Kyoto Financial Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kyoto Financial Group Bundle

What is included in the product

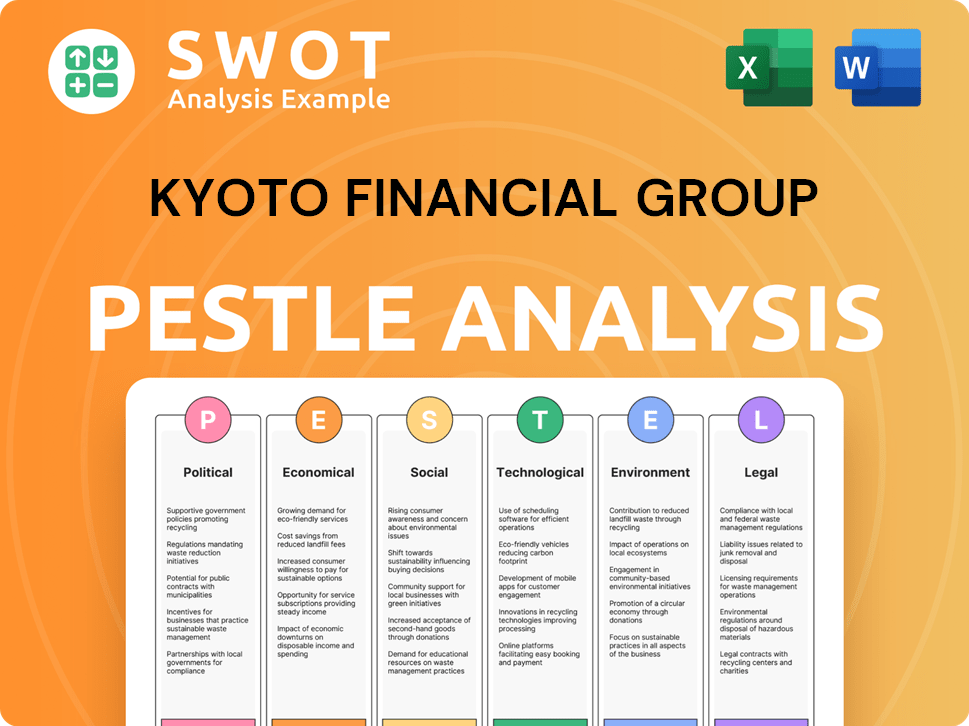

Unveils Kyoto Financial Group's environment via Political, Economic, Social, Tech, Environmental & Legal factors.

A succinct Kyoto Financial Group analysis format facilitates quick risk identification during team brainstorming sessions.

What You See Is What You Get

Kyoto Financial Group PESTLE Analysis

What you see is what you'll get! This preview showcases the comprehensive Kyoto Financial Group PESTLE Analysis you'll receive. It details Political, Economic, Social, Technological, Legal, and Environmental factors. All information is expertly formatted. The full document will be ready for immediate download upon purchase.

PESTLE Analysis Template

Navigate the complexities impacting Kyoto Financial Group. Our PESTLE analysis unveils key Political factors influencing operations. Economic trends, from interest rates to inflation, are dissected for actionable insights. Understand technological disruptions shaping the future and the evolving social landscape. Discover legal and environmental pressures affecting Kyoto Financial Group’s strategy. Equip yourself with the knowledge to thrive. Get the full report now!

Political factors

Japan's political stability, primarily under the LDP, offers a predictable environment for Kyoto Financial Group. Government policies, like fiscal stimulus, directly affect the banking sector; for instance, in 2024, Japan's fiscal deficit was around 6.2% of GDP. Changes in policy or leadership can introduce volatility, potentially impacting financial regulations.

Kyoto Financial Group navigates Japan's stringent financial regulations overseen by the Financial Services Agency (FSA). The FSA's emphasis on compliance and transparency, including regular audits, significantly impacts operational costs. The FSA's consideration of mandating greenhouse gas emission disclosures reflects the evolving regulatory environment. In 2024, Japan's FSA increased scrutiny on financial institutions' climate risk management. This includes stress tests and enhanced reporting requirements.

