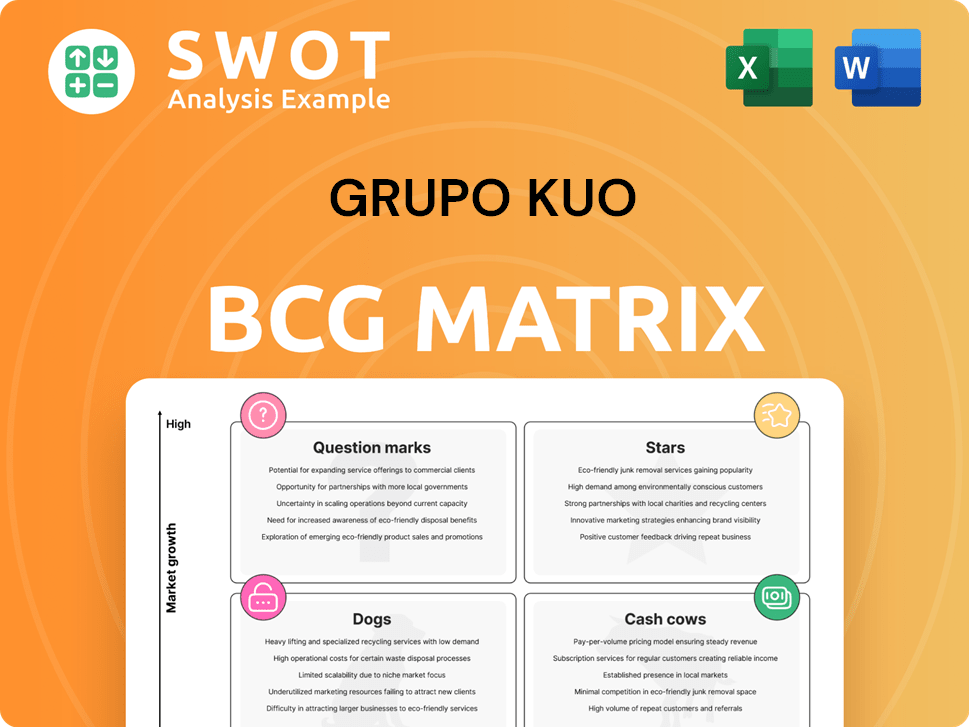

Grupo Kuo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Kuo Bundle

What is included in the product

Tailored analysis for Grupo Kuo's product portfolio, identifying investment, hold, or divest strategies.

Clearly visualizes Grupo Kuo's diverse portfolio, helping stakeholders understand strategic resource allocation.

What You See Is What You Get

Grupo Kuo BCG Matrix

The Grupo Kuo BCG Matrix preview is the complete document you'll receive. Get immediate access to a fully functional report with all charts and data, ready for your strategic planning and decision-making. You will receive the same document shown.

BCG Matrix Template

Grupo Kuo's BCG Matrix offers a snapshot of its diverse portfolio. See how its products are classified: Stars, Cash Cows, Dogs, or Question Marks. This preview gives you a glimpse into their strategic landscape.

Get the full BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

In 2024, Grupo Kuo's Pork Meat business is a Star. It's experiencing robust growth, with sales prices and volumes up, especially in exports. The business's vertical integration is a key advantage. It has boosted profitability through operational efficiency and favorable costs. In 2024, the division's revenue increased by 13.5%.

The Chemicals segment within Grupo Kuo, focusing on synthetic rubber and polymers, shines as a star performer. This sector, driven by robust sales in key areas like adhesives, tires, and footwear, demonstrates strong growth potential. In 2024, this segment saw increased volumes and prices in asphalt and adhesives, and the company also gained market share from European competitors. The focus on value-added applications and circular economies further solidifies its position for continued success.

Herdez Del Fuerte, a joint venture, shines brightly. It benefits from high demand for tomato puree and vegetables. In 2024, its revenue is expected to reach $500 million. Higher sales prices and efficiency boost its stellar growth, solidifying its star status within Grupo Kuo's BCG Matrix.

Synthetic Rubber JV

The Synthetic Rubber joint venture, a global leader, concentrates on tires, asphalt modifiers, and more. The business has shown resilience throughout 2024. It profits from regionalized plants and improved pricing and volume in chemicals. Competitiveness is further enhanced by favorable exchange rates.

- Global leader in synthetic rubber production.

- Focus on tires, asphalt modifiers, and various applications.

- Benefited from regionalized plants and improved pricing.

- Enhanced competitiveness through exchange rate advantages.

