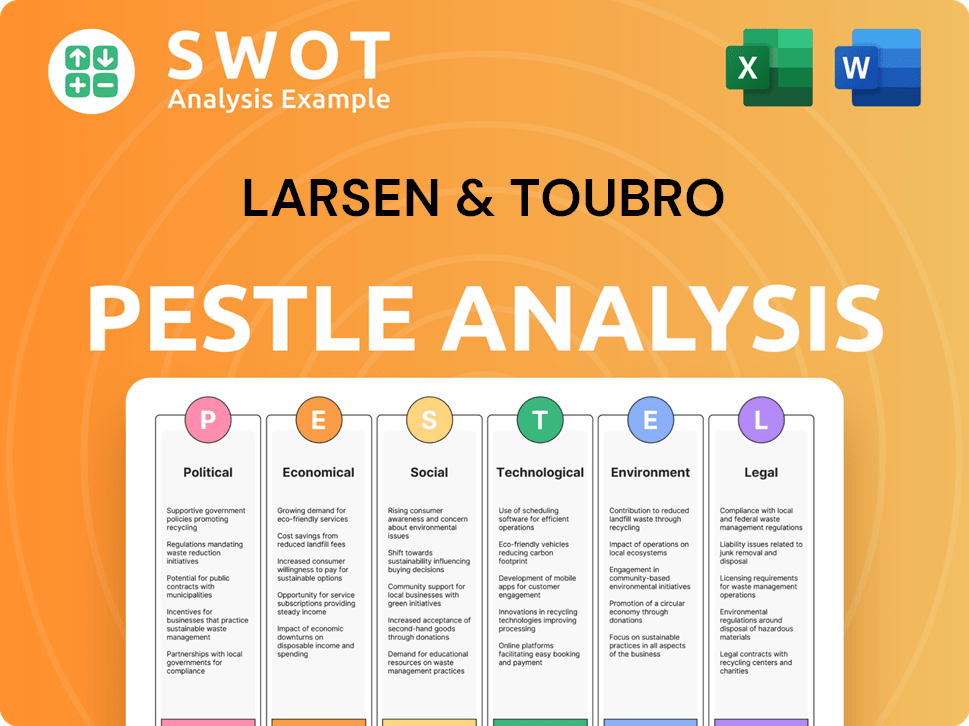

Larsen & Toubro PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Larsen & Toubro Bundle

What is included in the product

Evaluates external factors affecting Larsen & Toubro across Political, Economic, Social, Technological, Environmental, and Legal aspects.

Supports in-depth exploration by making complex industry data digestible and collaborative for team discussion.

What You See Is What You Get

Larsen & Toubro PESTLE Analysis

The preview presents Larsen & Toubro's PESTLE Analysis in its entirety.

What you see now is exactly what you’ll receive post-purchase.

This is the final document, professionally structured and ready for your use.

Download it immediately after payment—no hidden parts or changes!

Consider this the final product—no revisions necessary.

PESTLE Analysis Template

Explore Larsen & Toubro's strategic environment! Our PESTLE Analysis uncovers the external factors impacting their business.

We delve into political, economic, social, technological, legal, and environmental forces.

Understand challenges & opportunities in the infrastructure, energy, and technology sectors.

This analysis aids strategic planning, risk assessment, and investment decisions.

Get actionable insights for improved market positioning & decision-making.

Download the full analysis to gain a competitive edge today!

Political factors

The Indian government's strong emphasis on infrastructure development, backed by considerable budgetary allocations, presents significant opportunities for Larsen & Toubro (L&T). With the National Infrastructure Pipeline (NIP) outlining investments, L&T can bid for large-scale projects. The Union Budget 2024-2025 allocated ₹11.11 lakh crore for infrastructure, boosting growth prospects.

India's political stability supports business expansion. Policy consistency in infrastructure and manufacturing provides predictability for Larsen & Toubro. The government's 'Viksit Bharat' plan by 2047 highlights ongoing infrastructure investment. The Indian government allocated $11.8 billion for infrastructure development in the 2024-2025 budget. This indicates a strong commitment to long-term projects.

