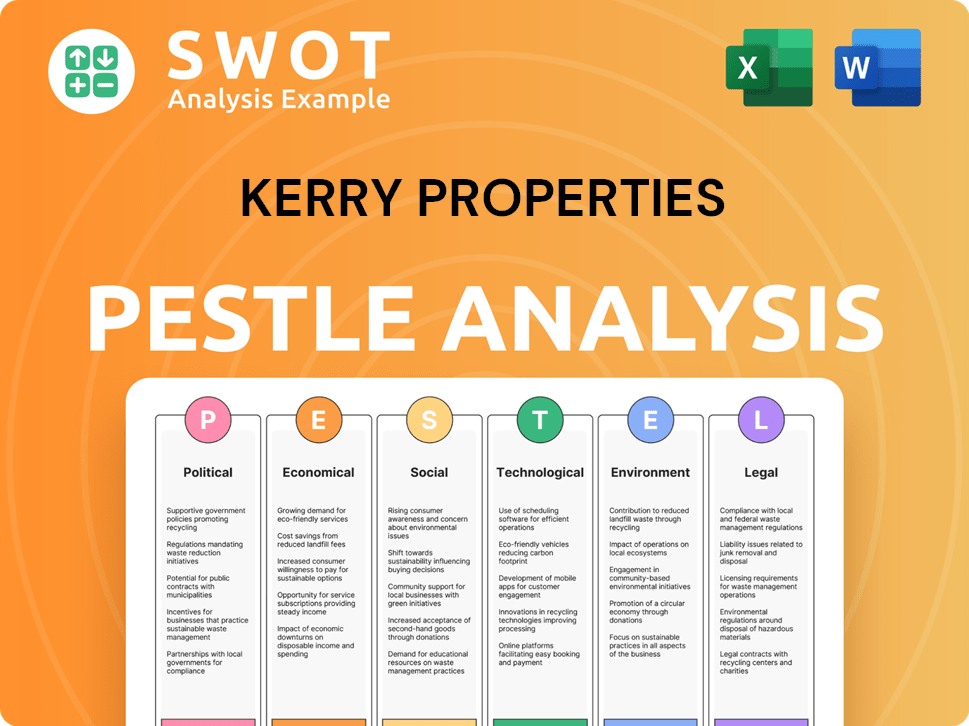

Kerry Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kerry Properties Bundle

What is included in the product

Assesses macro-environmental influences on Kerry Properties using PESTLE framework for strategic decision-making.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Kerry Properties PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured for Kerry Properties. It's a detailed PESTLE analysis covering the company’s environment. The political, economic, social, technological, legal, and environmental aspects are all addressed. No hidden content; this is the complete, downloadable document you'll get instantly. Ready to implement.

PESTLE Analysis Template

Navigate the complexities impacting Kerry Properties with our focused PESTLE analysis. Uncover crucial political, economic, social, technological, legal, and environmental factors. This analysis gives you a clear view of the external forces shaping the company's performance.

Identify potential risks, capitalize on emerging opportunities, and sharpen your strategic planning. Equip yourself with this data-driven report, perfect for investors and market analysts.

Get the full picture: instant download with detailed insights ready to guide your decisions!

Political factors

Government policies in Mainland China and Hong Kong heavily influence Kerry Properties. Measures such as property cooling steps and loan adjustments directly affect sales and investment. For example, in 2024, Hong Kong saw property transaction volumes fall. Changes in mortgage rates and regulations in both regions can significantly impact the company's financial performance. These factors are key for Kerry Properties' strategic planning.

Political stability in Mainland China and Hong Kong is crucial for Kerry Properties. Changes in political climate affect investor confidence. In 2024, Hong Kong's property market saw adjustments due to shifts in political dynamics. Mainland China's economic policies also impact the company's operations. These factors influence market sentiment and investment decisions.

Government urban planning dictates property development. Kerry Properties relies on these policies for land access and development approvals. In 2024, Hong Kong's focus on sustainable urban growth impacts Kerry's projects. Recent data shows shifts in zoning regulations affecting their new ventures.

