Knorr-Bremse PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Knorr-Bremse Bundle

What is included in the product

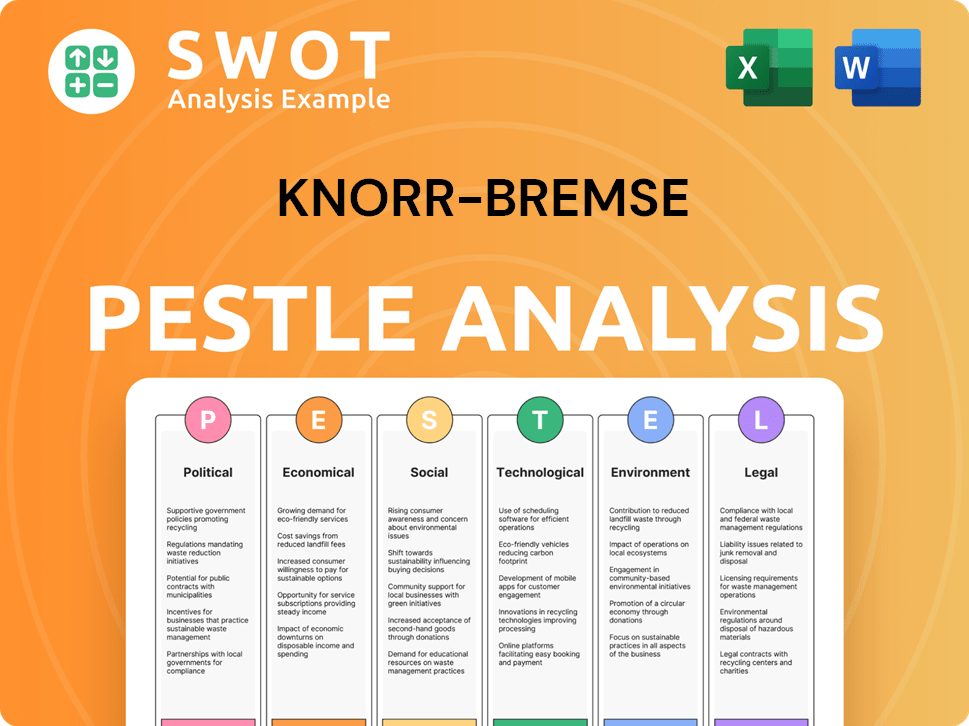

This PESTLE analysis examines Knorr-Bremse through Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Knorr-Bremse PESTLE Analysis

The preview illustrates the complete Knorr-Bremse PESTLE analysis document.

It's the exact file you'll download post-purchase.

No alterations, this is the finished product.

Receive it immediately, ready for analysis.

Content and formatting are as displayed.

PESTLE Analysis Template

Navigate the complexities affecting Knorr-Bremse's trajectory with our detailed PESTLE analysis. Discover the crucial external factors influencing the company's operations, from regulatory shifts to technological advancements. Uncover potential risks and identify strategic opportunities within a dynamic global landscape. This analysis offers essential insights for investors, business leaders, and market researchers. Gain a competitive advantage—download the full version now and equip yourself with critical knowledge.

Political factors

Government regulations heavily influence Knorr-Bremse's operations, especially in transportation. Safety standards for braking and other vehicle parts are crucial. Emission rules and tech mandates, like driver assistance systems, also matter. In 2024, the EU's Euro 7 emission standards will affect the company. These shifts require constant product and process adjustments.

Knorr-Bremse faces risks from shifting trade policies and tariffs. For example, the EU's import tariffs on certain goods could inflate costs. In 2024, global trade tensions led to a 3% rise in material costs for some automotive suppliers. This impacts Knorr-Bremse's global supply chain.

Political stability significantly impacts Knorr-Bremse's operations. Regions with instability can disrupt supply chains, like the 2022-2023 disruptions. Predictable business operations are crucial; Knorr-Bremse's 2024 revenue was €8.4 billion. Political risks can affect manufacturing and demand for transportation systems. A stable environment supports long-term investment and growth.

Government Investment in Infrastructure

Government infrastructure investments are crucial for Knorr-Bremse. Increased spending on rail and road projects boosts demand for its systems. For instance, in 2024, the U.S. government allocated significant funds for infrastructure. These investments directly impact Knorr-Bremse's order intake.

- U.S. infrastructure spending in 2024 reached $1.2 trillion.

- European Union's "Connecting Europe Facility" invests heavily in transport.

- China's ongoing railway expansion fuels global demand.

International Relations and Geopolitics

International relations and geopolitical events significantly impact Knorr-Bremse. These factors influence global economic activity, supply chain stability, and market access. The company must demonstrate resilience and adaptability in its business strategy to navigate these challenges successfully. For example, in 2024, disruptions in the Red Sea caused delays and increased costs for global shipping, affecting supply chains.