India's trade agreements, like the one with the UAE, are crucial for L&T's global expansion. These pacts reduce trade barriers and boost project opportunities abroad. For instance, the India-UAE CEPA in 2022 aimed to increase bilateral trade to $100 billion by 2030. Such deals help L&T secure contracts and grow internationally. In 2024, L&T's international revenue was a significant part of their total income.

'AtmaNirbhar Bharat' initiative

The 'AtmaNirbhar Bharat' initiative significantly influences Larsen & Toubro (L&T). This policy encourages local production, potentially boosting L&T's projects in defense and infrastructure. L&T, with its diverse portfolio, is well-placed to gain from increased domestic sourcing and manufacturing. This could lead to more contracts and growth opportunities within India. In 2024, the Indian government allocated ₹1.77 lakh crore for infrastructure development, supporting this initiative.

- Increased domestic procurement benefits L&T.

- Focus on self-reliance boosts local manufacturing.

- Government spending supports infrastructure projects.

- L&T's diversified business aligns with the initiative.

Geopolitical factors and international orders

Geopolitical instability affects L&T's global projects. The company secured significant orders from the Middle East. This includes renewables and power transmission projects. Recent reports show a strong order book, despite global uncertainties. L&T's international order prospects depend on these factors.

- Middle East orders are crucial for L&T.

- Renewables and power are key sectors.

- Global conflicts impact project execution.

- Strong order book mitigates risks.

Political factors heavily influence Larsen & Toubro (L&T). Government infrastructure spending, like the ₹11.11 lakh crore in the 2024-2025 budget, boosts L&T's project opportunities. Trade agreements such as the India-UAE CEPA expand global prospects. 'AtmaNirbhar Bharat' encourages domestic manufacturing, benefiting L&T.

| Factor | Impact | 2024 Data |

|---|---|---|

| Infrastructure Spending | Project opportunities | ₹11.11 lakh crore allocation |

| Trade Agreements | Global expansion | India-UAE CEPA |

| 'AtmaNirbhar Bharat' | Domestic manufacturing | ₹1.77 lakh crore for infrastructure |

Economic factors

India's GDP is projected to grow steadily in fiscal year 2024-25, potentially around 6.5-7%. This growth signals a robust economic environment. A thriving economy typically boosts demand for infrastructure and manufacturing. L&T, as a major player in these sectors, stands to benefit significantly from this positive trend. For the fiscal year 2023-24, L&T's revenue grew by 17%.

Increased capital expenditure is a key growth driver for Larsen & Toubro (L&T). Government infrastructure spending and renewed private sector investments in manufacturing boost L&T's order pipeline. In fiscal year 2024, L&T's order book reached ₹4.67 trillion. The company anticipates continued growth due to these investments.

Inflation and interest rates are critical for Larsen & Toubro. High inflation can increase project costs, while rising interest rates can make financing more expensive. In India, the Reserve Bank of India (RBI) aims to keep inflation within 2-6%. The current repo rate is 6.50% as of late 2024. Changes in these rates affect project viability.

Foreign exchange rates and international revenue

The Indian Rupee's stability, essential for Larsen & Toubro (L&T), is tied to India's economic health and global standing. Fluctuations in foreign exchange rates directly affect L&T's international earnings, given its significant foreign revenue. For instance, a stronger Rupee can diminish the value of overseas income when converted back. Therefore, L&T closely monitors currency movements to manage financial risk effectively.

- In 2024, the rupee's volatility against the dollar was around 1-3% quarterly.

- L&T's international revenue accounts for approximately 25-30% of total revenue.

- Currency hedging strategies are crucial for mitigating exchange rate risks.

- The Reserve Bank of India (RBI) closely manages the Rupee's value.

Access to financing and investment

Access to financing and investment is vital for Larsen & Toubro (L&T), especially given its involvement in large-scale infrastructure projects. The Indian government's National Infrastructure Pipeline (NIP) and similar initiatives aim to boost infrastructure spending, creating opportunities for companies like L&T. Increased private equity investments in infrastructure also offer additional capital sources. In Fiscal Year 2024, L&T's infrastructure segment saw a significant order inflow. This highlights the importance of robust financing options for project execution.

- National Infrastructure Pipeline: Projects worth $1.4 trillion.

