scale | Cost Advantages | KB Home margin: 21.1% |

Porter's Five Forces Analysis Data Sources

Our analysis employs annual reports, industry studies, market research, and SEC filings for a comprehensive evaluation of competitive pressures.