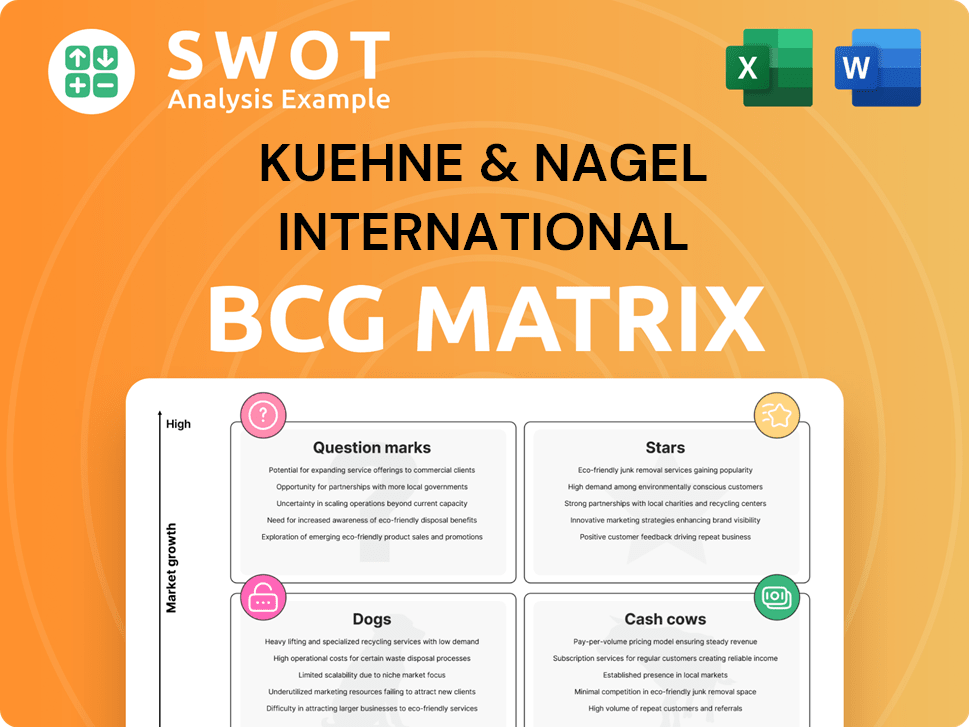

Kuehne & Nagel International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kuehne & Nagel International Bundle

What is included in the product

Tailored analysis for Kuehne & Nagel's product portfolio.

Printable summary optimized for A4 and mobile PDFs.

Full Transparency, Always

Kuehne & Nagel International BCG Matrix

The Kuehne & Nagel International BCG Matrix preview is the complete document you'll receive after purchase. Get the full, ready-to-use strategic analysis, designed for professional application and insightful decision-making.

BCG Matrix Template

Kuehne & Nagel's BCG Matrix reveals its diverse portfolio's strategic positions. Stars likely shine in high-growth markets, while Cash Cows generate steady revenue. Dogs may face challenges, and Question Marks need careful evaluation. Understanding these quadrants is key for strategic allocation. This analysis provides a snapshot, purchase for deeper insight.

Stars

Sea Logistics is a "Star" in Kuehne & Nagel's portfolio. The division's growth is fueled by the IMC Logistics acquisition. In Q1 2025, it saw a 30% rise in net turnover, reaching CHF 2.5 billion. EBIT hit CHF 210 million, showing strong profitability.

Kuehne+Nagel's Air Logistics is a star, showing strong growth. In Q1 2024, turnover hit CHF 1.8B, with EBIT at CHF 116M. They moved 514,000 tonnes, up 5%, gaining market share. The focus is on high-value goods like pharma.

Kuehne+Nagel's strategic acquisitions bolster its market stance. The 2025 consolidation of IMC Logistics boosts the Sea Logistics division. In 2024, Kuehne+Nagel's net turnover was CHF 23.8 billion, reflecting solid growth. These moves expand services and global reach, driving overall expansion. Acquisitions like Farrow also contribute to this strategy.

Data Center Logistics

Kuehne+Nagel is strategically focusing on data center logistics, recognizing its potential for growth. They are creating specialized solutions for secure and efficient server transport, aiming to meet rising demands. The company is actively building a 2025 global cloud infrastructure network. This move uses Kuehne+Nagel's vast network to tap into the expanding data center market.

- In 2024, the data center market was valued at over $50 billion.

- Kuehne+Nagel's revenue in 2023 was approximately CHF 25.2 billion.

- The company aims to capture a significant share of the growing data center logistics sector.