- Geopolitical tensions can lead to trade restrictions.

- Supply chain disruptions increase costs.

- Market access can be limited by political instability.

- Knorr-Bremse must adapt its strategies.

Political factors like government regulations and infrastructure spending significantly influence Knorr-Bremse's operations. Safety standards and emission rules require continuous adaptation. The U.S. infrastructure spending in 2024 was $1.2 trillion. International relations and geopolitical events also shape its supply chain.

| Factor | Impact | 2024 Data |

|---|---|---|

| Regulations | Compliance costs, product changes | Euro 7 emission standards (EU) |

| Trade Policies | Tariff impacts, supply chain costs | 3% rise in material costs (some suppliers) |

| Infrastructure | Demand for systems, order intake | U.S. infrastructure spending: $1.2T |

Economic factors

Knorr-Bremse's success hinges on global economic vigor. Increased economic activity boosts transportation needs, fueling demand for its products. For example, in 2024, the global automotive market grew by approximately 4%, impacting Knorr-Bremse's order intake. Economic slowdowns, however, can curb transportation investments, affecting revenue. Forecasts for 2025 suggest moderate growth, influencing the company's strategic planning and financial projections.

Inflation and high energy costs directly affect Knorr-Bremse's operational expenses. Rising prices for raw materials and components, like steel and electronics, increase production costs. In Q1 2024, Knorr-Bremse saw a slight increase in costs due to inflation. The company actively manages these costs to protect its profit margins. The ability to pass on costs to customers remains crucial for financial stability.

As a global entity, Knorr-Bremse faces currency exchange rate risks. Fluctuations impact production costs across regions. For instance, a stronger euro in 2024 could raise costs for exports. Currency shifts also affect reported financials. In 2024, currency impacts were a key focus for financial planning.

Interest Rates and Access to Financing

Interest rates significantly affect Knorr-Bremse and its clients. Rising rates can increase borrowing costs, influencing the company's investments and customer spending. Access to affordable financing is crucial for Knorr-Bremse's expansion. In 2024, the European Central Bank's key interest rate fluctuated, impacting financial decisions. The company's financial strategy must address these rate shifts.

- ECB key interest rates in 2024 varied, influencing borrowing costs.

- Higher rates can deter customer investments in new vehicles.

- Favorable financing is vital for Knorr-Bremse's growth initiatives.

Market Demand in Rail and Commercial Vehicle Sectors

Market demand within the rail and commercial vehicle sectors is a crucial economic factor for Knorr-Bremse. The rail division has shown strength, while the truck market has faced challenges. These different cycles affect Knorr-Bremse's revenue and profitability directly. In Q1 2024, rail systems saw a revenue increase, contrasting with a decline in commercial vehicle systems.

- Rail Systems revenue increase.

- Commercial Vehicle Systems revenue decline.

- Economic cycles impact Knorr-Bremse.

- Profitability affected by demand.

Economic growth boosts Knorr-Bremse's transportation product demand, reflecting market trends in 2024. Inflation, influenced by raw material costs and energy, pressures operational expenses. Exchange rates and interest rates impact financials and borrowing costs, thus affecting both investment and customer spending.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| GDP Growth | Drives transportation demand | Global auto market grew ~4% in 2024; Moderate 2025 forecasts |

| Inflation | Increases production costs | Q1 2024 costs up due to inflation; ongoing cost management |

| Interest Rates | Affects borrowing costs & investments | ECB rates fluctuated in 2024; Impact financial planning |

Sociological factors

Urbanization and population growth fuel demand for Knorr-Bremse's products. The global population is projected to reach 8.1 billion by 2025, increasing transportation needs. This supports growth in rail and commercial vehicle sectors. Knorr-Bremse benefits from this trend, specifically in safety and efficiency.

Societal shifts toward shared mobility and e-mobility are reshaping transportation. In 2024, the shared mobility market reached $140 billion, with e-mobility sales growing by 30% annually. Remote work also impacts commuting patterns. Knorr-Bremse must adapt to these trends to stay competitive.

Knorr-Bremse, operating globally, navigates workforce diversity across varied cultures. Diversity and inclusion are key for talent acquisition, innovation, and understanding diverse customers. In 2023, Knorr-Bremse reported a global workforce with a significant international presence. The company's commitment to cultural diversity is evident in its global operations.

Aging Population and Workforce

An aging population in key markets affects Knorr-Bremse. This can limit skilled labor availability and impact demand for specific vehicles. Knorr-Bremse must adjust workforce planning and talent strategies. For instance, Germany's over-65 population is projected to hit 23% by 2030. This demographic shift influences strategic decisions.

