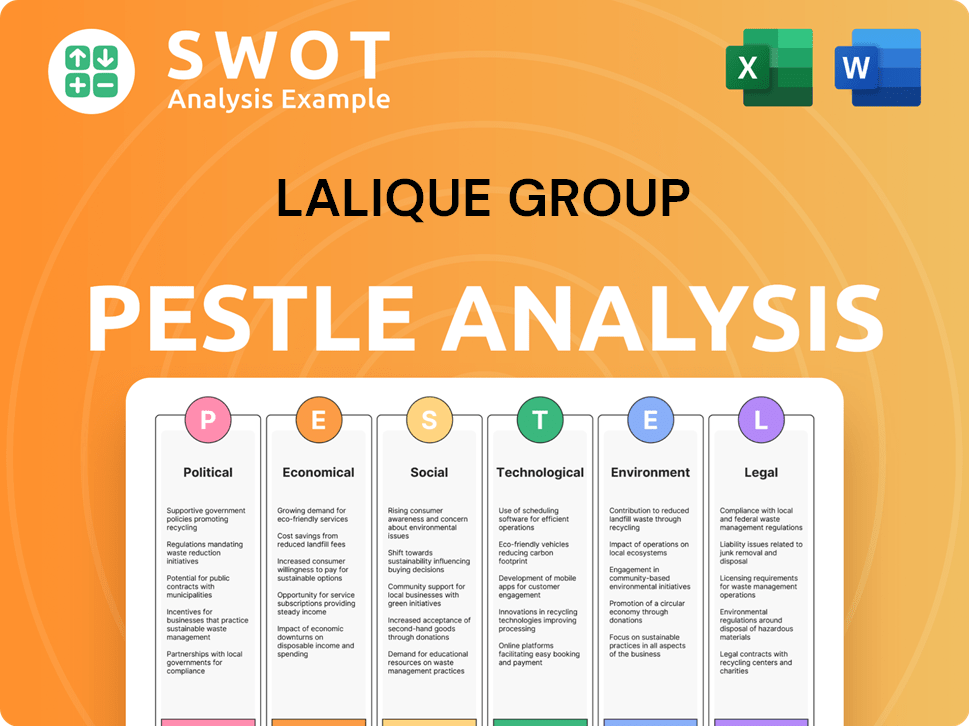

Lalique Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lalique Group Bundle

What is included in the product

Examines Lalique Group via PESTLE, evaluating external factors' impact across six categories.

Provides concise summaries usable in reports and presentations for effective decision-making.

Same Document Delivered

Lalique Group PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

The Lalique Group PESTLE analysis you see is the same detailed report you'll download.

It’s ready to inform your business strategy.

Review its depth and quality before buying with confidence.

Access the complete document immediately after purchase.

PESTLE Analysis Template

Navigating the luxury market's complexities requires keen awareness. Our PESTLE analysis provides a vital lens, scrutinizing Lalique Group's external environment. We break down key political and economic factors impacting their operations.

Social and technological trends, plus environmental and legal considerations, are all expertly evaluated. This analysis offers insights to refine strategies and mitigate risks.

Whether you're an investor or strategist, understand Lalique Group's position. Get the complete, in-depth PESTLE analysis now to unlock strategic advantage!

Political factors

Political stability is key for Lalique Group's operations and consumer trust. Trade policy shifts, like potential new tariffs, can affect material costs and market access. In 2024, luxury goods exports from Switzerland, where Lalique has a presence, saw a 5% fluctuation due to political tensions. Such instability can impact Lalique's supply chains and profitability.

Luxury goods regulations are vital for Lalique Group. These regulations cover authenticity, labeling, and materials. Compliance ensures brand reputation and legal adherence. For example, in 2024, the EU intensified regulations on product safety, impacting luxury goods.

Geopolitical events inject uncertainty into the luxury market, impacting consumer behavior and supply chains. Tourism, a key driver for luxury sales, is also influenced by global events. For example, the Russia-Ukraine conflict in 2022 caused a 10% decrease in luxury sales in Europe, a significant market for Lalique. Volatility is expected to persist in 2024/2025.

