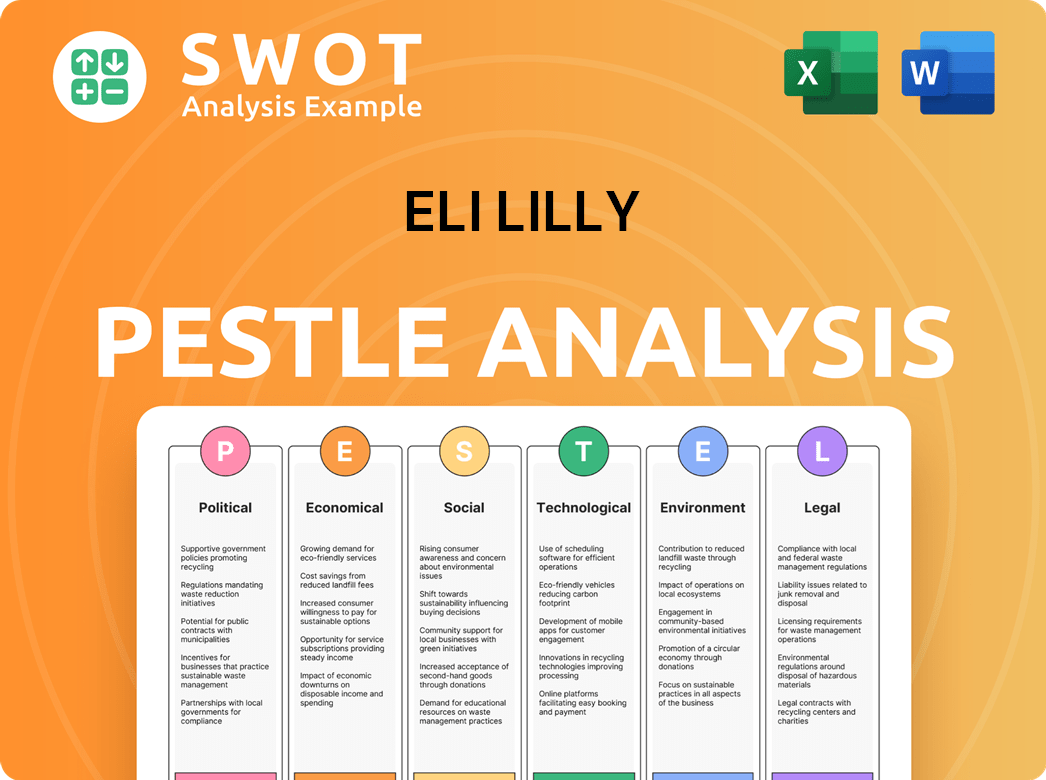

Eli Lilly PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eli Lilly Bundle

What is included in the product

It dissects external factors influencing Eli Lilly across political, economic, social, technological, environmental, and legal landscapes.

Allows users to modify the analysis to adapt the data based on real-world scenarios.

Preview Before You Purchase

Eli Lilly PESTLE Analysis

The content displayed here represents the full Eli Lilly PESTLE Analysis document. This detailed overview is professionally crafted. Upon purchase, you'll instantly receive this file—fully prepared. Expect to get the same insightful and comprehensive analysis you see here.

PESTLE Analysis Template

Analyze Eli Lilly's external environment! This concise PESTLE overview highlights key trends. Political changes, economic factors, and social shifts are all examined. Gain insights into regulatory landscapes and technological advancements impacting the company. Understand competitive pressures. Access the full PESTLE analysis now and gain an advantage.

Political factors

Governments globally push for lower drug prices. The U.S. Inflation Reduction Act (IRA) is a prime example. The IRA allows Medicare drug price negotiations. This could reduce Eli Lilly's revenue. In 2024, the IRA's impact is becoming increasingly visible.

Changes in political leadership and healthcare policies significantly affect Eli Lilly. The U.S. political landscape introduces uncertainty, especially regarding drug pricing and vaccine policies. For instance, the Inflation Reduction Act of 2022 is projected to influence drug prices. Healthcare policy shifts can impact Eli Lilly's market access and profitability. These changes necessitate strategic adaptability for the company.

