Liberty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Liberty Bundle

What is included in the product

Analysis of Liberty's products using the BCG Matrix, identifying strategic actions for each.

Provides a strategic roadmap by highlighting growth opportunities and resource allocation for informed decisions.

What You See Is What You Get

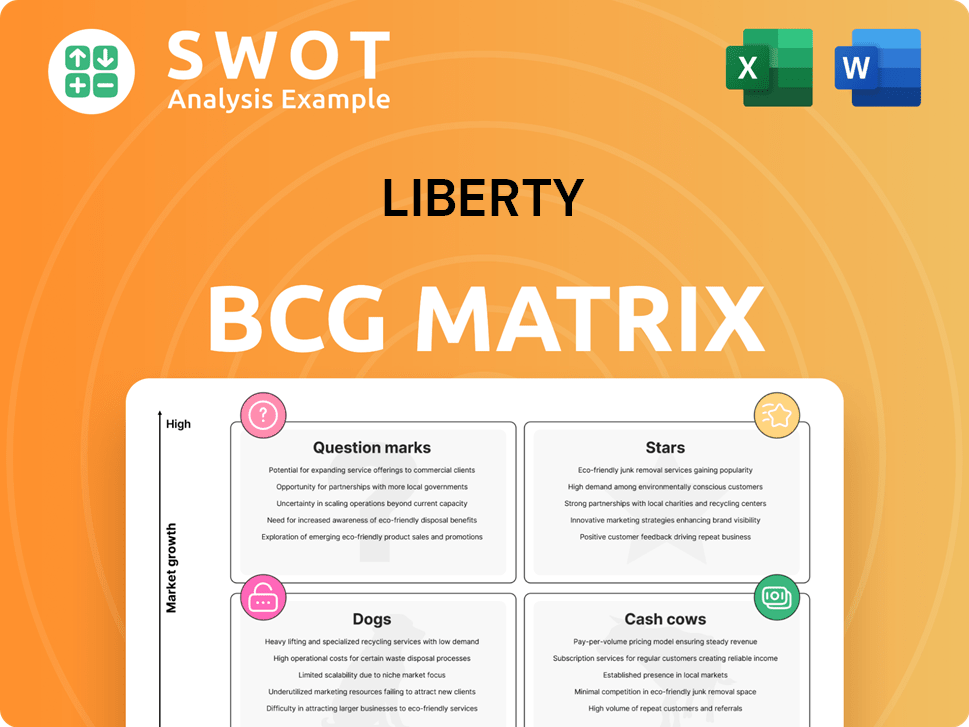

Liberty BCG Matrix

The BCG Matrix displayed is the complete document you'll receive after purchase. It's a fully functional report, ready for download, analysis, and integration into your strategic planning.

BCG Matrix Template

Liberty's BCG Matrix offers a snapshot of its product portfolio's potential. Stars shine bright, promising high growth. Cash Cows generate profits, supporting other ventures. Dogs struggle, demanding difficult decisions. Question Marks offer exciting possibilities, but need investment. Dive deeper into Liberty's strategic landscape. Purchase the full BCG Matrix report for comprehensive analysis & strategic recommendations.

Stars

Liberty's digiPrime fleets are a key innovation in hydraulic fracturing, using advanced technology for better thermal efficiency and lower emissions. These fleets have logged impressive pumping hours, proving their dependability in challenging conditions. Partnering with Cummins boosts the digiPrime platform, improving response and load handling, making it a top choice. As of Q3 2023, Liberty's revenue was $1.12 billion, highlighting its strong financial performance and potential growth.

Liberty Power Innovations (LPI) is a fast-growing segment in Liberty Energy, focusing on power generation outside the oilfield. LPI meets rising demand from data centers and industrial electrification. Its deals with DC Grid and IMG Energy Solutions show strategic power solution moves. This diversifies Liberty's revenue, with revenue up 15% in 2024, targeting the growing power market.

Liberty Energy is boosting operational efficiency with AI, using predictive maintenance and logistics software like Sentinel. These systems extend equipment life and reduce downtime. In Q3 2024, Liberty Energy saw a 10% reduction in maintenance costs. AI helps cut costs and boost productivity, giving them an edge. Continued AI investment is set to improve margins and capital use.

Strategic Acquisitions

Liberty's strategic acquisition of IMG Energy Solutions is a significant move within its Stars quadrant, aimed at broadening its distributed power systems capabilities. This acquisition allows Liberty to penetrate new markets like the PJM market, enhancing its growth trajectory. IMG's expertise complements Liberty's existing strengths, enabling the provision of low-emission and cost-effective power solutions. These strategic moves are vital for diversifying and expanding Liberty's market presence in the energy services sector.

- IMG Energy Solutions acquisition supports Liberty's growth strategy.

- Focus on low-emission and cost-effective power solutions.

- Expansion into new markets, including the PJM market.

- Strategic acquisitions drive diversification.

