Kingspan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kingspan Bundle

What is included in the product

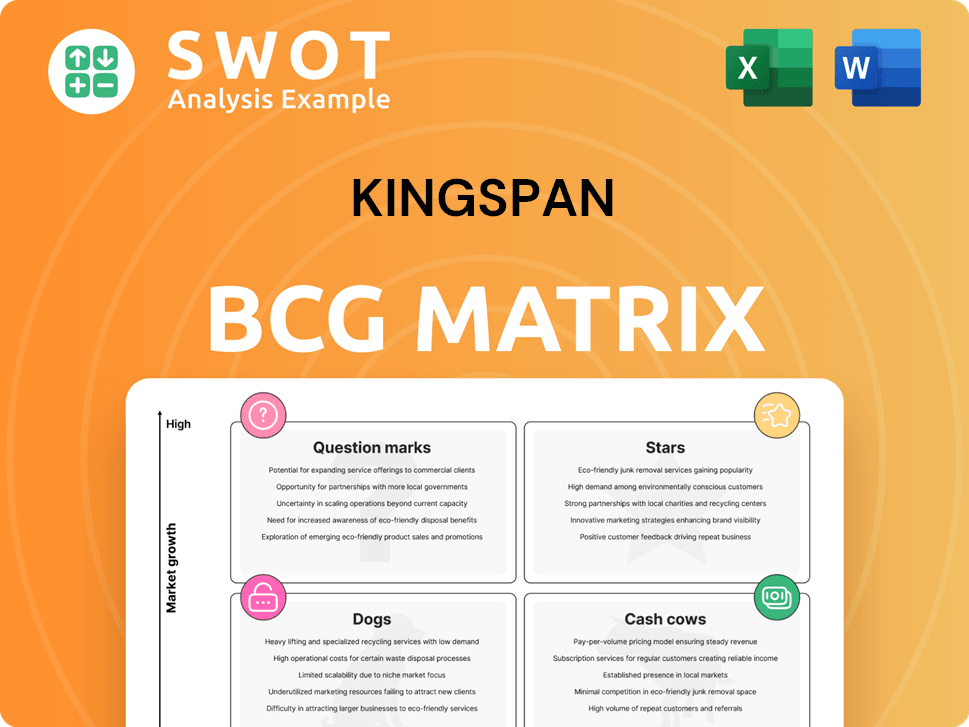

Analysis of Kingspan's portfolio using the BCG Matrix, showing investment, hold, or divest strategies.

Export-ready design for quick drag-and-drop into PowerPoint, giving you presentation-ready data instantly.

What You’re Viewing Is Included

Kingspan BCG Matrix

The BCG Matrix previewed here is identical to the file you'll receive after purchase. This comprehensive Kingspan analysis is yours, watermark-free, and ready for your strategic planning.

BCG Matrix Template

Kingspan’s product portfolio spans diverse sectors, each with unique market dynamics. This condensed BCG Matrix offers a glimpse into their strategic positioning, from high-growth stars to potential dogs. Understand where Kingspan invests its resources, and which products drive profitability. This preview provides a snapshot, but strategic decisions require deeper analysis. Purchase the full BCG Matrix for a comprehensive view of Kingspan’s market strategies and actionable insights.

Stars

Kingspan's insulated panels show strong performance in the Americas, especially in the U.S. and Latin America, indicating rapid growth. This is fueled by the need for energy-efficient buildings. For instance, the North American market for insulated metal panels was valued at $1.8 billion in 2024. Continued investment is essential to stay ahead.

The Data Solutions division at Kingspan is booming, with sales soaring by 36% thanks to the global data surge. Energy-efficient solutions are key, making this a high-growth sector for Kingspan. Innovation in liquid cooling and energy-efficient tech will be essential for continued success. In 2024, the data center market is valued at over $50 billion, showing substantial expansion.

The Roofing + Waterproofing division at Kingspan is a Star, achieving a breakthrough year by doubling profitability. It also shows expansion in margins. The acquisition of Nordic Waterproofing and its first US acquisition highlight growth. In 2024, strategic investments are crucial for continued success.

PowerPanel® Product Line

The PowerPanel® product line, soon launching in Ireland and the UK, is a star within Kingspan's BCG matrix. This innovative product integrates insulated panels with solar technology, promising high growth. Kingspan's focus on sustainable building solutions aligns with growing market demand, as evidenced by the 15% increase in demand for green building materials in 2024. Further development and strategic market penetration are vital for PowerPanel®'s success and Kingspan's overall growth.

- Kingspan reported a 19% increase in revenue for its Insulated Panels division in 2024.

