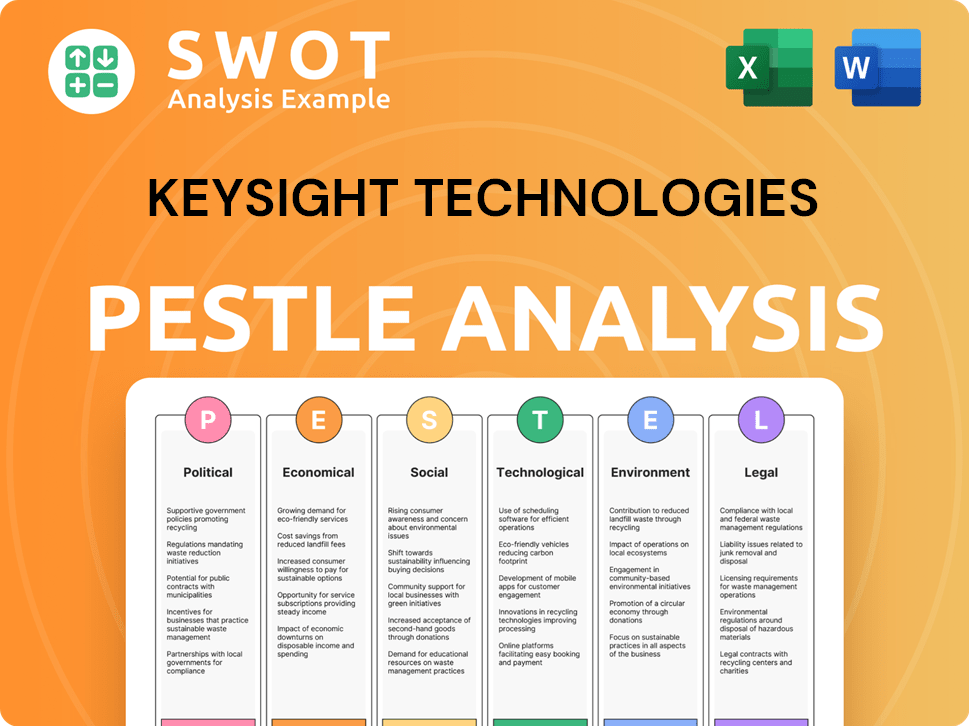

Keysight Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Keysight Technologies Bundle

What is included in the product

Evaluates macro factors influencing Keysight: Political, Economic, Social, Technological, Environmental, Legal.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Keysight Technologies PESTLE Analysis

The preview reflects the full Keysight Technologies PESTLE analysis. Every detail displayed is present in the purchased document.

This means no hidden extras or incomplete data upon receiving the file. You'll download the complete and fully-formatted PESTLE analysis directly.

All content and structure are exactly as seen now; it’s a ready-to-use analysis.

PESTLE Analysis Template

Explore the dynamic external factors shaping Keysight Technologies with our PESTLE analysis. We delve into the political climate, economic trends, social shifts, and technological advancements affecting their performance. Analyze legal frameworks and environmental considerations that impact their operations. This analysis equips you with strategic foresight to understand risks and spot growth opportunities. Download the full Keysight PESTLE analysis now and unlock in-depth insights for your strategic advantage.

Political factors

Keysight faces global trade regulations and export controls, crucial for its international operations. In 2024, geopolitical events led to increased scrutiny of tech exports. Export restrictions can limit sales, impacting revenue. Changes in trade agreements also pose risks.

Keysight's performance hinges on political stability in key markets. Elections and political shifts can cause uncertainty, impacting customer spending. For example, the 2024 US presidential election could influence tech sector investments. Stable environments foster predictable demand, crucial for Keysight's revenue, which reached $5.28 billion in fiscal year 2024.

Government investments in technology and defense are crucial for Keysight. The Communications Solutions Group benefits from government spending on 5G, 6G, and defense tech. In 2024, U.S. defense spending is projected at over $886 billion. These investments drive Keysight's revenue growth. Further expansion is expected, creating opportunities.

International Trade Policies

International trade policies significantly influence Keysight Technologies. Changes in tariffs and trade agreements directly affect supply chains and manufacturing costs. For instance, the US-China trade tensions in 2024/2025 could raise costs. Competitive product pricing is also impacted by these policies.

- Tariff rates on electronics from China to the US were at 25% in 2024.

- Keysight's revenue in the Asia-Pacific region was $1.3 billion in fiscal year 2024.

- The USMCA trade agreement had a $1.5 trillion impact on trade between the US, Mexico, and Canada in 2024.

