Kirin Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kirin Bundle

What is included in the product

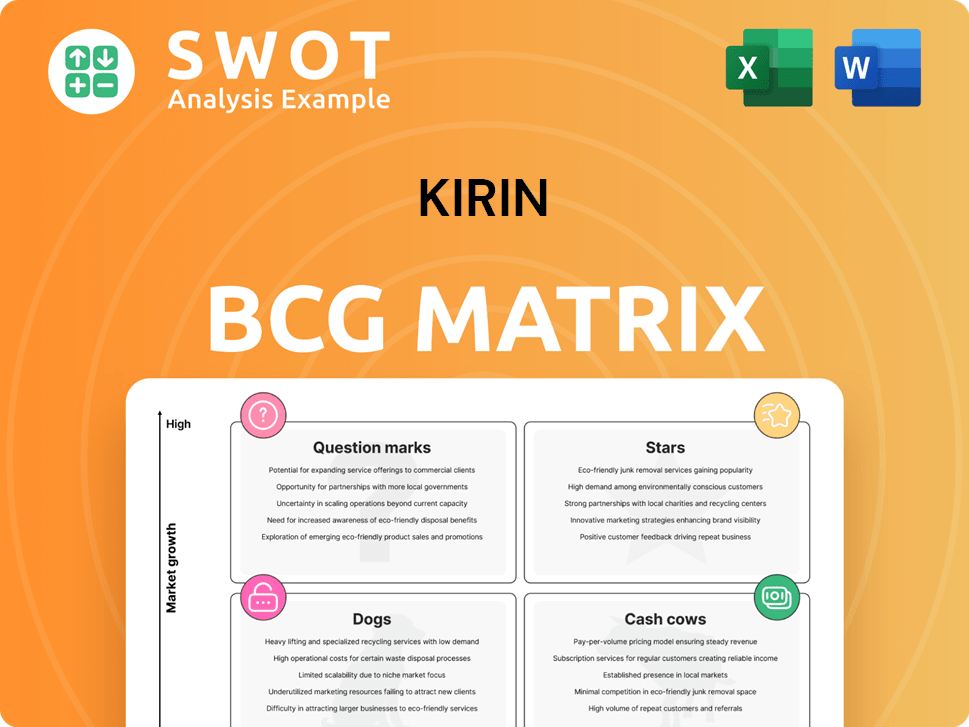

Kirin's BCG Matrix analysis unveils portfolio strategies: invest, hold, or divest.

Automated data import to speed up analysis and save time.

What You See Is What You Get

Kirin BCG Matrix

The Kirin BCG Matrix preview mirrors the final document delivered after purchase. You'll receive the complete, editable report, optimized for clear strategic insights, and actionable planning. Download and instantly leverage the full potential for informed decision-making, with no hidden content.

BCG Matrix Template

Curious about Kirin's product portfolio strategy? The BCG Matrix classifies products based on market growth & share, offering vital insights. See how Kirin's brands fare as Stars, Cash Cows, Dogs, or Question Marks. This preview shows the basics. Get the full BCG Matrix for a deep-dive & strategic recommendations.

Stars

Kirin Ichiban shines as a star in Kirin's portfolio, driven by brand renewal. Its strong performance in the competitive beer market validates its star status. The flagship brand's success is crucial, as Kirin focuses on core beer brands. Kirin's commitment is evident, with 2024 sales figures reflecting its ongoing investment.

Kirin Beer's Harekaze, launched in April 2024, is a Star in the BCG Matrix. It surpassed initial sales targets by 30%, indicating strong consumer interest. The brand's debut after 17 years signifies significant growth potential. Kirin's focus on pure beer categories suggests future investment. In 2024, Kirin saw a 5% increase in overall beer sales.

Hyoketsu, a ready-to-drink (RTD) canned cocktail by Kirin, has been a sales success since its 2001 launch. In 2024, the RTD market grew, with Hyoketsu as a major growth driver for Kirin. Kirin focuses on maintaining its strong brands, including Hyoketsu, despite alcohol market tax changes. The brand's appeal to a wide audience is a key factor.

Kyowa Kirin Pharmaceutical Products (Crysvita, Poteligeo)

Kyowa Kirin's key global products, such as Crysvita and Poteligeo, are vital to its pharmaceutical business, showing consistent growth. Kirin is actively investing in this segment, reflecting its belief in its future. The company's strategy focuses on enhancing profitability through these products. In 2024, Crysvita sales increased, with Poteligeo also showing positive trends.

- Crysvita sales show growth in 2024.

