Linde Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Linde Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clearly visualize growth strategies with a single glance, freeing you from complex data analysis.

What You See Is What You Get

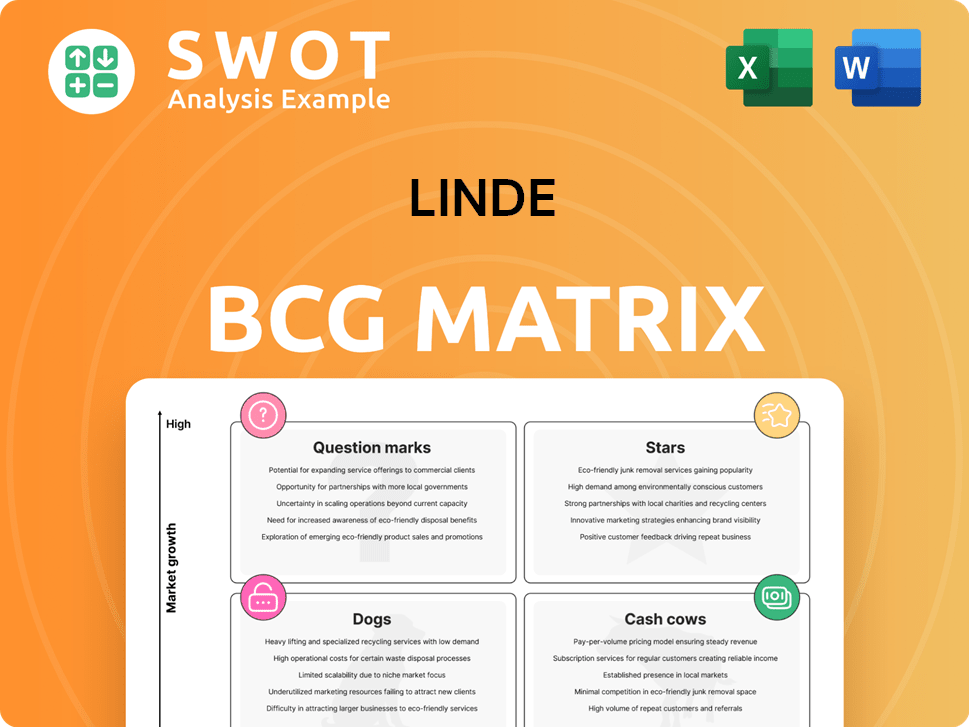

Linde BCG Matrix

The Linde BCG Matrix preview showcases the complete document you'll receive immediately after purchase. It's a fully realized report—no incomplete sections or hidden content—ready for strategic decision-making.

BCG Matrix Template

The BCG Matrix is a powerful tool for analyzing a company's product portfolio. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks. This framework helps businesses prioritize resource allocation. By understanding where each product sits, companies can make informed decisions. Strategic adjustments for growth or divestment become clear. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Linde's financial prowess shines, boasting a 25.9% ROC and a 29.5% operating margin in 2024, excluding currency impacts. This solid performance is a hallmark of its "Stars" status within the BCG matrix. The company's operating cash flow hit $9.4 billion in 2024. This fuels expansion and shareholder rewards.

Linde shines as a leader in industrial gases. It has a strong hold in the market. Engineering skills back its diverse gas offerings. In 2024, Linde's revenue hit $33.5 billion. This solidifies its market dominance.

Linde shines as a Star in the BCG Matrix due to its clean energy focus. The company invests heavily in clean hydrogen and carbon capture. Its clean hydrogen projects, like the Dow Path2Zero deal, fuel growth. Linde's revenue in Q4 2023 was $8.2 billion, showing strong performance.

Extensive Global Network

Linde's global network is a major strength, offering a competitive edge through its extensive reach. This allows Linde to serve diverse industries and locations efficiently. Its infrastructure fosters customer loyalty and supports economies of scale, boosting operational effectiveness. In 2024, Linde's global revenue was approximately $33 billion.

- Global Presence: Linde operates in over 200 countries.

- Market Share: Linde holds a leading market share in several key industrial gas markets.

- Infrastructure: Linde has a vast network of production and distribution facilities.

- Customer Base: Serves millions of customers worldwide.