Regulatory Approvals for Acquisitions

Regulatory approvals are vital for Keysight's acquisitions, like the Spirent deal. This process, influenced by political factors, can delay or alter deal terms. Governments globally scrutinize mergers to ensure fair competition. Delays can increase costs and uncertainty for Keysight.

- In 2024, the FTC and DOJ are actively reviewing mergers.

- Keysight's Spirent acquisition faces global regulatory hurdles.

- Antitrust concerns could lead to divestitures or renegotiations.

Keysight navigates complex political landscapes shaped by trade regulations and geopolitical events impacting global operations. Government tech and defense spending are key revenue drivers. In 2024, the US defense budget exceeded $886 billion, significantly impacting the company. Political stability and international trade policies also influence financial outcomes.

| Political Factor | Impact | 2024 Data/Example |

|---|---|---|

| Trade Regulations | Affects sales, costs. | US-China tariffs at 25%. Asia-Pac revenue: $1.3B |

| Government Spending | Drives growth, demand. | US defense spending >$886B. |

| Political Stability | Influences investments. | US Elections may impact sector spending. |

Economic factors

Keysight Technologies' performance is significantly affected by global economic conditions. Inflation, recession risks, and financial market volatility directly influence customer demand for electronic design and test solutions. For instance, the global semiconductor market is projected to reach $588 billion in 2024, potentially impacting Keysight's sales. Access to credit and overall spending on technology are also key factors.

Keysight's revenue is significantly influenced by customer spending and investment. Customer purchasing decisions and capital expenditures in communications, aerospace, defense, and industrial sectors are crucial. A decline in demand or reduced investments by these customers can directly impact Keysight's financial performance. For instance, a 5% decrease in capital expenditure in the aerospace sector could lead to a 2-3% revenue decrease for Keysight.

Interest rate fluctuations significantly affect Keysight. Higher rates increase borrowing costs, potentially impacting profitability. Reduced credit access could hinder customer purchases of Keysight's equipment. The Federal Reserve held rates steady in May 2024, but future changes remain uncertain. These factors directly influence Keysight's financial performance and market demand.

Foreign Exchange Rate Fluctuations

Keysight Technologies, operating globally, faces risks from foreign exchange rate fluctuations. These fluctuations can significantly impact financial results. For instance, in fiscal year 2024, currency fluctuations affected revenue. Currency movements can either boost or diminish reported earnings.

- Currency impacts can be material, affecting revenue and profitability.

- Hedging strategies are employed to mitigate some of these risks.

- Monitoring and managing currency exposure is a continuous process.

Supply Chain Costs and Disruptions

Supply chain issues significantly affect Keysight. Increased raw material expenses and global supply chain disruptions can elevate production costs, affecting timely product delivery. For example, in Q1 2024, many tech companies faced a 10-15% rise in component costs. Delays in semiconductor deliveries, crucial for Keysight's products, are also common.

- Raw material costs rose by 8% in 2023.

- Semiconductor lead times stretched to 26 weeks.

- Freight costs increased by 12% in early 2024.

Economic conditions like inflation and recession risks directly influence Keysight's performance by impacting customer spending. The semiconductor market, crucial for Keysight, is expected to hit $588 billion in 2024. Interest rate changes and credit access further shape demand for its products, impacting borrowing costs.

| Economic Factor | Impact | 2024/2025 Data |

|---|---|---|

| Inflation | Higher costs, reduced demand | US CPI: 3.3% (May 2024) |

| Interest Rates | Increased borrowing costs | Federal Reserve held rates steady May 2024 |

| Semiconductor Market | Direct influence on sales | Projected to $588B in 2024 |

Sociological factors

Societal shifts towards digital dependency fuel demand for advanced tech. 5G, 6G, AI, and IoT are expanding rapidly. Keysight's test solutions are crucial for these technologies. The global 5G market is projected to reach $300 billion by 2025, boosting Keysight's relevance. This growth highlights the need for precise testing.

The availability of a skilled workforce is vital for Keysight. The company needs engineers and technical experts. In 2024, the demand for these skills remains high. Data shows a shortage in STEM fields, impacting tech firms. Keysight's success depends on attracting and retaining top talent.

The societal embrace of digital transformation fuels the need for Keysight's offerings. Businesses' tech adoption directly boosts demand for their testing tools. In 2024, global digital transformation spending reached $2.3 trillion, a 17.6% increase. Keysight benefits from this growth as industries digitize. This trend is expected to continue, especially in 5G and IoT sectors.

