LG Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

LG Electronics Bundle

What is included in the product

BCG Matrix analysis of LG products, identifying strategic direction for each quadrant.

Printable summary optimized for A4 and mobile PDFs, transforming complex data into accessible formats.

Full Transparency, Always

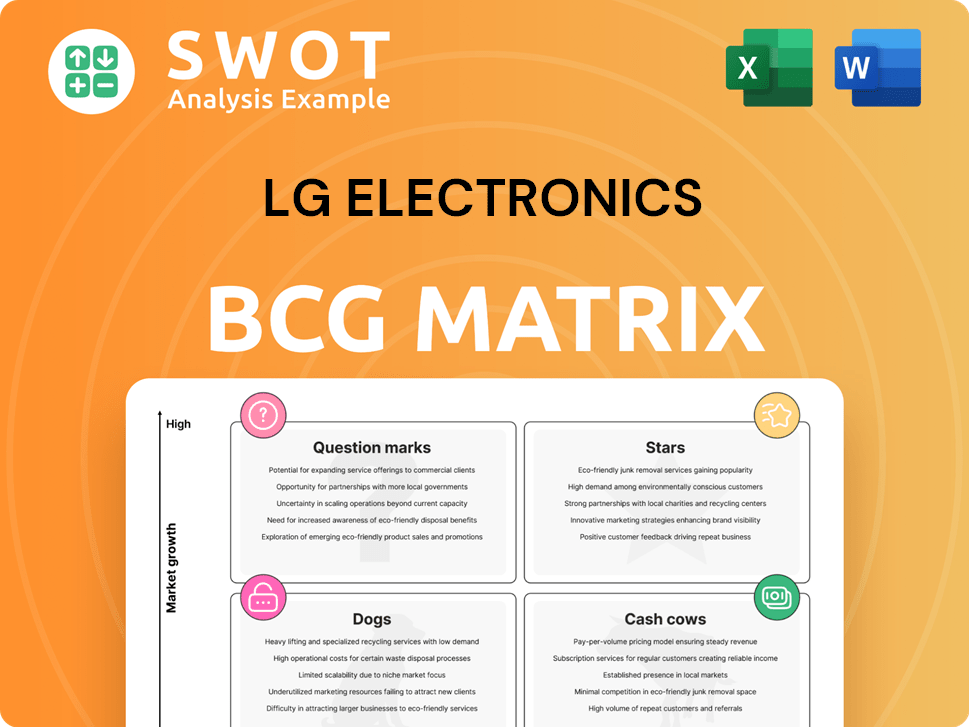

LG Electronics BCG Matrix

The BCG Matrix preview displays the exact, full version you'll receive after purchase. This complete, professionally formatted report is yours to use, with no hidden elements or alterations.

BCG Matrix Template

LG Electronics' BCG Matrix unveils its diverse product portfolio's market positions. Discover which products shine as Stars, generating high growth. Understand the Cash Cows, providing steady revenue streams. Identify potential Dogs needing strategic action. This sneak peek offers a glimpse. Get the full BCG Matrix for actionable strategies and data-driven decisions!

Stars

LG's OLED TVs are Stars in its BCG Matrix, dominating the premium TV market. They're a major revenue driver for LG. The company's global OLED TV market share reached over 52.4% in 2024. LG consistently innovates, keeping its competitive advantage.

LG's Home Appliance & Air Solution is a Star in its BCG Matrix. This segment saw a revenue of KRW 33.2 trillion in 2024. Growth came from new business models, including subscriptions and direct sales. They're boosting subscriptions for customer convenience.

LG Electronics' Vehicle component Solutions Company is a star, with KRW 10.62 trillion revenue in 2024. This marks its second year exceeding KRW 10 trillion. Despite EV demand fluctuations, a high order backlog supported growth. LG focuses on SDV transition and profitability-focused operations.

webOS Platform

LG's webOS platform is a rising star, contributing significantly to revenue. Advertising and content revenue exceeded KRW 1 trillion in 2023, marking substantial growth. The strategy involves expanding webOS beyond TVs. This includes IT products and vehicle infotainment.

- Revenue from webOS advertising and content business surpassed KRW 1 trillion in 2023.

- Expansion into IT products and vehicle infotainment systems is planned.

- webOS is a key element in LG's smart life solutions strategy.