- The UK solar panel market grew by 12% in 2024, indicating strong potential for PowerPanel®.

- Kingspan invested €150 million in R&D in 2024, supporting product innovation, including PowerPanel®.

Natural Insulation Category

Kingspan's strategic move into natural insulation, highlighted by the Steico acquisition, marks a significant foray into a high-growth market. The global green building materials market, valued at $369.6 billion in 2023, is projected to reach $723.8 billion by 2032, reflecting strong demand. This positions Kingspan well to capitalize on the rising preference for eco-friendly building solutions. Further investment in bio-based insulation strengthens this position.

- Steico acquisition as a market entry point.

- Increasing demand for sustainable building materials.

- Focus on bio-based insulation solutions.

- Global green building materials market is expanding.

Stars in Kingspan's BCG matrix show high growth and market share. The Roofing + Waterproofing division doubled profitability, signaling strong performance. PowerPanel® and Data Solutions also shine, driven by demand and innovation. Kingspan's strategic investments and acquisitions fuel these segments.

| Division | Performance | 2024 Data |

|---|---|---|

| Roofing + Waterproofing | Doubled Profitability | Acquisition of Nordic Waterproofing, US expansion |

| PowerPanel® | High Growth Potential | UK solar market grew 12% in 2024 |

| Data Solutions | Significant Growth | Sales up 36% |

Cash Cows

Insulated Panels sales in Europe mirrored the previous year's performance. The European market, though less dynamic than the Americas, remains a reliable revenue source. Kingspan's focus on cost management is crucial. In 2024, the European construction market saw moderate growth. This market's maturity requires a strategic emphasis on operational efficiency.

Kingspan's Kooltherm® and GreenGuard® insulation products are cash cows due to their strong market presence and brand recognition. These products generate consistent revenue, backed by their reputation for quality. In 2024, Kingspan reported a 1% increase in revenue for its insulation division. Maintaining high product standards and efficient production are key to sustaining profitability.

Kingspan's Light, Air + Water division in Europe saw a year of consolidation and margin improvement. Despite potentially slower growth, it offers a steady revenue stream, crucial for its "Cash Cow" status. Focusing on efficiency boosts and North American expansion can significantly improve cash flow. In 2024, Kingspan's revenue was €6.7 billion.

Existing Manufacturing Facilities

Kingspan's 273 global manufacturing sites are key cash cows. Optimizing these facilities ensures steady cash flow generation. Investments in technology and process improvements boost productivity. For example, in 2023, Kingspan invested €160 million in capital expenditure, focusing on efficiency. This strategic focus supports sustainable financial performance.

- 273 manufacturing sites globally.

- Focus on operational efficiency.

- Investment in technology.

- €160 million capital expenditure in 2023.

Acoustic Insulation Products

Acoustic insulation products represent a cash cow for Kingspan, given the established market and strong progress. This sector benefits from consistent demand and offers reliable revenue streams. Product development and expansion are vital for maintaining this position. Kingspan's focus on innovation ensures sustained profitability. The global acoustic insulation market was valued at $7.5 billion in 2023.

- Market Growth: The acoustic insulation market is projected to reach $10.2 billion by 2029.

- Kingspan's Strategy: Focus on new product development and market expansion.

- Revenue Streams: Provides reliable revenue through established products.

- Innovation: Continuous innovation helps maintain a competitive edge.

Kingspan's cash cows, like Kooltherm® and GreenGuard®, offer steady revenue due to strong market presence. This is supported by the company's 273 global manufacturing sites, which contribute to reliable cash flow. In 2024, the insulation division saw a 1% revenue increase, emphasizing the importance of maintaining high product standards and efficient production.

| Cash Cow Aspect | Key Feature | 2024 Data |

|---|---|---|

| Product Strength | Kooltherm®, GreenGuard® | 1% Revenue Increase (Insulation) |

| Manufacturing Base | 273 Global Sites | €6.7B Total Revenue |

| Market Focus | Acoustic Insulation | $7.5B Global Market (2023) |

Dogs

Kingspan's "Dogs" include underperforming product lines in low-growth markets. These lines have a low market share. Turnaround plans are often ineffective. Divestiture or discontinuation of these lines is a viable option. For example, in 2024, Kingspan might assess product lines with less than 5% market share in regions with under 2% annual growth.

Kingspan's operations face challenges in cyclical markets like Europe and Australasia. Prioritize markets with stable or growing economies. In 2024, Kingspan's revenue in Europe was affected by economic slowdown. Reducing exposure to these markets can stabilize performance. Consider focusing on regions showing resilience.