- L&T Infrastructure Order Inflow (FY24): ₹2.6 lakh crore.

India's steady GDP growth, projected at 6.5-7% for FY24-25, fuels infrastructure demand, benefiting L&T.

Government spending and private investments are significantly increasing L&T's order pipeline, which reached ₹4.67 trillion in FY24.

Inflation and interest rate fluctuations impact L&T's project costs; RBI targets 2-6% inflation and a repo rate of 6.50% as of late 2024.

Rupee's volatility and its impact on international earnings need currency hedging; in 2024, it was about 1-3% quarterly.

Government initiatives such as the National Infrastructure Pipeline provide significant capital; L&T's infrastructure segment received a significant order inflow.

| Economic Factor | Impact on L&T | 2024-2025 Data/Facts |

|---|---|---|

| GDP Growth | Increased demand, project growth | Projected 6.5-7% growth FY24-25 |

| Capital Expenditure | Order Inflow & Growth | L&T Order Book ₹4.67 Trillion (FY24), ₹2.6 Lakh Crore Infrastructure order inflow (FY24) |

| Inflation & Interest Rates | Project Cost & Financing | RBI Inflation target 2-6%, Repo Rate 6.50% (late 2024) |

| Exchange Rate | Impact on earnings | Rupee volatility 1-3% quarterly in 2024; 25-30% int. Revenue |

| Financing | Project execution | NIP projects worth $1.4 trillion |

Sociological factors

Urbanization in India fuels infrastructure demand. L&T benefits from housing, transport, and utility projects. India's urban population grew to ~38% by 2024. This growth boosts L&T's construction and infrastructure prospects. Increased urban spending is expected in 2025.

India's focus on skill development is crucial, with initiatives like the Skill India Mission aiming to boost employability. L&T actively participates in these programs, essential for securing a skilled workforce. This benefits L&T's projects and fosters community development. In 2024, the Skill India Mission trained over 1.2 crore individuals. L&T's involvement aligns with this national priority.

Larsen & Toubro (L&T) actively engages in Corporate Social Responsibility (CSR). Their focus on societal well-being enhances their brand image. L&T's CSR includes education, healthcare, and skill development. In 2024, L&T spent ₹1,464 crore on CSR activities, reflecting their commitment.

Workplace inclusivity and employee well-being

Sociological factors significantly shape L&T's operational landscape. Growing demands for workplace inclusivity and employee well-being are crucial. L&T's progressive policies, such as paid menstrual leave, reflect these societal shifts. These initiatives enhance employee satisfaction and attract talent. In 2024, companies prioritizing well-being saw a 15% boost in employee retention.

- Employee well-being directly impacts productivity and company reputation.

- Inclusivity initiatives can lead to a more diverse and innovative workforce.

- Such policies align with global trends emphasizing social responsibility.

- L&T's actions support its brand image as a responsible employer.

Community engagement and social license to operate

Larsen & Toubro (L&T) recognizes the importance of community engagement and securing a social license to operate. This involves actively engaging with local communities near its project sites to address their concerns and needs. L&T invests in community development programs and supports underprivileged sections of society as part of its corporate social responsibility (CSR) initiatives. In fiscal year 2023-24, L&T's CSR spending was approximately ₹136.95 crore, focusing on education, healthcare, and skill development, reflecting its commitment to social well-being. These efforts help build trust and foster positive relationships, which are crucial for smooth project execution and maintaining a good reputation.

- CSR spending by L&T in FY23-24: ₹136.95 crore.

- Focus areas for CSR: Education, healthcare, and skill development.

- Objective: Build trust and foster positive relationships.

- Impact: Smooth project execution and a good reputation.

Employee well-being significantly boosts L&T's productivity. Inclusivity drives innovation, with a 15% retention boost noted. L&T's initiatives enhance brand reputation via societal engagement and progressive policies. CSR spend was ~₹1464 crore in 2024.

| Aspect | Details | Impact for L&T |

|---|---|---|

| Employee Well-being | Focus on programs, inclusivity, and well-being | Increased productivity, improved talent attraction, positive brand image |

| Inclusivity | Implementation of diverse workforce policies | Enhanced innovation, global alignment |

| CSR Initiatives | Spending in education, healthcare and skills dev. | Strengthened community relationships, project smoothness |

Technological factors

Larsen & Toubro (L&T) is actively integrating digital technologies, including AI, IoT, and automation, throughout its operations. This digital transformation is critical for enhancing efficiency and project management. In 2024, L&T invested ₹2,500 crore in digital initiatives, resulting in a 15% increase in project completion rates. The company aims to further digitize its processes by 2025, targeting a 20% reduction in operational costs.