Japan's active role in trade agreements like the CPTPP bolsters market access for financial services. This opens new avenues for Kyoto Financial Group's expansion. Japan's ties with key economic players and regional groups shape the financial landscape. In 2024, Japan's trade surplus reached ¥3.69 trillion, showing its global economic influence.

Corporate Governance Reforms

Kyoto Financial Group faces pressure to improve corporate governance. Authorities and investors in Japan want financial institutions to cut cross-shareholdings. These holdings may hinder good governance practices. Kyoto Financial Group is reviewing and may reduce these stakes. This is driven by investor demands and regulatory guidance.

- Japan's Financial Services Agency (FSA) is actively promoting corporate governance reforms.

- In 2024, the average return on equity (ROE) for Japanese banks was around 7%.

- Kyoto Financial Group's market capitalization as of late 2024 was approximately $10 billion.

Political Influence on Economic Strategy

Political decisions significantly shape economic strategies. Government policies can address labor shortages or promote specific industries, impacting financial services. For instance, in 2024, Japan's government aimed to boost regional economies. This affected banks like Kyoto Financial Group.

- Government policies directly influence the financial sector.

- Regional development initiatives impact local banks.

- Labor market adjustments affect financial service demand.

- Political agendas can create new opportunities.

Kyoto Financial Group is influenced by political stability and shifts. The fiscal environment, affected by government stimulus, can significantly impact financial performance. Japan’s focus on regional economic development, as seen in 2024, directly influences banking strategies.

| Political Aspect | Impact on KFG | 2024/2025 Data Point |

|---|---|---|

| Government Policies | Directly affects financial operations. | Fiscal deficit approx. 6.2% of GDP in 2024. |

| Regulatory Framework | Influences compliance costs. | FSA increased scrutiny on climate risk management. |

| Trade Agreements | Expands market access. | Japan's trade surplus reached ¥3.69 trillion in 2024. |

Economic factors

Japan's low-interest-rate environment continues to pressure banks. This impacts profitability, including Kyoto Financial Group's. The Bank of Japan's (BOJ) ongoing monetary policy normalization discussions are key. Any rate increases will affect net interest income significantly. In 2024, Japan's base interest rate is still around 0-0.1%.

Kyoto Financial Group's success is heavily influenced by Kyoto's regional economy. Local GDP growth, business activity, and consumer spending directly impact financial service demand. The Kyoto area's economic recovery, which may have trailed other major cities, is a critical factor. Recent data indicates that Kyoto's GDP growth for 2024 is projected at 1.8%, below the national average. This slower growth potentially affects loan demand and investment opportunities.

Japan's economy anticipates around 2% inflation. This impacts asset values and lending. Inflation affects economic stability, crucial for finance. For example, in 2024, consumer prices rose, influencing investment strategies.

Wage Growth and Consumer Spending

Wage growth is a key economic factor influencing consumer spending, directly impacting Kyoto Financial Group. Rising real wages often boost consumer confidence and spending, fueling economic growth and demand for financial services. The latest data indicates a fluctuating trend; for instance, U.S. average hourly earnings rose by 4.1% year-over-year in December 2023, but growth has since moderated. This wage growth influences private consumption, crucial for the firm.

- December 2023: U.S. average hourly earnings rose 4.1% year-over-year.

- Wage growth directly impacts consumer spending and economic activity.

- Kyoto Financial Group's performance is influenced by this trend.

Investment Trends and Capital Flows

Investment trends and capital flows significantly influence financial markets and demand for financial services. In 2024, foreign direct investment (FDI) into Japan increased by 6.2% year-over-year, reaching $28 billion, indicating growing investor confidence. Government policies, such as tax incentives for green energy projects, are attracting investment in specific sectors, creating opportunities for financial institutions like Kyoto Financial Group. These shifts require strategic adaptation.