Focus on Data Privacy and Security

Societal focus on data privacy and security is increasing, impacting how connected devices and networks are tested. Keysight's solutions are crucial for ensuring customer compliance with these evolving standards. The global cybersecurity market is projected to reach $345.7 billion in 2024. Keysight's role in this area is vital.

- Data breaches increased by 15% in 2023.

- Cybersecurity spending is expected to grow by 12% annually.

- Keysight offers security testing solutions.

- Focus on privacy helps maintain customer trust.

Educational and Research Institutions

Educational and research institutions play a crucial role for Keysight Technologies, serving as both significant customers and sources of future talent. The health and focus of these institutions, particularly in STEM fields, directly impact Keysight's business. Increased investment in STEM education and research can foster innovation and create demand for Keysight's advanced testing and measurement solutions. This also secures a pipeline of skilled professionals.

- In 2024, global R&D spending reached approximately $2.5 trillion, with significant portions allocated to STEM fields.

- Keysight's sales to educational and research institutions accounted for about 10% of its total revenue in 2024.

- The U.S. government's investment in R&D is projected to increase by 5% in 2025.

Societal trends influence tech adoption, driving demand for Keysight's solutions in digital fields. Cybersecurity concerns, data privacy regulations, and tech dependence shape its market. STEM education investments and the availability of a skilled workforce remain critical factors. Keysight addresses evolving needs.

| Factor | Impact | Data |

|---|---|---|

| Digital Transformation | Boosts demand | Global digital spending: $2.3T in 2024. |

| Cybersecurity | Creates need | Cybersecurity market: $345.7B in 2024. Data breaches up by 15% in 2023. |

| STEM Education | Impacts innovation | R&D spending in 2024: approx. $2.5T; projected U.S. R&D growth: 5% in 2025. |

Technological factors

The speed of tech innovation, particularly in 5G, 6G, and semiconductors, fuels Keysight's growth. Testing and validation of new tech, including EVs and autonomous vehicles, boosts demand for its solutions. Keysight benefits from the need to ensure these technologies function correctly. Keysight's revenue in fiscal year 2024 was $5.28 billion, reflecting this trend.

The emergence of novel industry standards and communication protocols, such as 5G-Advanced and Wi-Fi 7, necessitates updated testing methods. Keysight Technologies must adapt its offerings to align with these shifting requirements. In 2024, the 5G equipment market was valued at $17.9 billion, demonstrating the importance of staying current. Staying ahead in this field is crucial for Keysight's success.

The rise of AI and machine learning is reshaping industries, creating opportunities for Keysight. Keysight can develop testing solutions for AI-driven devices, capitalizing on market growth. In 2024, the AI market is projected to reach $200 billion, offering significant prospects. Keysight also integrates AI into its products for enhanced performance.

Growth of IoT and Connected Devices

The Internet of Things (IoT) and the surge in connected devices significantly impact Keysight Technologies. This growth necessitates robust testing solutions for ensuring seamless interoperability, optimal performance, and robust security across various applications. The global IoT market, valued at $201.6 billion in 2019, is projected to reach $1.5 trillion by 2030, according to Statista. Keysight's role is critical.

- Growing demand for 5G and 6G technologies.

- Increased need for cybersecurity testing tools.

- Expansion in automotive electronics testing.

- Rising demand for network infrastructure testing.

Software and Services Trends

Keysight Technologies is significantly impacted by software and services trends. The industry's shift towards software-centric solutions is reshaping its business model. In fiscal year 2024, Keysight's services revenue reached $1.3 billion, a 10% increase year-over-year. This growth highlights the importance of expanding its software and services portfolio.

- Software and services revenue growth of 10% in fiscal year 2024.

- $1.3 billion in services revenue in fiscal year 2024.

Keysight benefits from advancements in 5G, 6G, and semiconductors. Rapid tech changes, like AI, drive demand for testing solutions. Software/services revenue increased, with $1.3B in fiscal 2024. IoT and EVs also create significant opportunities.

| Technology | Impact on Keysight | 2024/2025 Data |

|---|---|---|

| 5G/6G | Testing, Validation | $17.9B (5G market, 2024) |

| AI | Testing Solutions | $200B AI market (projected, 2024) |

| IoT | Testing for Interoperability | $1.5T IoT market (projected by 2030) |

Legal factors

Keysight Technologies faces legal hurdles related to export control regulations across its global operations. These regulations are strict, especially when dealing with advanced tech sales to specific regions or entities. Non-compliance can lead to heavy penalties, including fines and legal action. In 2024, companies faced an average penalty of $1.2 million for export violations.