Branded Foods

Branded Foods, a star in Grupo Kuo's BCG matrix, demonstrates enhanced profitability due to stable raw material costs. The company capitalizes on its leading brands in expanding categories, fostering innovation and new product development. This segment experiences robust growth with substantial expansion prospects. For instance, in 2024, Branded Foods reported a 15% increase in revenue, driven by a 10% volume growth.

- Enhanced Profitability

- Stable Raw Material Costs

- Top-of-Mind Brands

- Strong Growth

Stars in Grupo Kuo's BCG matrix are experiencing robust growth. They show high market share and growth potential. Key segments like Pork Meat and Branded Foods boosted profitability.

The Chemicals segment and Herdez Del Fuerte also contribute significantly. These divisions leverage advantages like vertical integration and strong brand recognition.

| Segment | 2024 Revenue Growth | Key Driver |

|---|---|---|

| Pork Meat | 13.5% | Export Growth |

| Branded Foods | 15% | Volume Growth |

| Herdez Del Fuerte | $500M (Est.) | Demand for Tomato Puree |

Cash Cows

The Consumer sector within Grupo Kuo's BCG Matrix showed robust performance in 2024. Revenue surged by 16%, fueled by higher sales prices and volume, particularly in the Pork Meat business's main distribution channels. A substantial 64% growth in EBITDA was driven by solid performance and operational efficiencies. Operating and EBITDA margins in 4Q24 were 10.1% and 12.9%, respectively, demonstrating strong profitability.

Grupo Kuo's exports to Asia, including China, Japan, and South Korea, exceeded expectations in 2024. The pork meat segment benefits from lower-than-expected raw material prices. The company is expanding the pork meat segment, aiming for up to 45% of total sales from exports, particularly to Japan, South Korea, and the U.S. Stable raw material costs are anticipated in the upcoming years, enhancing profitability.

Grupo Kuo's Chemicals business, a cash cow, benefits from growing demand for specialized products. In 2024, resilience was shown through higher volumes and prices, especially in asphalt and adhesives. The business gained market share from European competitors, and higher styrene prices boosted profitability. The chemical segment's revenue grew by 8% in 2024.

Aftermarket Business (Divested)

Grupo Kuo's Aftermarket business, which contributed roughly 20% to its EBITDA, was divested. This strategic move allows Grupo Kuo to reallocate resources. Proceeds from the sale will be used to pay down debt, distribute dividends, and bolster its cash reserves. The divestiture aligns with the company’s plan to reduce debt and navigate the automotive supplier industry’s volatility.

- EBITDA Contribution: The Aftermarket business contributed approximately 20% to Grupo Kuo's EBITDA before the divestiture.

- Use of Proceeds: Funds from the sale are earmarked for debt reduction, dividend payments, and enhancing the company's cash position.

- Strategic Alignment: The divestiture supports Grupo Kuo's strategic goals of decreasing financial leverage and lessening exposure to a volatile sector.

Industrial Sector

Grupo Kuo's Industrial sector saw a 10% revenue increase last quarter. This growth was fueled by increased prices and volume, especially in chemical applications. The adhesives, tires, and packaging segments performed well.

The sector's regionalization strategy and focus on eco-friendly products are key. New production lines also contribute to its success. The industrial sector's performance reflects strategic investments and market adaptability.

- Revenue growth: 10%

- Focus: Eco-friendly products

- Key segments: Adhesives, tires, packaging

- Strategy: Regionalization

Grupo Kuo's Chemicals business, a cash cow, saw an 8% revenue increase in 2024, driven by demand. Market share gains and higher styrene prices boosted profitability. The sector's resilience and strategic moves highlight its strong performance.

| Metric | 2024 Performance | Details |

|---|---|---|

| Revenue Growth | 8% | Driven by higher volumes and prices in asphalt and adhesives. |

| Strategic Moves | Market Share Gain | Gained market share from European competitors. |

| Key Driver | Higher Styrene Prices | Boosted profitability within the segment. |

Dogs

Grupo Kuo's transmission business saw challenges in 2024, with lower sales volume impacting performance. The Corvette platform experienced a decline in backlog, affecting volume. EBITDA decreased by 64%, influenced by lower demand and increased expenses. However, a volume recovery is anticipated in 2025.

Grupo Kuo's OEM volume faces challenges, with its electrification strategy under scrutiny. The business grapples with fierce competition from Asia, alongside exchange rate volatility, impacting profitability. Higher labor costs and US tariffs further squeeze margins. In 2024, Grupo Kuo's sales in the automotive sector were $1.2 billion, a 3% decrease compared to 2023.