Policies on Foreign Investment

Mainland China's foreign investment policies directly impact Kerry Properties. Restrictions or incentives influence the inflow of international capital and partnerships. Recent data shows a fluctuating trend; foreign direct investment in China's real estate decreased by 13.7% year-on-year in the first quarter of 2024. These policies affect project financing, development timelines, and overall profitability.

- 2024 Q1: FDI in China's real estate decreased 13.7% YoY.

- Policy shifts can alter project feasibility.

- Regulations affect capital inflow and partnerships.

Government Stimulus Measures

Government stimulus measures, such as tax breaks or infrastructure projects, can significantly influence Kerry Properties. These measures can boost economic activity and, consequently, increase demand for property. For example, in 2024, Hong Kong's government implemented policies to support the real estate sector, potentially benefiting companies like Kerry Properties. Such policies can create a more favorable environment, leading to increased investment and development opportunities.

- Government stimulus can increase property demand.

- Infrastructure projects can boost property values.

- Tax incentives can attract investors.

- Economic growth driven by stimulus supports the property market.

Political factors, like government policies in China and Hong Kong, substantially influence Kerry Properties. Changes in mortgage rates and urban planning significantly affect operations, with FDI in China’s real estate down 13.7% YoY in Q1 2024.

Government stimulus, such as tax breaks, also shapes property demand, potentially benefiting Kerry. Political stability and evolving economic policies create market shifts and affect investment decisions and project feasibility.

| Factor | Impact | Data (2024) |

|---|---|---|

| Property Regulations | Influence on sales & investment. | HK property transaction volume decreased |

| Political Climate | Affects investor confidence & sentiment. | China's economic policies adjustments. |

| Foreign Investment | Affects capital inflow & partnerships. | FDI in China real estate -13.7% YoY (Q1). |

Economic factors

The economic health of Mainland China and Hong Kong directly impacts Kerry Properties. Strong economic growth fuels demand for various property types. In 2024, China's GDP growth is projected around 5%, influencing property investments. Hong Kong's economy, though smaller, also plays a crucial role. Positive growth in both regions boosts Kerry Properties' prospects.

Interest rate fluctuations significantly influence Kerry Properties' profitability. In 2024, Hong Kong's prime rate hovered around 5.875%, affecting mortgage rates. Rising rates increase borrowing costs for Kerry Properties' projects. Conversely, falling rates could boost property demand and potentially improve sales, as seen with the 2023 rate cuts.

Inflation significantly impacts Kerry Properties. Rising construction material and labor costs increase development expenses. Decreased purchasing power of buyers/tenants affects demand. In 2024, Hong Kong's inflation rate was around 2.1%, impacting property investments. This trend continues into 2025.

Property Prices and Rental Yields

Fluctuations in property prices and rental rates directly impact Kerry Properties' investment property values and project profitability. For instance, in Hong Kong, where Kerry Properties has a significant presence, property prices saw a decrease in 2023 and early 2024, affecting valuation. Rental yields in key areas like Central and Causeway Bay have shown variations, influencing income streams.

- Hong Kong property prices decreased by approximately 5-10% in 2023.

- Rental yields in Hong Kong's prime areas were around 2-3% in early 2024.

- Changes in interest rates also influence property market dynamics.

- Economic downturns can negatively impact property values and rental income.

Availability of Credit and Liquidity

The availability of credit and market liquidity significantly influence real estate development and sales, directly impacting Kerry Properties. High liquidity and accessible credit typically fuel property market growth, benefiting the company's financial performance. Conversely, tighter credit conditions and reduced liquidity can hinder development projects and sales volumes. In 2024, Hong Kong's prime lending rate is at 5.875%, influencing borrowing costs.

- Hong Kong's residential property prices decreased by 6.3% in 2023.

- The Hong Kong Monetary Authority (HKMA) manages liquidity in the banking system.

