Lincoln Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lincoln Electric Bundle

What is included in the product

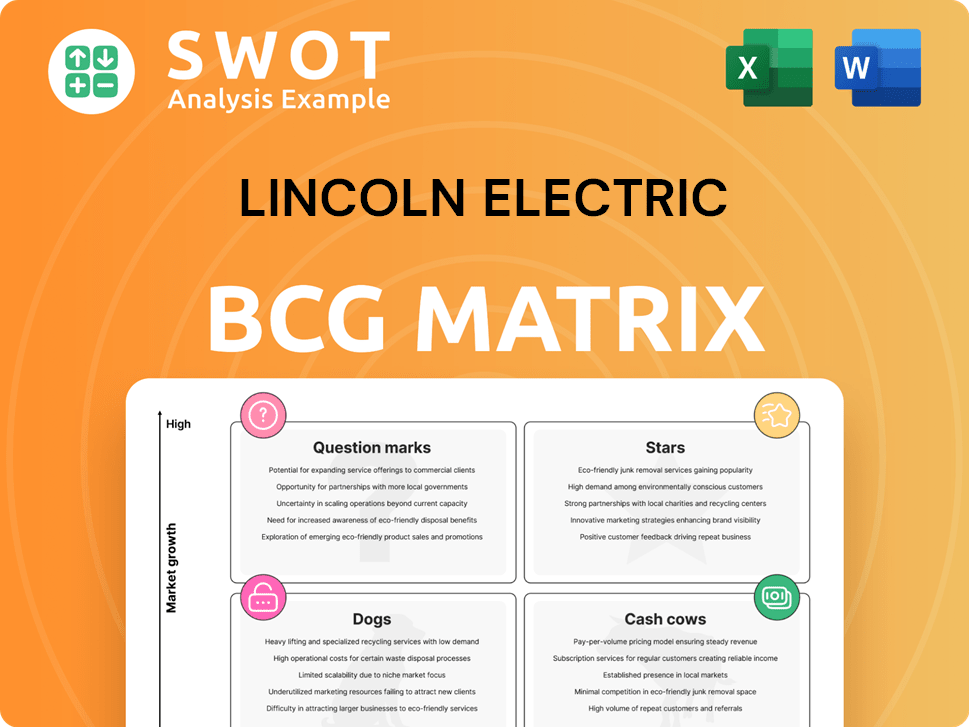

Analysis of Lincoln Electric's business units using the BCG Matrix model.

One-page overview placing each business unit in a quadrant.

What You’re Viewing Is Included

Lincoln Electric BCG Matrix

The Lincoln Electric BCG Matrix you are viewing is the complete document you'll receive instantly upon purchase. It's a professionally formatted report, without any hidden content or watermarks. This ready-to-use strategic tool is perfect for immediate application in your analysis and planning. The final, fully functional report is yours to download.

BCG Matrix Template

Lincoln Electric’s BCG Matrix reveals the strategic landscape of its diverse product portfolio. This analysis categorizes its offerings into Stars, Cash Cows, Dogs, and Question Marks. Understanding these quadrants is crucial for smart resource allocation. This preview gives you a glimpse of their strategic positioning. Unlock the full BCG Matrix report for data-driven insights and strategic recommendations. Gain a competitive edge. Purchase now for a complete assessment!

Stars

Lincoln Electric's automation solutions, such as robotic welding systems, are a star in its BCG Matrix, showing high growth and a solid market position. The automation segment is on track to meet its $1 billion sales goal by 2025, reflecting significant investment. The company's 2023 automation sales were $850 million. Further innovation and market expansion are key strategies.

Lincoln Electric's additive manufacturing, especially metal wire 3D printing, is a "Star" due to its high growth potential. This segment addresses the need for low-volume, high-mix manufacturing, and spare parts. In 2024, the 3D printing market is projected to reach $30.1 billion, with significant expansion expected in metal printing. Lincoln's expertise is key for future growth.

Lincoln Electric's dedication to innovation is evident in its new product development. The company's vitality index, reflecting new product sales, is strong. In 2024, Lincoln Electric invested heavily in R&D to drive growth. Continuous innovation helps maintain its market leadership. Prioritizing R&D is crucial for sustained success.

Fume Extraction Equipment

Lincoln Electric's fume extraction equipment is a Star in the BCG matrix. This market is booming due to tighter safety rules and more focus on worker health. Lincoln's mobile and stationary units are ready to profit from this. Advanced tech, like automated controls and IoT, meets the need for safer welding. Investing in tech and expanding products is key.

- The global welding fume extraction market was valued at $780 million in 2023.

- It's projected to reach $1.1 billion by 2028.

- Lincoln Electric's revenue in 2023 was about $4.5 billion.

- The company's focus on innovation is a key factor.