Eco Solutions

LG's Eco Solutions is a Star in its BCG Matrix, fueled by a commitment to future tech and sustainability. The company's focus on R&D in software, AI, and robotics is paying off. In Q1 2025, Eco Solutions hit record revenue and operating profit, showing B2B sector strength. LG's eco-certifications for 2025 OLED TVs further solidify its position.

- Eco Solutions achieved a record-high in Q1 2025.

- LG is investing in AI, robotics, and software.

- The company is focused on sustainable practices.

- LG secured eco-certifications for its 2025 TVs.

LG’s Stars, including webOS and Eco Solutions, are key revenue drivers. WebOS saw advertising revenue over KRW 1 trillion in 2023. Eco Solutions hit record highs in Q1 2025, driven by AI and robotics investments.

| Segment | 2024 Revenue (KRW Trillion) | Key Strategy |

|---|---|---|

| OLED TVs | 52.4% market share | Innovation, premium market dominance. |

| Home Appliance | 33.2 | Subscriptions, direct sales growth. |

| Vehicle Components | 10.62 | SDV transition, profitability focus. |

| webOS | >1 in 2023 | Expansion to IT, vehicle infotainment. |

| Eco Solutions | Record High Q1 2025 | AI, Robotics, sustainable tech. |

Cash Cows

LG's LCD TVs are cash cows, offering steady revenue. Despite OLED's popularity, they generate consistent income, especially in mid-range markets. Production costs are lower, boosting profitability. In Q4 2023, Samsung led the TV market with 51.4% of shipments, while LG had 22.2%.

LG's traditional home appliances, such as refrigerators and washing machines, are cash cows. These products have high market penetration in established markets, ensuring consistent demand. LG's appliance segment generated approximately $20 billion in revenue in 2024. The company focuses on providing total space solutions, boosting its cash flow.

LG's B2B commercial displays, like hotel TVs and digital signage, are cash cows. These displays deliver steady revenue through long-term contracts. The segment has seen solid growth, especially in premium digital signage. In 2023, LG's B2B sales hit $7.3 billion, a 10% increase.

Audio Products

LG's audio products, such as soundbars and Bluetooth speakers, are cash cows. They generate consistent revenue, especially when bundled with TVs. LG's brand recognition helps these products maintain a strong market position. In 2024, LG's audio segment saw a stable revenue stream. For example, the company offered promotions, including the chance to win home appliances.

- Steady Revenue: LG audio products generate a reliable income.

- Brand Recognition: LG's strong brand supports market presence.

- Bundled Sales: Revenue is boosted by bundling with TVs.

- Promotional Offers: Contests for appliances like refrigerators.

Premium Laptops

LG's premium laptops, like the LG gram series, are cash cows due to their consistent revenue generation and established market presence. These laptops appeal to professionals and consumers seeking high-quality, reliable, and lightweight devices. In 2024, the LG Business Solutions Company, which includes laptops, reported a revenue. However, it also reported an operating loss, which might impact the cash cow status.

- Target Audience: Professionals and consumers.

- Revenue Source: High-quality, reliable, and lightweight laptops.

- 2024 Financials: LG Business Solutions Company revenue: KRW 5.69 trillion, operating loss: KRW 193.1 billion.

- Market Position: Established presence in the premium laptop market.

LG audio products are steady revenue generators, bolstered by strong brand recognition and bundling with TVs. Promotional offers like appliance contests further support sales. Stable revenue is evident in 2024.

| Feature | Details | Impact |

|---|---|---|

| Revenue Source | Soundbars, Bluetooth speakers | Consistent income |

| Market Strategy | Bundling, Promotions | Increased Sales |

| 2024 Performance | Stable revenue | Financial Stability |

Dogs

LG's mobile device division, a 'dog' in its BCG matrix, was discontinued in 2021. The brand faced tough competition, ultimately exiting the smartphone market. Despite innovations like modular designs, it failed to gain significant market share. LG's 2020 mobile communications revenue was $5.2 billion, a decline from previous years. The company now focuses on other profitable sectors.

Legacy Products, like older LG TV models, are nearing the end of their life cycle. Sales and profitability are minimal, with little active promotion. LG's strategic shifts, including subscription services, drove growth. In 2024, LG's revenue reached approximately $60 billion, showing resilience. The company's focus is on future tech.

Low-end LCD TVs represent a "Dog" in LG's BCG matrix. These TVs, basic and low-cost, face fierce price competition, especially from Chinese manufacturers. In 2024, the LCD TV market share is dominated by Chinese brands like TCL and Hisense. LG's profitability in this segment is under pressure.