- Germany's labor force is shrinking, impacting manufacturing.

- Demand for public transport could rise with older populations.

- Knorr-Bremse needs to invest in training for existing employees.

- Consider the need for age-friendly vehicle features.

Societal Focus on Safety and Security

Knorr-Bremse thrives on society's growing emphasis on safety and security, particularly in transportation. This trend boosts demand for their braking systems and safety technologies. Regulations aimed at reducing accidents and enhancing security worldwide directly fuel their business. The market for advanced driver-assistance systems (ADAS) is projected to reach $77.3 billion by 2027.

- Increasing demand for safety features.

- Regulatory focus on accident reduction.

- Growing market for ADAS.

- Knorr-Bremse's core business aligns well.

Sociological factors heavily influence Knorr-Bremse’s prospects. The shift towards shared mobility, valued at $140 billion in 2024, and the growth of e-mobility, rising by 30% annually, drive industry change. An aging global population affects labor availability, as Germany projects a 23% over-65 population by 2030. Furthermore, the increasing focus on transport safety and security, which is backed by a market expected to reach $77.3 billion by 2027 for ADAS.

| Factor | Impact on Knorr-Bremse | Supporting Data (2024/2025) |

|---|---|---|

| Shared Mobility | Increased demand | $140B market in 2024 |

| E-Mobility Growth | Opportunities in electric vehicles | 30% annual sales growth |

| Aging Population | Labor, market challenges | Germany: 23% over 65 by 2030 |

| Safety/Security Focus | Demand for safety systems | $77.3B ADAS market by 2027 |

Technological factors

Knorr-Bremse thrives on advancements in braking tech. Electronic braking systems, regenerative braking, and lightweight materials are key. In 2024, the global automotive braking systems market was valued at $35.7 billion. Staying ahead ensures a competitive edge. The company must meet customer needs for safety and efficiency.

The evolution of autonomous driving in commercial vehicles and rail offers Knorr-Bremse opportunities and hurdles. Their braking and control systems expertise is crucial, but adapting to automation levels, including redundancy, is key. In 2024, the autonomous trucking market is projected to reach $1.7 billion, showing growth potential. Knorr-Bremse must innovate to stay relevant.

Digitalization and connectivity reshape transportation. Knorr-Bremse integrates digital solutions. Predictive maintenance and remote diagnostics are key. This demands investment in software and cybersecurity. In 2023, Knorr-Bremse's R&D spending was €400 million, reflecting this shift.

Electromobility and Alternative Powertrains

Electromobility and alternative powertrains significantly influence Knorr-Bremse. This shift requires optimized braking systems, including electric braking. Knorr-Bremse invests in zero-emission solutions. The global electric vehicle market is projected to reach $823.75 billion by 2030.

- Knorr-Bremse's R&D spending in 2023 was €446 million.

- The company aims for sustainable products, with 60% of sales from sustainable products by 2030.

- Electric braking systems' market is growing rapidly.

Data Analytics and Artificial Intelligence

Knorr-Bremse can leverage data analytics and AI, given the rise in data from connected vehicles. This enables predictive maintenance, boosting product value and creating new business models. The global AI in automotive market is projected to reach $16.2 billion by 2025. This growth signals increased opportunities for Knorr-Bremse.

- Predictive maintenance reduces downtime and costs.

- AI optimizes performance for enhanced efficiency.

- New service offerings create revenue streams.

Knorr-Bremse is driven by tech in braking systems like regenerative braking, worth $35.7B in 2024. Autonomous driving and digitalization, predictive maintenance, and digital solutions are also key trends. R&D spending hit €446M in 2023, with 60% of sales aimed at sustainable products by 2030.

| Technology Trend | Knorr-Bremse Action | 2024/2025 Data |

|---|---|---|

| Advanced Braking | Evolving Braking Tech | $35.7B Market (2024) |

| Autonomous Systems | Adapt to Automation | $1.7B Autonomous Trucking (2024) |

| Digitalization | Integrate Solutions | €446M R&D (2023) |

Legal factors

Knorr-Bremse faces strict vehicle safety regulations. These rules, like those from the EU and NHTSA, dictate braking system standards. Adapting to changing safety rules impacts product design and testing. In 2024, the global automotive safety systems market was valued at $30.5 billion. This market is projected to reach $42.8 billion by 2029.

Environmental regulations significantly shape Knorr-Bremse's operations. Stricter emissions and noise standards for commercial vehicles and rail systems directly influence product design. In 2024, complying with Euro 7 standards is critical, and Knorr-Bremse invests heavily in eco-friendly tech. The company's focus on efficiency helps meet these evolving legal requirements.