- FDI into Japan: $28B (2024)

- YoY growth in FDI: 6.2% (2024)

- Government incentives drive investment.

Kyoto Financial Group faces challenges due to low Japanese interest rates, approximately 0-0.1% in 2024. Regional economic growth, especially in Kyoto (1.8% GDP growth projected in 2024), influences demand. Inflation around 2% and fluctuating wage growth, like a 4.1% rise in US earnings in December 2023, are also key.

| Economic Factor | Impact | 2024 Data |

|---|---|---|

| Interest Rates | Profitability & Lending | Japan: 0-0.1% |

| GDP Growth (Kyoto) | Loan Demand, Investments | 1.8% (Projected) |

| Inflation | Asset Values & Lending | Approx. 2% |

Sociological factors

Japan's aging population and decline pose challenges. The population decreased by 800,000 in 2023. This shrinking workforce reduces the consumer base. Consequently, there are structural shifts in regional economies. These shifts significantly influence demand for financial services.

Societal shifts, like digital adoption, impact customer banking habits and product needs. Kyoto Financial Group must adapt to these trends to stay relevant. In 2024, digital banking users grew by 15% globally. Consumer preferences are leaning towards personalized financial solutions.

Kyoto Financial Group (KFG) prioritizes regional prosperity. KFG's strategy centers on local business support and regional development. This approach is crucial for its social license. Recent data shows a 2.5% increase in SME loans in the Kyoto region, demonstrating KFG's impact. Community well-being directly influences KFG's long-term success.

Workforce Dynamics and Labor Shortages

Kyoto Financial Group faces workforce challenges due to Japan's aging population and declining birth rates. This demographic shift intensifies labor shortages across industries, including finance. The firm must compete for talent, potentially increasing labor costs and impacting operational efficiency. These trends require strategic workforce planning.

- Japan's population decreased by 837,000 in 2023, the largest drop on record.

- The labor force participation rate for those aged 65+ is rising but not enough to offset shortages.

- Financial institutions are implementing strategies like remote work and automation to mitigate labor gaps.

Social Responsibility and Sustainability Expectations

Kyoto Financial Group faces heightened expectations for social responsibility and sustainability. Consumers increasingly favor businesses committed to ethical practices and environmental stewardship. This shift impacts the company's reputation and stakeholder relationships, especially concerning investments in sustainable projects.

- In 2024, sustainable investing reached $40.5 trillion globally.

- Over 70% of consumers prefer sustainable brands.

Japan's declining population and an aging workforce necessitate workforce planning adjustments at Kyoto Financial Group. In 2024, labor shortages persisted. Financial institutions strategically adopted remote work and automation. Societal demands, with digital banking and ESG trends, compel Kyoto Financial Group's response to maintain competitiveness.

| Factor | Impact | Data |

|---|---|---|

| Demographics | Labor shortages | 837K population drop in 2023 |

| Digital Adoption | Changing consumer behavior | Digital banking users grew 15% in 2024 |

| Sustainability | Reputational & investment changes | $40.5T sustainable investments (2024) |

Technological factors

Kyoto Financial Group faces a rapidly evolving technological landscape. Digital transformation, including online banking and mobile payments, is crucial. In 2024, mobile banking users increased by 15%. Investment in technology is vital for customer experience and operational efficiency.

Kyoto Financial Group (KFG) must adapt to AI and blockchain. AI can automate tasks and improve fraud detection. Blockchain enables secure, transparent transactions, potentially including XRP for remittances. In 2024, global blockchain spending reached $19.6 billion, showing growth. KFG's tech investments are crucial to stay competitive.

Cybersecurity and data protection are paramount for Kyoto Financial Group, given its reliance on digital platforms. In 2024, global cybercrime costs reached $9.2 trillion, highlighting the need for robust security investments. Financial institutions face increasing threats; thus, data breaches can lead to significant financial and reputational damage. Kyoto Financial Group must prioritize these measures to maintain customer trust.