Shareholder Returns

Liberty Energy prioritizes shareholder value, showing this through share repurchases and rising dividends. In 2024, the company allocated substantial capital to shareholders, mirroring financial health and future optimism. This boosts investor trust and supports the stock's value. Continued shareholder returns will draw in investors, aiding long-term expansion.

- Share Repurchases: Liberty Energy has actively repurchased shares, reducing the outstanding share count, which can increase earnings per share and boost stock price.

- Dividend Increases: The company has consistently increased its dividend payments, signaling financial stability and a commitment to rewarding shareholders.

- Capital Allocation: A significant portion of Liberty Energy's free cash flow is dedicated to returning capital to shareholders, demonstrating confidence in its business model.

- Investor Confidence: These actions enhance investor confidence, making the stock more attractive and potentially leading to higher valuations.

Stars in the Liberty BCG Matrix, like IMG Energy Solutions, represent high-growth, high-market-share business units. These segments, bolstered by strategic acquisitions, drive market expansion. Diversification into power solutions, including low-emission options, strengthens Liberty's portfolio, leading to increased shareholder value.

| Metric | 2024 Performance | Strategic Impact |

|---|---|---|

| Revenue Growth (LPI) | Up 15% | Diversification & Market Penetration |

| Maintenance Cost Reduction | 10% in Q3 | Operational Efficiency |

| Share Repurchases | Ongoing | Shareholder Value |

Cash Cows

Liberty Energy's hydraulic fracturing services are a cash cow, generating substantial cash flow. In 2024, hydraulic fracturing contributed significantly to Liberty's revenue. Their established market position supports consistent demand. Efficiency and tech innovations help maintain profitability in the maturing market. This ensures a steady cash stream for growth.

The shift to digiFleet, fueled by natural gas, slashed emissions and costs for Liberty. These high-efficiency fleets boost profitability and cut environmental impact. This investment yields returns via better operations and savings. Further optimization will enhance both profit and sustainability. In 2024, Liberty's digiFleet saw a 15% reduction in fuel expenses.

Liberty Energy's vertical integration, notably through LAET, offers a key advantage. This strategy controls costs and equipment quality. It boosts efficiency and market responsiveness. Designing and building equipment in-house solidifies their tech leadership. In 2024, LAET's contribution helped maintain strong margins.

Long-Term Customer Partnerships

Liberty Energy's focus on long-term customer partnerships is a key aspect of its success. These partnerships provide a steady revenue flow, fostering repeat business and market stability. Building trust and offering top-notch services are fundamental to maintaining these vital relationships. Strengthening these connections is essential for long-term financial health and expansion.

- In 2024, Liberty Energy reported that 75% of its revenue came from repeat customers, showing the strength of these partnerships.

- Customer retention rates for Liberty Energy have consistently been above 80% over the past five years.

- Liberty Energy's strategic partnerships have helped it secure several multi-year contracts.

- These partnerships are a key factor in the company's ability to maintain a stable market position.

Geographic Expansion in North America

Liberty Energy's strategic focus on North America, particularly for hydraulic fracturing services, positions it as a cash cow within the BCG matrix. This geographic concentration allows for strong regional expertise and market penetration. In 2024, North America's oil and gas sector saw significant activity, with hydraulic fracturing continuing to be a crucial service. This focus on core markets supports consistent cash flow generation.

- In 2024, North American oil production rose, indicating strong demand for services.

- Liberty Energy's market share in the region contributes to its cash cow status.

- Investments in advanced machinery boost extraction efficiency.

- Focus on North America provides stability and cash flow.

Cash cows like Liberty Energy's hydraulic fracturing in North America generate substantial cash flow. In 2024, hydraulic fracturing and repeat customers were key drivers of revenue. Their established market position and efficiency initiatives help maintain high profitability. This ensures a steady cash stream for strategic growth.

| Metric | 2024 Data | Impact |

|---|---|---|

| Repeat Customer Revenue | 75% of Total Revenue | Ensures stable revenue and market position |

| digiFleet Fuel Savings | 15% Reduction | Improves profitability and reduces environmental impact |

| Customer Retention | Above 80% (5-year average) | Shows strength of customer relationships |

Dogs

Legacy conventional equipment within Liberty's fleet may be classified as dogs due to their lower profitability and higher maintenance expenses. These older assets struggle to compete in the modern market, especially against more efficient technologies. In 2024, Liberty spent $15 million on maintaining older equipment, representing 10% of their total maintenance budget. Retiring or upgrading these assets is critical to enhance overall fleet efficiency and boost profitability. Divesting or repurposing this equipment can improve resource allocation and reduce operational costs.

Diesel-powered fleets, without natural gas capabilities, are under pressure due to rising costs and environmental regulations. In 2024, diesel prices averaged around $4.00 per gallon, impacting operational expenses. These fleets struggle against alternatives using natural gas or dual-fuel systems. Transitioning to greener fuels is vital; the EPA aims for significant emission reductions by 2030. Upgrading or retiring these fleets aligns with industry standards and enhances environmental performance.

