LG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

LG Bundle

What is included in the product

Strategic guidance for LG's products.

One-page overview placing each business unit in a quadrant

What You’re Viewing Is Included

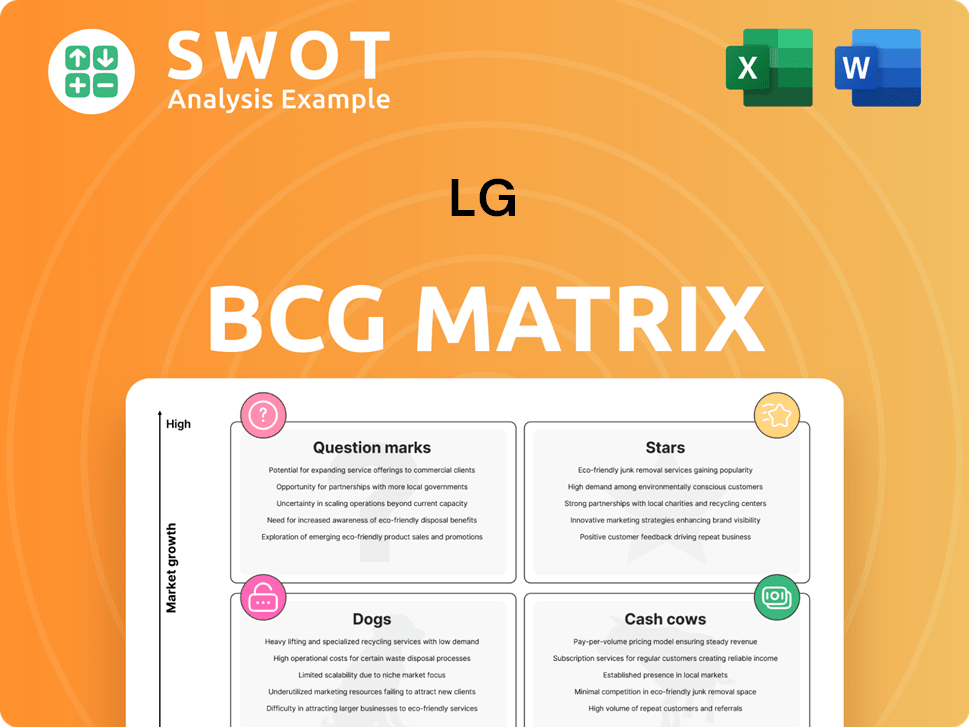

LG BCG Matrix

The displayed preview is the complete BCG Matrix you'll receive after purchase. This document offers ready-to-use strategic insights, ensuring a smooth integration into your business analysis and planning processes.

BCG Matrix Template

The BCG Matrix helps businesses visualize their product portfolios, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This allows for strategic decisions based on market share and growth. Understanding these placements can highlight investment opportunities and areas needing restructuring. Our preview offers a glimpse of this powerful framework.

Dive deeper into this company's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

LG's premium OLED TVs are a shining star in its portfolio. LG has led the global OLED TV market for 12 years. In 2024, LG held over 52.4% market share. Innovations like wireless 4K transmission and AI-driven webOS boost their appeal. This dominance solidifies OLED TVs' star status.

LG's Vehicle component Solutions Company saw revenue above KRW 10 trillion in 2024, showing consistent growth. IVI systems and automotive content platforms are key areas for expansion. These high-value components are crucial for LG's growth in the evolving auto industry. The automotive sector's shift towards electrification and connectivity boosts their importance.

LG's B2B Eco Solutions (ES) is a Star in its BCG Matrix, driving revenue and profit. In 2024, ES, including HVAC and energy solutions, saw significant growth. LG targets 100% renewable energy use by 2030. This aligns with increasing sustainability demands.

Smart Factory Solutions

LG is aggressively growing its smart factory solutions. They're using a new AI system for quicker, better quality predictions in product design. LG wants to serve more industries, like semiconductors and pharmaceuticals. The goal is a trillion-won portfolio by 2030.

- LG's smart factory solutions target a trillion-won portfolio by 2030.

- The AI system enhances quality predictions during product design.

- Expansion includes industries beyond home appliances.

- The initiative aims to boost competitiveness and future growth.