New Fulfillment Centers

Kuehne+Nagel's investment in new fulfillment centers, like the one for Adidas in Mantova, Italy, positions them as a Star in the BCG Matrix. These centers boost contract logistics and handle massive shipment volumes efficiently. The Adidas facility, for instance, manages up to 500,000 daily shipments. This expansion signals strong growth and market leadership.

- Adidas's Mantova center serves Southern and Eastern Europe.

- Kuehne+Nagel's investment in automation drives efficiency.

- These centers enhance contract logistics capabilities.

- High shipment volumes indicate strong market demand.

Kuehne+Nagel's Stars like Sea and Air Logistics drive growth, as evidenced by strong Q1 2025 turnover. Strategic moves, including the IMC Logistics acquisition, amplify market presence. Investments in data center logistics and fulfillment centers also boost their Star status, generating robust returns.

| Division | Q1 2025 Turnover | EBIT |

|---|---|---|

| Sea Logistics | CHF 2.5B | CHF 210M |

| Air Logistics | CHF 1.8B (Q1 2024) | CHF 116M (Q1 2024) |

| Data Center Logistics (Market Value 2024) | N/A | >$50B |

Cash Cows

Kuehne+Nagel's mature sea freight routes, especially those with steady high volumes, function as cash cows. They produce substantial revenue with limited new investment needs. These routes profit from long-term contracts and dependable demand. In 2024, sea freight contributed significantly to Kuehne+Nagel's revenue. The company's vast network secures stable cash flow.

Kuehne+Nagel's pharma and healthcare logistics is a cash cow. Demand for secure pharma transport stays strong. The company's expertise ensures consistent revenue. In 2024, the healthcare logistics market was worth billions. This segment provides stable profitability.

Perishable goods logistics, akin to pharmaceuticals, offers Kuehne+Nagel a stable income stream. The constant demand for temperature-controlled transport ensures consistent revenue. Kuehne+Nagel's cool corridors and expertise drive profitability. This segment bolsters resilience; in 2024, the perishable logistics market was valued at approximately $200 billion.

Customs Brokerage Services

Kuehne+Nagel's customs brokerage services are cash cows, especially in complex trade regions. Acquisitions like Farrow boost these capabilities, ensuring stable revenue. Their expertise in customs procedures guarantees continuous demand. Revenue from these services contributes significantly to overall financial stability. In 2024, the customs brokerage segment showed consistent growth, aligning with the company's strategic focus.

- Steady Income Source

- Strategic Acquisitions

- Expertise-Driven Demand

- Revenue Contribution

Contract Logistics for Major Retailers

Contract logistics for major retailers are a cash cow for Kuehne & Nagel, generating stable revenue. These long-term agreements include warehousing and distribution. The predictability and scale of these contracts ensure consistent cash flow. This segment is vital for financial stability. In 2024, the contract logistics market grew, reflecting its importance.

- Stable Revenue: Predictable income from long-term contracts.

- Value-Added Services: Includes warehousing and distribution.

- Consistent Cash Flow: Due to the stability and scale of operations.

- Market Growth: The contract logistics market expanded in 2024.

Cash cows for Kuehne & Nagel include mature sea freight routes, pharma logistics, perishable goods transport, customs brokerage, and contract logistics. These segments generate stable revenue with low investment needs, ensuring consistent cash flow. Strategic acquisitions like Farrow enhance these capabilities, contributing to financial stability.

| Cash Cow Segment | Revenue Contribution in 2024 | Key Features |

|---|---|---|

| Sea Freight | Significant, based on long-term contracts | Mature routes, high volume, steady demand. |

| Pharma Logistics | Billions in market value | Secure transport, consistent revenue, expertise. |

| Perishable Logistics | Approx. $200B market | Temperature-controlled, consistent demand, cool corridors. |

Dogs

Kuehne & Nagel's general cargo business in Europe struggles with weak demand and low capacity use. The segment faced profit losses in 2024, reflecting economic woes. With little improvement expected, it's categorized as a 'dog'. In Q3 2024, KN saw a decline in sea logistics, showing challenges.

The automotive sector faces air logistics hurdles, affecting profitability. Automotive parts have seen an EBIT decline, a key financial metric. Volatility and specific challenges have caused the automotive sector to underperform. Kuehne + Nagel's 2024 financials reflect these struggles in this sector, classifying it as a 'dog'. According to the 2024 financial report, the automotive sector's EBIT margin decreased by 2.5%.

Specific road logistics routes, like those with low volume, can be 'dogs' for Kuehne + Nagel. These routes may not cover operational costs. For example, in 2024, routes with less than 100 shipments monthly faced profitability challenges. Continuous assessment and possible divestiture are vital.