- Kerry Properties' financial health depends on its ability to secure funding for projects.

- Interest rate hikes can increase financing costs, affecting profitability.

China's 2024 GDP growth, around 5%, supports property demand for Kerry Properties, while Hong Kong's economy remains vital. Interest rates significantly affect costs; HK's prime rate around 5.875% impacts mortgages and borrowing. Inflation, like Hong Kong's 2.1% in 2024, influences expenses and buyer purchasing power.

| Economic Factor | Impact on Kerry Properties | 2024/2025 Data |

|---|---|---|

| GDP Growth (China) | Influences property demand | Projected ~5% in 2024 |

| Interest Rates (HK) | Affect borrowing costs/mortgage rates | Prime rate ~5.875% |

| Inflation (HK) | Increases expenses, impacts purchasing power | ~2.1% in 2024 |

Sociological factors

Mainland China and Hong Kong's population growth and urbanization fuel demand for housing and commercial spaces. China's urban population reached 950 million in 2024, driving property needs. Hong Kong's high population density and limited land further intensify this demand. Kerry Properties benefits from this trend, given its urban focus.

Changing lifestyles significantly impact housing preferences. Demand for larger homes and better amenities is rising. In 2024, luxury home sales increased by 15% in major cities. Properties in specific locations, like those near transit hubs, are highly sought after. This trend influences Kerry Properties' development strategies, focusing on features and locations that meet evolving consumer needs.

Kerry Properties' market is significantly shaped by demographic shifts. Changes in age structure, like the aging population in Hong Kong, influence demand for retirement-focused properties. In 2024, Hong Kong's median age is about 47 years. Household size trends, with more single-person households, affect housing demand. The average household size in Hong Kong is 2.8 people. Income level variations impact the affordability of different property types. The median monthly household income in Hong Kong is approximately HK$30,000.

Consumer Confidence and Sentiment

Consumer confidence significantly influences property investment decisions. High confidence often leads to increased spending and property purchases, while low confidence can stall the market. Data from late 2024 and early 2025 shows fluctuating consumer sentiment in Hong Kong, affecting property demand. This is crucial for Kerry Properties' strategic planning.

- Hong Kong's Consumer Confidence Index (CCI) in Q4 2024: 85.2 (below the neutral mark of 100)

- Property transaction volume in Q1 2025: Down 15% year-over-year, reflecting cautious consumer behavior.

- Residential property prices forecast for 2025: A potential decrease of 3-5% due to economic uncertainties.

Social Trends in Urban Living

Urban living is evolving, with a growing interest in co-living and mixed-use spaces. This trend influences property design and amenities. For instance, in 2024, co-living saw a 15% rise in demand in major cities. Kerry Properties can capitalize on this by incorporating community-focused elements. Such developments can attract a wider demographic.

- Co-living demand increased by 15% in 2024.

- Mixed-use developments are gaining popularity.

- Community elements enhance property appeal.

Sociological factors critically shape Kerry Properties. Urbanization in mainland China and Hong Kong fuels property demand, with China's urban population at 950 million in 2024. Changing lifestyles impact housing preferences, evident in rising luxury home sales (15% increase in 2024). Demographic shifts like an aging population influence housing needs.

| Factor | Details | Impact |

|---|---|---|

| Urbanization | China's urban pop. 950M (2024). | Drives property demand. |

| Lifestyle Changes | Luxury home sales +15% (2024). | Influences housing preferences. |

| Demographic Shifts | Hong Kong's median age~47 (2024). | Shapes housing needs. |

Technological factors

BIM and construction tech adoption by Kerry Properties can boost efficiency, cut costs, and lift project quality. In 2024, the global BIM market was valued at $7.7 billion, expected to reach $15.5 billion by 2029. This tech can lead to a 10-20% reduction in project costs.

Smart building tech boosts property value. Kerry Properties integrates smart home systems, energy management, and security. This enhances appeal for buyers and tenants. Globally, the smart home market is projected to reach $150 billion by 2025. These tech upgrades improve efficiency and sustainability.

