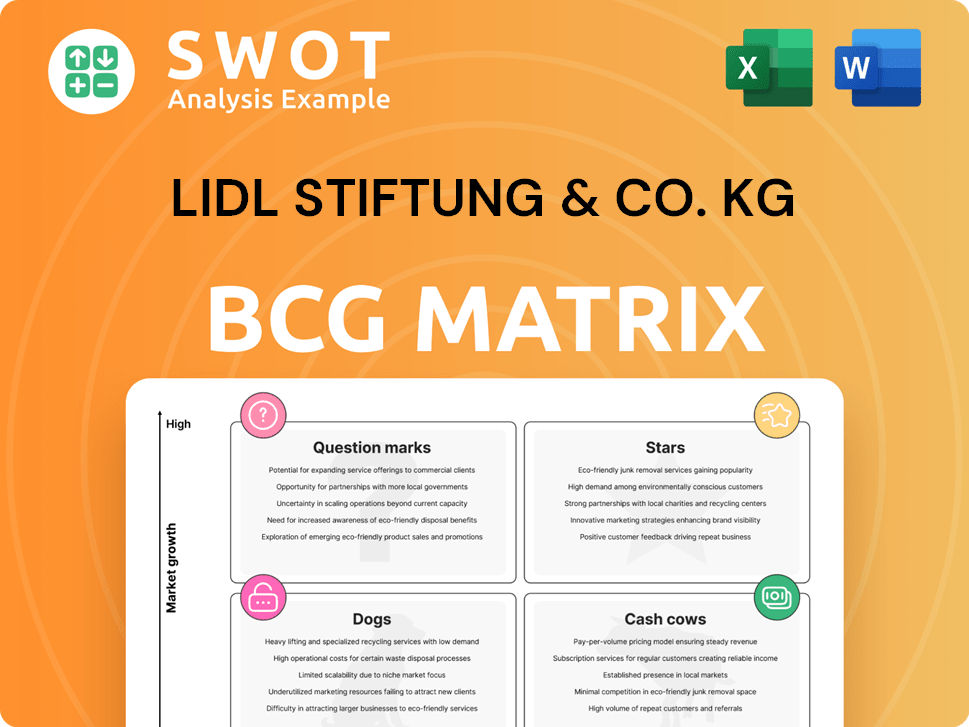

Lidl Stiftung & Co. KG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lidl Stiftung & Co. KG Bundle

What is included in the product

Tailored analysis for Lidl's product portfolio across the BCG Matrix.

Clean, distraction-free view optimized for C-level presentation, enabling focused strategy discussion.

What You See Is What You Get

Lidl Stiftung & Co. KG BCG Matrix

The preview mirrors the actual Lidl Stiftung & Co. KG BCG Matrix report you'll receive post-purchase. It's a fully comprehensive document, without any hidden content or alterations. This is the complete analysis you'll download and can put straight into action.

BCG Matrix Template

Lidl's diverse product range, from groceries to home goods, offers a complex strategic landscape. Understanding the BCG Matrix reveals which items drive profit (Cash Cows) and which need more investment (Stars). Identifying Dogs, those dragging down performance, is crucial. Analyzing Question Marks helps determine promising future investments.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Lidl's international expansion, especially in emerging markets, is a key growth strategy. This focus enables Lidl to access new customer bases and diversify its income. For example, in 2024, Lidl continued to expand its presence in Central and Eastern Europe. The company aims to increase market presence, particularly where it faces local competitors.

Lidl's "Stars" status in its BCG matrix stems from its private-label focus. This strategy allows Lidl to control quality and pricing. Private-label products are priced around 30% lower, boosting customer loyalty. In the latest reports, Lidl's turnover surged by 16.9%, reaching nearly £11 billion, with profits also increasing.

Lidl's sustainability initiatives, like reducing its carbon footprint, resonate with eco-minded shoppers. This boosts Lidl's brand, drawing in more customers. They aim for net-zero by 2050, with new supply chain climate goals. In 2024, Lidl's focus on sustainable sourcing increased, with 80% of its seafood now certified sustainable.

Loyalty Program Growth

Lidl's Loyalty Program, Lidl Plus, is experiencing significant growth. This growth is fueled by personalized discounts and rewards, boosting customer engagement. The app has enhanced footfall, with a 24% increase in users this year. Lidl Plus offers special discounts, product brochures, and an extended returns policy.

