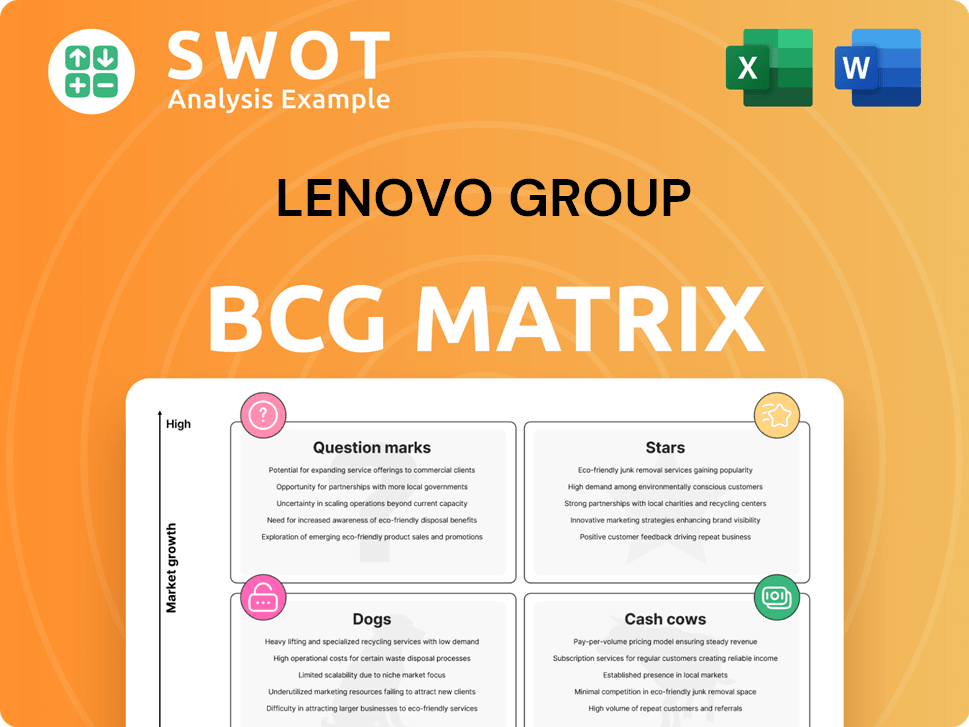

Lenovo Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lenovo Group Bundle

What is included in the product

Lenovo's BCG Matrix reveals investment, holding, or divestment strategies across its diverse product categories.

Easily identify strategic areas needing attention via a clear, shareable, and printable BCG Matrix.

What You See Is What You Get

Lenovo Group BCG Matrix

The Lenovo Group BCG Matrix you see is the complete, ready-to-use report you receive post-purchase. This preview showcases the same detailed strategic analysis, formatting, and data visualizations instantly available upon download.

BCG Matrix Template

Lenovo's BCG Matrix reveals its diverse product portfolio across various market segments. This analysis identifies its "Stars," likely its successful laptops and premium devices, and "Cash Cows" such as its well-established ThinkPad series. Understanding Lenovo's "Dogs" and "Question Marks" helps pinpoint areas needing strategic adjustment. This snapshot offers a glimpse into Lenovo's strategic positioning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Lenovo's AI-powered PCs, such as the Yoga and ThinkPad X9 Aura Editions, are shining stars in its portfolio. These premium AI PCs are seeing impressive growth, driven by enhanced performance and user experiences. With the AI PC market expected to reach $190 billion by 2027, Lenovo's strong position, backed by its recent financial results, is vital. Ongoing innovation will keep Lenovo at the forefront.

Lenovo's Infrastructure Solutions Group (ISG) is a Star in the BCG Matrix, showing robust revenue gains. ISG's shift to profitability highlights its success in cloud services and AI infrastructure. Partnerships with NVIDIA and AMD boost its leadership in AI workloads. In fiscal year 2024, ISG revenue rose to $7.7 billion, a 9% increase year-over-year.

Lenovo's Solutions and Services Group (SSG) is a Star in its BCG matrix. SSG saw significant growth in 2024, with revenue up 18% and a 21% operating margin. This success stems from strong demand for IT services. SSG's focus on AI and managed services positions it well for future growth.

Premium Smartphones (Motorola Razr and Edge)

Lenovo's premium smartphones, like the Motorola Razr and Edge, are rising stars, particularly outside China. These phones use AI to boost user experience, making them strong contenders. To keep growing, Lenovo needs to keep innovating and expanding globally. In 2024, the global premium smartphone market is estimated to be worth over $160 billion.

- Motorola's smartphone shipments increased by 21% year-over-year in Q3 2024.

