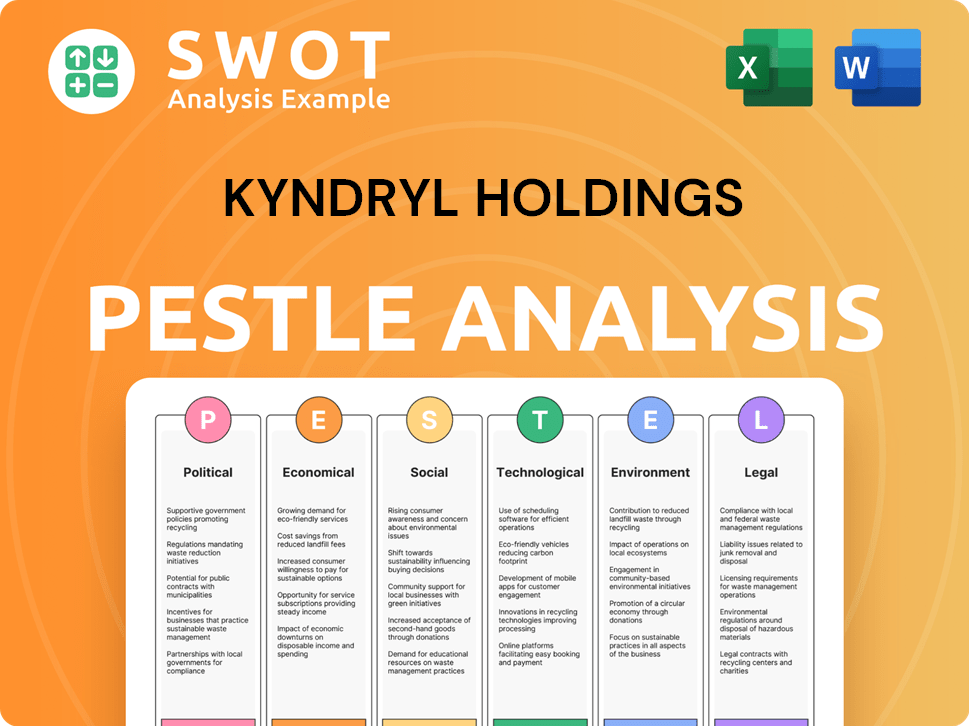

Kyndryl Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kyndryl Holdings Bundle

What is included in the product

Evaluates how external macro-factors impact Kyndryl across six dimensions: Political, Economic, Social, Tech, Environmental, Legal.

A concise version ideal for PowerPoint use and quick team planning.

Preview Before You Purchase

Kyndryl Holdings PESTLE Analysis

What you're previewing is the actual Kyndryl PESTLE Analysis file. You'll receive this comprehensive document instantly after purchase.

PESTLE Analysis Template

Uncover Kyndryl Holdings' future with our PESTLE Analysis. Understand how external factors influence its strategy and market position. Analyze political, economic, social, technological, legal, and environmental influences. Gain competitive advantages and optimize strategic decisions. Download now for actionable insights.

Political factors

Kyndryl's substantial government contracts expose it to political factors. The company manages IT infrastructure for government entities worldwide. In 2024, government contracts accounted for a significant portion of Kyndryl's revenue, about 15%. These contracts are subject to procurement rules and IT modernization initiatives. Public scrutiny and political shifts can directly impact these revenue streams.

Kyndryl faces geopolitical risks due to its global presence, operating in over 60 countries. Trade restrictions, including technology transfer policies, and export controls, pose challenges. US-China tech trade restrictions and EU digital sovereignty regulations are specific concerns. These factors can impact Kyndryl's service delivery and operations.

Governments globally are tightening cybersecurity and data protection laws to safeguard critical infrastructure and personal data. Kyndryl must adhere to these evolving mandates, like GDPR and national cybersecurity frameworks. Compliance demands significant investment in security and reporting. Non-compliance risks heavy penalties and reputational harm. The global cybersecurity market is projected to reach $345.4 billion in 2024.

Political Stability and Operational Complexity

Kyndryl's global presence means political stability is crucial. Unstable regions can disrupt operations and increase costs. Political shifts force Kyndryl to adjust strategies and risk management. For example, in 2024, Kyndryl's revenue from EMEA was $5.6 billion, highlighting the impact of regional political climates.

- Unstable regions can lead to operational disruptions.

- Kyndryl must adapt strategies in response to political changes.

- Political stability directly affects service delivery.

Government Investment in Technology and AI Strategies

Government investments in technology and AI are key for Kyndryl. These initiatives, like the UK's AI Opportunities Action Plan, offer chances for Kyndryl. They can tailor services to align with these strategies, aiming for government contracts and sector growth. The UK government's AI sector saw investments rise, with a 2024 projection of £1.5 billion.