Keysight Technologies heavily relies on intellectual property (IP) protection. Patents, trademarks, and copyrights safeguard its innovations. Strong IP laws are vital for its competitive advantage. In 2024, Keysight invested significantly in R&D, indicating a focus on protecting these assets.

Keysight Technologies faces scrutiny under antitrust laws globally, influencing its business practices. Regulatory bodies review acquisitions, like the 2024 acquisition of ESI Design, to ensure fair competition. These reviews can delay or block deals, impacting strategic growth. For instance, in 2024, the Federal Trade Commission (FTC) actively investigated tech mergers. Compliance is vital to avoid penalties and maintain market access.

Data Protection and Privacy Regulations

Keysight Technologies must comply with data protection and privacy laws like GDPR. This impacts how they handle customer data and sensitive information. Failure to comply can lead to hefty fines. The GDPR can impose fines up to 4% of annual global turnover.

- GDPR fines increased by 40% in 2023.

- Data breaches cost an average of $4.45 million in 2023.

- Keysight's revenue in 2024 was $5.28 billion.

Tax Laws and Regulations

Keysight Technologies faces legal risks from tax law changes globally. For example, in 2024, the US corporate tax rate is 21%. A tax case in Malaysia underscores the importance of compliance. Navigating these rules is vital for financial stability.

- 21% US corporate tax rate in 2024.

- Compliance is crucial in Malaysia.

Keysight must navigate export controls, with penalties averaging $1.2 million for violations in 2024. Strong intellectual property protection is crucial for its innovation-driven business, protecting patents and trademarks. Antitrust scrutiny influences its mergers, like the ESI Design acquisition, and impacts strategic moves.

Compliance with data privacy laws and tax regulations, such as GDPR, are also vital for avoiding fines. Data breaches in 2023 cost $4.45 million on average, underlining risks.

| Legal Area | 2024 Focus | Impact |

|---|---|---|

| Export Controls | Strict global regulations | $1.2M average penalty |

| Intellectual Property | Protecting Innovations | Safeguards Competitive Edge |

| Antitrust Laws | M&A Scrutiny (e.g., FTC) | Delays, Blocks Deals |

Environmental factors

Keysight Technologies is actively working towards net-zero emissions. The company is focused on sustainable practices. This includes enhancing energy efficiency. In 2024, Keysight increased its renewable energy usage by 15% globally. They are also looking into renewable energy investments.

Customer demand for sustainable solutions is growing. This impacts Keysight as clients increasingly prioritize eco-friendly products. Keysight could see pressure to create energy-efficient testing solutions. The global green technology and sustainability market is projected to reach $74.6 billion by 2025. This presents both challenges and opportunities.

Keysight Technologies faces environmental scrutiny. They must follow rules for manufacturing, waste, and hazardous substances. Stricter rules can increase costs. The global environmental technology market is projected to reach $98.5 billion by 2025. Compliance is key for Keysight's financial health.

Impact of Climate Change and Extreme Weather

Climate change and extreme weather pose risks to Keysight's operations. These events could disrupt supply chains and damage facilities. For example, the 2023 floods in northern Italy, a region with significant tech manufacturing, caused over $2 billion in damages, potentially affecting suppliers. Companies are increasingly focusing on climate resilience.

- Supply chain disruptions due to extreme weather events.

- Potential damage to manufacturing facilities from floods, storms, etc.

- Increased operational costs related to climate adaptation and mitigation.

- Growing pressure from stakeholders for sustainable practices.

Sustainability in the Technology Sector

Sustainability is increasingly vital in the tech sector, especially concerning data center energy use and e-waste. Keysight Technologies can contribute significantly to these areas. The global e-waste volume reached 62 million tons in 2022. Keysight's measurement solutions help improve energy efficiency and reduce environmental impact.

- Data centers account for about 1-2% of global electricity use.

- E-waste is growing by 2.5 million tons annually.

- Keysight offers solutions for sustainable product design and manufacturing.

Environmental factors significantly influence Keysight. Extreme weather threatens supply chains and facilities. They must also meet growing demands for sustainable products. Environmental regulations can raise costs. The tech industry's focus on data center energy and e-waste presents both challenges and opportunities.

| Aspect | Impact | Data |

|---|---|---|

| Supply Chain | Disruptions from weather events. | 2023 floods in Italy cost $2B in damages. |

| Sustainability | Demand for eco-friendly products. | Green tech market projected to $74.6B by 2025. |

| Regulations | Compliance increases costs. | Environmental tech market expected to reach $98.5B by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis draws on diverse sources including government data, industry reports, and economic indicators.