- The Edge series is expanding into new markets, including Latin America and Europe.

- The Razr continues to attract attention with its unique foldable design.

- Lenovo is investing heavily in AI to differentiate its premium offerings.

AI-Driven Innovation

Lenovo's AI-driven innovation is a shining star in its portfolio, fueled by substantial R&D investments. The company's "AI Now" initiative and agentic AI advancements position it as a key player in AI solutions. This strategic focus, supported by financial commitments, ensures Lenovo stays competitive. Continued investment is vital for capturing growth.

- Lenovo's R&D spending reached $2.04 billion in fiscal year 2023-2024.

- The "AI Now" strategy aims to integrate AI across all Lenovo products and services.

- Agentic AI breakthroughs are focused on enhancing user experience and productivity.

- Lenovo aims for AI-driven solutions to contribute significantly to revenue growth by 2025.

Lenovo's stars, including AI PCs and ISG, show robust growth. SSG and premium smartphones also shine, driven by innovation. AI-driven initiatives and R&D investments further boost Lenovo's competitive edge.

| Segment | Key Products/Initiatives | 2024 Performance Highlights |

|---|---|---|

| AI PCs | Yoga, ThinkPad X9 Aura | Strong growth; market at $190B by 2027 |

| ISG | Cloud services, AI infrastructure | Revenue up 9% YoY to $7.7B; partnerships with NVIDIA, AMD |

| SSG | IT services | Revenue up 18%; operating margin 21% |

| Premium Smartphones | Motorola Razr, Edge | Motorola shipments up 21% in Q3; expanding globally |

| AI Initiatives | "AI Now," Agentic AI | R&D spending $2.04B; aims for significant revenue by 2025 |

Cash Cows

Lenovo's traditional PCs, including laptops and desktops, are a cash cow. In 2024, Lenovo held a significant 23.6% share of the global PC market. This mature market allows Lenovo to generate consistent revenue. Operational efficiency and cost management are critical, with Lenovo's gross margin at 16.9% in fiscal year 2024.

Lenovo's global supply chain is a strong cash cow, vital for its operations. It offers a robust and adaptable manufacturing network, helping them meet global demand. In 2024, Lenovo's revenue reached $57 billion, reflecting its supply chain efficiency. Ongoing optimization is key to handling potential disruptions and maintaining its financial strength.

Lenovo's strong brand recognition is a key cash cow. They are known for quality and reliability. This loyalty leads to consistent sales, especially in mature markets. For example, in 2024, Lenovo's PC market share was around 24%, showing brand strength. Leveraging this is vital.

Operational Efficiency

Lenovo's operational efficiency is a cornerstone of its success, particularly in supply chain management and manufacturing. This efficiency allows Lenovo to reduce costs and boost profit margins. In 2024, Lenovo reported a gross profit margin of approximately 17%, reflecting its strong operational performance. Continuous enhancements in operational processes are crucial for maintaining a competitive edge in the market.

- Supply chain optimization is a key focus area.

- Efficient manufacturing processes drive down production costs.

- Cost management strategies support higher profitability.

- Ongoing improvements ensure sustained competitiveness.

Strategic Partnerships

Lenovo's strategic partnerships are a key aspect of its success as a Cash Cow in the BCG Matrix. These collaborations with component vendors, software companies, and entities like Formula 1, boost its product offerings and global reach. In 2024, Lenovo's partnerships were instrumental in driving a 10% increase in its server and solutions revenue. Nurturing these alliances is crucial for maintaining a strong market stance.

- Strategic partnerships boosted Lenovo's market position.

- Collaborations include component vendors and software companies.

- Partnerships drove a 10% revenue increase.

- Expanding these relationships is key for Lenovo.

Lenovo's cash cows, including PCs and brand recognition, generate steady revenue. The company's focus on operational efficiency, marked by a 16.9% gross margin in 2024, helps maximize profits. Strategic partnerships and a strong supply chain also fuel this financial strength.

| Cash Cow Aspect | Key Feature | 2024 Data/Impact |

|---|---|---|

| PC Market Share | Strong Brand Loyalty | 23.6% market share |

| Operational Efficiency | Cost Management | 16.9% Gross Margin |

| Supply Chain | Global Network | $57B Revenue |

Dogs

Lenovo's legacy feature phones are likely 'Dogs' in its BCG Matrix. These phones face declining market share and low growth. They generate minimal revenue, consuming resources without returns. Lenovo's mobile phone revenue in FY24 was $6.3B, down from $7.0B in FY23. Divesting these is strategic.