Development of Fintech Ecosystem

The fintech landscape in Japan is rapidly evolving, presenting both opportunities and risks for Kyoto Financial Group. The emergence of new fintech companies offering digital payment solutions, AI-driven investment platforms, and blockchain-based services is reshaping the financial services industry. According to a recent report, the Japanese fintech market is projected to reach $2.5 billion by the end of 2024. This growth necessitates strategic decisions regarding partnerships or direct competition with fintech firms.

- Fintech market in Japan: $2.5 billion in 2024.

- Focus on digital payments and AI investment platforms.

- Strategic choices: Collaborate or compete.

Technological Infrastructure and Innovation Adoption Rate

Technological advancements and adoption rates are key for Kyoto Financial Group. The region's tech infrastructure and how quickly people embrace new tech directly affect the success of their digital projects and demand for tech-based financial services. According to recent data, the adoption rate of mobile banking in Japan, including the Kyoto area, reached 70% by late 2024. This shows a strong market for digital financial products. The group must stay ahead of tech trends to meet evolving customer needs.

- Mobile banking adoption in Japan reached 70% by late 2024.

- Kyoto's tech infrastructure is vital for digital service success.

- Staying current with tech trends is essential.

Kyoto Financial Group (KFG) should monitor technology advancements closely. Digital payments, AI, and blockchain require significant investment. Cybersecurity is crucial, given $9.2 trillion global cybercrime costs in 2024.

| Technology Factor | Impact on KFG | 2024 Data/Trend |

|---|---|---|

| Mobile Banking | Enhance customer experience & Efficiency | 15% increase in users |

| AI & Blockchain | Automate tasks, Secure transactions | Blockchain spending: $19.6B |

| Cybersecurity | Protect data and Trust | Cybercrime costs: $9.2T |

Legal factors

Kyoto Financial Group strictly adheres to the Banking Act and financial regulations overseen by Japan's FSA. These regulations dictate licensing, capital adequacy, and lending standards. In 2024, the FSA increased scrutiny on financial institutions' risk management. The group's compliance efforts directly impact its operational scope and risk profile. Maintaining regulatory compliance is crucial for its continued operations.

Amendments to financial laws, like the Payment Services Act and Banking Act, shape Kyoto Financial Group's operations. Recent changes in electronic payment services and stablecoins directly affect its strategies. For instance, the 2024 revisions to the Banking Act introduced new compliance standards. These updates influence how Kyoto Financial Group manages risk and innovation. The legal environment evolves, requiring continuous adaptation.

Kyoto Financial Group must adhere to stringent corporate governance regulations. The Tokyo Stock Exchange sets guidelines influencing management and shareholder relations. Recent data indicates a focus on reducing cross-shareholdings. These regulations are part of the revised Corporate Governance Code, impacting the group's strategic decisions.

Data Privacy and Security Laws

Kyoto Financial Group must adhere to Japan's stringent data privacy and security laws, which dictate the handling of customer information. Failure to comply can lead to significant legal repercussions and reputational damage. In 2024, the Financial Services Agency (FSA) increased scrutiny on data protection practices within financial institutions. This heightened focus reflects a global trend towards stronger data privacy regulations.

- The FSA reported a 20% increase in data breach investigations in 2024.

- Penalties for non-compliance can include substantial fines and operational restrictions.

- Customer trust is directly linked to data security, influencing market share.

International Financial Regulations and Standards

Kyoto Financial Group, though regional, navigates international financial regulations. These include capital adequacy rules like Basel III. Risk management practices must align with global standards. Anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, such as those from the Financial Action Task Force (FATF), are also crucial.

- Basel III implementation is ongoing globally, with final adjustments expected by 2025.

- FATF continues to update its recommendations; the latest updates were in 2024.

