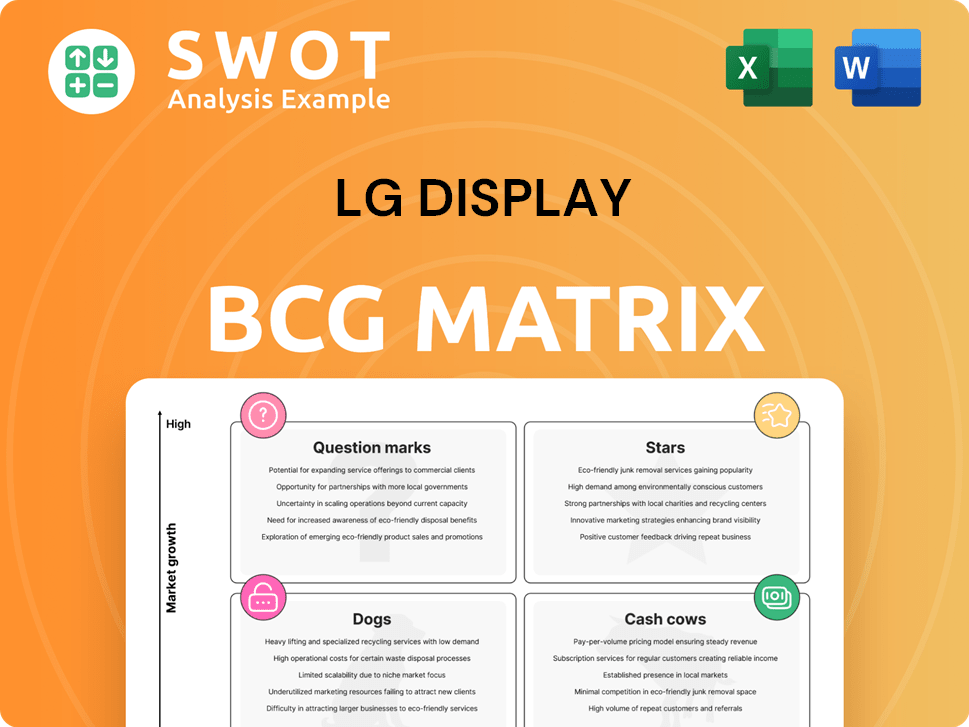

LG Display Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

LG Display Bundle

What is included in the product

LG Display's BCG Matrix analyzes its product units, highlighting investment, hold, or divest strategies.

Printable summary optimized for A4 and mobile PDFs, allowing for easy distribution and review of strategic data.

Delivered as Shown

LG Display BCG Matrix

The preview you see is the exact BCG Matrix you'll receive after purchase, ready for immediate strategic planning. This document is complete, fully formatted, and designed to provide clear market insights.

BCG Matrix Template

LG Display's BCG Matrix reveals key product positioning in the display market. Explore its Stars, like OLED technology, driving high growth. Cash Cows, such as established LCD panels, offer steady revenue. Question Marks like emerging technologies need careful evaluation. Dogs, potentially older products, require strategic decisions. This preview is just a taste. Get the full BCG Matrix report for detailed analysis and strategic insights.

Stars

LG Display has led the global OLED TV market for 12 years. In 2024, they shipped 3.18 million OLED TV units. This gave them over 52.4% market share. OLED TV panels are a major revenue source for LG Display.

LG Display is a major force in automotive displays, particularly with OLED and LTPS LCD. They've partnered with top automakers and are mass-producing ultra-large displays. This area is poised for significant growth. In 2024, the automotive display market is projected to reach $10.5 billion.

The gaming OLED monitor market is booming, expected to exceed $1 billion by 2025. LG Display, a major player, is capitalizing on this trend. They are releasing advanced OLED panels with high resolution and refresh rates. This move solidifies their leadership in this expanding market, promising significant growth.

Fourth-Generation OLED Technology

LG Display's fourth-generation OLED technology, optimized for AI TVs, marks a leap in display capabilities. These panels boost brightness and energy efficiency using a Primary RGB Tandem structure. This advancement is crucial for LG's premium TV lineup, aiming to cement its high-end market position. LG Display invested $1.9 billion in OLED production in 2024.

- The new panels increase brightness by up to 30% compared to previous generations.

- Energy efficiency has improved by 20%.

- LG Display aims to capture over 60% of the premium TV market with this technology.

- The global OLED TV market is projected to reach $25 billion by 2025.

