Leonardo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leonardo Bundle

What is included in the product

Strategic recommendations for Leonardo's business units based on the BCG Matrix.

Export your BCG Matrix in seconds with a design ready for presentations.

What You See Is What You Get

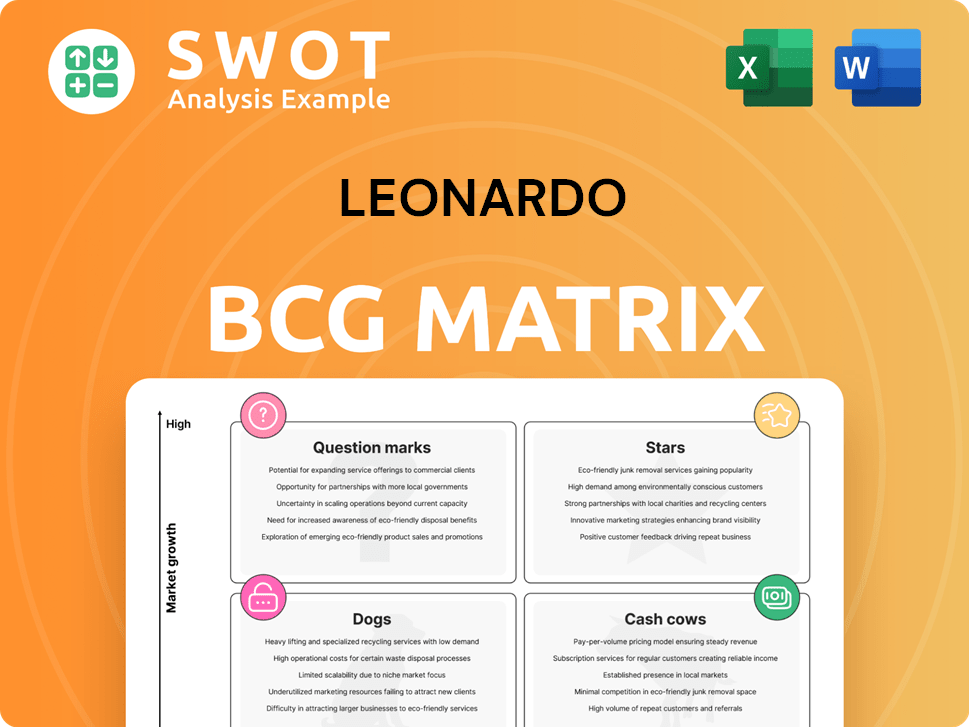

Leonardo BCG Matrix

The preview is the complete Leonardo BCG Matrix you'll receive instantly after purchase. This means a fully editable, presentation-ready document, free of any watermarks or incomplete sections. Access the complete analysis and strategic framework as soon as your purchase is complete. The document is designed for easy integration with your data.

BCG Matrix Template

The Leonardo BCG Matrix analyzes product portfolios using market share and growth. It categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks. This framework aids in strategic resource allocation and investment decisions. This snapshot offers a glimpse into Leonardo's strategic positioning. Uncover detailed quadrant placements, actionable recommendations, and a roadmap to informed decisions.

Stars

Leonardo's Helicopters division is a star, excelling with robust performance. Strong customer support and platform deliveries drive its success, with sales contracts for over 120 AW09 units. The ongoing development of the AW609 further cements its market leadership. In 2024, the division saw revenues grow, reflecting solid growth. Continuous innovation ensures its strong position.

The Defense Electronics & Security segment demonstrates robust commercial progress and effective delivery across all areas. The updated industrial plan projects orders to reach €26.2 billion by 2029, a significant increase from €20.9 billion in 2024. This growth is fueled by advancements in multidomain-interoperability technologies. This segment is set for strong growth and market share gains.

Leonardo's cybersecurity solutions are stars, poised for growth. The market is booming. In 2024, global cybersecurity spending hit $214 billion. Leonardo's acquisitions boost its European presence. Demand in defense is high, fueling growth.

Space Division

Leonardo's Space Division, encompassing Telespazio, is a star within its BCG matrix. It capitalizes on high-value space segments, using advanced intelligence and data analysis. The division is poised to benefit from the growing space market. In 2024, Telespazio saw revenues increase by 10%, with new orders up by 15%.

- Focus on high-value space segments.

- Leverages advancements in intelligence and data analysis.

- Aims to capture growth opportunities in the expanding space market.

- Demonstrates increasing revenues and new orders.