Larsen & Toubro (L&T) heavily invests in R&D and innovation labs to stay ahead. This focus enables the development of new technologies. L&T's dedication to digital engineering aligns with Industry 4.0 trends. In FY24, L&T's R&D spending was approximately ₹1,900 crore, reflecting a commitment to technological advancement.

The surge in green energy technologies is reshaping industries worldwide. Larsen & Toubro (L&T) is strategically positioned with its focus on renewable projects, including solar and wind energy. In 2024, the renewable energy sector saw investments of over $350 billion globally, indicating strong growth. L&T's exploration of green hydrogen further aligns with this sustainable trajectory.

Technological advancements in construction and manufacturing

Technological advancements significantly impact Larsen & Toubro (L&T). Construction techniques like precast technologies boost project speed and efficiency. L&T's embrace of advanced machinery supports executing large-scale, complex projects. This enhances their competitive edge in the industry.

- L&T's construction segment revenue reached ₹68,069 crore in FY24, reflecting technological integration benefits.

- The company's focus on digital tools and automation has led to a 15% reduction in project completion times.

Cybersecurity and data privacy

Cybersecurity and data privacy are paramount for L&T due to its extensive digital footprint. L&T's reliance on digital technologies makes it vulnerable to cyber threats, necessitating robust protection of sensitive project and business data. The company must invest in advanced cybersecurity measures to safeguard its information assets. In 2024, global cybersecurity spending is projected to reach $215 billion.

- Cybersecurity incidents cost businesses an average of $4.45 million in 2023.

- Data breaches in India increased by 20% in 2024.

- L&T's IT spending reached $700 million in FY24, with a 15% allocation for cybersecurity.

Larsen & Toubro (L&T) is heavily investing in digital transformation, allocating ₹2,500 crore in 2024. The focus includes AI, IoT, and automation. L&T's R&D spending was ₹1,900 crore in FY24. Cybersecurity is a priority; IT spending reached $700 million with 15% for cyber-protection.

| Technological Factor | Impact on L&T | 2024/2025 Data |

|---|---|---|

| Digital Transformation | Enhanced efficiency & project management | ₹2,500 Cr invested in digital initiatives (2024), targeting 20% cost reduction (2025) |

| R&D and Innovation | New tech development and Industry 4.0 alignment | ₹1,900 Cr R&D spend (FY24) |

| Cybersecurity | Protecting digital assets & sensitive data | IT spend $700 M with 15% on Cybersecurity (FY24), data breaches up 20% in India (2024) |

Legal factors

Larsen & Toubro (L&T) must comply with diverse laws. This includes company law and foreign exchange rules across multiple nations and sectors. For instance, in FY24, L&T's international revenue was 40% of the total. Adherence to these regulations is crucial for operations.

Larsen & Toubro (L&T) must adhere to environmental laws like the Environment Protection Act. This compliance is critical for all its projects. L&T needs to incorporate environmental considerations into its planning and operations. The goal is to meet regulations and reduce its environmental footprint. In 2024, L&T invested ₹1,500 crore in green initiatives, reflecting its commitment.

Larsen & Toubro (L&T) must adhere to India's labor laws, impacting workforce management. These laws cover wages, working conditions, and industrial relations. Compliance ensures workplace safety and operational continuity. In 2024, the labor law landscape saw updates impacting employee benefits. For instance, the minimum wage increased in some states, which L&T must implement.

Contract laws and dispute resolution

Larsen & Toubro (L&T) heavily relies on contracts for its diverse projects, making contract law compliance essential. Effective dispute resolution is critical, as legal battles can significantly affect project schedules and financial results. In 2024, L&T's legal expenses were approximately INR 600 crore, highlighting the financial implications of legal issues. Delays from disputes can lead to increased costs and potential revenue loss. L&T's robust legal teams and dispute resolution strategies are vital for mitigating risks.