P-OLED and ATO Displays

LG Display's P-OLED and ATO displays, utilizing Tandem OLED technology, are designed for brighter, more stable, and durable performance, especially in automotive environments. The company's emphasis on unique product offerings and technological diversity within the automotive segment is key. This strategic approach is aimed at securing consistent profitability and market dominance. In 2024, the automotive display market is projected to reach $9.6 billion, with significant growth expected.

- P-OLED and ATO displays use Tandem OLED technology.

- Focus on automotive applications for stable profit.

- Automotive display market size in 2024: $9.6 billion.

- LG Display aims for market leadership.

LG Display's OLED TV and automotive display sectors are Stars. They show high growth and market share. Gaming OLED monitors also contribute to their Star status. Strong investments and tech advancements boost their position. Projected OLED TV market: $25B by 2025.

| Sector | Market Share/Growth | 2024 Revenue/Projected |

|---|---|---|

| OLED TV | 52.4% Market Share | $25B (2025 Projection) |

| Automotive Displays | Significant Growth | $10.5B (2024 Projected) |

| Gaming Monitors | Booming Market | $1B+ (by 2025) |

Cash Cows

LG Display's LCD panel business, though less emphasized than OLED, remains a cash cow, especially in the IT sector. LCD panels for IT devices represented 28% of Q4 2024 revenues. Despite the rise of competitors, these panels still provide steady income. Their stable cash flow supports other ventures.

LG Display's automotive LCD segment, especially LTPS LCDs, is a reliable revenue source. The automotive display market is expanding, and LCDs are still key. LG Display is a major player, providing panels for various car uses. In 2024, the automotive display market is valued at approximately $9.8 billion.

LG Display's commercial display segment, offering tailored solutions for B2B clients, is a steady revenue source. Despite operating losses in 2024, this business remains significant. In Q3 2024, LG Display's revenue was KRW 5.09 trillion. The segment faced challenges from rising raw material costs and market competition. It caters to diverse needs, including hotels and schools.

Mobile and IT Device Panels

Mobile and IT device panels are a crucial revenue stream for LG Display, acting as a cash cow. In Q4 2024, they represented a substantial 42% and 28% of the company's revenue, respectively. This segment's established market position and tech prowess ensure a reliable cash flow despite competitive pressures.

- Q4 2024: Mobile panels accounted for 42% of revenue.

- Q4 2024: IT panels contributed 28% of revenue.

- Competitive mobile display market.

- LG Display maintains a steady cash flow.

Legacy LCD TV Panels

LG Display's legacy LCD TV panel business is a cash cow as the company gradually reduces its LCD production. Despite the strategic shift, existing production lines and contracts continue to generate revenue. The sale of its Guangzhou plant demonstrates a move away from large-sized LCDs. This allows LG Display to extract value from remaining assets.

- In Q3 2023, LG Display reported a slight profit despite the LCD market downturn.

- LG Display's revenue in 2024 is expected to show a decrease due to the LCD market decline.

- The Guangzhou plant sale was completed in 2023, reflecting the strategic shift.

LG Display's diverse cash cow segments provide consistent revenue, particularly from mobile and IT device panels, which contributed 42% and 28% of Q4 2024 revenue, respectively. Automotive displays, valued at around $9.8 billion in 2024, also offer stable income. Even the commercial display segment, though facing challenges, contributes meaningfully, with Q3 2024 revenue reaching KRW 5.09 trillion.

| Segment | Q4 2024 Revenue Contribution | Market Status |

|---|---|---|

| Mobile Panels | 42% | Competitive |

| IT Panels | 28% | Stable |

| Automotive Displays | $9.8B (2024 Market Value) | Growing |

Dogs

Traditional LCD TV panels are under pressure from Chinese competitors, driving down prices and profits. LG Display is shifting away from this segment, exemplified by selling its Guangzhou LCD plant. This part of the business is probably a 'dog' due to slow growth and low market share. In 2024, the LCD market saw a 10% drop in revenue.

In LG Display's BCG matrix, a-Si LCD displays are 'dogs'. They're lower-end products in the automotive display market. LG Display has minimal a-Si LCD production. This is due to low market share. The company focuses on LTPS LCD and OLED displays.

Outdated display tech, like older LCDs, faces obsolescence. These have low market share and limited growth. LG Display's 2024 financials show a shift to OLED, with older tech sales declining. For example, in Q3 2024, OLED revenue grew by 30% YoY, while older LCDs saw a 15% decrease.