- Footfall Increase: 24% rise in Lidl Plus users.

- Rewards: Personalized discounts and rewards.

- App Features: Special discounts, brochures, extended returns.

Adaptability to Consumer Preferences

Lidl's adaptability to consumer preferences is key to its market strategy. They adjust to changing tastes, like the rising demand for organic and plant-based foods. Offering private label products helps Lidl manage costs and quality, providing affordable options. This approach has helped Lidl increase its revenue to €122.3 billion in fiscal year 2023.

- Adaptation to market trends is crucial for Lidl's growth.

- Private labels enable competitive pricing and quality control.

- Budget-conscious shoppers are a primary target.

- Lidl uses diverse channels to connect with consumers.

Lidl's "Stars," driven by its private-label focus, saw turnover surge 16.9% in 2024, reaching nearly £11 billion. This success is fueled by customer loyalty to affordable, quality products. Private-label items priced around 30% lower boost consumer engagement.

| Metric | Value (2024) |

|---|---|

| Turnover Growth | 16.9% |

| Approximate Turnover | £11 billion |

| Private-Label Price Advantage | ~30% lower |

Cash Cows

Lidl's operational efficiency is key. They use streamlined processes and a strong supply chain to keep costs low. This lets them offer lower prices, drawing in budget-conscious shoppers. In 2024, Lidl's focus on efficiency helped them maintain a competitive edge, with sales figures reflecting their success.

Lidl's limited product range, around 2,000 items, enhances buying power and cuts costs. This strategy supports its competitive pricing, differentiating it from supermarkets with roughly 20,000 products. In 2024, Lidl's focus on a curated selection has helped it maintain strong profit margins despite market fluctuations.

Lidl's strategic store layouts are cash cows. Efficient designs and smaller footprints, averaging 10,000-15,000 sq ft, cut costs and streamline shopping. This approach, with wide aisles and a focused product range, boosts operational efficiency. In 2024, Lidl's revenue hit approximately $150 billion, reflecting the success of this model.

Direct Sourcing

Lidl's "Cash Cows," leveraging direct sourcing, are a key element of their success. This approach enables tight control over their supply chain, optimizing costs and ensuring product availability. In 2024, Lidl's direct sourcing strategy contributed significantly to its revenue, which was approximately €122.5 billion. The rail company is focused on the hinterland transport of goods arriving at the Slovenian port of Koper. This strategy boosts affordability, a crucial factor in a competitive market.

- Direct sourcing enhances supply chain control.

- Centralized distribution ensures product availability.

- Lidl's 2024 revenue was around €122.5 billion.

- Focus on affordability remains a key strategy.

Strong Market Position in Europe

Lidl's extensive network in Europe, boasting over 12,000 stores, positions it as a cash cow. This robust infrastructure supports consistent cash generation. The company's presence in over 31 countries ensures diversified revenue streams. Lidl strategically expands in markets with lower penetration.

- Over 12,000 stores across Europe.

- Presence in more than 31 countries.

- Focus on expanding market share.

Lidl's "Cash Cows" benefit from direct sourcing and efficient supply chains, optimizing costs and product availability, contributing significantly to its 2024 revenue. This model, with a focus on affordability, is supported by a wide European store network. In 2024, the revenue was approximately €122.5 billion.

| Feature | Details |

|---|---|

| 2024 Revenue | Approx. €122.5B |

| Store Count | Over 12,000 in Europe |

| Key Strategy | Direct Sourcing |

Dogs

Historically, Lidl's online presence lagged; this limited its e-commerce market capture. In 2021, Lidl's online platform was less developed than many competitors. Their tech strategy prioritized store efficiency, speed, and cost reduction. This focus supported physical expansion over extensive online development.

Lidl's strong private label focus is a strength, but over-reliance could hinder appeal for brand-conscious shoppers. In 2024, private labels made up a significant portion of sales, reaching up to 82% in some categories. Adapting to changing customer preferences for branded items poses a challenge. The increasing share of private labels highlights this strategic consideration.

Lidl faces intense competition in the discount retail sector. Competitors like Aldi, Tesco, and Carrefour aggressively pursue market share. This crowded market can trigger price wars, squeezing Lidl's profit margins. In 2024, the retail sector saw a 2.8% average profit margin, highlighting the pressure.