Technological Innovation

Linde's "Stars" status in the BCG Matrix highlights its technological prowess. Their innovative spirit fuels the development of proprietary technologies. These technologies, such as ECOVAR® and HISORP®, are designed to boost efficiency. This helps customers reduce emissions, aligning with current market demands.

- Linde invested $1.4 billion in R&D in 2023.

- ECOVAR® is projected to save customers 15% in energy costs.

- HISORP® technology reduces carbon emissions by up to 20%.

- Linde secured 1,300 patents in 2024, showcasing innovation.

Linde's financial health and market leadership classify it as a "Star" in the BCG Matrix. Its high market share and robust growth are fueled by a global presence and technological innovation. The company's strategic investments in clean energy and innovative technologies solidify its future.

| Metric | Value (2024) | Notes |

|---|---|---|

| Revenue | $33.5B | Confirms Market Leadership |

| Operating Margin | 29.5% | Excluding Currency Impacts |

| R&D Investment | $1.4B (2023) | Innovation Focused |

| Patents | 1,300 (2024) | Showcasing innovation |

Cash Cows

Linde's atmospheric gases business, including oxygen and nitrogen, is a cash cow. These gases support critical sectors like healthcare and manufacturing. In 2023, Linde generated approximately $8.5 billion from its global gas sales. This segment shows stable demand and high market share. The growth rate is steady, demonstrating its consistent revenue potential.

Linde's process gases, including hydrogen and carbon dioxide, are cash cows. These gases are vital for sectors like chemicals and food, generating consistent revenue. In 2024, Linde's industrial gas sales reached approximately $30 billion. The demand is steady, requiring limited marketing spend.

Linde's engineering services are a cash cow. They design and build gas processing plants. This segment has a high market share, generating substantial cash flow. Growth is moderate, focusing on maintenance and expansion. In 2024, the industrial gas market was valued at $100+ billion.

Healthcare Gases

Linde's healthcare gases business, supplying essential gases like oxygen and nitrous oxide, is a strong cash cow. This segment enjoys steady demand and a significant market share. The consistent need for these gases in medical settings ensures stable revenue. Linde's 2023 healthcare sales were approximately $7.8 billion.

- Reliable revenue from essential medical gases.

- High market share due to critical healthcare applications.

- 2023 healthcare sales: ~$7.8 billion.

- Steady demand driven by medical procedures.

Specialty Gases

Linde's specialty gases segment, which caters to industries like electronics and fiber optics, acts as a cash cow due to its high profitability in a slow-growing market. These gases generate substantial cash flow with minimal investment in promotion or placement. Specialty gases benefit from consistent demand, providing stable revenue streams.

- 2023: Specialty gases revenue contributed significantly to Linde's overall earnings.

- High margins: Specialty gases often have gross margins exceeding 40%.

- Low growth market: The market expands approximately 2-4% annually.

- Consistent cash flow: This segment provides dependable earnings for reinvestment.

Linde's cash cows consistently deliver substantial profits with low investment needs, exemplified by industrial and specialty gases. These segments boast strong market shares and stable demand, contributing significantly to overall revenue. For instance, Linde's 2023 total revenue was over $33 billion.

| Segment | Characteristics | 2023 Revenue (Approx.) |

|---|---|---|

| Atmospheric Gases | High market share, stable demand | $8.5B |

| Process Gases | Consistent revenue | $30B (Industrial Gases, 2024) |

| Engineering Services | Moderate growth, high market share | N/A |

| Healthcare Gases | Steady demand | $7.8B |

| Specialty Gases | High margins, low growth | Significant contribution to earnings |

Dogs

Legacy equipment sales, representing older gas production tech, likely reside in the Dogs quadrant. These offerings, with limited growth and market share, may be targeted for divestiture. For example, in 2024, Linde may have decreased investment in these areas. This aligns with Linde's strategic shift.

Commodity gas supply contracts with low margins fit the "Dogs" quadrant. These contracts often have minimal profit margins and limited growth prospects. In 2024, Linde's focus will be on optimizing such contracts. Consider that in 2023, Linde's operating profit margin was around 25%. Renegotiation or termination might be considered.

Specific niche applications, like those in certain manufacturing processes, face dwindling demand. These segments, potentially needing costly overhauls, show poor prospects. For example, a 2024 report showed a 7% drop in demand for specialty gases in a specific sector. Turnaround strategies are often ineffective.

