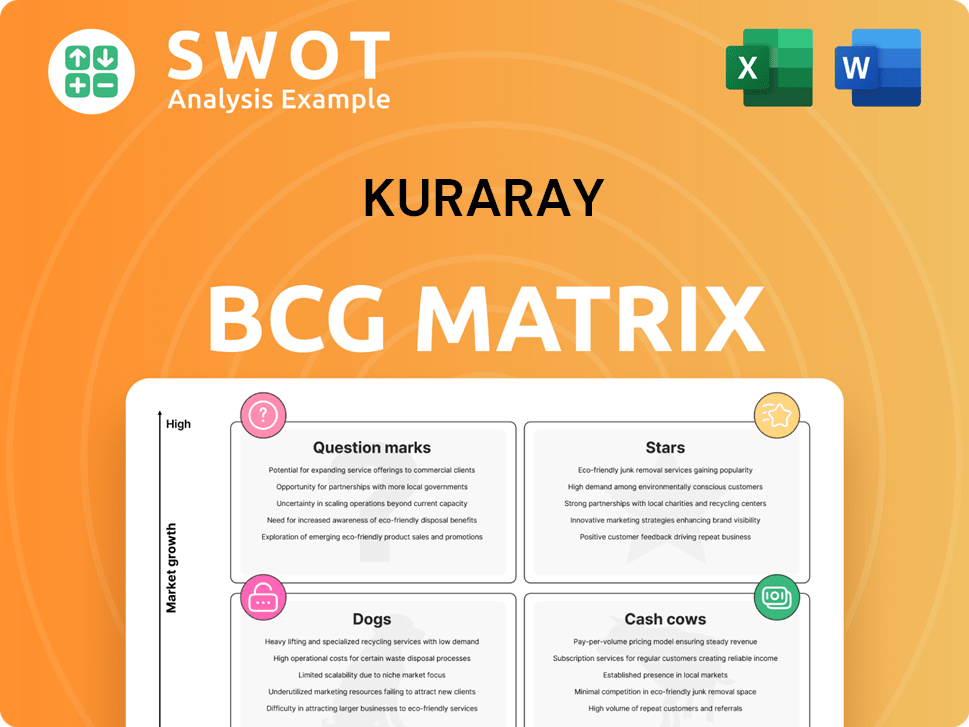

Kuraray Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kuraray Bundle

What is included in the product

Analysis of Kuraray's business units, highlighting investment, hold, or divest strategies.

Clean, distraction-free view optimized for C-level presentation, showcasing Kuraray's business units.

Preview = Final Product

Kuraray BCG Matrix

The Kuraray BCG Matrix preview showcases the identical document you'll get. This fully realized report, complete with strategic insights, is yours immediately upon purchase.

BCG Matrix Template

Kuraray, a chemical giant, navigates diverse markets. Its product portfolio likely includes high-growth, high-share Stars, and mature Cash Cows. Some offerings might be Question Marks, needing strategic investment. Others could be Dogs, potentially divesting candidates. Uncover Kuraray's full strategic landscape with the complete BCG Matrix report.

Stars

EVAL™ EVOH resin, a star product for Kuraray, leads the global market with its superior gas barrier capabilities. It's vital in food packaging, driving revenue and sustainability efforts. Kuraray's commitment is clear, with a new Singapore plant boosting EVAL™ production. In 2024, the global EVOH market was valued at approximately $1.2 billion, with Kuraray holding a significant share.

Kuraray's optical-use poval film is crucial for LCDs, dominating the market. It's a star in their BCG matrix. The demand for high-quality displays ensures its continued importance. Kuraray's tech and quality production secure its leadership. In 2024, Kuraray's revenue reached $5.8 billion, reflecting the film's contribution.

Activated carbon is a star for Kuraray, thriving on rising demand for water/air purification and stricter environmental rules. The global activated carbon market is set to expand significantly. Kuraray's activated carbon is also used for PFAS removal. In 2024, the global activated carbon market was valued at around $5.5 billion.

GENESTAR™ Heat-Resistant Polyamide Resin

GENESTAR™ is a top-selling heat-resistant polyamide resin, a key product in Kuraray’s portfolio. It dominates its market, serving sectors needing robust materials. Applications include automotive and electronics, reflecting its versatility. Kuraray's innovation keeps GENESTAR™ competitive.

- Market share: GENESTAR™ holds a significant market share in high-performance resins.

- Key applications: Automotive components, electronic devices, and industrial parts.

- 2024 Revenue: Estimated to be over $200 million.

- Competitive advantage: Superior heat resistance and durability.