Smaller, Less Efficient Warehousing Facilities

Smaller, less efficient warehousing facilities can be Dogs in Kuehne & Nagel's portfolio, underperforming due to outdated tech and smaller scale. These facilities often face higher operational costs, impacting profitability. To improve efficiency, upgrading or divesting these facilities is a strategic move. Kuehne & Nagel's 2024 financial reports may reveal specific underperforming facilities.

- High operational costs.

- Lower throughput.

- Outdated technology.

- Potential for divestiture.

Commodity-Based Freight Forwarding

Commodity-based freight forwarding services, often seen as 'dogs' in the BCG matrix, are highly vulnerable to price wars and market swings. These services, lacking unique features, struggle to maintain profitability during economic downturns. This segment's reliance on undifferentiated pricing makes it risky. Kuehne & Nagel can mitigate this by boosting value-added services.

- In 2024, the global freight forwarding market faced intense price competition, with margins shrinking by up to 5%.

- The volatility of commodity prices directly impacts these services, as seen with the 2024 fluctuations in fuel costs.

- Kuehne & Nagel's strategy involves investing in specialized logistics solutions to counter the 'dog' status.

- Focusing on value-added services could increase profitability by 10-15% in 2024.

In Kuehne & Nagel's BCG matrix, "Dogs" represent struggling business areas. These segments have low market share and growth. General cargo in Europe, automotive, and specific road routes underperform, facing profitability issues.

| Category | Characteristics | Impact in 2024 |

|---|---|---|

| General Cargo | Weak demand, low capacity. | Profit losses reported. |

| Automotive | Air logistics hurdles. | EBIT margin decline of 2.5%. |

| Road Logistics | Low volume routes. | Profitability challenges. |

Question Marks

Kuehne+Nagel's emerging market expansion is a 'question mark'. These regions promise high growth but require considerable investment and carry uncertainty. Success hinges on effective entry strategies and adapting to local specifics. In 2024, they are investing heavily in Asia-Pacific, showing a commitment to this strategy. The outcome is yet to be fully realized.

Investments in new digital logistics platforms are 'question marks' for Kuehne & Nagel. These innovations aim to boost efficiency and customer service. Success hinges on market adoption and system integration. In 2024, Kuehne & Nagel invested €279 million in digital initiatives. Continuous monitoring and adaptation are key.

Sustainable logistics solutions at Kuehne & Nagel, such as low-emission transport and sustainable packaging, are classified as a 'question mark' in the BCG matrix. The demand for eco-friendly practices is increasing, yet customer willingness to pay extra is uncertain. In 2024, the market for green logistics is estimated at $1.2 trillion globally. Strategic investments and marketing are key to driving adoption and turning this question mark into a star.

Specialized Logistics for New Industries

Entering specialized logistics for emerging sectors like renewable energy and electric vehicles positions Kuehne & Nagel as a 'question mark' in the BCG Matrix. These industries present high growth potential but demand specific logistics expertise and infrastructure. For instance, the global electric vehicle market is projected to reach $823.8 billion by 2030, according to Statista. This requires careful market analysis and strategic investments.

- Market analysis is crucial for the EV and renewable energy sectors.

- Investments require specialized infrastructure and expertise.

- The EV market is expected to be worth $823.8B by 2030.

- These sectors present high growth potential.

Cross-Border E-commerce Solutions

Expanding cross-border e-commerce solutions is a 'question mark' for Kuehne & Nagel. E-commerce is growing, but international logistics are complex. Significant investment and expertise are needed to succeed. Overcoming these challenges is crucial for market potential.

- The global e-commerce market was valued at $3.5 trillion in 2023 and is projected to reach $8.1 trillion by 2027.

- Cross-border e-commerce is expected to account for 22% of global e-commerce sales by 2027.

- Kuehne & Nagel's revenue in 2023 was CHF 23.8 billion.

Kuehne+Nagel's 'question mark' strategies require careful evaluation. These ventures, like digital platforms, sustainable logistics, and emerging sectors, offer high growth but face uncertainty. Success hinges on strategic investment and adaptation. The global e-commerce market, a key area, was worth $3.5T in 2023.

| Category | Description | 2023 Data |

|---|---|---|

| Digital Initiatives | Investment in new platforms | €279M investment |

| Green Logistics | Market demand, customer adoption | $1.2T market estimate |

| E-commerce | Cross-border expansion | $3.5T global market value |

BCG Matrix Data Sources

The Kuehne & Nagel BCG Matrix uses market reports, financial statements, industry analyses, and competitor data for robust evaluations.