Products with low sustainability ratings, like those not meeting current standards or lacking energy efficiency, risk obsolescence. Kingspan should concentrate on developing and promoting green building-aligned products. In 2024, the construction industry saw a 15% increase in demand for sustainable materials. Divesting from environmentally unfriendly products is crucial for long-term viability.

Non-core business activities

Kingspan should reduce business activities that don't fit its main goals of insulation and building envelope solutions. This means focusing on what it's good at and buying companies that help with those goals. Getting rid of non-core activities can make the company run more efficiently. In 2024, Kingspan's strategic moves included acquisitions focused on sustainable building products, aligning with their core business.

- Divestiture of non-core assets improves resource allocation.

- Focus on core competencies drives innovation and market leadership.

- Strategic acquisitions enhance product offerings and market presence.

Outdated technologies and processes

Kingspan's "Dogs" include outdated manufacturing processes. Phasing out inefficient technologies is vital for cost reduction. Modern, sustainable tech investments boost efficiency. Competitiveness relies on eliminating obsolete processes. Kingspan's 2024 report showed a 12% efficiency gain post-technology upgrades.

- Inefficient technologies increase operational costs.

- Upgrading to modern systems can reduce waste by up to 15%.

- Phasing out outdated processes improves product quality.

- Investment in automation can lower labor costs by 10%.

Kingspan's "Dogs" represent underperforming areas with low market share in slow-growth sectors. These segments often struggle, and revitalization is challenging. Divesting from these units can improve resource allocation and profitability. In 2024, Kingspan might have identified several product lines with less than a 3% market share.

| Aspect | Description |

|---|---|

| Market Share Threshold | Below 3% |

| Growth Rate | Under 2% |

| Divestment Priority | Low-performing product lines. |

Question Marks

Kingspan's expansion into emerging markets like Southeast Asia, offers high growth potential, but demands considerable upfront investment. These regions are in the initial stages of adopting sustainable construction practices. For example, the Asia-Pacific construction market is projected to reach $5.8 trillion by 2025. Strategic investments and thorough market analysis are vital for success.

New bio-based insulation materials show high growth potential, aligning with rising demand for sustainable building solutions. Kingspan invested significantly in R&D, with 2024 R&D spending at €150 million. Marketing is crucial to capture market share, with the sustainable insulation market projected to reach $12.5 billion by 2028.

Liquid cooling solutions show high growth potential for data centers, but demand significant investment. The market for energy-efficient data centers is expanding rapidly, creating opportunities. Strategic partnerships and innovation are crucial for success. The liquid cooling market is projected to reach $8.5 billion by 2028, with a CAGR of 18% from 2023 to 2028.

PowerPanel® in New Markets

Introducing PowerPanel® to new markets outside Ireland and the UK is a significant growth prospect. Expanding the product's reach demands investments in marketing and distribution networks. Strategic alliances and detailed market analysis are vital for success. This expansion aligns with Kingspan's goal to broaden its sustainable building solutions globally. PowerPanel® could tap into the growing demand for energy-efficient construction materials.

- Market penetration requires investment.

- Strategic partnerships are crucial.

- PowerPanel® is a high-growth opportunity.

Acoustic Insulation in Untapped Regions

Expanding acoustic insulation products into untapped regions presents significant growth potential for Kingspan. These areas often experience rising demand for noise reduction solutions, particularly in rapidly urbanizing areas. Strategic market entry, including understanding local building codes and consumer preferences, is crucial for success. Tailoring product offerings to meet specific regional needs ensures competitiveness and customer satisfaction.

- Market research indicates a 10-15% annual growth in the global acoustic insulation market.

- Emerging markets in Asia-Pacific and Latin America show the highest growth rates.

- Local building regulations increasingly mandate acoustic performance standards.

- Kingspan's revenue from emerging markets grew by 12% in 2023.

Question Marks represent high-growth potential ventures requiring strategic investment. Success hinges on market penetration and strategic partnerships. PowerPanel® expansion and acoustic insulation growth exemplify this category.

| Feature | Details | Data |

|---|---|---|

| Growth Potential | High, requiring investment for expansion. | Asia-Pacific construction market: $5.8T by 2025 |

| Strategic Need | Market entry and partnerships are vital. | Acoustic insulation market growth: 10-15% annually. |

| Examples | PowerPanel®, acoustic insulation in new regions. | Kingspan's emerging market revenue growth in 2023: 12%. |

BCG Matrix Data Sources

Kingspan's BCG Matrix uses market reports, financial data, and industry analysis for reliable quadrant placements.