Political relationships and trade agreements significantly impact Eli Lilly's market access. The company must navigate diverse regulatory environments and potential trade barriers. For example, in 2024, the US-China trade tensions could affect drug pricing and distribution. International trade accounted for approximately 40% of Eli Lilly's revenue in 2024, highlighting the importance of stable political relations for its global operations.

Government Funding for Research and Development

Government funding significantly impacts the pharmaceutical industry, including Eli Lilly, by accelerating research and development. Changes in funding levels or priorities can affect the speed of drug discovery and innovation. In 2024, the National Institutes of Health (NIH) received approximately $47.1 billion, supporting various biomedical research projects. This funding benefits the entire industry.

- NIH's budget for 2024 was around $47.1 billion.

- Government funding supports drug discovery efforts.

- Funding changes can influence R&D timelines.

Geopolitical Events and Supply Chain Security

Geopolitical instability poses significant risks to pharmaceutical supply chains. Events like the Russia-Ukraine conflict have highlighted vulnerabilities, leading to increased scrutiny. Companies like Eli Lilly are responding by fortifying domestic manufacturing and diversifying their sourcing networks. This strategic shift aims to ensure resilience against future disruptions.

- In 2024, the pharmaceutical industry saw a 15% increase in supply chain disruptions due to geopolitical events.

- Eli Lilly has invested $1 billion in domestic manufacturing facilities to enhance supply chain security.

- Diversification efforts include sourcing from at least three different regions for key raw materials.

Political factors significantly impact Eli Lilly, with government policies affecting drug prices. The Inflation Reduction Act of 2022 continues to reshape market dynamics in 2024 and beyond. Political stability and international trade relations are critical for market access.

| Political Factor | Impact on Eli Lilly | Data (2024-2025) |

|---|---|---|

| Drug Pricing Regulations | Potential revenue reduction, especially in the U.S. | IRA impact on Medicare price negotiations. |

| Healthcare Policies | Influence on market access & profitability | Policy shifts that necessitate strategic adaptation. |

| Trade Agreements | Impact on global market access and sales | Approximately 40% of Eli Lilly's revenue comes from international sales. |

Economic factors

Global economic growth significantly shapes healthcare expenditure. The global pharmaceutical market is projected to reach approximately $1.7 trillion by 2025. This growth indicates a positive economic outlook for the industry. Unforeseen global economic shifts can impact these projections.

Eli Lilly confronts persistent pricing pressures from payers, especially in the U.S. where complex reimbursement rules and healthcare consolidation are significant. For example, in 2024, the average net price decline for branded drugs was around 3.5%, highlighting these challenges. These factors potentially affect profitability and market access for new medications.

Inflation poses a significant challenge, increasing Eli Lilly's costs. Raw materials, manufacturing, and operational expenses are all affected. In Q1 2024, the company reported a slight increase in COGS. Managing these costs is crucial for maintaining profitability amidst pricing pressures. Specifically, the pharmaceutical industry is facing headwinds, with inflation impacting the cost of goods sold.

Currency Exchange Rate Fluctuations

Eli Lilly, operating globally, faces currency exchange rate fluctuations affecting financial results. These fluctuations impact reported revenues and profitability as foreign earnings are converted. For example, in 2024, a stronger US dollar could reduce the value of international sales when translated. The company actively manages these risks.

- Currency fluctuations can significantly alter reported financial performance.

- Hedging strategies are used to mitigate currency risks.

- International sales contribution varies with exchange rates.

Market Demand for Specific Therapies

Market demand for specific therapies heavily influences Eli Lilly's financial performance. The strong demand for GLP-1 drugs, particularly for diabetes and obesity treatments, fuels substantial revenue growth. Notably, Mounjaro and Zepbound have become significant economic drivers for the company. This demand is reflected in the company's robust sales figures.

- Mounjaro sales in 2024: $2.5 billion.

- Zepbound sales in Q1 2024: $517.4 million.