Specific Low-Margin LCD Products

Specific low-margin LCD products face tough competition. These "dogs" may drag down overall profitability. LG Display might consider selling or stopping these products. In 2024, LCD panel prices saw fluctuations due to supply and demand.

- Low profit margins are a key indicator.

- Limited product differentiation increases risk.

- Divestiture or discontinuation are potential strategies.

- Market analysis shows price sensitivity.

Unsuccessful or Discontinued Projects

In the LG Display BCG Matrix, 'Dogs' represent ventures discontinued due to poor market performance or tech hurdles. These projects, like certain OLED TV panel models, haven't delivered the expected returns. Such investments often drain cash without significant gains. For instance, some discontinued projects cost millions in R&D without substantial revenue.

- OLED TV panel models faced market resistance.

- Ineffective investments resulted in cash drain.

- R&D costs exceeded revenue generation.

- Discontinued projects' financial impact was significant.

Dogs in LG Display's BCG matrix include underperforming LCD and certain OLED models. These products have low market share, face intense competition, and generate minimal profit. In 2024, older LCD tech saw declining sales, while OLED revenue increased.

| Category | Description | Financial Impact (2024) |

|---|---|---|

| LCD Panels | Low-margin, outdated tech | 15% decrease in revenue |

| a-Si LCD | Low-end automotive displays | Minimal Production |

| Discontinued OLED | Unsuccessful models | Millions in R&D cost |

Question Marks

Transparent OLEDs represent a nascent technology, with LG Display heavily invested in its development. Market adoption is still in its infancy, but potential applications in automotive displays and digital signage are promising. In 2024, LG Display allocated a significant portion of its R&D budget to transparent OLEDs. The company's strategic focus indicates a long-term bet on this technology's expansion.

Rollable OLEDs represent a promising area, especially for automotive displays. LG Display showcased rollable OLEDs for car cockpits, indicating high growth potential. Although commercialization is early, the technology could become a major product line. The global automotive display market was valued at $9.6 billion in 2023, with growth projected.

MicroLED is an emerging display tech boasting superior brightness and efficiency. LG Display is investing in microLED solutions, aiming for high growth. Its market penetration is still limited, but the tech's potential is huge. In 2024, the microLED display market was valued at approximately $1.5 billion, showing strong growth potential.

Bending and Flexible Displays

Bending and flexible displays are emerging growth areas for LG Display, especially in gaming monitors and automotive applications. LG offers bendable OLED gaming monitors, showcasing their innovation. These displays are still in the early stages of adoption, but they could bring in substantial revenue. The market for flexible displays is expected to reach $27.5 billion by 2024.

- LG Display is investing in flexible display technology for automotive applications.

- Bendable OLED gaming monitors are a key product in this segment.

- The market for flexible displays is projected to grow significantly.

- These technologies have the potential to become major revenue sources.

New Automotive Display Solutions

LG Display's automotive display solutions, like the 40-inch Pillar-to-Pillar (P2P) display, are positioned as "Question Marks" within its BCG matrix, targeting the Software-Defined Vehicle (SDV) market. These innovative displays, including ultra-large formats, aim to capture a share of the rapidly evolving automotive technology sector. Partnerships with automakers such as Sony Honda Mobility show promise, yet market success is not guaranteed. Substantial investment is necessary for both development and aggressive marketing to establish a strong market presence.

- LG Display aims to capitalize on the growing demand for advanced in-vehicle displays, which the global automotive display market was valued at USD 8.5 billion in 2022 and is projected to reach USD 13.9 billion by 2029.

- The company's strategy involves creating displays with high resolution and innovative designs to meet the evolving demands of SDVs.

- Securing partnerships with major automotive players is crucial for gaining a foothold in this competitive market.

LG Display’s automotive displays are "Question Marks" in its BCG matrix, targeting the SDV market.

These displays, like the P2P, require significant investment for market presence.

Partnerships are key for success, in a market projected to reach $13.9B by 2029.

| Category | Description | Data |

|---|---|---|

| Market Value (2022) | Global Automotive Display | $8.5 billion |

| Projected Market (2029) | Global Automotive Display | $13.9 billion |

| Key Strategy | Partnerships & Innovation | With Automakers |

BCG Matrix Data Sources

The LG Display BCG Matrix leverages financial filings, market studies, and industry benchmarks. It also considers growth forecasts and expert analysis for precise assessments.