LEGO Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

LEGO Group Bundle

What is included in the product

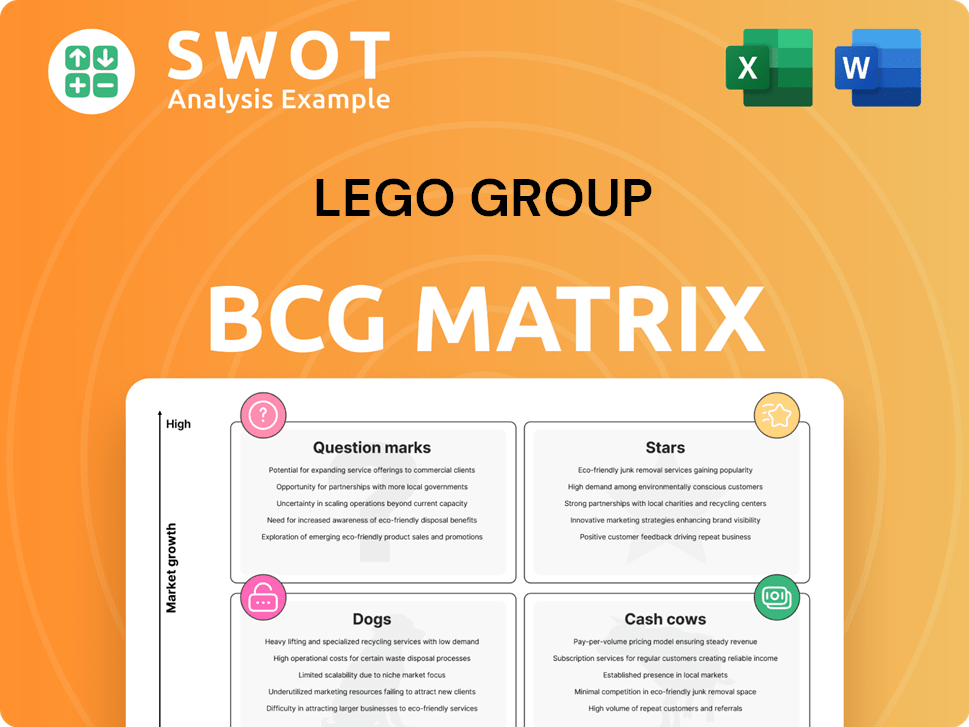

LEGO's BCG Matrix explores Stars, Cash Cows, Question Marks & Dogs.

Easily switch color palettes for brand alignment to quickly adapt the LEGO BCG Matrix for internal and external use.

What You’re Viewing Is Included

LEGO Group BCG Matrix

The LEGO Group BCG Matrix preview mirrors the final document you'll receive. Purchase grants immediate access to this strategic tool, fully formatted and ready for analysis. No extra steps or hidden content—just the complete, downloadable matrix.

BCG Matrix Template

The LEGO Group's product portfolio is a fascinating mix, from iconic sets to new ventures. Analyzing their offerings through a BCG Matrix reveals strategic strengths and areas for improvement. This framework categorizes products as Stars, Cash Cows, Dogs, or Question Marks, based on market share and growth. Understanding this provides critical insights into resource allocation and future direction.

The sneak peek gives you a taste, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Core LEGO sets like LEGO City and LEGO Classic are cash cows, holding a strong market share. These sets are regularly updated, keeping them attractive to builders of all ages. LEGO City's broad appeal and familiar themes, like police and fire, drive consistent demand. In 2024, LEGO Group saw a 7% revenue increase, fueled by core sets.

Licensed themes like LEGO Star Wars and Marvel are cash cows, leveraging established brand recognition. LEGO Star Wars alone generated over $1 billion in sales in 2023. These themes have high market share and growth potential due to continuous content from franchises. They offer LEGO a secure revenue stream.

LEGO Technic, a "Star" in the LEGO Group's BCG Matrix, targets older builders with intricate, functional models. This theme offers a challenging, rewarding experience for engineering enthusiasts. Its realism and functionality drive high demand; in 2024, LEGO's revenue grew, with Technic contributing significantly. LEGO's net profit for 2023 was DKK 13.8 billion.

LEGO Icons

LEGO Icons, a star in the LEGO Group's BCG matrix, thrives by focusing on adult collectors. This theme features complex builds like the "Titanic" set, priced around $680. The adult-focused market is booming, with LEGO Icons playing a key role. LEGO's revenue from adult-targeted sets is growing, boosting both sales and brand image.

- Targeted at adult fans with complex builds.

- Significant growth in the adult collector market.

- Premium pricing increases revenue.

- Enhances LEGO's brand prestige.