- Global obesity drug market forecast: $100 billion by 2030.

Economic factors significantly influence Eli Lilly. Pricing pressures and inflation pose ongoing challenges, with a reported 3.5% decline in branded drug prices in 2024. Currency fluctuations impact reported financials, requiring hedging strategies. Strong demand for GLP-1 drugs boosts revenue.

| Metric | Impact | Data |

|---|---|---|

| Pricing Pressure | Challenges profitability | Avg. price decline for branded drugs in 2024: 3.5% |

| Inflation | Increases costs | Impacted COGS in Q1 2024 |

| Currency Fluctuations | Alters financials | Strong USD can reduce international sales value. |

Sociological factors

An aging global population fuels the rise of chronic diseases. This demographic trend boosts demand for pharmaceuticals. Eli Lilly capitalizes on this, with diabetes treatments generating $8.4 billion in 2023. The neuroscience sector offers further growth potential, aligning with the aging population's needs.

Public perception significantly influences Eli Lilly's success. Concerns about drug pricing, safety, and ethical behavior directly affect consumer trust and sales. In 2024, negative perceptions, fueled by high prices, led to decreased brand trust. Building and maintaining trust is a continuous effort for pharmaceutical firms. Data indicates that public trust in pharmaceutical companies has fluctuated, with recent surveys showing a decline in some areas.

Changing lifestyles significantly affect health, boosting demand for drugs. Obesity, fueled by trends, is a growing concern globally. The World Obesity Atlas 2024 predicts over 1.9 billion adults will be obese by 2035. This societal impact drives the need for treatments, increasing Eli Lilly's market.

Patient Engagement and Personalized Medicine

Patient engagement and personalized medicine are increasingly vital. Eli Lilly recognizes this shift, focusing on patient-centric care. They are using digital tools to enhance patient involvement. This approach helps tailor treatments, as seen in their oncology and diabetes programs. In 2024, the personalized medicine market was valued at over $300 billion, showing its importance.

- Digital health market projected to reach $600 billion by 2025.

- Eli Lilly's R&D budget for 2024 was approximately $9 billion, reflecting investment in these areas.

- Personalized medicine is expected to grow by 10-15% annually through 2025.

Health Awareness and Education

Growing health awareness, fueled by digital platforms, shapes patient expectations and medication demand. Eli Lilly uses digital marketing and social media for health education, reaching a broad audience. Increased health literacy impacts treatment choices and adherence. The global digital health market is projected to reach $660 billion by 2025.

- Digital health market expected at $660B by 2025.

- Social media used for health education.

- Patient expectations influence demand.

Societal factors like aging and lifestyle shifts boost drug demand. Public perception impacts sales; high prices led to trust decline in 2024. Patient-centric care and digital health are vital for Eli Lilly's growth.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Aging Population | Increased demand for chronic disease treatments | Diabetes drug sales: $8.4B (2023) |

| Public Perception | Affects trust, sales | Decline in brand trust (2024) due to pricing |

| Digital Health | Shapes patient behavior, growth | Market expected at $660B (2025) |

Technological factors

Eli Lilly benefits from rapid tech advancements. AI, machine learning, and gene editing speed up drug discovery. These tools cut costs and enable personalized treatments. In 2024, Lilly invested heavily in R&D, with over $9 billion allocated, reflecting its commitment to these technologies.

Eli Lilly is navigating the digital transformation in healthcare, which includes telemedicine and wearable devices, significantly altering patient care. The global digital health market is projected to reach $660 billion by 2025. This offers opportunities for improved data utilization and personalized medicine approaches. The company is investing in digital tools to enhance clinical trials and patient engagement. Data analytics are crucial for monitoring drug efficacy and patient outcomes.

Technological advancements in manufacturing, such as smart manufacturing and automation, are key for increasing production capacity and efficiency. Eli Lilly is significantly investing in expanding its manufacturing capabilities to meet the high demand for its products. This includes investments in advanced technologies to streamline processes. For example, in 2024, the company allocated billions towards manufacturing expansions. This aims to support the production of its innovative medicines.