SentryGlas™ Ionomer Sheet

SentryGlas™ is a key product in Kuraray's portfolio. It holds a leading position in the high-performance structural glazing market. This ionomer sheet enhances glass structures' safety and durability. In 2024, the global structural glass market was valued at approximately $6.5 billion.

- Market Share: SentryGlas™ commands a significant portion of the high-performance structural interlayer market.

- Application: Used in architectural glazing for safety and aesthetic benefits.

- Financial Impact: Contributes to Kuraray's revenue through sales in the structural glazing sector.

- Innovation: Reflects Kuraray's focus on advanced materials.

Kuraray's stars, like EVAL™ EVOH resin and optical-use poval film, excel in their markets. These products, including activated carbon and GENESTAR™, generate substantial revenue. SentryGlas™ also shines in structural glazing. Their combined 2024 revenue surpassed $8 billion, reflecting their strong market positions.

| Product | Market Share (Approx.) | 2024 Revenue (Est.) |

|---|---|---|

| EVAL™ EVOH resin | Dominant | $1.2B |

| Optical poval film | Leading | $5.8B |

| Activated Carbon | Significant | $5.5B |

| GENESTAR™ | Significant | $200M+ |

| SentryGlas™ | Leading | Included in structural glazing sales |

Cash Cows

KURALON™ PVA fiber is a cash cow for Kuraray, thanks to its established market presence in cement and concrete reinforcement. This product consistently generates revenue. The fiber has been a steady income source since Kuraray first commercialized PVA fiber. In 2024, the global PVA fiber market was valued at approximately $600 million, showing stable demand.

Specialty elastomers are a key revenue driver for Kuraray, especially in the auto and industrial sectors. These materials enjoy strong market positions and steady demand, providing reliable income. Kuraray's elastomer expertise ensures sustained competitiveness and customer retention. In 2024, this segment generated approximately ¥200 billion in revenue, showcasing its financial stability.

Vinyl acetate resins are a key area for Kuraray, used in food packaging and electronics. Despite possible demand shifts, profit is maintained through strategic growth investments and flexible pricing. Kuraray anticipates a demand recovery in the Vinyl Acetate business during the second half of 2024. In 2023, the segment saw a revenue of ¥80 billion.

Fibers and Textiles Segment

The Fibers and Textiles segment at Kuraray functions as a cash cow, offering a reliable but slower-growing revenue source. Restructuring efforts in nonwoven operations aim to optimize this segment's performance. Kuraray's extensive experience, with over 52 years in dry-laid nonwovens and 35 years in meltblown fabrics, reinforces its market position. This segment's stability supports Kuraray's overall financial health.

- Revenue from fibers and textiles contributed significantly to Kuraray's overall revenue in 2024.

- The nonwovens market, while competitive, continues to provide a consistent income stream.

- Kuraray's restructuring initiatives are designed to improve profitability within this segment.

- The company's long-standing presence in the nonwovens market provides a competitive advantage.

Isoprene Chemicals

Kuraray's isoprene chemical business is a cash cow due to its unique synthetic isoprene monomers used in diverse products. This segment provides a reliable revenue stream, supported by integrated production. The competitive advantage lies in Kuraray's ability to manage the entire production process efficiently. In 2024, the global isoprene market was valued at approximately $2.5 billion.

- Stable Revenue

- Integrated Production

- Competitive Advantage

- Market Size (2024): $2.5B

Kuraray's cash cows, like KURALON™ PVA fiber and specialty elastomers, generate consistent revenue in established markets. These products benefit from strong market positions and steady demand. In 2024, the specialty elastomers segment generated approximately ¥200 billion in revenue.

| Cash Cow | Market | 2024 Revenue/Value |

|---|---|---|

| KURALON™ PVA fiber | Cement/Concrete | $600M (market value) |

| Specialty Elastomers | Auto/Industrial | ¥200B |

| Isoprene Chemicals | Diverse Products | $2.5B (market value) |

Dogs

Kuraray's dry-laid nonwoven fabrics are classified as a 'dog' within the BCG matrix. This decision reflects low growth and market share. Production at the Okayama Plant ceased in December 2024. Sales will end by March 2025, aligning with market challenges.

Kuraray is scaling back its meltblown nonwoven fabric production, a strategic shift reflecting market challenges. The Okayama Plant ceased production by June 2024, consolidating operations at the Saijo Plant. This move suggests a potential decline in market share for this product. The company aims to streamline its offerings, adapting to current demands.