Grupo Kuo's Synthetic Rubber & Polymers struggles with global oversupply, especially from Asia, and faces dumping actions. Logistic costs increased in the first half of 2024, impacting profitability. Weaker demand and ongoing Asian capacity expansion continue to pressure volumes. The division's performance in 2024 reflects these challenges, with revenue potentially down.

Aftermarket

The Aftermarket business, a part of Grupo Kuo's portfolio, focuses on engine, powertrain, and brake system components, with a significant export component for gaskets, seals, and joints. In 2024, Grupo Kuo made a strategic decision to divest this business unit. The divestiture aimed to bolster KUO's financial health through debt reduction and strategic investments.

- Divestiture proceeds were allocated for strengthening the capital structure.

- The Aftermarket business included components for engines, powertrains, and brakes.

- Exports included gaskets, seals, and joints.

- The move aimed to improve financial flexibility.

Transmissions Business

The Transmissions Business within Grupo Kuo's portfolio is classified as a "Dog" in the BCG Matrix, indicating low market share in a low-growth industry. In 2024, the segment saw a revenue decrease of 4.3%, reflecting challenges in the market. However, projections for 2025 anticipate a growth of 5.7%, potentially signaling a turnaround. The company's transmission business faces cyclical trends and softer demand.

- Revenue drop of 4.3% in 2024.

- Projected revenue growth of 5.7% in 2025.

- Faces cyclical trends.

- Softer demand in the transmission business.

The Transmissions Business is a "Dog" due to low market share and low growth. Revenue decreased by 4.3% in 2024 but is projected to grow 5.7% in 2025. It faces cyclical trends and softer demand.

| 2024 | 2025 (Projected) | |

|---|---|---|

| Revenue Change | -4.3% | +5.7% |

| Market Position | Low | Low |

| Industry Growth | Low | Low |

Question Marks

New chemical applications, especially in specialized products, are a question mark for Grupo Kuo. Demand is rising for specialized chemicals, driving product diversification. The company battles global oversupply, particularly from Asia, requiring significant investment to compete. Consider that Grupo Kuo's chemical segment revenue in 2024 was approximately $1.2 billion, with a 6% growth.

Grupo Kuo's electrification strategy is being reevaluated. The company faces critical investment needs to boost market share or consider divestiture. Innovation and new product development are key to expanding its market presence, especially in a competitive landscape. Currency exchange rates further impact competitiveness, requiring strategic financial planning and execution to mitigate risks. In 2024, the automotive industry saw significant shifts towards EVs, influencing Grupo Kuo's strategic decisions.

New technologies pose a question mark for Grupo Kuo, especially in refining. Investments in energy-efficient processes are critical to meet EU emission targets. Innovation is key for new products to increase market share. In 2024, the refining sector saw a 10% increase in efficiency investments.

Consumer Products

Grupo Kuo's consumer products segment, focusing on pork meat, processed foods, and beverages, faces strategic challenges. To boost market share, the company must prioritize innovation and introduce new products. Currency fluctuations also impact competitiveness, requiring strategic financial planning.

- In 2024, Grupo Kuo's revenue was approximately $3.5 billion.

- The consumer segment accounts for about 40% of total revenue.

- The company invested $50 million in R&D for new products in 2024.

- Exchange rate effects reduced net profits by 5% in 2024.

Expansion into New Markets

Grupo Kuo's expansion into new markets, particularly in its pork meat segment, is driven by anticipated export growth. This includes increasing sales to Japan, South Korea, and the U.S., which could boost exports up to 45% of total sales. To capitalize on these opportunities, the company should concentrate on innovation and introduce new products to enhance its market share.

Exchange rate fluctuations pose a challenge, requiring Grupo Kuo to focus on improving its competitiveness. This involves strategic financial planning to mitigate the impact of currency volatility on profitability and market positioning. The company must also consider factors like consumer preferences and trade agreements to refine its expansion strategies.

- Export growth is expected to reach up to 45% of total sales.

- Key export markets include Japan, South Korea, and the U.S.

- Innovation and new products are crucial for increasing market share.

- Exchange rate fluctuations necessitate improved competitiveness.

Grupo Kuo faces "question mark" challenges across its business segments. These include chemical applications, electrification strategy, and new technologies like refining processes, requiring significant strategic investment. The company must navigate currency fluctuations and the need for innovation to boost market share and profitability.

| Segment | Challenge | Strategic Need |

|---|---|---|

| Chemicals | Oversupply, specialized products | Investment, product diversification |

| Electrification | Market share, strategic decisions | Investment or divestiture, innovation |

| Refining | Emission targets, new technologies | Efficiency investments, new products |

BCG Matrix Data Sources

This Grupo Kuo BCG Matrix uses financial reports, industry research, and market data to define each business unit's strategic position.