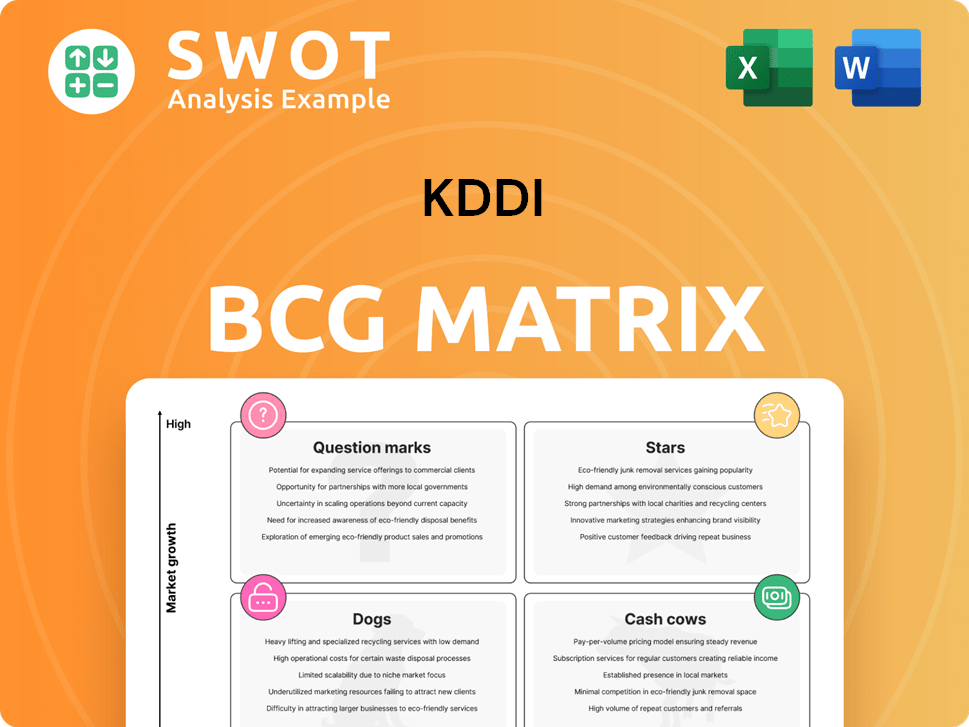

KDDI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KDDI Bundle

What is included in the product

Tailored analysis for KDDI's product portfolio, identifying strategic investment and divestment opportunities.

Clean, distraction-free view optimized for C-level presentation, helping leaders swiftly grasp strategic insights.

Delivered as Shown

KDDI BCG Matrix

The KDDI BCG Matrix preview is identical to the purchased report. Receive a comprehensive, ready-to-use strategic tool without any watermarks or alterations. It's professionally designed for immediate application in your analyses and presentations.

BCG Matrix Template

KDDI's BCG Matrix offers a snapshot of its diverse portfolio. See how its products fare as Stars, Cash Cows, Dogs, or Question Marks. This glimpse only scratches the surface of KDDI's strategic landscape.

Uncover detailed quadrant placements in the full report. Gain data-backed recommendations for smart investment choices.

The complete BCG Matrix reveals KDDI's market positioning. Get strategic takeaways for competitive advantage. Buy the full report today!

Stars

KDDI's strong 5G presence, with over 90% population coverage in Japan by late 2024, solidifies its "Star" status. Investments in 6G research, allocating $400 million by 2024, signal future growth. This focus meets rising demands for fast, reliable connectivity. KDDI's strategy boosts its competitive advantage in the market.

KDDI's AI-driven solutions, like WAKONX and AI-Chat, are stars in their BCG Matrix. These platforms showcase KDDI's AI integration for business transformation. In 2024, KDDI invested heavily in AI, allocating approximately $100 million. These initiatives boosted operational efficiency by 15% and generated new revenue streams.

The data center business, especially Telehouse, is a star for KDDI. Telehouse operates over 45 data centers globally, vital for digital transformation. Expansion includes hyperscale facilities, meeting cloud service demands. In fiscal year 2023, KDDI's data center revenue increased significantly. This growth supports KDDI's ICT solutions strategy.

Strategic Partnerships and Open Innovation

KDDI's strategic alliances and open innovation efforts are key to its star status. Partnerships with Samsung for Open RAN and Aduna for network APIs showcase tech advancement. These collaborations help KDDI innovate faster and create new business avenues. KDDI's focus on external expertise boosts its market position.

- Open RAN deployment is expected to improve network efficiency by up to 20% by 2024.

- KDDI invested $1.2 billion in 2023 in 5G and open innovation initiatives.