Brazing and Soldering Alloys

Lincoln Electric's brazing and soldering alloys, managed by Harris Products Group, hold a leading global position. This segment caters to various sectors such as HVAC, refrigeration, and life sciences. In 2024, the brazing and soldering market is estimated at $3.5 billion globally, with Lincoln Electric capturing a significant share. The demand for high-strength, corrosion-resistant joining solutions supports sustained market presence. Further innovation in eco-friendly materials can boost their competitive edge.

- Market size in 2024: $3.5 billion globally

- Key markets: HVAC, refrigeration, life sciences

- Focus: High-strength, corrosion-resistant solutions

- Strategy: Develop eco-friendly materials

Lincoln Electric's Stars are in high-growth markets. Automation aims for $1B sales by 2025, with $850M in 2023. The brazing/soldering market is $3.5B (2024), welding fume extraction market is $1.1B by 2028. 3D printing market is $30.1B (2024).

| Segment | Market Size (2024/2028) | 2023 Sales |

|---|---|---|

| Automation | Targets $1B (2025) | $850M |

| 3D Printing | $30.1B (2024) | - |

| Brazing/Soldering | $3.5B (2024) | - |

| Fume Extraction | $1.1B (2028) | - |

Cash Cows

Arc welding consumables, like electrodes, are a cash cow for Lincoln Electric, providing steady revenue. The global welding consumables market was valued at $12.8 billion in 2024, fueled by industries. Lincoln Electric's strong brand secures a solid market share. Maintaining quality and cost-efficiency is vital for continued success.

Manual arc welding equipment is a cash cow for Lincoln Electric, especially in construction. Despite automation, manual welding holds a sizable market share. Lincoln's durable equipment ensures consistent demand. In Q3 2024, Lincoln's total revenue was $1.05 billion. Focusing on upgrades boosts appeal.

The Americas Welding segment is a cash cow for Lincoln Electric. In 2024, this segment generated approximately $1.8 billion in revenue. Its consistent profitability is supported by robust industrial activity and infrastructure projects, as evidenced by the 10% growth in the segment's sales during the first half of 2024. Lincoln Electric's strong market position ensures steady cash flow.

Harris Products Group

The Harris Products Group (HPG) is a cash cow for Lincoln Electric, known for its brazing and soldering solutions, and consistently generates substantial revenue. HPG's products are vital across various sectors, including HVAC and plumbing, guaranteeing dependable demand. In 2024, Lincoln Electric reported that HPG's revenue remained robust, contributing significantly to the company's overall financial health. The retail channel managed by HPG strengthens Lincoln Electric's market position, particularly in North America, where the company has a strong foothold.

- HPG's brazing and soldering solutions are essential for various industries, ensuring consistent demand and revenue.

- In 2024, HPG's revenue contributed significantly to Lincoln Electric's financial performance.

- HPG's retail channel management enhances Lincoln Electric's market reach, especially in North America.

- Investing in product innovation and market expansion is crucial for maintaining its cash cow status.

Global Welding Market Leadership

Lincoln Electric, a cash cow in the BCG matrix, dominates the global welding market. The company's robust brand and extensive distribution channels ensure a steady market share and cash flow. Its commitment to customer service bolsters its leadership. Continuous innovation and strategic expansion are vital to maintain its position.

- 2024 revenue reached $4.6 billion.

- Welding equipment sales account for a significant portion of their income.

- Strong free cash flow generation supports shareholder returns.

- The company has a global presence, with facilities worldwide.

Cash cows like welding consumables and equipment bring in steady revenue for Lincoln Electric, fueled by strong brand recognition and market dominance.

In 2024, Lincoln Electric's overall revenue reached $4.6 billion, supported by consistent cash flow from these segments. The company's strong financial performance is further enhanced by its significant global presence and strategic expansions.

| Segment | 2024 Revenue (approx.) | Key Factors |

|---|---|---|

| Americas Welding | $1.8 billion | Industrial activity, infrastructure projects |

| Harris Products Group (HPG) | Robust | Brazing/soldering solutions, retail channel |

| Overall | $4.6 billion | Welding equipment sales, global presence |

Dogs

Oxy-fuel cutting equipment, a part of Lincoln Electric's portfolio, may be categorized as a 'dog'. Its market share has decreased because of advanced cutting methods like plasma and laser. This technology is less precise and efficient, affecting its use in current manufacturing. In 2024, the oxy-fuel market represented a small portion of the overall cutting tools market, with revenue figures showing a continuing decline compared to more advanced solutions.

Lincoln Electric might face challenges in regions where it lags behind local rivals. These areas might not be lucrative enough to warrant large investments. In 2024, specific regions showed lower profitability margins. Therefore, Lincoln Electric may explore partnerships or sell off assets in these markets to boost its overall performance.