- Legal expenses in 2024: ~INR 600 crore.

- Impact of delays: Increased project costs and revenue reduction.

Industry-specific regulations (e.g., nuclear energy)

Larsen & Toubro (L&T) operates in sectors like nuclear energy, which are heavily regulated. The Atomic Energy Act and the Civil Liability for Nuclear Damage Act have a direct impact. Regulatory changes can affect L&T's ability to participate in projects. Compliance costs can also impact profitability.

- Nuclear energy projects require strict adherence to safety and operational standards, as mandated by regulatory bodies like the Atomic Energy Regulatory Board (AERB) in India.

- In 2024, L&T secured several contracts in the nuclear sector, which are subject to these regulatory requirements.

- Any changes in regulations can lead to delays or increased costs for L&T's projects.

L&T must navigate a complex web of laws across sectors and geographies, influencing project execution and financial outcomes.

Contract law compliance is essential, and any legal issues, like the ~₹600 crore expenses in 2024, can lead to cost overruns and delays.

In the regulated nuclear sector, adherence to acts like the Atomic Energy Act and AERB standards is crucial.

| Area | Impact | 2024 Data |

|---|---|---|

| Legal Expenses | Financial Impact | ~₹600 crore |

| International Revenue | Compliance | 40% of Total |

| Green Initiatives | Investment | ₹1,500 crore |

Environmental factors

The world is increasingly focused on sustainable infrastructure and green building. L&T is aligning with sustainable development goals. This is crucial, as the global green building materials market is projected to reach $497.9 billion by 2028. Eco-friendly construction methods are becoming more significant for L&T.

Companies globally face increasing pressure to lower their carbon footprint and enhance energy efficiency. Larsen & Toubro (L&T) is actively working towards reducing its carbon emissions. For example, L&T aims to reduce its Scope 1 and 2 emissions by 50% by 2030 from a 2021 baseline. This includes a focus on renewable energy sources.

Responsible water usage and effective waste management are critical for L&T, especially in construction. L&T focuses on water conservation and aims for zero waste to landfills. In FY24, L&T recycled 98% of construction and demolition waste. They also reduced water consumption intensity by 15% by March 2024.

Use of renewable resources

Larsen & Toubro (L&T) actively integrates renewable resources, aligning with global sustainability trends. The company is increasing its use of solar and wind energy across its operations. L&T is also exploring green hydrogen for its energy needs. In 2024, L&T aims to increase renewable energy usage by 15%.

- L&T's renewable energy capacity increased by 10% in 2023.

- The company plans to invest $500 million in green hydrogen projects by 2025.

- L&T aims for 50% of its energy to come from renewables by 2030.

Environmental impact assessments and compliance

Larsen & Toubro (L&T) must conduct environmental impact assessments and secure environmental clearances, which are crucial for project approvals. These assessments help identify and mitigate potential environmental issues associated with L&T's operations. Compliance with environmental regulations is essential to avoid legal issues and maintain a positive public image.

- In 2023-24, L&T's environmental expenditure was approximately ₹1,350 crore, reflecting its commitment to sustainability.

- L&T has implemented various green initiatives, including water conservation and waste management, at its construction sites.

- The company's focus on renewable energy projects aligns with global efforts to reduce carbon emissions.

L&T's focus includes sustainable infrastructure, targeting the $497.9B green building market by 2028. Reducing carbon footprint is a key goal, aiming for a 50% reduction in Scope 1 and 2 emissions by 2030 from 2021 baseline. Water conservation and waste management are also vital; in FY24, L&T recycled 98% of construction waste.

| Aspect | Details | Data |

|---|---|---|

| Renewable Energy | Increased capacity & investments | 10% increase in 2023, $500M by 2025 for green hydrogen |

| Emissions Reduction | Targets and strategies | 50% reduction by 2030 (Scope 1 & 2), 15% renewable energy increase by 2024 |

| Environmental Expenditure | Financial commitment | ₹1,350 crore in 2023-24 |

PESTLE Analysis Data Sources

This PESTLE Analysis compiles insights from diverse sources: financial databases, policy updates, industry reports, and governmental publications.