- UK's AI sector investment: Projected £1.5 billion in 2024.

- Kyndryl can align with national AI strategies.

- Opportunities for government contracts.

- Contribution to national tech development.

Kyndryl relies on government contracts, with about 15% of 2024 revenue from them. Geopolitical factors impact global operations and trade. Cybersecurity laws and AI investments shape Kyndryl's compliance needs and market opportunities.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Government Contracts | Revenue dependent on procurement rules | 15% of Kyndryl's 2024 revenue. |

| Geopolitical Risks | Operational disruptions | US-China tech restrictions continue in 2025. |

| Cybersecurity | Compliance demands | Global cybersecurity market ~$345.4B in 2024. |

Economic factors

Kyndryl's success hinges on global economic health and enterprise IT spending. Economic dips can slash IT budgets, hitting Kyndryl's sales and profits. Strong economies boost demand for IT services. In Q3 FY24, Kyndryl saw a 5% revenue increase, reflecting improved IT spending. The company's focus is on digital transformation, which is influenced by these economic factors.

Kyndryl's global operations expose it to currency exchange rate fluctuations. These shifts affect reported revenue and profit during consolidation. For example, a stronger US dollar can reduce the value of revenue from other markets. Companies often use hedging strategies to mitigate these risks.

The IT infrastructure services sector is intensely competitive. Kyndryl faces pricing pressures from established firms and nimble competitors. To stay profitable, they must showcase service value, differentiating themselves to optimize costs. For example, in Q3 2024, Kyndryl's gross profit margin was 27.4%, reflecting these challenges.

Inflation and Operating Costs

Inflation presents a significant challenge to Kyndryl, potentially escalating operating expenses across labor, energy, and technology. The company must actively manage these costs to protect its profit margins, which could involve boosting efficiency and optimizing sourcing strategies. Kyndryl might need to adjust pricing to adapt to these inflationary pressures, ensuring sustained profitability. In 2024, the U.S. inflation rate has fluctuated, impacting operational costs.

- Labor costs: Approximately 60-70% of operational expenses.

- Energy costs: Subject to market volatility.

- Technology components: Prices influenced by supply chain dynamics and inflation.

- Pricing adjustments: Kyndryl's ability to pass costs to clients.

Investment in New Technologies and Solutions

Kyndryl's economic success hinges on its investments in new technologies like AI, cloud, and cybersecurity. These investments are vital for remaining competitive. However, this necessitates substantial capital spending, potentially affecting short-term earnings. Kyndryl's strategy includes expanding its AI services, which is projected to grow the AI market to $300 billion by 2025.

- Capital expenditures are a key factor.

- AI market growth by 2025.

- Impact on short-term profitability.

Economic factors significantly impact Kyndryl's performance through IT spending and currency exchange rates. Strong economies fuel IT services demand, while exchange rate fluctuations can alter reported revenue, requiring hedging strategies. Kyndryl actively manages costs, particularly in areas like labor, which accounts for 60-70% of operational expenses. Strategic investments in technology, such as AI, also affect short-term profitability.

| Economic Factor | Impact | Financial Data (2024-2025) |

|---|---|---|

| IT Spending | Influences Sales & Profit | Q3 FY24 Revenue Growth: 5% |

| Currency Exchange Rates | Affects Reported Revenue | Hedging strategies utilized. |

| Inflation & Costs | Impacts Operational Expenses | U.S. Inflation Rate (2024): Fluctuating; Labor Costs: 60-70%. |

Sociological factors

Kyndryl faces talent acquisition challenges in a competitive IT landscape. The company must invest in training programs to upskill its workforce. According to a 2024 report, the demand for cloud computing skills increased by 40% over the past year. Kyndryl's success hinges on its ability to adapt to these skill shifts. Effective talent management is vital for Kyndryl's growth.

The rise of hybrid and remote work models significantly impacts IT needs. Kyndryl's digital workplace services address these shifts. In 2024, remote work grew, with 30% of U.S. employees working remotely. Kyndryl’s offerings are crucial for supporting distributed teams. This affects service delivery and the types of solutions offered.

Societal focus on DEI is crucial for global firms. Kyndryl's DEI efforts affect its image, employee morale, and ability to draw talent and customers. In 2024, companies with strong DEI practices often saw better financial performance. Studies reveal that diverse teams boost innovation and market reach.

Corporate Social Responsibility and Community Engagement

Kyndryl's commitment to Corporate Social Responsibility (CSR) and community engagement is shaped by evolving societal norms. This includes programs focused on education and digital skills training. Such initiatives boost Kyndryl's reputation. In 2024, companies globally increased CSR spending by 15%. This reflects growing stakeholder emphasis on social impact.