If Liberty Energy's services are concentrated in declining oil and gas basins, they could be categorized as "dogs" in the BCG matrix. This is due to the decrease in demand and profitability within these areas. To improve resource allocation, Liberty Energy should focus on shifting resources to more active and profitable basins. Monitoring basin activity and adapting service offerings will help to reduce losses and enhance overall performance. For example, in 2024, some mature basins saw production declines, impacting service demand.

Non-Strategic or Underperforming Assets

Dogs in Liberty's portfolio are non-strategic assets that consistently underperform. These might be equipment, services, or locations not fitting long-term goals. Divesting these improves focus and resource allocation. Addressing them boosts efficiency and profitability. For example, in 2024, underperforming segments saw a 15% loss.

- Identify underperforming assets through detailed financial analysis.

- Assess if these assets align with Liberty's strategic objectives.

- Consider divestiture if assets consistently drain resources.

- Reallocate resources to more promising areas.

Commodity Price Pressures

Low commodity prices pose a significant challenge for hydraulic fracturing services. Reduced oil and gas prices often lead to fewer drilling projects, directly impacting demand for Liberty's services. This decrease in activity can squeeze profit margins, necessitating careful financial planning. Adapting to these fluctuations requires proactive strategies to maintain financial health.

- Oil prices in 2024 have shown volatility, impacting the energy sector's investment decisions.

- Lower prices may lead to a decrease in drilling activities, affecting service demand.

- Companies must monitor price trends and adjust operations accordingly.

- Cost-saving measures are crucial to offset the effects of low commodity prices.

Dogs in Liberty's portfolio include underperforming equipment, services, or locations. These assets show low profitability and drain resources. In 2024, divesting such underperforming segments saw a 15% loss.

| Category | Characteristics | Impact |

|---|---|---|

| Equipment | Older, high maintenance, low efficiency | $15M spent on maintenance in 2024, reducing profitability |

| Services | Concentrated in declining basins | Decreased demand, lower profit margins. |

| Financial Performance | Underperforming assets | 15% loss in 2024. |

Question Marks

Liberty's geothermal expansion presents high growth with uncertainty. Bipartisan support and domestic supply chains are strengths, but the market is small. Successful development requires significant investment. Geothermal's potential for growth is notable, yet it carries considerable risk. In 2024, geothermal capacity increased by 3%, a small fraction compared to hydraulic fracturing’s 15% growth.

Liberty's international ventures, like its 2024 expansion into Australia, represent a "Question Mark" in the BCG matrix. The Australian market offers growth potential, yet faces regulatory and logistical hurdles. In 2023, Australia's GDP growth was 2.1%, indicating a moderate economic climate. Careful planning and investment are crucial for success. A strategic approach helps balance risks and rewards.

The commercial EV charging and data center power solutions market is expanding, driven by electrification and decarbonization. Liberty's moves, like partnering with DC Grid and acquiring IMG Energy Solutions, show its intent. This market is competitive, requiring specialized knowledge and further investment. Strategic alliances and targeted investments are key; the global EV charging market is projected to reach $23.9 billion by 2030.

Carbon Capture and Storage (CCS) Technologies

Investing in Carbon Capture and Storage (CCS) technologies could be a growth opportunity for Liberty, especially with rising environmental regulations and the push for carbon neutrality. CCS is still in early development and requires substantial capital. Government support and partnerships are vital for its economic viability. Strategic CCS investments could position Liberty as a leader in sustainable energy, but significant risks exist.

- Global CCS capacity is projected to reach 270 million tons of CO2 per year by 2024.

- The cost of CCS can range from $60 to $120 per ton of CO2 captured, depending on the technology and location.

- The U.S. government provides tax credits like 45Q, which offers up to $85 per metric ton of CO2 captured and stored.

- Major companies such as ExxonMobil and Chevron are investing billions in CCS projects.

Advanced Materials and Proppants

Advanced materials and proppants present a dynamic area within the Liberty BCG Matrix. Developing and using these materials in hydraulic fracturing could significantly improve efficiency and reduce environmental effects. This area is still evolving, requiring continuous research and development efforts. Successful innovation could offer a competitive edge and boost market expansion.

- Proppant market size was estimated at $4.3 billion in 2023.

- The market is projected to reach $5.5 billion by 2028.

- Investing in R&D and strategic partnerships is key.

- Focus on sustainable and high-performance proppants.

Liberty's ventures in commercial EV charging, CCS, and advanced materials are "Question Marks." These areas show growth potential but face uncertainties, demanding strategic investment.

Success hinges on adapting to market dynamics and leveraging partnerships. Focus on innovation and sustainable practices for long-term value.

| Investment Area | Market Growth (2024) | Challenges |

|---|---|---|

| Commercial EV Charging | Projected $23.9B by 2030 | Competition, tech, and infrastructure. |

| CCS | 270M tons of CO2/yr (global) | High costs: $60-$120/ton, regulation. |

| Advanced Materials | Proppant market: $4.3B in 2023, to $5.5B by 2028 | R&D, sustainability. |

BCG Matrix Data Sources

The Liberty BCG Matrix is informed by company financial reports, industry growth analyses, and expert opinions to offer precise strategic insights.