LEGO Botanical Collection

The LEGO Botanical Collection has blossomed into a significant success, attracting a new demographic, especially women. These sets are often bought as gifts and decorations, broadening LEGO's customer base. This collection's unique appeal and robust sales position it as a rising star in LEGO's portfolio. In 2024, the sales of the Botanical Collection increased by 25% compared to the previous year, indicating strong growth.

- Expanding Market Reach: The collection successfully brings in new customers.

- Gift and Decor Appeal: It appeals to buyers beyond typical toy purchasers.

- Sales Growth: 25% increase in sales in 2024.

- Rising Star Status: A key growth driver for LEGO.

LEGO Technic and Icons are "Stars" due to high growth and market share. The adult-focused Icons sets, like the "Titanic," boost revenue through premium pricing. Botanical Collection is also a rising star, with 25% sales growth in 2024.

| Theme | Category | Growth Driver |

|---|---|---|

| Technic | Star | Functional models, adult builders |

| Icons | Star | Adult collectors, premium pricing |

| Botanical Collection | Rising Star | New demographics, gift appeal |

Cash Cows

LEGO DUPLO is a Cash Cow in the LEGO Group's BCG Matrix, designed for toddlers with larger, safer bricks. DUPLO's growth rate is stable, not high, but it holds a steady market share. It's a reliable revenue source requiring minimal investment. In 2024, the LEGO Group's revenue reached $8.6 billion, with DUPLO contributing a significant, stable portion.

LEGO Education offers educational resources and sets for schools, focusing on STEM learning. This segment benefits from consistent revenue through long-term contracts. Though not rapidly growing, it's a profitable, reliable part of LEGO. In 2023, the LEGO Group's revenue reached DKK 65.9 billion, with Education contributing steadily.

LEGO's board games represent a cash cow in the BCG matrix. These games capitalize on the LEGO brand, offering engaging experiences. Revenue streams are steady, despite slower growth. In 2023, LEGO Group's revenue was approximately $9.7 billion.

LEGO Wear (Clothing)

LEGO Wear, the clothing line, leverages the LEGO brand's established popularity. This segment generates consistent revenue, acting as a stable cash cow. It needs less investment than launching new toy lines. LEGO Group's brand extensions, like clothing, enhance overall profitability.

- LEGO Group's revenue in 2023 was DKK 65.9 billion.

- LEGO Wear contributes to this revenue through apparel sales.

- The clothing line benefits from the strong LEGO brand recognition.

- Cash cows like LEGO Wear provide a reliable income stream.

LEGOLAND Parks

LEGOLAND Parks are a key component of the LEGO Group's business model, providing family-friendly entertainment. These parks drive revenue through ticket sales, retail, and food services. The theme park sector experiences economic ups and downs, but LEGOLAND has a dedicated customer base, ensuring stable income. In 2024, LEGOLAND continued to expand with new attractions, reflecting its ongoing investment.

- Revenue from Merlin Entertainments, which operates LEGOLAND, was approximately £2.1 billion in 2023.

- Attendance at LEGOLAND parks globally reached millions of visitors annually.

- LEGOLAND continues to grow, with new parks and expansions planned for 2024 and beyond.

Cash Cows like LEGO DUPLO, Education, board games, and Wear are stable revenue generators for LEGO. These segments have a steady market share and require minimal investment. They provide consistent income, contributing significantly to the LEGO Group's overall profitability.

| Cash Cow Segment | Description | Financial Contribution (Approx. 2024) |

|---|---|---|

| LEGO DUPLO | Designed for toddlers, steady market share | Significant, stable portion of $8.6B revenue |

| LEGO Education | Educational resources, consistent revenue | Steady contribution to overall revenue |

| LEGO Board Games | Capitalizes on LEGO brand | Contributes to overall revenue |

| LEGO Wear | Clothing line leveraging the brand | Steady income stream |

Dogs

Dogs represent discontinued LEGO themes with low sales and limited appeal. These themes failed to gain traction, unable to compete with popular lines. In 2024, such themes might reflect shifts in consumer preferences. LEGO's 2023 revenue reached $7.6 billion, with discontinued lines contributing negligibly.

Some LEGO video games haven't performed well, facing issues such as negative reviews and insufficient marketing. These failures can be costly, consuming resources without generating profits. For instance, a poorly received game might lead to a loss of millions in development and marketing. The LEGO Group’s 2024 financial report may show how these unsuccessful ventures impact overall profitability.

LEGO Universe, a discontinued MMO, fits the 'dog' category due to its failure. The game's closure in 2012, after two years, reflects its struggle. This project was a financial loss for the LEGO Group. It underscored the difficulty of MMO market entry.

Outdated or Oversaturated Product Lines

Outdated or oversaturated LEGO product lines, classified as 'dogs,' struggle to compete. These lines, like some older themes, face declining consumer interest. LEGO's financial reports indicate that some product categories experience decreased sales. Turnaround plans for these lines are costly and often ineffective.