Knorr-Bremse faces product liability laws, especially given its safety-critical systems. They must ensure product reliability and safety to avoid legal claims. In 2024, product liability insurance costs rose by 15% for similar manufacturers. Potential payouts for safety failures can reach millions, impacting financials.

International Trade Laws and Sanctions

Knorr-Bremse, with its worldwide presence, must navigate international trade laws and sanctions, which significantly influence its operations. These regulations, including export controls and economic sanctions from organizations like the UN and the EU, directly affect Knorr-Bremse's ability to trade and conduct business globally. For instance, in 2024, the EU imposed sanctions on several entities related to the railway sector, potentially impacting Knorr-Bremse's supply chain or sales in specific regions. Non-compliance can lead to hefty fines, reputational damage, and restricted market access, as seen with previous cases involving violations of trade regulations by multinational corporations. Adhering to these laws is crucial for Knorr-Bremse's long-term sustainability and success.

- EU sanctions have increased by 15% in 2024, affecting various industrial sectors.

- Knorr-Bremse's global revenue for 2024 reached €7.5 billion.

- The company has invested approximately €200 million in compliance measures.

Data Protection and Privacy Regulations

Data protection and privacy regulations are critical for Knorr-Bremse. With vehicle digitalization, adherence to GDPR and similar laws is essential. In 2024, the global data privacy market was valued at $8.1 billion. Compliance ensures secure data handling. Non-compliance can lead to significant fines, potentially impacting revenue.

- Data privacy market projected to reach $14.7 billion by 2029.

- GDPR fines in the EU reached €1.8 billion in 2023.

- Knorr-Bremse must protect sensitive data from connected systems.

- Investment in data security is crucial for business continuity.

Knorr-Bremse's legal environment is defined by strict regulations. Safety and environmental rules drive product design, while liability laws increase costs. The company must comply with international trade laws.

| Regulation Type | Impact | 2024 Data |

|---|---|---|

| Product Liability | Affects safety and legal risks | Insurance costs rose by 15%. |

| Trade Laws | Global operations, sanctions | EU sanctions increased by 15% in 2024. |

| Data Protection | Compliance costs, fines | GDPR fines reached €1.8 billion in 2023. |

Environmental factors

Climate change concerns and emission reduction targets are boosting demand for sustainable transport. Knorr-Bremse's electric braking systems help reduce vehicle environmental impact. In 2024, the EU set a target to cut emissions by 55% by 2030. The global market for green vehicles is projected to reach $800 billion by 2025.

Resource scarcity and a shift toward circular economy models are gaining traction. This includes using recycled materials and designing products for recyclability. Knorr-Bremse may need to adapt its product lifecycle. The global circular economy market is projected to reach $623.2 billion by 2024, showing significant growth.

Knorr-Bremse faces environmental regulations impacting manufacturing. Compliance includes waste, water, and air pollution standards. Investing in eco-friendly practices is essential. In 2024, the EU's Green Deal increased pressure on industrial emissions. Companies failing to meet these regulations face penalties. These factors influence Knorr-Bremse's operational costs and market access.

Customer Demand for Sustainable Products

Customer demand for sustainable products is rising in the rail and commercial vehicle sectors. Clients increasingly seek eco-friendly components. These components aim to enhance fuel efficiency, reduce emissions, and lower noise levels. Knorr-Bremse's sustainable innovations directly address this customer preference.

- In 2024, the global green technology and sustainability market was valued at approximately $367 billion, with projections indicating continued growth.

- Knorr-Bremse has invested significantly in sustainable product development, allocating approximately 15% of its R&D budget to green technologies in 2024.

- The demand for electric vehicle (EV) components, a key area of focus for Knorr-Bremse, is expected to grow by over 20% annually through 2025.

Physical Risks from Climate Change

Knorr-Bremse faces physical climate risks, including extreme weather. These events can disrupt manufacturing, supply chains, and logistics. This impacts operations and increases costs. Business continuity planning must address these risks.

- 2024: Munich Re reported a rise in weather-related losses.

- 2024/2025: Supply chain disruptions are becoming more frequent.

- 2024: Companies are investing in climate resilience.

Knorr-Bremse must consider environmental impacts like climate change and resource scarcity. Regulations such as the EU's Green Deal boost sustainability demands. Customer preferences increasingly favor eco-friendly components and sustainable transport solutions. Physical climate risks pose significant disruptions.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Emissions | Reduce vehicle environmental impact | EV components market: 20%+ annual growth to 2025. |

| Resource Scarcity | Circular economy focus. | Green tech market ~$367B (2024). |

| Climate Risks | Disrupted operations and costs. | Weather-related losses rising. |

PESTLE Analysis Data Sources

The analysis leverages diverse data sources, including governmental bodies, economic reports, industry journals, and international organizations for accurate macro-environmental insights.