Kerry Properties must leverage digital marketing. Online platforms, virtual tours, and digital strategies are critical. In 2024, digital ad spending in real estate reached $15 billion. This trend is projected to grow by 10% annually through 2025. Property transactions increasingly rely on digital tools.

Data Analytics in Property Management

Data analytics offers Kerry Properties significant opportunities to enhance property management. By analyzing data, they can predict maintenance requirements, improving efficiency and reducing costs. Understanding tenant behavior through data insights allows for better service and informed investment choices. In 2024, the global property management software market was valued at $15.6 billion, with projections to reach $26.3 billion by 2029, highlighting the importance of tech integration.

- Predictive maintenance reduces downtime by up to 30%.

- Tenant behavior analysis can increase lease renewals by 15%.

- Data-driven investment decisions improve ROI by 10%.

- The adoption of smart building tech is growing by 20% annually.

Technological advancements in Logistics

Technological advancements significantly influence Kerry Properties' logistics. Automation in warehouses, such as automated guided vehicles (AGVs), boosts efficiency. Improved tracking systems, including real-time monitoring, enhance service quality. These technologies can lead to cost savings and better customer satisfaction. Investments in these areas are crucial for maintaining a competitive edge.

- Warehouse automation market is projected to reach $40.5 billion by 2028.

- Real-time tracking reduces delivery times by up to 20%.

- Kerry Logistics Network saw a 15% increase in operational efficiency due to tech upgrades in 2024.

Technological factors are vital for Kerry Properties. Integrating BIM and construction tech, which has a $7.7B market (2024) growing to $15.5B by 2029, cuts costs by 10-20%. Smart building and digital marketing are crucial for property value and transactions.

Data analytics, as the property management software market valued at $15.6 billion in 2024, provides insight. Warehouse automation (projected $40.5B by 2028) and tracking enhance logistics. These tech strategies drive efficiency.

| Technology Area | Impact | Financial Data (2024/2025) |

|---|---|---|

| BIM & Construction Tech | Cost Reduction, Efficiency | $7.7B market (2024), growing to $15.5B by 2029. 10-20% cost reduction. |

| Smart Building Tech | Increased Property Value, Sustainability | Smart home market: ~$150B by 2025. Efficiency & appeal boost. |

| Digital Marketing | Property Transactions | Real estate digital ad spend: $15B (2024), +10% growth. |

| Data Analytics | Property Management, Tenant Insights | Property mgmt. software: $15.6B (2024) to $26.3B (2029). |

| Logistics Tech | Automation, Efficiency | Warehouse automation: $40.5B (2028). 15% efficiency (Kerry Logistics). |

Legal factors

Property laws in Mainland China and Hong Kong, including ownership, zoning, and building codes, significantly influence Kerry Properties. For instance, changes in land use regulations in 2024 impacted project approvals. Hong Kong's property market saw fluctuating prices, with residential property values down by 5.5% in Q1 2024. These legal factors directly affect Kerry's development strategies and investment decisions.

Kerry Properties heavily relies on contract law, especially for sales, leases, and construction. The legal framework dictates how these agreements are formed, executed, and enforced. For instance, in 2024, the company likely navigated numerous lease renewals, with the legal aspects impacting profitability. Any disputes, perhaps over construction delays, would be resolved within this framework.

Kerry Properties must comply with environmental laws. These cover construction and property management. They include energy efficiency standards and waste rules. Meeting these regulations affects costs. For 2024, the company invested heavily in eco-friendly tech. This included $5 million for green building upgrades.

Taxation Laws related to Property

Taxation laws significantly shape property market dynamics. Changes in property taxes, like those in Hong Kong, directly impact investment returns and market demand. Stamp duties, a major revenue source, can cool or heat the market based on rates. For example, in 2024, Hong Kong's stamp duty rates remained a key consideration for property transactions. These tax adjustments influence both short-term trading and long-term investment strategies within the real estate sector.