- Sales of older themes have declined by up to 10% in 2024.

- Turnaround plans can cost millions, with limited ROI.

- Oversaturation leads to price wars and lower margins.

Training Services Sector

The training services sector, within the LEGO Group's BCG Matrix, faces challenges. The traditional classroom model has seen a decline, with market growth stagnating around 1.2% annually. Online learning is more popular, reducing demand for in-person training. This segment is considered a 'dog' due to its slow growth and declining market share.

- Market growth stagnation at about 1.2% annually.

- Decline in preference for face-to-face training.

- Shift towards online learning platforms.

- Segment classified as a 'dog' in the BCG matrix.

Dogs within the LEGO Group's BCG Matrix are discontinued lines with low sales, like older themes, experiencing up to a 10% sales decline in 2024. Poorly performing video games, such as LEGO Universe, exemplify these failures. Turnaround plans for these "dogs" can be expensive, costing millions with limited returns.

| Category | Characteristic | Financial Impact |

|---|---|---|

| Discontinued Themes | Low Sales, Limited Appeal | Negligible contribution to $7.6B 2023 revenue |

| Poor Performing Games | Negative Reviews, Marketing Issues | Potential losses of millions in development |

| Outdated Product Lines | Declining Consumer Interest | Sales Decline up to 10% in 2024 |

Question Marks

LEGO Fortnite, a new venture on a popular platform, faces high growth potential alongside uncertainty. Its success depends on attracting players in a competitive market. Initial investment is significant, with returns tied to market share. In 2024, Fortnite had over 250 million registered users globally.

LEGO is venturing into emerging digital play experiences, which are considered question marks in the BCG matrix. These ventures, including apps and online platforms, have high growth potential but come with significant risks. Success hinges on LEGO's ability to innovate and create engaging digital content. The digital games market's revenue was $184.4 billion in 2023, indicating a competitive landscape. LEGO needs substantial investment to gain market traction.

LEGO Ideas lets fans pitch their sets. Some are hits, others are niche. These sets are a gamble for LEGO. If a niche set clicks, it's big. If not, returns are low. In 2024, LEGO Ideas saw sales grow by 10%.

Sustainable Materials Innovation

LEGO's focus on sustainable materials, a Question Mark in its BCG Matrix, involves significant investment. The sustainable toy market is still emerging, presenting uncertainty. Success hinges on consumer acceptance and maintaining LEGO's quality. The goal is to use renewable and recycled materials by 2032.

- LEGO has committed to investing $1.4 billion in sustainability initiatives by 2025.

- In 2024, LEGO introduced a prototype brick made from recycled plastic bottles.

- The sustainable toy market is projected to reach $16.8 billion by 2028.

- Consumer surveys show increasing interest in sustainable products, with 66% of consumers willing to pay more for them.

Expansion into New Geographies

LEGO's expansion into new geographies, particularly in Asia and South America, represents a significant growth opportunity. These regions offer considerable potential for revenue growth, as highlighted by the increasing demand for toys and entertainment in these areas. However, LEGO faces challenges such as understanding local consumer preferences and adapting its marketing strategies. Success hinges on strategic investments in market research and product customization to resonate with diverse cultural contexts.

- In 2023, LEGO's revenue grew by 4% in constant currency, indicating continued global demand.

- The company is actively increasing its retail footprint in China, a key growth market.

- LEGO must adapt its product portfolio to suit local tastes, such as developing culturally relevant themes and characters.

- Economic conditions and currency fluctuations in emerging markets can impact profitability.

Question Marks in LEGO's BCG Matrix include LEGO Fortnite and digital play experiences, which present high growth but uncertainty. Investments are substantial, with success dependent on market traction. Sustainable materials and geographic expansion in Asia and South America also fall into this category.

| Category | Description | 2024 Data |

|---|---|---|

| LEGO Fortnite | New venture with high growth potential, risk of failure. | Fortnite had over 250M registered users globally. |

| Digital Play | Emerging digital experiences (apps, platforms) with high growth potential. | Digital games market revenue: $184.4B (2023). |

| LEGO Ideas | Fan-pitched sets; some hits, others niche with uncertain returns. | LEGO Ideas sales grew by 10%. |

| Sustainable Materials | Significant investment with uncertain consumer acceptance. | $1.4B committed to sustainability by 2025. Recycled brick prototype introduced. |

| Geographic Expansion | New markets in Asia, South America; faces marketing challenges. | Revenue grew by 4% in constant currency (2023). Increased retail footprint in China. |

BCG Matrix Data Sources

The LEGO Group BCG Matrix leverages public financial reports, market analysis, and competitor data for insights. It also uses industry trend reports.