Data Analytics and Real-World Evidence

Eli Lilly heavily invests in data analytics and real-world evidence (RWE) to improve drug development and understand product performance. This data-driven approach offers a significant competitive edge in the pharmaceutical industry. Leveraging big data helps in identifying new drug targets and optimizing clinical trial designs. The focus on RWE is growing, with the global RWE market projected to reach $2.7 billion by 2025.

- 2024: Eli Lilly's R&D spending reached $8.5 billion.

- 2025 Projection: RWE market to hit $2.7 billion.

- Data analytics aids in personalized medicine.

- Improves clinical trial efficiency.

Supply Chain Technology and Traceability

Eli Lilly is leveraging technology, including blockchain, to enhance its supply chain. This improves the tracking of pharmaceutical products, ensuring authenticity and reducing counterfeiting. The global blockchain in the pharmaceutical market is projected to reach $1.8 billion by 2025. This also boosts supply chain resilience.

- Blockchain technology use in pharma is expected to grow significantly by 2025.

- Supply chain visibility is crucial for regulatory compliance and patient safety.

- Traceability helps in quickly identifying and addressing supply chain disruptions.

Eli Lilly employs tech to boost drug discovery via AI & gene editing. They invested $9B in R&D in 2024. Digital healthcare, like telemedicine, is key, aiming at a $660B market by 2025.

| Aspect | Details | 2024 Data |

|---|---|---|

| R&D Investment | Focus on new technologies | $8.5B |

| Digital Health Market (Projection) | Growth of telehealth | $660B by 2025 |

| RWE Market (Projection) | Focus on drug performance | $2.7B by 2025 |

Legal factors

Pharmaceutical companies like Eli Lilly face rigorous drug approval processes, manufacturing standards, and marketing rules. Compliance with these global regulations is crucial for market entry and operations. In 2024, the FDA approved 43 new drugs, reflecting the stringent oversight. Failure to adhere can lead to significant financial penalties and reputational damage. Eli Lilly's success hinges on effectively navigating these complex regulatory landscapes worldwide.

Patent protection is vital for Eli Lilly to safeguard its innovative drugs and maintain a competitive edge. The company actively manages its patent portfolio to extend exclusivity and fend off generic competition. In 2024, Eli Lilly invested approximately $9 billion in R&D, highlighting the importance of protecting these investments through intellectual property rights. Legal battles over patent infringements are common in the pharmaceutical industry, requiring constant vigilance and significant legal resources.

Drug pricing legislation, like the Inflation Reduction Act, significantly affects Eli Lilly. The IRA allows Medicare to negotiate drug prices, impacting revenue. For example, Lilly's Trulicity saw sales of $6.9 billion in 2023. These policies pose legal and political challenges, requiring strategic adaptation. Lilly faces increased price pressures and potential revenue reductions due to these changes.

Product Liability and Litigation Risks

Eli Lilly, like other pharmaceutical giants, confronts product liability and litigation risks. These risks stem from potential lawsuits related to the side effects of their medications. Managing these risks involves strong legal strategies and financial provisions. In 2023, the pharmaceutical industry allocated billions to cover litigation expenses.

- Product liability claims can significantly impact a company's financial performance.

- Legal strategies include rigorous clinical trials and post-market surveillance.

- Financial reserves are crucial for covering potential settlements or judgments.

- Recent data shows a rise in lawsuits related to certain drug classes.

Data Privacy and Security Regulations

Data privacy and security regulations are critical for Eli Lilly, especially with its extensive use of patient data. Compliance with regulations like HIPAA is essential to safeguard sensitive patient information. In 2024, the global healthcare cybersecurity market was valued at $12.6 billion, reflecting the importance of data protection. Non-compliance can lead to significant fines and reputational damage, impacting investor confidence.

- HIPAA compliance is crucial for protecting patient data.

- The healthcare cybersecurity market was worth $12.6B in 2024.

- Non-compliance can result in heavy financial penalties.