- Poteligeo contributes positively.

- Kirin invests in pharmaceuticals.

- Focus on profit from these products.

LC-Plasma Immune Care Products

The LC-Plasma immune care product line, a key component of Kirin's portfolio, generated over 23 billion yen in sales during 2024, reflecting strong consumer interest in health. Kirin's strategic emphasis on health science and functional foods supports the future expansion of LC-Plasma products. The company's investment in promoting immune care as a daily practice further fuels the product line's growth.

- 23+ billion yen in sales in 2024 showcases strong demand.

- Focus on health science aligns with consumer trends.

- Investment in immune care habits boosts growth.

Stars in Kirin's portfolio include Kirin Ichiban, Harekaze, and Hyoketsu, all showing strong performance. Kirin Ichiban's brand renewal drives its success in the beer market. Harekaze, launched in April 2024, exceeded sales targets by 30%. Hyoketsu, an RTD, has been a sales success, with the RTD market growing in 2024.

| Brand | Category | 2024 Performance |

|---|---|---|

| Kirin Ichiban | Beer | Strong Sales |

| Harekaze | Beer | 30% above targets |

| Hyoketsu | RTD | Major Growth Driver |

Cash Cows

Kirin Lager is a cash cow, thriving in the established beer market. It benefits from strong brand loyalty, ensuring consistent demand. This mature product generates steady revenue with minimal investment. Kirin Lager's stable cash flow supports Kirin's innovations. In 2024, Kirin's beer sales were over ¥500 billion.

Kirin Tanrei Happoshu is a stable low-malt beer, a cash cow due to its consistent sales. Production and distribution are efficient due to its established market presence. Kirin's diverse portfolio includes low-malt choices, reflecting consumer preferences. In 2024, low-malt beer sales showed steady performance. This segment remains a reliable revenue source for Kirin.

Coca-Cola Beverages Northeast is a cash cow for Kirin, consistently profitable in the non-alcoholic beverage sector. Its strong soda sales and strategic pricing drive high profitability. Efficiency gains in the supply chain, including digital ICT, boost its cash generation. In 2023, Coca-Cola HBC, a similar entity, saw revenues of EUR 9.6 billion, highlighting the segment's financial strength.

Gogo-no-Kocha Black Tea

Gogo-no-Kocha, especially the unsweetened black tea, is a cash cow for Kirin. It has a strong presence in the established black tea market. Kirin is focusing on health-conscious consumers. The company is supporting the brand's growth.

- Market share in 2024: Gogo-no-Kocha holds a significant market share in the ready-to-drink tea segment.

- Renewal strategy: Kirin regularly updates the product to stay competitive.

- Unsweetened focus: Promotions boost the sales for the health-conscious consumers.

Lion Nathan Beer Brands (Australia)

Lion Nathan's Australian beer brands are cash cows for Kirin, providing steady revenue. Brands such as Hahn contribute reliably. Kirin is supporting the performance of these brands. In 2024, Lion's revenue reached approximately $3.6 billion.

- Hahn's market share in Australia is consistently strong.

- Hyoketsu's expansion in Australia and New Zealand boosts revenue.

- Lion Nathan's brands maintain a stable presence.

- Kirin focuses on innovation while these brands generate revenue.

Kirin's cash cows, like Gogo-no-Kocha, are crucial for generating steady revenue. These products benefit from established market positions. This ensures consistent financial contributions.

| Product | Category | Key Feature |

|---|---|---|

| Gogo-no-Kocha | RTD Tea | Strong market share |

| Kirin Lager | Beer | Brand loyalty |

| Lion Nathan's | Beer | Stable Revenue |

Dogs

Kirin divested low-return businesses like its Australian dairy subsidiary. These units likely drained resources without substantial profits. Divestiture enables Kirin to concentrate on core, high-growth segments. This strategic shift aims to boost overall profitability. In 2024, Kirin's operating profit increased, reflecting these strategic moves.

Kyowa Hakko Bio's amino acid business, part of Kirin's portfolio, saw losses from inventory write-downs, prompting a sale decision. This indicates struggles in market share and growth. In 2024, the market for amino acids faced competitive pressures. Kirin's move streamlines its focus, aligning with strategic goals.

Prior to its 2023 divestment, Myanmar Brewery, faced significant hurdles due to Myanmar's political and economic instability, impacting profitability. The brewery's performance was likely inconsistent, with growth hampered by market volatility. Kirin's exit, a move reflecting a strategic pivot away from high-risk environments, occurred after the 2021 coup, during which the firm faced immense pressure. By 2022, Kirin’s investment in Myanmar was valued at approximately 80.8 billion yen.