Economic Fluctuations

Economic downturns can curb consumer spending on non-essential items, affecting Lidl's sales and profitability. During economic uncertainty, consumers might cut back on discretionary purchases, potentially hitting Lidl's revenue. This could lead to decreased demand for certain products, impacting overall financial performance. In 2023, the Eurozone's inflation rate was around 5.4%, influencing consumer behavior.

- Impact on Sales: Economic downturns can lead to a decline in sales volume.

- Profitability Concerns: Reduced sales can squeeze profit margins.

- Consumer Behavior: Shifts toward essential goods and away from non-essentials.

- Market Dynamics: Increased price sensitivity and competition.

Supply Chain Disruptions

Lidl, heavily reliant on its supply chain, faces risks from disruptions impacting cost and availability. Geopolitical issues and events like the 2021 Suez Canal blockage, which cost global trade billions, can severely affect Lidl. This vulnerability is amplified by the emphasis on private-label goods. Disruptions lead to higher expenses and potential customer dissatisfaction.

- Supply chain disruptions can lead to 10-15% increase in product costs.

- Geopolitical tensions can cause a 20-30% delay in product deliveries.

- Customer dissatisfaction can rise by 25% during shortages.

- Lidl's reliance on private-label products increases vulnerability.

Dogs represent products with low market share in a high-growth market. These items require significant investment to gain traction. Their profitability is uncertain, demanding careful resource allocation.

| Characteristic | Implication | Financial Data |

|---|---|---|

| Market Share | Low | <5% of market sales |

| Growth Rate | High | >10% annual growth |

| Investment Needs | Significant | High marketing costs |

Question Marks

New product launches, particularly in response to changing consumer trends like vegan and organic options, position Lidl as a question mark in the BCG matrix with high growth potential. Lidl's expansion into plant-based products reflects this strategy. In 2024, Lidl's sales increased, with a notable rise in demand for sustainable and organic products.

Expansion into new geographic markets, such as further expansion in the US or emerging economies, carries high growth potential but also uncertainty for Lidl. The company is cautiously accelerating its international market expansion. Lidl is trying to increase its market presence, especially where market penetration is low, and it competes with strong local retailers. In 2024, Lidl's US expansion saw the opening of new stores, aiming for a larger footprint. This strategy reflects a focus on markets with growth potential, balancing it with risk management.

Lidl's tech investments, like energy-efficient chillers, are question marks. These aim for high returns via efficiency gains. With no UK e-commerce, focus is on stores. In 2024, Lidl invested heavily in its store upgrades.

Partnerships and Collaborations

Lidl's strategic partnerships, like the one with WWF, are key for growth, especially in sustainability. This collaboration, active in 31 countries, focuses on climate and nature-based financing. The partnership aims to address Lidl's remaining emissions. These collaborations enhance Lidl's brand image and operational efficiency.

- WWF and Lidl International launched a five-year Sustainable Business Partnership in 2024.

- The partnership operates across 31 countries, demonstrating a broad reach.

- It focuses on developing climate and nature-based financing strategies.

Innovative Store Formats

Lidl's experimentation with innovative store formats, like smaller urban stores and specialized concepts, is a strategic move. This approach allows Lidl to target different customer segments effectively. These formats, such as the smaller stores with a focus on food and convenience, cater to the evolving needs of consumers. This flexibility is key in today's market. For example, Lidl's expansion in the UK has shown this strategy in action.

- Smaller urban stores focus on convenience, with freshly baked goods and snacks.

- This caters to consumers prioritizing quick shopping experiences.

- These formats help adapt to varied consumer preferences.

- Lidl's UK expansion demonstrates this strategy.

Lidl's innovations and market entries, like new vegan options and US expansion, are "question marks" due to high growth potential and uncertainty. Tech investments, such as energy-efficient chillers, also fall in this category. Strategic partnerships like the WWF collaboration boost growth.

| Category | Example | Impact |

|---|---|---|

| Product Innovation | Vegan/Organic Products | Increased sales in 2024. |

| Market Expansion | US market entry | New store openings in 2024. |

| Strategic Partnerships | WWF collaboration | Partnership active in 31 countries in 2024. |

BCG Matrix Data Sources

The BCG Matrix for Lidl utilizes financial reports, market analyses, and industry benchmarks. This data drives the strategic classifications.