Legal factors significantly affect Eli Lilly's operations, including stringent drug regulations and approval processes impacting market entry and compliance. Patent protection is critical; Eli Lilly invests billions in R&D, needing legal strategies to defend its innovations from competition.

Drug pricing legislation, like the IRA, presents legal and financial challenges through Medicare price negotiations impacting revenue; for example, in 2023, Lilly's Trulicity sales reached $6.9 billion. Data privacy and product liability further contribute to significant legal risk; in 2024, the healthcare cybersecurity market was worth $12.6 billion.

| Legal Factor | Impact on Eli Lilly | Relevant Data (2024) |

|---|---|---|

| Drug Regulations | Compliance & Market Entry | FDA Approved 43 new drugs |

| Patent Protection | Innovation & Competition | ~$9B R&D Investment |

| Drug Pricing | Revenue & Strategy | Trulicity Sales: $6.9B (2023) |

| Data Privacy | Reputation & Finance | Cybersecurity Market: $12.6B |

Environmental factors

Eli Lilly is increasingly focused on sustainable manufacturing. They aim to reduce environmental impact, energy, and water use, and adopt renewables. In 2024, the company invested $75 million in renewable energy projects. Lilly has set targets to cut emissions by 42% by 2030.

Eli Lilly faces stringent regulations for pharmaceutical waste. In 2024, the global pharmaceutical waste market was valued at $8.5 billion. Proper disposal is crucial to prevent soil and water contamination. The company's waste management strategies must comply with environmental laws. They must also reduce their carbon footprint.

The pharmaceutical supply chain significantly impacts the environment, especially through transportation and logistics. Eli Lilly is actively working to reduce its carbon footprint. For example, in 2024, the company aimed to reduce its emissions by 42% from a 2019 baseline. This involves optimizing logistics and adopting energy-efficient solutions.

Water Usage and Wastewater Discharge

Water usage and wastewater management are critical for Eli Lilly. The pharmaceutical industry is under scrutiny regarding its environmental impact. Effective water management is essential for sustainable operations. Water-related risks can affect production and compliance.

- In 2024, Eli Lilly reported a focus on reducing water consumption across its manufacturing sites.

- The company invests in wastewater treatment technologies.

- Compliance with stringent environmental regulations is a priority.

Climate Change and Environmental Regulations

Climate change and environmental regulations are becoming increasingly important. Governments worldwide are implementing new rules for businesses to lower their carbon emissions and focus on sustainability. The European Green Deal, for example, sets environmental standards that influence business practices. This means Eli Lilly must adjust its operations to meet these changing expectations.

- In 2024, the pharmaceutical industry faced stricter environmental scrutiny.

- The European Green Deal targets a 55% reduction in emissions by 2030.

- Companies are investing in sustainable practices to comply with regulations.

Environmental factors are crucial for Eli Lilly, influencing its operations and strategy. The company emphasizes sustainable manufacturing, aiming to cut emissions by 42% by 2030, showcasing its commitment to environmental responsibility.

Pharmaceutical waste disposal and water management are key concerns, driven by stringent regulations. Effective waste management, including investments in wastewater treatment technologies, ensures regulatory compliance and operational sustainability.

Climate change and environmental regulations are vital, compelling companies like Eli Lilly to adopt sustainable practices. The European Green Deal targets significant emissions reductions, which drives investment in green initiatives to meet global environmental standards.

| Environmental Aspect | Eli Lilly Initiatives | Data/Facts |

|---|---|---|

| Sustainable Manufacturing | Investing in renewables, reducing emissions | $75M invested in renewable projects (2024), 42% emissions reduction target by 2030 |

| Waste Management | Ensuring proper pharmaceutical waste disposal | Global pharma waste market: $8.5B (2024), complying with disposal regulations |

| Water Management | Reducing water consumption & wastewater treatment | Focus on decreasing water use across manufacturing, investment in wastewater tech |

PESTLE Analysis Data Sources

Eli Lilly's PESTLE is based on IMF, World Bank, OECD data and credible industry reports. Political, economic & more factors use current, fact-based insights.