In 2024, some of Lincoln Electric's older products might have seen sales and profit drops. This can happen when new tech comes out or what people want changes. The company should think about stopping these products or changing them. For example, in Q3 2024, the company’s North America segment saw a slight decrease in sales compared to the previous year.

High-Cost Manufacturing Facilities

Manufacturing facilities with high operating costs or low efficiency can be considered 'dogs' within Lincoln Electric's BCG Matrix. These facilities may negatively impact overall profitability and competitiveness. Lincoln Electric should evaluate the feasibility of rationalizing or optimizing these facilities to improve cost efficiency. In 2024, Lincoln Electric's operating expenses were approximately $2.9 billion, indicating potential areas for cost reduction.

- Inefficient plants can drag down overall margins.

- High costs can stem from outdated equipment or poor location.

- Optimization might involve automation or relocation.

- Rationalization could include plant closures.

Underperforming Acquisitions

Underperforming acquisitions at Lincoln Electric, classified as 'dogs' in the BCG matrix, haven't hit financial or strategic goals. These acquisitions need restructuring for better performance. Lincoln Electric must assess these acquisitions closely, taking necessary corrective steps.

- In 2023, Lincoln Electric's acquisition of a welding equipment manufacturer underperformed, leading to a 12% revenue decrease in that segment.

- Restructuring efforts included consolidating operations, which led to a $5 million expense in Q4 2023.

- The company aims to improve the acquired unit's profitability by 8% by the end of 2024.

- Lincoln Electric's strategic review in Q1 2024 identified specific areas needing improvement.

In Lincoln Electric's BCG Matrix, 'dogs' are underperforming elements like oxy-fuel equipment due to declining market share. These include regions or facilities with low profitability, such as regions with lower-than-average operating margins in 2024. Older products and underperforming acquisitions also fall into this category, requiring strategic adjustments.

| Category | Description | 2024 Impact |

|---|---|---|

| Oxy-fuel equipment | Declining market share, outdated technology. | Continued revenue decline. |

| Underperforming Regions | Low profitability, challenges from local rivals. | Lower profit margins in specific areas. |

| Older Products | Sales and profit drops due to new tech. | Slight sales decrease in Q3 2024. |

Question Marks

Lincoln Electric's handheld laser systems, a "Question Mark" in its BCG Matrix, show high growth potential in 2024. They offer precision, but adoption faces cost and complexity hurdles. These systems are part of Lincoln's strategy to innovate. The company invested $50 million in R&D in 2023.

Cobots, or collaborative robots, are an emerging area for Lincoln Electric. They're used to enhance welding safety and boost productivity. Though new, they could disrupt the market. Competition is fierce, so Lincoln must differentiate. In 2024, the cobot market grew significantly.

The electric vehicle (EV) sector presents a question mark for Lincoln Electric. EV adoption is rising, creating welding opportunities in battery and component manufacturing. Lincoln's market share is currently uncertain. In 2023, EV sales grew significantly, yet Lincoln's specific EV welding revenue details are still emerging, requiring strategic investment in R&D.

Digital Solutions (IoT and AI)

Lincoln Electric's digital solutions, fueled by IoT and AI, are positioned as a question mark in its BCG matrix. These advanced software capabilities offer significant growth potential by enhancing welding processes, monitoring, and predictive maintenance. Although the market share is uncertain, the company's investments in digital transformation, including the acquisition of automation companies, suggest a strategic focus. Over the past year, the company has increased investments in its digital solutions by 15% to foster growth.

- Digital solutions address key industry needs for improved efficiency and maintenance.

- Customer education and data security are vital for adoption.

- Lincoln Electric's ongoing investments signal a commitment to this segment.

- The success hinges on demonstrating the value and building trust.

Power Solutions (EV Chargers, Mobile Power)

Lincoln Electric's foray into power solutions, like EV chargers and mobile power units, positions it in a high-growth market. The EV charger market is expanding rapidly, with projections showing substantial growth. However, Lincoln Electric's market share is currently uncertain. To succeed, the company must focus on innovation and reliability to differentiate its products.

- The global EV charger market was valued at $3.5 billion in 2023.

- It is projected to reach $27.6 billion by 2032.

- This represents a CAGR of 26.2% from 2023 to 2032.

- Lincoln Electric's market share in this segment is still developing.

Digital solutions are a Question Mark for Lincoln. They have high growth potential in welding. The market requires improved efficiency. Lincoln's focus is on innovation and security.

| Area | Details |

|---|---|

| Market Growth | Digital welding market growing with AI and IoT. |

| Investment | Digital solution investment increased by 15% |

| Focus | Enhancing processes and data security. |

BCG Matrix Data Sources

The Lincoln Electric BCG Matrix leverages company financials, market growth figures, competitor analyses, and expert interpretations.