- Stamp Duty: Hong Kong's standard rate is 15% for non-first-time buyers.

- Property Tax: Typically based on the annual rental value.

- Tax Implications: Affects cash flow and overall investment profitability.

Labor Laws and Employment Regulations

Kerry Properties must adhere to labor laws and employment regulations across its operational areas, crucial for managing its workforce in property development and management. Non-compliance can lead to significant legal and financial repercussions, including fines and reputational damage. In 2024, labor law violations cost businesses globally billions of dollars in penalties. These laws cover areas like fair wages, working conditions, and employee rights. The company's success depends on its ability to navigate these regulations effectively.

- Compliance with labor laws and employment regulations is crucial.

- Non-compliance can lead to fines and damage reputation.

- Labor laws cover fair wages, working conditions, and rights.

- Businesses globally faced billions in penalties in 2024.

Kerry Properties navigates property and contract laws, which directly shape development. Environmental regulations and taxation influence operational costs and investment returns. Adherence to labor laws protects against legal risks, crucial in all areas.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| Property Law | Development, approvals | Land use changes in Mainland China |

| Contract Law | Sales, leases, construction | Lease renewals impacting profit |

| Environmental Laws | Construction & Management | $5M in upgrades (green tech) |

Environmental factors

Climate change, with rising sea levels and extreme weather, presents physical risks to Kerry Properties. In 2024, insured losses from natural disasters in Asia reached approximately $40 billion. This impacts property values and necessitates adjustments in construction, potentially increasing costs.

Kerry Properties faces increasing pressure to adopt sustainable practices due to rising environmental awareness and regulations. Green building standards, such as LEED, are becoming crucial in attracting tenants and investors. In 2024, the global green building materials market was valued at $368.5 billion. This trend necessitates investments in eco-friendly designs and operations. Compliance with environmental standards impacts costs and market competitiveness.

Resource scarcity, especially water and energy, poses operational cost challenges for Kerry Properties. Rising energy prices in 2024, with electricity costs up 8% in Hong Kong, directly affect property management expenses. Implementing energy-efficient systems, like smart building tech, becomes crucial. Water conservation measures, such as rainwater harvesting, may also be needed to mitigate rising utility bills and ensure sustainable operations in the long term.

Pollution and Environmental Remediation

Kerry Properties faces pollution control regulations, which can increase project costs. Environmental remediation is crucial for development sites, adding to financial burdens. The global environmental remediation market was valued at $106.84 billion in 2023 and is projected to reach $159.65 billion by 2030. These costs can impact project profitability and timelines.

- Environmental regulations compliance costs.

- Remediation expenses on contaminated sites.

- Potential delays due to environmental issues.

- Impact on project profitability.

Biodiversity and Land Use Impacts

Kerry Properties must consider biodiversity and land use impacts, which affect project approvals and designs. In Hong Kong, the government aims to increase green spaces by 10% by 2030. This includes initiatives to protect local ecosystems. Failure to address these factors can lead to project delays and increased costs.

- Government targets for green space expansion.

- Impact of failing to meet environmental standards.

Kerry Properties confronts climate risks, with 2024's Asian natural disaster losses at $40B. Environmental awareness boosts green building demand, reflected in a $368.5B global market in 2024. Resource scarcity and pollution controls, plus the goal of 10% more green spaces by 2030, require Kerry to invest to remain competitive and minimize disruptions.

| Environmental Factor | Impact on Kerry Properties | 2024/2025 Data |

|---|---|---|

| Climate Change | Increased insurance costs, property value risks. | $40B in insured losses in Asia. |

| Green Building Trends | Need for sustainable designs and tech, costs. | $368.5B global green building materials market. |

| Resource Scarcity | Operational cost increases due to energy, water. | Electricity costs up 8% in Hong Kong. |

PESTLE Analysis Data Sources

The PESTLE relies on government publications, market research, and financial reports. Data is sourced from official agencies and industry analysis.