Commoditized Green Tea Products

In the Dogs quadrant, Kirin's commoditized green tea products encounter tough competition and low profit margins. These items often lack unique selling points, making it difficult to capture a substantial market share. To boost profitability, Kirin is strategically focusing on its more lucrative offerings. For instance, in 2024, Kirin's beverage segment saw a 2% decrease in sales volume for its mass-market green tea products due to market saturation.

- Intense competition affects profitability.

- Differentiation is difficult for these products.

- Kirin aims to improve profits through strategic choices.

- Focus on profitable portfolio.

Inefficient or Underperforming RTD Products

Some of Kirin's RTD products may be "Dogs" if they have low market share in slow-growing segments. These products might not contribute much to revenue or profit. Kirin could consider dropping or changing these products. For example, a 2024 analysis showed certain RTD lines saw a 5% sales decline.

- Low market share in slow-growth segments.

- Potential for low revenue and profit generation.

- Consideration for product discontinuation.

- Example: 5% sales decline in specific RTD lines (2024).

Kirin's "Dogs" face tough competition and low profitability, especially in commoditized products like green tea. Differentiation proves difficult, affecting market share. Strategic moves, such as focusing on more lucrative products, are key. In 2024, certain RTD lines saw a 5% sales decline, signaling potential discontinuation.

| Product Category | Market Share | Sales Decline (2024) |

|---|---|---|

| Mass-market green tea | Low | 2% |

| Specific RTD lines | Variable | 5% |

| Overall "Dogs" | Low, Declining | N/A |

Question Marks

The Electric Salt Spoon, introduced in May 2024, fits the question mark category. It targets the health-conscious, a growing market segment. Kirin's investment will determine its future success. Its potential lies in its innovative health focus, despite uncertain market size. The CES Innovation Awards highlight its novelty.

Blackmores, purchased by Kirin in 2023, is a key player in Asia-Pacific's natural health market. Kirin's integration of Blackmores presents chances to expand margins. Challenges include streamlining operations and aligning strategies. In 2024, focus is on leveraging Blackmores' brand for growth. The acquisition cost was approximately $1.7 billion.

Kirin's 2024 acquisition of FANCL boosts its health science portfolio, focusing on skincare and health foods. The integration is key to unlocking synergies, leveraging Kirin's existing strengths. Kirin aims to issue Social Bonds to finance the FANCL deal, reflecting its strategic significance. This move aligns with Kirin's goal to expand its health and wellness business. The acquisition cost was around ¥228.8 billion.

Ziftomenib (Pharmaceutical Pipeline)

Ziftomenib is a key pharmaceutical in Kirin's pipeline, fitting the "Question Mark" category. Its future depends on successful trials and regulatory nods. Kirin's R&D boosts the chances of Ziftomenib's launch. The company has invested ¥150 billion in R&D in 2024.

- Potential for High Growth: Ziftomenib could significantly boost Kirin's revenue.

- Risks Involved: Success depends on trial results and approvals.

- R&D Investment: Kirin is increasing R&D spending.

- Strategic Importance: Key to Kirin's long-term growth.

Bira 91 (Indian Craft Beer Investment)

Kirin's investment in Bira 91, an Indian craft beer brand, is a strategic move to capitalize on the expanding craft beer market in India. This investment aligns with Kirin's strategy to diversify its portfolio and tap into high-growth markets. Bira 91's performance is key to the success of this investment, depending on its ability to compete. Kirin's confidence in the Indian craft beer sector is evident through this investment.

- Kirin's investment reflects a growing trend in the alcoholic beverage industry, with craft beer gaining popularity.

- The Indian beer market was valued at $7.8 billion in 2024, showing significant growth potential.

- Bira 91 has expanded its distribution network to over 400 cities across India.

- The craft beer market is competitive, with several international and local brands vying for market share.

Question marks represent high-growth potential with uncertain market share. Kirin's Electric Salt Spoon and Ziftomenib fall into this category. Successful market positioning determines their transformation.

| Product | Category | Market Potential |

|---|---|---|

| Electric Salt Spoon | Question Mark | Health-conscious market |

| Ziftomenib | Question Mark | Pharmaceutical revenue boost |

| Bira 91 | Question Mark | Indian craft beer market ($7.8B in 2024) |

BCG Matrix Data Sources

The Kirin BCG Matrix uses sales figures, market growth data, and competitive landscapes from industry reports and financial databases.