- Kyndryl's CSR efforts enhance its brand image.

- Societal expectations drive CSR program development.

- Digital skills training aligns with tech industry needs.

- Community engagement builds social capital.

Customer Expectations for Sustainable and Ethical Practices

Customers are now prioritizing sustainability and ethical practices when choosing service providers. Kyndryl's commitment to these areas is a key sociological factor. This includes environmental sustainability, responsible business practices, and ethical conduct. These factors can significantly influence customer decisions and partnerships. For example, 70% of consumers globally consider a company's values before making a purchase.

- Environmental sustainability efforts, reducing carbon footprint.

- Responsible business practices, including fair labor standards.

- Ethical conduct in operations and supply chain.

- Compliance with ESG (Environmental, Social, and Governance) standards.

Kyndryl's DEI, CSR and ethical stances shape its image. Focus on ESG grows with 15% increase in 2024. Customer decisions are greatly influenced by sustainable and ethical practices.

| Sociological Factor | Impact | 2024 Data |

|---|---|---|

| DEI Initiatives | Enhances brand & attracts talent | Improved financial performance in companies. |

| CSR/Community Engagement | Boosts Reputation & Social Capital | 15% rise in CSR spending. |

| Sustainability & Ethics | Influences Customer Choice | 70% of consumers consider values. |

Technological factors

Kyndryl is significantly impacted by the swift progress in cloud computing and AI. These advancements are crucial for Kyndryl's service modernization. The company needs to enhance its capabilities in cloud migration and AI implementation. In 2024, the global cloud computing market was valued at $670 billion, with AI spending at $200 billion. This growth underscores Kyndryl's need to adapt.

Cybersecurity threats are escalating, demanding strong solutions. Kyndryl's services protect essential infrastructure. A 2024 report shows cyberattacks rose 30% globally. Kyndryl's resilience helps clients recover. Addressing these threats is key for their tech focus.

Many enterprises still use legacy IT systems, including mainframes. Kyndryl modernizes these systems, integrating them with cloud and hybrid IT environments. This bridges old and new technologies. In Q1 2024, Kyndryl reported $4.2 billion in revenue, reflecting its work in this area. Their focus helps clients navigate technological transitions.

Automation and AI in IT Operations

Automation and AI are revolutionizing IT operations, a trend Kyndryl actively capitalizes on. Kyndryl Bridge automates workflows, optimizing performance and enhancing efficiency. This is crucial in managing complex IT infrastructures. Automation can reduce operational costs by up to 30%, as reported by industry analysts in late 2024.

- Kyndryl's automation solutions are projected to manage over $3 billion in IT infrastructure by the end of 2025.

- AI-driven automation helps reduce downtime by up to 40%.

- Automation saves an average of 20% on labor costs in IT operations.

Data Governance and Analytics

Data governance and analytics are crucial as data's role expands, especially with AI's growth. Kyndryl excels in helping clients manage and use data effectively, which is essential for AI integration and data-driven strategies. The global data analytics market is projected to reach $684.1 billion by 2030. Kyndryl's focus on data solutions positions them well.

- Market size: Expected $684.1B by 2030.

- Kyndryl's role: Data management and AI support.

Technological advancements drive Kyndryl's business. Cloud computing, AI, and cybersecurity are key. They aim to modernize legacy IT and leverage automation.

| Factor | Impact | Data |

|---|---|---|

| Cloud Computing | Crucial for modernization. | Market worth $670B in 2024. |

| Cybersecurity | Protecting vital infrastructure. | Cyberattacks increased 30% in 2024. |

| Automation | IT operations improvement. | Expected to manage over $3B in infrastructure by 2025. |

Legal factors

Kyndryl faces stringent data privacy regulations worldwide, including GDPR and CCPA. Compliance demands meticulous data handling practices, affecting service delivery across regions. In 2024, data breaches cost companies an average of $4.45 million, highlighting the stakes.

Kyndryl faces stringent cybersecurity regulations due to its critical IT services. These laws dictate incident reporting, security controls, and risk management. Failure to comply can lead to hefty fines and reputational damage. In 2024, cybersecurity spending is projected to reach $215 billion globally, underscoring the importance of compliance.

Kyndryl's operations heavily rely on contracts with clients, defining service expectations through Service Level Agreements (SLAs). These legally binding agreements are critical for outlining responsibilities and performance metrics. In 2024, successful SLA management directly impacts Kyndryl's revenue, with potential penalties for non-compliance. Legal disputes related to service delivery could affect the company's financial results.