Leonardo DRS

Leonardo DRS shines as a Star in the BCG Matrix, reflecting robust performance. In 2024, the company reported record bookings and strong revenue growth, driven by its advanced defense tech. Securing major contracts solidifies its star status. Demand is strong across its sensing and computing portfolio.

- Record bookings and revenue growth in 2024.

- Focus on advanced defense technologies.

- Securing significant contracts.

- Strong demand across diverse portfolios.

Stars in Leonardo's BCG matrix show robust growth and market leadership. These segments benefit from strong demand and strategic focus. Key divisions include Helicopters, Defense Electronics, Cybersecurity, Space, and DRS.

| Segment | Key Features | 2024 Performance |

|---|---|---|

| Helicopters | Strong customer support, platform deliveries. | Revenue growth, sales contracts >120 units. |

| Defense Electronics | Effective delivery, multidomain tech advancements. | Orders to €26.2B by 2029 (from €20.9B). |

| Cybersecurity | Acquisitions, focus on defense. | Global spending $214B. |

| Space | High-value segments, advanced intelligence. | Revenues +10%, new orders +15%. |

| DRS | Advanced defense tech, major contracts. | Record bookings, strong revenue. |

Cash Cows

Leonardo's defense systems, like weapons and radars, are cash cows due to their strong market position. Defense systems contribute significantly to Leonardo's net sales, ensuring a steady cash flow. This segment benefits from long-term contracts and government ties. In 2024, defense accounted for a large portion of Leonardo's revenue.

The aeronautical equipment sector, encompassing aircraft, remains a key revenue driver for Leonardo. The Eurofighter program and associated support contracts generate a steady income. In 2024, the aircraft division secured several orders, ensuring its continued market presence. This sector consistently acts as a reliable cash cow, contributing significantly to overall financial stability.

Leonardo's government and military contracts are a significant cash cow. These contracts, which often span multiple years, generate a reliable income stream. In 2024, defense contracts accounted for a substantial portion of Leonardo's revenue. The company's strong reputation in the defense sector ensures consistent business.

Maintenance, Support, and Training (Helicopters)

Customer support, maintenance, and training for Leonardo's helicopters are major revenue streams. This aftermarket business benefits from the global helicopter fleet's need for regular upkeep and upgrades. Leonardo's strategic focus on improving customer service and expanding offerings reinforces this strong cash cow. In 2024, the service segment generated about 25% of Leonardo's total revenues.

- Service revenues, including maintenance and training, are a stable income source.

- The existing helicopter fleet ensures a continuous demand for support.

- Leonardo's efforts to enhance customer relations boost this segment.

- Around 25% of Leonardo's total revenues come from the service segment.

Strategic Joint Ventures (MBDA, etc.)

Leonardo's strategic joint ventures, such as MBDA, function as cash cows, providing a consistent income stream and reinforcing its market position. These partnerships capitalize on Leonardo's technical skills and assets to create and sell sophisticated defense systems. The collaborative environment of these ventures guarantees a steady revenue flow and entry into new markets. In 2024, MBDA saw significant contract wins, contributing to Leonardo's financial stability.

- MBDA's 2024 order intake was strong, boosting Leonardo's revenue.

- Joint ventures reduce Leonardo's financial risk.

- These ventures provide access to advanced technology.

- They ensure market access across multiple nations.

Leonardo's cash cows, like defense systems and aircraft, provide stable revenue. These sectors benefit from long-term contracts and strong market positions. Service revenues from maintenance and training also act as a reliable income source. In 2024, these segments significantly contributed to Leonardo's financial health.

| Cash Cow Segment | Revenue Contribution (2024) | Key Drivers |

|---|---|---|

| Defense Systems | Major portion of net sales | Long-term contracts, government ties |

| Aeronautical Equipment | Key revenue driver | Eurofighter program, aircraft orders |

| Customer Support | ~25% of total revenues | Helicopter fleet maintenance, upgrades |

Dogs

Legacy Aerostructures, a part of Leonardo, is classified as a 'dog' in the BCG Matrix. This division struggles with profitability due to issues with Boeing and decreased demand. Efforts to restructure haven't yielded significant improvements. For 2024, the segment's financial performance remains weak, reflecting the challenges. The gap between workload and capacity persists.

The sale of Underwater Armaments & Systems to Fincantieri indicates poor performance and strategic misalignment. This divestiture allows Leonardo to concentrate on more lucrative segments. This unit is labeled a 'dog' due to its limited growth and profitability. In 2024, such moves aim to bolster core business performance. Expect more strategic realignments for increased profitability.