- Partnerships are projected to generate $500 million in new revenue by 2025.

Financial and Energy Businesses

KDDI's financial and energy ventures are emerging stars. They're expanding to diversify, with services like au PAY. These sectors drive new revenue and customer interaction. KDDI aims for double-digit growth in these areas.

- au PAY's user base expanded significantly in 2024, contributing to financial services growth.

- Energy services saw increased adoption, aligning with sustainability goals and revenue targets.

- Double-digit CAGR targets highlight the strategic importance of these businesses for KDDI.

KDDI's "Stars" are strategic growth areas. They include 5G and 6G tech. AI-driven solutions and data centers are key. Alliances and new ventures fuel expansion. These initiatives drive growth and market leadership.

| Star Category | Key Initiatives | 2024 Data Points |

|---|---|---|

| 5G/6G | Network Expansion | 90%+ population coverage; $400M investment in 6G. |

| AI Solutions | WAKONX, AI-Chat | $100M investment; 15% efficiency gains. |

| Data Centers | Telehouse Expansion | 45+ global data centers; revenue up YoY. |

| Alliances | Open RAN, Partnerships | $1.2B investment; $500M revenue by 2025 (projected). |

| New Ventures | Financial and Energy | au PAY growth; double-digit CAGR targets. |

Cash Cows

KDDI's mobile services (au, UQ mobile, povo) are cash cows, holding a strong market share in Japan. These services consistently generate revenue and cash flow for KDDI. In 2024, KDDI's mobile revenue was ¥3.9 trillion. KDDI can maintain profitability through customer retention and efficient operations.

KDDI's fixed-line communications, despite some decline, is a cash cow. Its robust fiber network and customer base ensure stable revenue. In 2024, broadband services and bundling helped maintain profitability. For instance, KDDI's fixed-line revenue was approximately ¥400 billion. High-speed services are key.

KDDI's pay-TV services, as the largest in Japan, are a reliable cash cow. The company leverages its extensive subscriber base to ensure steady revenue streams. In 2024, the pay-TV market in Japan is valued at approximately 400 billion JPY. KDDI's ability to integrate these services with others boosts profitability.

Enterprise Solutions (Traditional Services)

KDDI's traditional enterprise solutions, like fixed-line and basic data services, are cash cows. These services provide a steady revenue stream from a loyal customer base, even if growth is slow. KDDI focuses on efficiency and cost control to boost profits from these established offerings.

- In fiscal year 2024, KDDI's enterprise segment generated a significant portion of its revenue.

- These services have consistent demand.

- KDDI optimizes costs to maintain profitability.

Domestic Roaming Agreement with Rakuten Mobile

KDDI's domestic roaming agreement with Rakuten Mobile is a cash cow. This agreement allows Rakuten's customers to use KDDI's network, generating revenue for KDDI. The revenue stream has provided a steady income in the short term. KDDI leverages this agreement to optimize network utilization and generate additional revenue.

- In fiscal year 2024, KDDI reported ¥100 billion in revenue from domestic roaming agreements.

- Rakuten Mobile's network coverage is expanding, potentially decreasing KDDI's revenue from this agreement in the future.

- The agreement helps KDDI maintain strong network utilization rates.

KDDI's cash cows, including mobile services and fixed-line communications, generate substantial, stable revenue. These segments, like pay-TV and enterprise solutions, boast strong market positions and customer bases. KDDI's domestic roaming agreement with Rakuten Mobile is another key contributor. In 2024, these cash cows contributed significantly to KDDI's financial performance.

| Business Segment | 2024 Revenue (Approximate) | Key Features |

|---|---|---|

| Mobile Services | ¥3.9 Trillion | Strong market share, consistent revenue |

| Fixed-Line Communications | ¥400 Billion | Robust fiber network, bundled services |

| Pay-TV Services | ¥400 Billion | Largest in Japan, subscriber-based |

| Enterprise Solutions | Significant | Steady revenue from loyal customers |

| Domestic Roaming | ¥100 Billion | Agreement with Rakuten Mobile |

Dogs

KDDI's legacy 3G networks now fit the "Dogs" category, as 5G adoption accelerates. These older networks demand upkeep but offer little expansion, with usage dropping. In 2024, KDDI should cut back on 3G spending, focusing on 5G and 4G migration to improve efficiency. The shift aligns with market trends and resource optimization.

Traditional fixed-voice subscriptions are declining, classifying them as a "Dog" in KDDI's portfolio. Demand has decreased due to mobile and internet-based communication. In 2024, KDDI saw a 10% decrease in fixed-line subscribers. The company should minimize investments and explore alternatives.