Employment Law and Labor Regulations

Kyndryl faces complex employment law challenges globally. The company must adhere to varied wage, working condition, and employee rights regulations across numerous countries. Workforce adjustments, like layoffs, carry significant legal risks and necessitate careful planning. In 2024, labor law compliance costs for multinational corporations increased by approximately 7%. Navigating these regulations is crucial for Kyndryl's operational and financial health.

- Compliance costs for multinational corporations have risen by about 7% in 2024.

- Employment laws vary significantly by country, demanding tailored strategies.

- Layoffs and workforce changes require careful legal consideration.

Export Controls and Trade Sanctions Compliance

Kyndryl, rooted in the U.S., faces export control laws and trade sanctions that impact its international operations. These regulations necessitate strict compliance when delivering services globally, potentially limiting business activities in certain regions or with specific entities. In 2024, the U.S. government increased enforcement of export controls, leading to higher compliance costs for companies like Kyndryl. These controls are crucial for national security and foreign policy objectives.

- Compliance costs rose by 15% in 2024 due to stricter regulations.

- Affected countries include those with significant geopolitical tensions.

- Kyndryl must navigate complex legal landscapes to avoid penalties.

Kyndryl must navigate intricate legal landscapes, including data privacy and cybersecurity regulations worldwide, such as GDPR and CCPA, with global spending on cybersecurity expected to reach $215 billion in 2024. The company is also subject to diverse employment and contract laws, increasing compliance costs for multinationals. In 2024, successful SLA management directly impacts Kyndryl's revenue, with potential penalties for non-compliance. Export controls add further complexity.

| Legal Area | Regulation Impact | 2024 Financial Impact |

|---|---|---|

| Data Privacy | GDPR, CCPA compliance | Average data breach cost: $4.45M |

| Cybersecurity | Incident reporting, security controls | Projected global spending: $215B |

| Contracts/SLAs | Service level agreements | Penalties for non-compliance affect revenue |

Environmental factors

Growing climate change worries boost demand for sustainable IT. Kyndryl aims to cut emissions and reach net-zero. In 2024, Kyndryl's sustainability efforts included energy efficiency improvements. They help clients reduce their carbon footprint.

Data centers and IT infrastructure consume substantial energy, posing environmental challenges. Kyndryl focuses on boosting energy efficiency in managed systems. In 2024, data centers used ~2% of global electricity. Kyndryl's adoption of renewables is crucial, aligning with sustainability goals and client demand for eco-friendly solutions.

E-waste, from discarded IT gear, poses environmental risks due to hazardous materials. Kyndryl's asset lifecycle management, focusing on responsible disposal and recycling, is crucial. The global e-waste volume reached 62 million metric tons in 2022, highlighting the issue's scale. Kyndryl's initiatives in this area are vital for sustainability, influencing stakeholder perception and operational costs.

Customer Demand for Sustainable IT Services

Customer demand for sustainable IT services is on the rise, influencing procurement decisions. Kyndryl can gain a competitive edge by providing "Green IT" solutions. This commitment to environmental responsibility is a key environmental factor for Kyndryl. For example, a 2024 Gartner report projects a 20% increase in demand for sustainable IT solutions. The company's ability to meet this demand can significantly impact its market position.

- Growing demand for sustainable IT.

- Kyndryl's "Green IT" offerings.

- Competitive advantage in the market.

- Environmental responsibility matters.

Environmental Regulations and Reporting

Kyndryl must comply with environmental regulations impacting its facilities and operations. Transparency in environmental reporting is becoming crucial, with frameworks like SASB, TCFD, GRI, and CDP gaining prominence. This reflects a global trend where businesses face more scrutiny regarding their environmental impact. For example, the IT sector saw a 15% increase in ESG-related regulatory changes in 2024. The company's focus on sustainability is increasingly important to stakeholders.

- Kyndryl's operations are subject to environmental regulations.

- Reporting frameworks like SASB, TCFD, GRI, and CDP are relevant.

- ESG-related regulatory changes increased by 15% in 2024.

Environmental factors are crucial for Kyndryl, including increasing demand for sustainable IT, and Kyndryl’s eco-friendly solutions give a competitive edge. Kyndryl must comply with rising environmental regulations. Reporting frameworks like SASB, TCFD, GRI, and CDP are key.

| Factor | Details | Impact |

|---|---|---|

| Sustainability Demand | Growing 20% yearly (Gartner, 2024) | Increased Client & Investor Interest |

| E-waste | 62 million tons in 2022 | Responsible Asset Lifecycle Needed |

| Regulations | 15% ESG change in 2024 | Compliance & Reporting Emphasis |

PESTLE Analysis Data Sources

The Kyndryl Holdings PESTLE analysis is built using data from government reports, financial publications, and technology market analysis.