Regions with High Operational Costs and Low Market Share

Operations in regions with high costs and low market share are "Dogs" in the BCG Matrix. These areas often drag down overall profitability, making them prime candidates for strategic action. For instance, a 2024 analysis might reveal a specific geographic segment with a negative profit margin. This could be due to high labor costs or low customer demand.

- Divestiture: Selling off the operation.

- Restructuring: Streamlining operations to cut costs.

- Focus: Shifting resources to more profitable areas.

- Closure: Completely ceasing operations in the region.

Outdated Technologies

Outdated technologies in Linde's portfolio represent a "Dogs" quadrant characteristic. These are gas production methods that are no longer competitive. Phasing out such technologies is crucial for efficiency and sustainability. In 2024, Linde's focus remains on modernizing its plants.

- Outdated technologies face declining demand and profitability.

- Linde aims to replace older plants with advanced facilities.

- This strategy enhances overall operational efficiency.

- Focusing on newer tech reduces environmental impact.

Linde's "Dogs" include legacy tech, commodity gas with low margins, and niche applications facing declining demand. These segments show limited growth and low market share. In 2024, strategic actions focused on these areas, potentially divestiture or closure.

| Category | Characteristics | Linde's 2024 Strategy |

|---|---|---|

| Legacy Equipment Sales | Older tech, limited growth | Divestiture |

| Commodity Gas Contracts | Low margins, minimal profit | Optimize/Terminate |

| Niche Applications | Dwindling demand, poor prospects | Restructure/Exit |

Question Marks

Linde's CCUS technologies are in the Question Marks quadrant, signifying high growth potential but a small market share. The global CCUS market is projected to reach $7.2 billion by 2024. If Linde invests further, these could evolve into Stars. This aligns with the rising demand for sustainable solutions; the CCUS market is expected to hit $10 billion by 2027.

Green hydrogen production, using renewable energy, is a high-growth, low-share opportunity for Linde. Linde's investments in electrolysis plants aim to boost its market position. Global green hydrogen demand is projected to reach 530 million tons by 2050. Linde's focus on green hydrogen could position it as a Star.

Linde's foray into emerging markets, where growth is high but market share is initially low, fits the "Question Mark" category. This positioning necessitates strategic investments to boost its presence. For instance, in 2024, Linde's investments in Asian markets reflected this strategy. The goal is to capture growth, with market share being a key metric.

Advanced Gas Processing Solutions for New Industries

Linde's ventures into advanced gas processing for emerging sectors, like electric vehicle battery production, represent a Question Mark in its BCG Matrix. These initiatives demand substantial R&D investments, aiming to capture market share and leadership. The EV battery market is projected to reach $80 billion by 2028, presenting significant growth potential. However, success hinges on effective execution and market adoption. This strategy aligns with Linde's goal to expand its footprint in high-growth markets.

- Projected EV battery market size by 2028: $80 billion.

- Linde's focus on R&D for gas processing solutions.

- Strategy aimed at market share and leadership.

- Alignment with high-growth market expansion goals.

Small On-Site Solutions

Linde's small on-site solutions, focusing on nitrogen and oxygen, represent a growth opportunity. These solutions are positioned as potential Stars within the BCG Matrix, indicating high growth and market share. To maintain this status, Linde needs to invest further in these projects. This will help expand their market presence and solidify their position.

- Small on-site solutions offer high growth potential.

- These projects require continued investment.

- Linde aims to increase market share.

- The goal is to secure a Star position.

Linde's CCUS technologies are "Question Marks" with high growth potential but low market share, aiming to become "Stars" with strategic investments. Green hydrogen production also fits this category, targeting a rapidly expanding market. Emerging market ventures, like those in Asia, likewise represent high-growth, low-share opportunities for Linde.

| Aspect | Details | Data Point |

|---|---|---|

| CCUS Market | High growth, low share | $7.2B in 2024 |

| Green Hydrogen | High growth potential | 530M tons by 2050 |

| Emerging Markets | Investment-driven | Asia-focused |

BCG Matrix Data Sources

This BCG Matrix uses comprehensive data: company reports, market trends, competitive analysis and expert opinions for sound insights.