Outdated Accessories

Outdated accessories, like older phone chargers or outdated audio equipment, fall into the Dogs category for LG. These products suffer from low sales due to obsolescence and limited market demand. LG's shift towards subscription services and D2C models aims to move away from such low-profit, high-inventory items. In 2024, accessories accounted for a small portion of LG's overall revenue, with these older items contributing minimally.

- Low Sales Volume

- Minimal Profitability

- Obsolescence

- Limited Market Demand

Discontinued Product Lines

LG's "Dogs" in its BCG Matrix include discontinued product lines that underperformed. These products, no longer generating revenue, could strain resources. LG's strategic shift, including the "3B" strategy, aims to boost tech capabilities. This is evident in LG's 2024 focus on AI and robotics, moving away from underperforming segments.

- Discontinued mobile phone business in 2021, reflecting a strategic shift.

- Focus on profitability and core business areas like home appliances and TVs.

- Strategic acquisitions like Alpha Inc. to strengthen its tech portfolio in 2024.

LG's Dogs represent underperforming or discontinued products. These include legacy items and accessories with minimal profitability. The mobile phone business, discontinued in 2021, exemplifies this. LG focuses on more profitable areas like AI and robotics, shifting away from these Dogs.

| Product Category | Status | Reason |

|---|---|---|

| Mobile Phones | Discontinued (2021) | Low market share, competition |

| Low-End LCD TVs | Dog | Price competition |

| Outdated Accessories | Dog | Obsolescence |

Question Marks

LG's AI-powered home robots represent a Question Mark in its BCG Matrix. This is because they're in a high-growth market, yet LG's market share is currently low. The company plans to use its AI and manufacturing skills to gain ground. In 2024, the global home robotics market was valued at approximately $6.7 billion, indicating significant growth potential.

LG's "Smart Home Energy Solutions" fit into the BCG Matrix, likely as a "Star" due to its growth potential. LG is investing heavily in future tech, like AI, which fuels this segment. B2B expansion boosts revenue, supporting growth in this area. LG's sustainability drive, aiming for 100% renewable energy by 2050, strengthens the segment's appeal.

LG's advanced automotive technologies, including autonomous driving and connected car solutions, are positioned as Question Marks in the BCG Matrix. These areas demonstrate high growth potential but face significant investment needs and market uncertainty. LG is investing heavily in these technologies, with the goal of transforming vehicles into intelligent, connected living spaces. In Q3 2024, LG's VS Company (Vehicle component Solutions) saw a 28.6% YoY revenue increase, reaching 2.7 trillion KRW.

Healthcare and Wellness Devices

LG is venturing into healthcare and wellness devices, a sector ripe with potential. The market is expanding, but LG's foothold is still developing, necessitating strategic moves. They're upping their marketing budget by 10% annually to boost visibility. Last year, LG Thailand's sales hit 15.2 billion baht, showing a 5% increase.

- Market growth in healthcare tech is significant, projected to reach billions.

- LG's investment in marketing aims to capture a larger share.

- LG Thailand's sales growth indicates positive momentum.

- Strategic investment is key for market penetration.

Subscription Services

LG's subscription services are a "Question Mark" in its BCG Matrix, indicating high growth potential but a small market share. In 2024, this segment generated over KRW 2 trillion in revenue, exceeding the KRW 1.8 trillion target. LG aims to triple this figure by 2030, showing a strong commitment to this business model. Further investments and marketing efforts are crucial to boost its market share.

- High growth potential, small market share.

- 2024 revenue exceeded KRW 2 trillion.

- Target: Triple revenue by 2030.

- Requires further investment and marketing.

LG's home robots are a Question Mark, showing high growth potential but low market share. They leverage AI and manufacturing for expansion. Global home robotics market was $6.7 billion in 2024.

LG's advanced automotive tech is also a Question Mark, with high growth but needing significant investments. In Q3 2024, LG's VS Company's revenue rose 28.6%, reaching 2.7T KRW.

Subscription services fall into the Question Mark category. In 2024, they brought in over KRW 2T in revenue, with plans to triple that by 2030.

| Category | Market Status | LG's Strategy |

|---|---|---|

| Home Robots | High Growth, Low Share | AI, Manufacturing |

| Automotive Tech | High Growth, High Investment | Autonomous, Connected |

| Subscription Services | High Growth, Low Share | Invest, Market |

BCG Matrix Data Sources

The LG BCG Matrix leverages comprehensive sources: financial statements, market analyses, and competitor assessments.