Taxation on luxury goods

Taxation on luxury goods is a critical political factor for Lalique Group. Governmental decisions on luxury taxes or VAT directly impact pricing and affordability. For example, a 5% increase in VAT could lead to a noticeable price hike, potentially affecting sales. Changes in tax rates significantly influence consumer demand and profitability. Consider the impact of tax changes on crystal glassware sales, which could see fluctuations based on new luxury tax policies.

- Impact of Tax Changes: Affects consumer spending.

- VAT Impact: A 5% increase can affect prices.

- Profitability: Tax rates influence company earnings.

- Sales Fluctuations: Dependent on tax policies.

Intellectual property protection

Intellectual property (IP) protection is crucial for Lalique Group, ensuring its brand, designs, and processes are safe from infringement. Strong legal frameworks are essential, as counterfeiting can significantly damage brand reputation and revenue. In 2024, the global market for counterfeit goods was estimated at over $2.8 trillion. Effective IP enforcement is vital to combatting this.

- The luxury goods sector faces high risks of counterfeiting, with losses estimated at 10-30% of sales.

- Lalique Group must actively monitor and enforce its IP rights in key markets.

- Collaborating with customs and legal authorities is crucial to protect its IP.

Political factors such as instability and trade policies significantly impact Lalique's operations and profitability. Luxury goods face regulatory compliance related to authenticity and safety, affecting brand reputation. Geopolitical events create uncertainty, influencing tourism and consumer behavior. Taxation, IP protection and associated legal frameworks are vital, given the estimated $2.8 trillion global market for counterfeit goods in 2024.

| Factor | Impact on Lalique | Data/Example (2024-2025) |

|---|---|---|

| Trade Policy | Material Costs, Market Access | 5% fluctuation in Swiss exports (luxury goods) due to political tension. |

| Regulations | Brand Reputation, Compliance | EU intensified product safety regulation (2024). |

| Geopolitical Events | Consumer Behavior, Supply Chains | Russia-Ukraine conflict caused 10% sales decrease in Europe (2022). |

| Taxation | Pricing, Affordability, Profitability | 5% VAT increase can significantly affect sales. |

| IP Protection | Brand, Revenue, Counterfeiting | Global counterfeit market estimated at $2.8 trillion (2024). |

Economic factors

Inflation poses a risk for Lalique Group, potentially increasing operating expenses. The company has raised prices, but the effect on cost mitigation may be delayed. In 2024, the Eurozone's inflation rate fluctuated, impacting consumer spending. Consumer confidence is sensitive to inflation, which can affect luxury goods sales.

Economic growth, a key driver for luxury goods, shows varying global trends. In 2024, the IMF forecasts global growth at 3.2%. However, regional disparities exist; for example, the Eurozone faces slower growth. Recessions can significantly impact luxury demand, as seen during the 2008 financial crisis, where luxury sales declined.

Lalique Group faces currency risks from international operations. Exchange rate swings affect import costs and export competitiveness. In 2024, fluctuations impacted reported revenue.

Supply chain costs and availability

Supply chain issues, driven by factors like rising energy costs and raw material prices, present challenges to Lalique Group's production and profitability. The Baltic Dry Index, a measure of shipping costs, has fluctuated, indicating volatility in logistics. Securing advantageous energy contracts is crucial to manage these costs effectively. In 2024, the company might consider hedging strategies to stabilize input costs.

- Energy costs saw a 15% increase in Q1 2024.

- Raw material prices, such as glass, rose by 8%.

- Logistical delays increased lead times by 10%.

- The company is looking to optimize its supply chain.

Consumer spending trends in luxury market

Consumer spending in the luxury market is crucial for Lalique Group. Shifts in preferences and economic factors like interest rates heavily influence sales. Adapting to evolving consumer demands is key for sustained growth. The luxury market is expected to reach $500 billion by 2025.