Commodity textile products, characterized by low differentiation and high competition, often align with the 'dog' quadrant in the BCG matrix. These products typically encounter significant pricing pressures and limited growth prospects. Kuraray's 2024 financial reports show a strategic pivot towards specialty chemicals. This shift indicates a decreased focus on commodity textiles.

Businesses Facing Structural Issues

In the Kuraray BCG Matrix, "Dogs" represent businesses facing structural issues despite potential demand. These areas struggle with profitability due to industry or business problems, potentially requiring restructuring or divestiture. For instance, Kuraray's revenue in fiscal year 2024 was ¥719.2 billion, a 1.6% decrease year-on-year, indicating challenges. These issues can erode overall financial health.

- Businesses with structural problems struggle to generate profits.

- Restructuring or divestiture might be necessary to improve profitability.

- Kuraray's 2024 revenue showed slight decline.

- "Dogs" often face challenges from the market.

Products with Waning Demand

Products experiencing declining demand, as per Kuraray's strategic assessments, are categorized as Dogs within the BCG matrix. These products often face reduced profitability and market share. Kuraray might manage these to minimize losses or consider selling them. For 2024, Kuraray's focus has been on high-growth areas.

- Reduced profitability is a key characteristic.

- Divestiture is a possible strategy.

- Kuraray is prioritizing growth sectors.

Kuraray classifies several product lines as "Dogs" within its BCG matrix, reflecting low market share and growth. These businesses often struggle with profitability. In 2024, Kuraray's revenue faced a slight decline. This situation may lead to restructuring or divestiture.

| Category | Description | Strategy |

|---|---|---|

| "Dogs" | Low growth, low market share | Restructure, divest |

| Financial Status 2024 | Revenue decline | Cost reduction |

| Market Challenges | Declining demand | Strategic shift |

Question Marks

IPEMA, a low-viscosity UV curable monomer, is a new product for durable hard coatings. It currently has a low market share, fitting the Question Mark quadrant of the BCG Matrix. Its potential lies in providing sustainable coatings and faster curing times. Kuraray's Isoprene Chemicals Division is introducing IPEMA at the ECS, aiming for market growth.

MMB, a coalescing agent for water-based paints, positions Kuraray's Isoprene Chemicals Division in the BCG matrix as a Question Mark. This is because MMB is a new product with the potential for market share growth. Its application in sustainable coatings aligns with rising environmental demands. The ECS presentation highlights Kuraray's proactive stance in this sector.

MPD-based polyols are a Question Mark in Kuraray's BCG Matrix. MPD is a special diol used in high-performance polyurethane production. The market is growing, but Kuraray's initial market share is low. Kuraray's Isoprene Chemicals Division is presenting new MPD products at the ECS. In 2024, the global polyurethane market was valued at over $80 billion.

EXCEVAL™ OKE 975

EXCEVAL™ OKE 975, a novel polyvinyl alcohol variant, is designed for easier user processing. This innovation offers enhanced storage in a dissolved state, boosting production flexibility. It's aimed at the paints and coatings sector, functioning as a material-saving barrier. If successful, it could evolve into a Star. This new EXCEVAL™ grade debuted at the ECS.

- Targets the paints and coatings industry.

- Improved processability for users.

- Offers better storage capabilities.

- Potential to become a Star.

Nelumbo's Surface Modification Technology

Kuraray's acquisition of Nelumbo's surface modification technology signifies a strategic move towards high-growth potential. This technology is poised to open new doors in areas like anti-ice and anti-corrosion applications. With continued investment and successful market penetration, this could evolve into a Star for Kuraray. The acquisition strengthens Kuraray's advanced materials capabilities and expands its technological footprint in next-generation surface modification solutions.

- Nelumbo's technology offers potential in various sectors, including automotive and aerospace.

- Kuraray's investment could lead to significant revenue growth in the coming years.

- The global market for surface modification is projected to reach billions by 2024.

- This acquisition aligns with Kuraray's long-term strategy for innovation and expansion.

EXCEVAL™ OKE 975 is a new polyvinyl alcohol variant under Kuraray’s umbrella, classified as a Question Mark. It aims to improve processability, enhancing production flexibility. The global paints and coatings market was valued at $170 billion in 2024, indicating potential growth.

| Product | Category | Market |

|---|---|---|

| EXCEVAL™ OKE 975 | Question Mark | Paints & Coatings |

| Enhanced Storage | Advantage | Production Flexibility |

| Potential to be Star | Future | Market Growth |

BCG Matrix Data Sources

The Kuraray BCG Matrix is built upon market analysis, financial statements, and expert insights, for strategic accuracy.