Lenovo's budget tablets can be 'Dogs' if they underperform. These tablets might face low sales and thin profit margins. In 2024, the tablet market saw a 5% decline, making competition fierce. Lenovo needs to assess if these tablets are worth keeping.

Outdated IT management software at Lenovo could be a "Dog" in their BCG matrix. These legacy systems face shrinking demand and strong competition. Maintaining them drains resources without generating significant profits. In 2024, Lenovo's revenue was $56.9 billion, so streamlining underperforming segments is vital.

Unsuccessful Smart Home Devices

In Lenovo's BCG matrix, "Dogs" represent smart home devices that failed in the market. These products, lacking consumer adoption, generate minimal revenue and incur high support costs. A strategic review, potentially leading to discontinuation, is crucial. For example, in 2024, some smart home gadgets from various brands saw a sales decline of up to 15%.

- Low market share.

- High support costs.

- Minimal revenue generation.

- Strategic review needed.

Specific Regional Markets with Low Presence

In certain regional markets where Lenovo's presence is weak, its operations might be classified as 'Dogs' within the BCG Matrix. These areas often face challenges in gaining market share and profitability. Turning these markets around could demand substantial investment, with uncertain returns. Lenovo must strategically evaluate whether to invest further or consider exiting. For example, in 2024, Lenovo's sales in the Americas decreased by 8% year-over-year, indicating potential struggles in a key region.

- Struggling to compete in specific regional markets.

- Significant investment needed for turnaround.

- Uncertain returns in these markets.

- Strategic decisions on investment or withdrawal are crucial.

Lenovo's "Dogs" often include underperforming product lines or regions. These are characterized by low market share and minimal revenue growth, indicating challenges in profitability. They consume resources without significant returns. In 2024, streamlining these segments was crucial for overall financial health.

| Characteristic | Impact | Example |

|---|---|---|

| Low market share | Reduced revenue | Legacy feature phones |

| High support costs | Resource drain | Smart home devices |

| Minimal revenue | Poor profitability | Underperforming regions |

Question Marks

Lenovo's smart home initiatives, powered by AI, are currently in the Question Mark quadrant of the BCG matrix. The smart home market is expanding, yet Lenovo's market share is modest. To become a Star, boosting market share, significant investment in product development, marketing, and strategic partnerships is crucial. The global smart home market was valued at $119.6 billion in 2023.

Lenovo's AR/VR initiatives are in a high-growth, uncertain-share market. The AR/VR sector is projected to reach $86 billion by 2024. To increase market share, Lenovo needs strong marketing. In 2024, Lenovo launched new AR/VR products.

Lenovo's blockchain initiatives fall under the "Question Mark" category due to their exploratory nature. The blockchain market, valued at roughly $16 billion in 2023, is still evolving. Lenovo must strategically invest to carve out a space and boost market share in this nascent sector. Success hinges on identifying and developing valuable blockchain solutions.

Sustainable Computing Initiatives

Lenovo's "Question Marks" in the BCG Matrix include sustainable computing, an area of increasing interest. Eco-friendly product demand is rising, offering growth potential. Strategic initiatives can position Lenovo as a leader. This boosts market share and aligns with consumer values.

- Lenovo aims to reduce emissions by 1 million tons by 2025.

- The global green IT market is projected to reach $70 billion by 2024.

- Lenovo's 2023 sustainability report highlights eco-friendly product advancements.

- Sustainable computing can attract environmentally conscious investors.

Edge Computing Solutions for Specific Verticals

Lenovo's edge computing solutions for manufacturing and healthcare represent a "question mark" in its BCG matrix. These sectors are experiencing substantial growth, with the global edge computing market projected to reach $250.6 billion by 2024. Investment in research and development is crucial for Lenovo to capture market share. This strategy aligns with the increasing demand for real-time data processing in these industries.

- Market Size: The global edge computing market is expected to reach $250.6 billion in 2024.

- Key Industries: Focus on manufacturing and healthcare for edge computing solutions.

- Investment Need: Significant R&D investment is required.

- Growth Potential: High growth potential in targeted sectors.

Lenovo's Question Marks in the BCG matrix face uncertain markets. Smart home, AR/VR, and blockchain initiatives require strategic investment. Edge computing in manufacturing offers high growth, with the market at $250.6B in 2024.

| Initiative | Market Size (2024) | Strategic Need |

|---|---|---|

| Smart Home | $119.6B (2023) | Increase market share |

| AR/VR | $86B | Marketing, New Products |

| Blockchain | $16B (2023) | Strategic Investment |

| Edge Computing | $250.6B | R&D Investment |

BCG Matrix Data Sources

Lenovo's BCG Matrix is fueled by financial reports, market analyses, and tech industry insights for strategic decision-making.