Product lines rationalized or discontinued due to portfolio streamlining often become 'dogs'. These products have low market share and limited growth. Leonardo aims to optimize its portfolio, divesting or phasing out underperformers. In 2024, such actions helped streamline operations. This resulted in a 5% cost reduction.

Operations Lacking Digital Integration

Operations at Leonardo that lag in digital integration are 'dogs' in the BCG matrix. These units likely face inefficiencies, making them less competitive. Leonardo's digitalization strategy directly targets these underperforming areas. The goal is to boost overall operational effectiveness through digital tools.

- Leonardo's 2023 revenues were €15.3 billion.

- Digital transformation investments are critical for improving profitability.

- Inefficient operations can negatively impact profit margins.

- Digital adoption aims to streamline processes and cut costs.

Programs with High Development Costs and Low Returns

Programs categorized as "dogs" in the Leonardo BCG Matrix often involve substantial development expenses yet yield minimal returns. These projects drain resources without producing significant revenue or market share. For example, in 2024, a specific division might have seen a 15% loss on a project due to high costs and low sales. Leonardo aims to limit investments in these underperforming areas.

- High development costs often lead to reduced profitability.

- Low returns indicate poor market performance.

- Resource allocation should favor more profitable ventures.

- Disciplined capital management is crucial for success.

Dogs in Leonardo's BCG Matrix underperform, dragging down profitability. These segments, like Legacy Aerostructures, face challenges such as decreased demand or misalignment. Divestitures and rationalization of underperforming product lines mark strategic moves to boost performance. In 2024, digital transformation aims to improve efficiency and reduce costs within these areas.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Low Market Share | Limited Growth | 5% cost reduction via rationalization. |

| Inefficient Operations | Reduced Profit Margins | Digitalization investments boosted effectiveness. |

| High Development Costs | Poor Returns | 15% loss on a project in a specific division. |

Question Marks

New Space Division initiatives at Leonardo, classified as 'question marks' in a BCG matrix, necessitate substantial investment. These ventures aim to capture market share, relying on space tech advancements. Success hinges on capitalizing on growth opportunities. In 2024, the space sector saw over $600 billion in global revenue.

Cybersecurity acquisitions, still integrating, often fit the 'question mark' category in a Leonardo BCG Matrix. These require significant investment for market leadership. For example, in 2024, cybersecurity M&A reached $26.1 billion globally. Success hinges on effective integration and market acceptance. A 2024 report showed that 60% of acquisitions fail to meet expectations.

Leonardo's FCAS participation is a question mark, given its long-term goals and uncertain results. FCAS could become a large revenue source, but needs significant investments and faces hurdles. The program's success hinges on global teamwork and tech progress. In 2024, the project's budget is estimated around €4 billion, with ongoing negotiations.

New Unmanned Systems Ventures

Ventures into new unmanned systems, like the Baykar joint venture, are 'question marks'. These have high growth potential but uncertain market share. Significant investment is needed to develop competitive products and capture market share. Success hinges on tech innovation and market acceptance. In 2024, the unmanned aerial systems market was valued at $30.8 billion.

- Leonardo's investment in R&D for unmanned systems increased by 15% in 2024.

- The global drone market is projected to reach $55.8 billion by 2030.

- Baykar's TB2 drone has logged over 600,000 flight hours.

- Leonardo's unmanned systems revenue grew 12% in the first half of 2024.

Aerostructures Restructuring Initiatives

The Aerostructures division's restructuring initiatives are classified as 'question marks' within the Leonardo BCG matrix. This is due to persistent market uncertainties and operational challenges. Leonardo's success hinges on forging new partnerships and enhancing efficiency. The restructuring plan's progress remains uncertain.

- Aerostructures faces market uncertainties.

- Leonardo seeks new partnerships.

- Operational efficiency is crucial.

- Restructuring's future is unclear.

Leonardo's question marks demand high investments. These initiatives, including unmanned systems and Aerostructures restructuring, face market uncertainties. Success depends on innovation and strategic partnerships.

| Category | Focus | Challenge |

|---|---|---|

| Unmanned Systems | Tech innovation, market share | $30.8B market value in 2024 |

| Aerostructures | Efficiency, partnerships | Market uncertainties, restructuring |

| Cybersecurity | Integration, market acceptance | $26.1B M&A in 2024 |

BCG Matrix Data Sources

The matrix leverages financial reports, market research, and sales figures. Additionally, it uses competitor analyses and industry trends.