- AML compliance costs for financial institutions have increased by approximately 10-15% annually.

- The Japanese Financial Services Agency (JFSA) actively monitors these regulations.

Kyoto Financial Group complies with Japan's financial laws, including the Banking Act and payment services regulations. In 2024, the FSA intensified its focus on financial institutions' risk management and data protection.

Compliance costs related to regulations are a significant factor, increasing by approximately 10-15% annually.

The firm also navigates international standards like Basel III and AML/CTF requirements, facing continuous adaptation due to evolving regulatory landscapes, especially from updates like those in 2024.

| Regulation Area | Regulatory Body | 2024 Focus |

|---|---|---|

| Data Privacy | FSA | Increased Scrutiny & 20% Rise in Breach Investigations |

| AML/CTF | FATF | Continuous Updates & Compliance Requirements |

| Basel III | Global Standards | Ongoing implementation; final adjustments by 2025 |

Environmental factors

Kyoto Financial Group faces climate change risks, including physical threats like increased natural disasters and transition risks from policy changes. The group acknowledges these challenges. In 2024, global insured losses from natural disasters reached $118 billion. They also see opportunities in financing sustainable projects. Kyoto Financial Group aims to support customers in transitioning to a greener economy, aligning with global sustainability goals.

Environmental regulations are increasing, with potential mandates for disclosing greenhouse gas emissions and nature-related financial risks. This pushes financial institutions to be more transparent. For example, the EU's Corporate Sustainability Reporting Directive (CSRD) requires detailed environmental disclosures. In 2024, the global sustainable finance market reached over $40 trillion, reflecting this shift.

The global shift toward sustainable finance and ESG investing is accelerating. Kyoto Financial Group's green bonds and ESG-linked loans appeal to environmentally conscious investors. In 2024, ESG assets reached $40 trillion globally, reflecting strong investor interest. This approach can boost the firm's reputation and attract clients.

Impact of Natural Disasters

Japan's vulnerability to natural disasters, such as earthquakes and typhoons, poses significant risks to Kyoto Financial Group. Climate change could worsen these events, potentially leading to more frequent and severe disruptions. These disasters can halt business activities, decrease asset values, and elevate credit risks for both the bank and its clients. The economic impact of natural disasters in Japan reached $300 billion in 2024, according to the World Bank.

- Earthquakes and tsunamis are a major concern.

- Climate change may increase the intensity of typhoons.

- Disruptions can affect loan repayments.

- Insurance payouts could strain the bank’s resources.

Initiatives for Environmental Preservation

Kyoto Financial Group prioritizes environmental preservation, recognizing it as a key concern. They are actively working to lessen their environmental footprint. The group measures greenhouse gas emissions. Also, it incorporates environmental policies into its investments and loans.

- In 2024, the financial sector saw a rise in sustainable finance, with green bond issuances increasing.

- Kyoto Financial Group's efforts align with global trends towards sustainable investing.

- Their actions can lead to a stronger reputation and better financial performance.

Kyoto Financial Group faces climate risks, including natural disasters and policy changes. The group acknowledges climate change's impact. Japan’s economic losses from natural disasters totaled $300B in 2024. They aim to finance sustainable projects amid increasing environmental regulations.

| Environmental Aspect | Impact on KFG | 2024/2025 Data/Facts |

|---|---|---|

| Climate Change | Increased risks from natural disasters, transition risks | Global insured losses: $118B (2024), Japan disaster impact: $300B (2024) |

| Environmental Regulations | Increased need for transparency; potential for higher compliance costs | Global sustainable finance market: $40T (2024), ESG assets $40T (2024) |

| Sustainable Finance Trends | Opportunities for green bonds and ESG investments | Green bond issuance rising in 2024/2025, attracting eco-conscious investors. |

PESTLE Analysis Data Sources

Our PESTLE analysis uses data from governmental reports, economic indicators, and financial market research.