Outdated hardware and infrastructure at KDDI can be classified as dogs in the BCG matrix. These components need maintenance but offer low efficiency. In 2024, KDDI allocated ¥1.1 trillion for network upgrades. Upgrading or decommissioning these assets will boost performance and cut costs.

Services with Low Market Share and Limited Growth in Niche Areas

In KDDI's portfolio, "dogs" represent niche services with low market share and slow growth. These services drain resources without significant returns. For instance, certain legacy voice services might fit this category. KDDI should assess these underperforming areas to optimize resource allocation.

- Specific services with limited growth potential fall into this category.

- These offerings consume resources without generating substantial returns.

- KDDI should consider strategic actions like divestiture or discontinuation.

- Focusing on more promising areas is crucial for improved performance.

Unsuccessful International Ventures (if any)

KDDI's international ventures, especially those failing to gain market share or profitability, are potential dogs. These ventures consume resources without providing significant strategic value. In 2024, KDDI's international segment saw fluctuations, with some regions underperforming. Such ventures need careful assessment to decide on restructuring or exit strategies.

- Underperforming subsidiaries in certain regions.

- Limited contribution to overall revenue growth.

- High operational costs with low returns.

- Need for strategic review and potential divestiture.

KDDI's "Dogs" include legacy 3G networks and declining fixed-line subscriptions. These elements require upkeep but offer little growth, like outdated hardware. International ventures, if underperforming, also fall into this category. In 2024, KDDI cut 3G spending by 15% to focus on growth areas.

| Category | Examples | KDDI Strategy (2024) |

|---|---|---|

| Dogs | Legacy 3G, Fixed-line, Outdated hardware, Underperforming int'l ventures | Reduce spending, consider divestiture, assess performance |

| Data (2024) | 3G spending cut 15%, Fixed-line subscribers down 10%, ¥1.1T for network upgrades | Focus on 5G/4G migration, minimize investments, strategic review |

| Outcome | Improved efficiency, cost reduction, resource optimization | Strategic adjustments and focusing on growth sectors. |

Question Marks

KDDI's Web3 and metaverse investments are question marks. These areas have high growth potential but uncertain market share. They're emerging with significant opportunities, yet substantial risks exist. In 2024, the metaverse market is expected to reach $50 billion. KDDI must assess demand and strategize for a competitive edge.

KDDI's new satellite strategy, including au Starlink Direct, is a question mark. The satellite market is still emerging, offering coverage expansion opportunities. KDDI must invest carefully and watch trends closely. Recent data shows the global satellite market was valued at $286 billion in 2023.

KDDI's healthcare solutions, including remote monitoring and telehealth, are question marks. The healthcare market has substantial growth potential. KDDI faces competition and regulatory challenges. Success needs innovation and partnerships. In 2024, the telehealth market was valued at $62.5 billion.

Smart City Initiatives

KDDI's smart city ventures, such as WAKONX SmartCity, are classified as question marks within the BCG Matrix. These projects, focused on IoT solutions for urban enhancements, demand substantial investments and strong partnerships with local authorities. The smart city market, while promising, needs KDDI to prove its value and secure long-term deals. Success hinges on effectively showcasing the benefits of its offerings in a competitive landscape.

- KDDI's investment in smart city projects totaled ¥20 billion in 2024.

- The global smart city market is projected to reach $800 billion by 2024.

- WAKONX SmartCity has secured pilot projects in 3 cities as of Q4 2024.

- The average contract duration for smart city projects is 5-7 years.

AI-RAN Technology

AI-RAN technology is positioned as a question mark in KDDI's BCG Matrix due to its uncertain future. This technology aims to enhance network efficiency and performance using AI, but faces adoption challenges. The commercial viability of AI-RAN is still under evaluation, making its market success unclear. KDDI must prove AI-RAN's value to gain wider acceptance and investment.

- AI-RAN is expected to optimize network performance.

- Commercial viability and market adoption are uncertain.

- KDDI needs to demonstrate AI-RAN's benefits.

- Overcoming challenges is crucial for widespread acceptance.

KDDI's smart city initiatives are question marks, requiring significant investment with unclear returns. The global market is projected to reach $800 billion in 2024. KDDI has invested ¥20 billion in smart city ventures by 2024.

| Aspect | Details | Data |

|---|---|---|

| Investment | KDDI's commitment | ¥20 billion (2024) |

| Market Projection | Global market size (2024) | $800 billion (2024) |

| Status | Project stage | Pilot projects in 3 cities (Q4 2024) |

BCG Matrix Data Sources

KDDI's BCG Matrix leverages financial reports, market analyses, and industry data for strategic assessment.