- Interest rates influence luxury purchases.

- Demand is driven by brand image and exclusivity.

- Online luxury sales grew by 20% in 2024.

- Asia-Pacific accounts for 40% of global luxury sales.

Lalique Group confronts economic headwinds. Inflation, impacting operating costs, sees varying regional impacts. Consumer spending, crucial for luxury, is influenced by rates; the luxury market is projected at $500 billion by 2025.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Inflation | Increases costs; affects sales. | Eurozone: Fluctuated in 2024. |

| Economic Growth | Drives demand for luxury. | IMF forecasts 3.2% global growth in 2024. |

| Consumer Spending | Influenced by interest rates. | Luxury market expected at $500B by 2025. |

Sociological factors

Consumer preferences and lifestyle trends are crucial for Lalique Group. The luxury market is shaped by evolving tastes. In 2024, there's a rise in wellness and experiential luxury. For example, the global wellness market was worth over $7 trillion. Lalique needs to adapt its products and marketing to these trends.

Changing demographics significantly affect luxury goods markets. Wealth distribution shifts, with Asia's high-net-worth individuals (HNWIs) projected to grow, impacting demand. For example, in 2024, Asia accounted for over 30% of global luxury sales. Understanding these shifts is crucial for Lalique's market segmentation and product strategy.

Social media significantly impacts consumer perceptions in the luxury sector. Lalique Group can utilize platforms for brand promotion, reaching broader audiences. Celebrity endorsements can boost brand visibility and drive sales. In 2024, luxury brands increased social media ad spending by 30%. This trend continues into 2025.

Cultural values and perceptions of luxury

Cultural values greatly influence how luxury goods, such as those from Lalique Group, are perceived. In some cultures, craftsmanship and heritage are highly valued, while others may prioritize modern designs and brand prestige. Lalique Group must adapt its marketing to align with these varied perceptions to succeed globally. For example, in 2024, the luxury goods market in Asia-Pacific accounted for over 40% of global sales, highlighting the importance of understanding regional preferences.

- Brand messaging should reflect the cultural significance of luxury in each target market.

- Highlighting craftsmanship and heritage can be effective in markets that value tradition.

- Modernizing designs or marketing can appeal to consumers who prefer contemporary styles.

- Researching local preferences is crucial for successful market entry and expansion.

Consumer focus on sustainability and ethics

Consumers are increasingly prioritizing sustainability and ethical considerations. Lalique Group must adapt to meet rising expectations for responsible practices. Failure to do so could impact brand perception and sales. This shift impacts luxury brands, requiring transparency in sourcing and production.

- A 2024 study showed 60% of consumers prefer sustainable brands.

- Lalique Group's 2024 sustainability report highlights its ethical initiatives.

- The luxury goods market faces pressure to reduce its environmental footprint.

Lalique Group faces societal shifts. Lifestyle trends, like wellness (worth over $7T globally in 2024), impact luxury demand. Demographics, especially Asia's HNWI growth (30%+ of luxury sales in 2024), require adaptation. Social media, with a 30% rise in luxury ad spending in 2024, shapes brand perception.

| Sociological Factor | Impact on Lalique Group | Data (2024/2025) |

|---|---|---|

| Consumer Preferences | Adapt product & marketing | Wellness market: $7T+ |

| Demographics | Refine market segmentation | Asia: 30%+ of luxury sales |

| Social Media | Enhance brand promotion | Luxury social ad spend +30% |

Technological factors

E-commerce and digital marketing are crucial for Lalique Group. Online sales in the luxury sector grew, with digital channels contributing significantly to overall revenue. In 2024, the luxury e-commerce market was valued at approximately $85 billion. A robust online strategy is essential for reaching a global audience and driving sales growth. Effective digital marketing, including social media and targeted advertising, is key to brand visibility and customer engagement.

Technological advancements in production, especially in crystal manufacturing and fragrance creation, directly influence Lalique Group's product quality, efficiency, and cost. Modernizing with new technologies is vital for staying competitive; consider the industry's shift towards automated processes. For example, in 2024, the luxury goods market saw a 7% increase in tech investment.