Subscription-Based Home Appliances

LG's home appliance subscription model is a rising star. In 2024, subscription revenue jumped over 75% year-over-year, approaching KRW 2 trillion. LG is expanding subscription services globally, focusing on product lineup and customer care. This strategy is crucial for future growth.

- 2024 Subscription Revenue: Near KRW 2 Trillion

- Year-over-year Growth: Over 75%

- Strategic Focus: Global Rollout and Enhanced Services

LG's Stars shine brightly in its portfolio, showcasing strong growth and market leadership. OLED TVs, leading the global market with a 52.4% share in 2024, are a prime example. Vehicle component solutions also contribute significantly.

B2B Eco Solutions and the home appliance subscription model also see strong performance. Smart factory solutions aim for a trillion-won portfolio by 2030.

| Sector | Key Metric (2024) | Growth/Share |

|---|---|---|

| OLED TV | Market Share | 52.4% |

| Vehicle Components | Revenue (KRW) | Above 10 Trillion |

| Subscription Revenue | Year-over-year Growth | Over 75% |

Cash Cows

LG's home appliance business is a cash cow, with KRW 33.2 trillion in revenue in 2024. The company has shown sustainable performance, with double-digit revenue growth. LG's premium products are global market leaders. They significantly boost overall profitability.

LG's motors and compressors are cash cows, especially in B2B. These components generate consistent revenue. For example, in 2024, LG's B2B sales in these areas reached $10 billion. LG invests in tech to stay competitive.

LG's webOS platform is a cash cow, generating substantial revenue. In 2024, this platform achieved over KRW 1 trillion in annual revenue. LG integrates its display businesses to boost webOS. This enhances customer engagement and ensures recurring revenue.

Global Manufacturing Hub in India

LG Electronics is leveraging India as a key global manufacturing hub, a strategic move to diversify its production capabilities. In 2024, LG's sales in India surged to a record 3.79 trillion won, a 14.8% increase. This expansion is part of a broader strategy to reduce reliance on China and tap into India's growth potential. This shift is expected to provide a stable, growing revenue stream.

- 2024 sales in India: 3.79 trillion won.

- Sales growth in India: 14.8%.

- Strategic goal: Establish India as a manufacturing hub.

- Primary driver: Diversification from China.

B2B Commercial Displays

LG's B2B commercial displays are a cash cow. The commercial display segment, including premium digital signage, shows strong growth. LG's information display business has seen a 7% annual average growth since 2019. Products like LG MAGNIT boost revenue.

- Revenue from commercial displays is consistently increasing.

- Demand is driven by high-quality displays in various commercial settings.

- This segment provides a reliable income stream for LG.

- Steady revenue increases are observed.

LG's various business segments consistently generate substantial revenue, positioning them as cash cows. These segments include home appliances, B2B components, webOS, and commercial displays. The company’s focus on premium products and strategic market diversification supports strong financial performance, as evidenced by record sales in India in 2024.

| Business Segment | 2024 Revenue/Sales | Key Driver |

|---|---|---|

| Home Appliances | KRW 33.2T | Premium Products |

| B2B Components | $10B | Tech Investments |

| webOS | KRW 1T+ | Display Integration |

| India Sales | 3.79T won | Manufacturing Hub |

Dogs

LG's mobile phone business, a clear "Dog" in the BCG Matrix, was shut down in 2021. This exit followed years of struggling against giants like Apple and Samsung. The company faced challenges in maintaining brand loyalty and global market share. Avoiding this segment is wise, as costly turnaround strategies rarely succeed. In 2020, LG's mobile business reportedly lost nearly $4.5 billion.

LG's legacy LCD TVs, despite the company's OLED leadership, face challenges. These older models experience slower growth amid competition. In 2024, LCD TV sales are projected to decline. Divestiture or niche market focus may be needed.

With the rise of smart lighting, LG's traditional lighting faces declining demand. This aligns with the BCG Matrix's "Dogs" category. In 2024, the global smart lighting market was valued at $28.4 billion. Strategic options include divestiture or niche market focus.

Commodity Chemicals

LG Chem's commodity chemicals might struggle in 2025. Overcapacity in China and weak demand are key issues. The petrochemical business cycle's downturn and trade tensions could hurt profits. This segment could be a "dog" in the BCG matrix.

- China's chemical overcapacity is expected to persist, impacting global prices.

- Demand from key sectors like construction and manufacturing is currently subdued.

- Trade disputes could raise costs and reduce market access.

- LG Chem's chemical sales dropped 11.7% YoY in Q3 2023.

Non-Core Assets

LG Chem, facing a challenging operational climate, has been strategically restructuring its assets. This includes potentially selling stakes in its naphtha cracking center (NCC) facilities, as part of a broader effort to streamline operations. These non-core assets, under the Boston Consulting Group (BCG) Matrix, are classified as "Dogs." Divesting such assets is a common strategy to improve financial flexibility.

- LG Chem's Q3 2023 operating profit decreased by 36.7% year-on-year.

- NCC facilities are capital-intensive, potentially straining resources in a downturn.

- Divestment provides cash to reinvest in more profitable areas.

LG's Dogs are underperforming businesses. These segments, including mobile phones and some chemical lines, face declining demand or overcapacity. Divestiture of these underperforming assets is a common strategy to improve profitability.

| Category | Details | 2024 Data (Projected/Actual) |

|---|---|---|

| Mobile Phones | Shutdown due to losses | Lost $4.5B in 2020 (last reported) |

| LCD TVs | Slower growth and declining sales | Projected decline in sales |

| Traditional Lighting | Declining demand amid smart lighting | Global market $28.4B |

| Commodity Chemicals | Overcapacity, weak demand | Sales -11.7% YoY (Q3 2023) |

Question Marks

LG is strategically expanding its B2B focus to include EV charging solutions. Despite the rapidly expanding EV charging market, LG currently holds a relatively small market share, classifying it as a question mark in the BCG matrix. To capture a larger share, LG must make significant investments in this growing sector, with the global EV charging market projected to reach $40 billion by 2028.

LG views medical monitors as a "Question Mark" in its BCG matrix, focusing on B2B growth. The global medical display market was valued at $2.8 billion in 2023, projected to reach $4.1 billion by 2028. Despite market growth, LG's current market share is modest. To succeed, LG must invest significantly in this sector.

LG is investing in AI-powered home robots, aiming to disrupt the appliance market. This area is considered a question mark in the BCG matrix. Success hinges on innovative, practical solutions. The market's nascent stage requires significant investment and strategic focus. In 2024, the global home robotics market was valued at $9.7 billion.

6G Technology

LG Uplus is strategically positioning itself in the nascent 6G technology space, a move that could redefine telecommunications. The company's significant investment in 6G reflects its ambition to stay ahead in a rapidly evolving market. Given the early stage of 6G development and deployment timelines, it currently fits the question mark category. LG Uplus must foster ongoing R&D and partnerships for future success.

- Investment: LG Uplus is investing billions in 6G R&D.

- Timeline: Commercial 6G deployment is projected for the late 2020s.

- Partnerships: Strategic alliances are crucial for technology development.

- Market Impact: 6G is expected to enable new applications like advanced AI.

AI-Driven Enterprise Solutions

AI-driven enterprise solutions represent a "Question Mark" for LG Uplus within the BCG Matrix. The company aims for KRW 2 trillion in B2B revenue by 2028, indicating significant investment and strategic development. Success hinges on delivering innovative, practical AI solutions tailored to enterprise customer needs. The market's growth offers potential, but execution is crucial.

- LG Uplus targets KRW 2 trillion in B2B revenue by 2028 from AI-driven solutions.

- The initiative requires substantial investment and strategic development.

- Success depends on creating innovative and practical AI solutions.

- The market for AI-driven enterprise solutions is experiencing growth.

LG's focus on AI-driven enterprise solutions is a "Question Mark," requiring strategic investment. LG Uplus aims for KRW 2 trillion in B2B revenue by 2028, a significant goal. Success requires innovative, practical AI solutions tailored to enterprise needs.

| Aspect | Details | Financial Data |

|---|---|---|

| Strategic Goal | LG Uplus B2B Expansion | Targeting KRW 2 trillion by 2028 |

| Market Focus | AI-Driven Solutions | Market growth is promising. |

| Investment Needs | Significant Investment | Ongoing R&D and Partnerships are key. |

BCG Matrix Data Sources

The BCG Matrix utilizes market research, financial statements, and industry reports. These combined inputs allow for data-driven strategic recommendations.