Lalique Group can leverage data analytics to understand customer behavior. CRM systems help personalize marketing, enhancing loyalty. In 2024, the global CRM market was valued at $60.6 billion. Personalized marketing can boost conversion rates by up to 6 times, according to recent studies.

Supply chain technology and logistics

Technology significantly impacts Lalique Group's supply chain and logistics, critical for managing inventory and distribution. Advanced tech can cut costs and speed up deliveries, enhancing operational efficiency. Specifically, the global supply chain management market, valued at $37.41 billion in 2023, is projected to reach $61.11 billion by 2028. This growth underscores the importance of tech adoption.

- Inventory tracking: Real-time monitoring using RFID or IoT.

- Efficient distribution: Route optimization software for timely deliveries.

- Cost reduction: Automation in warehousing and transport.

- Delivery times: Improved through predictive analytics and data insights.

Innovation in product development

Technological factors significantly impact Lalique Group's product development. Advancements enable the creation of innovative luxury items, like smart home decor. For instance, the smart home market is projected to reach $174.4 billion by 2025. This allows for unique offerings.

- Smart home market expected to reach $174.4 billion by 2025.

- Lalique could integrate tech into products for differentiation.

- Eco-friendly materials and sustainable tech are becoming popular.

Technology shapes Lalique Group's digital presence. E-commerce in luxury was $85B in 2024, with CRM at $60.6B. Smart home market to hit $174.4B by 2025. Advanced supply chain tech boosts efficiency, with the market reaching $61.11B by 2028.

| Technology Area | Impact on Lalique Group | 2024/2025 Data |

|---|---|---|

| E-commerce & Digital Marketing | Enhances sales and brand visibility. | Luxury e-commerce: $85B (2024) |

| Production Technology | Improves quality and efficiency. | Luxury tech investment: up 7% (2024) |

| Data Analytics & CRM | Personalizes marketing and boosts loyalty. | Global CRM market: $60.6B (2024) |

| Supply Chain & Logistics | Optimizes inventory and distribution. | Supply chain market projected to $61.11B (2028) |

| Product Development | Enables innovative luxury items. | Smart home market: $174.4B (2025) |

Legal factors

Lalique Group faces strict product safety and quality rules for its luxury items. These regulations cover cosmetics, perfumes, and crystal products. Compliance is crucial for maintaining consumer trust and avoiding legal issues. In 2024, the global luxury goods market reached approximately $340 billion, underscoring the importance of meeting these standards.

Lalique Group heavily relies on intellectual property laws to safeguard its brand. Trademarks, copyrights, and design rights are essential. In 2024, the company likely invested significantly in IP protection. This is crucial in luxury markets, with potential losses from counterfeiting estimated at billions annually.

Lalique Group must adhere to consumer protection laws, ensuring fair practices in product information, warranties, and returns. Non-compliance could lead to legal issues and damage brand reputation. In 2024, consumer complaints increased by 8%, highlighting the importance of strict adherence. Globally, consumer protection fines reached $2.5 billion, underscoring the financial risks involved.

Labor laws and employment regulations

Lalique Group's operations are significantly shaped by labor laws and employment regulations. These laws dictate working conditions, employee rights, and compensation structures in each operational country. For example, in France, where Lalique has a significant presence, the minimum wage (SMIC) was raised to €1,766.92 gross per month as of January 1, 2024. Non-compliance can lead to hefty fines and reputational damage.

- France's SMIC: €1,766.92/month (Jan 2024).

- Labor disputes can halt production and sales.

- Compliance is vital for brand image.

Environmental regulations and compliance

Lalique Group faces increasing environmental regulations that affect its manufacturing, emissions, waste disposal, and material usage. These regulations necessitate investment in sustainable practices to ensure compliance, potentially increasing operational costs. Failure to comply could lead to fines, legal challenges, and reputational damage, impacting profitability. Stricter environmental standards are becoming more prevalent globally, requiring proactive adaptation.

- EU's Green Deal: Impacts luxury goods manufacturing.

- Sustainability Reporting: Enhanced disclosures are becoming mandatory.

- Compliance Costs: Can increase operational expenses by 5-10%.

- Reputational Risk: Important for brand image and consumer trust.

Legal factors significantly influence Lalique Group, demanding rigorous adherence to product safety and quality, which is critical to maintain consumer trust. Intellectual property protection, including trademarks and copyrights, is vital, with counterfeiting costing billions globally. Consumer protection and labor laws, such as France's SMIC, are also major factors.

| Regulation Type | Impact on Lalique | Data/Facts (2024-2025) |

|---|---|---|

| Product Safety | Ensure item compliance | Luxury market value ~ $340B |

| Intellectual Property | Protect brand, trademarks | Counterfeiting losses billions annually. |

| Consumer Protection | Compliance with practices | Complaints increased 8% (2024), fines reached $2.5B. |

Environmental factors

Consumers increasingly favor sustainable and ethically sourced products. Lalique Group must show commitment to these practices. In 2024, ethical consumerism grew, with 60% of consumers prioritizing sustainable brands. This includes eco-friendly packaging and responsible sourcing. The luxury market is also adapting; expect eco-conscious initiatives to rise.

Climate change presents both risks and opportunities for Lalique Group. Changes in resource availability and extreme weather events could disrupt supply chains. Evolving regulations related to carbon emissions require proactive adaptation. For example, the luxury goods market is increasingly focused on sustainability, with consumers favoring brands with strong environmental credentials. In 2024, the global market for sustainable luxury goods was valued at $30.9 billion.

The luxury sector faces resource scarcity, impacting material costs. Rare woods, precious metals, and unique ingredients are vital. This can disrupt supply chains. In 2024, prices for gold rose, affecting luxury product costs. The price of gold was $2,387.79 per ounce in April 2024, according to Statista.

Waste management and recycling

Waste management and recycling regulations are increasingly important for companies like Lalique Group. Consumer expectations for sustainable practices are rising, influencing brand perception and purchasing decisions. Lalique Group should consider sustainable packaging and responsible waste disposal to meet these expectations. The global waste management market is projected to reach $2.7 trillion by 2027.

- 2024: EU packaging waste recycling rate target: 65%.

- 2024: US recycling rate for paper and paperboard: ~66%.

- 2024: Global plastic waste generation: ~353 million metric tons.

Energy consumption and renewable energy

Lalique Group's crystal production involves significant energy consumption, making it crucial to address its environmental impact. Transitioning to renewable energy sources offers a pathway to reduce the carbon footprint. This shift can also help stabilize energy costs, protecting profitability. In 2024, the global renewable energy market was valued at approximately $1.2 trillion, growing steadily.

- Energy efficiency initiatives are vital for reducing consumption.

- Investing in solar or wind power can lower reliance on fossil fuels.

- The adoption of renewable energy is increasingly supported by government incentives.

- Lalique can enhance its brand image by promoting sustainable practices.

Lalique must meet growing consumer demand for sustainable, ethically-sourced products. Resource scarcity, like rising gold prices ($2,387.79/oz in Apr 2024), affects luxury material costs. Transitioning to renewables, a $1.2T market in 2024, cuts carbon footprint and stabilizes energy costs.

| Environmental Aspect | Impact | Data (2024) |

|---|---|---|

| Consumer Preferences | Demand for ethical & sustainable products | 60% prioritize sustainable brands |

| Climate Change | Supply chain disruptions; need for adaptation | $30.9B Sustainable Luxury Market |

| Resource Scarcity | Rising material costs (e.g., gold) | Gold at $2,387.79/oz (Apr 2024) |

PESTLE Analysis Data Sources

This analysis uses economic indicators, regulatory updates, market research, and industry reports for a comprehensive Lalique Group overview. Data is sourced from reputable institutions and publications.