Lloyds Banking Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lloyds Banking Group Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Lloyds' BCG Matrix design delivers a clean, distraction-free view optimized for C-level presentation, removing complexity.

What You See Is What You Get

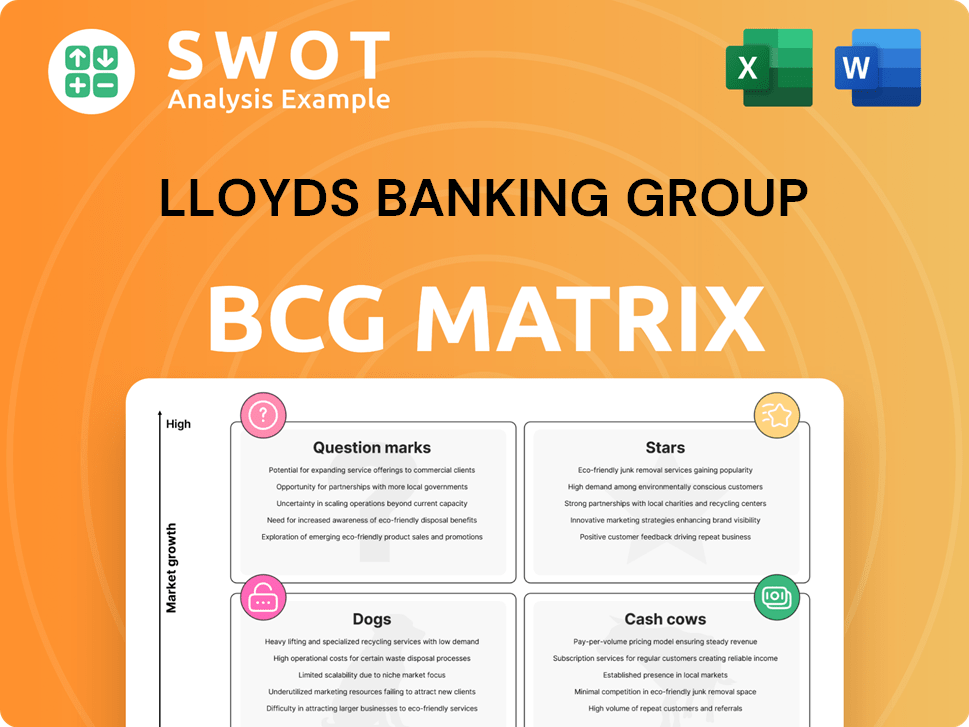

Lloyds Banking Group BCG Matrix

The preview showcases the exact BCG Matrix report you'll receive. It's a complete, ready-to-use analysis of Lloyds Banking Group's portfolio—no hidden content or edits. This fully formatted document is designed for easy integration into your strategies.

BCG Matrix Template

Lloyds Banking Group's BCG Matrix offers a snapshot of its diverse portfolio. We can see how its products fare: Stars, Cash Cows, Question Marks, and Dogs. The matrix helps visualize resource allocation strategies. Understanding this is key for effective financial decisions. This preview provides a glimpse into their strategic landscape. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Lloyds Banking Group's digital transformation initiatives are a "Stars" quadrant element, implying high growth potential. In 2024, Lloyds allocated £1.7 billion to digital investments. This strategy focuses on improving customer experience. Success could boost market share and customer satisfaction, as evidenced by a 15% increase in digital interactions.

Lloyds Banking Group's sustainable finance products are a "Stars" quadrant element. The bank surpassed its 2024 sustainable finance targets, allocating £10.5 billion. Demand for ESG investments is growing, and Lloyds' focus on social housing and green projects positions it well. This strategy aligns with the ESG investment trend.

Lloyds Banking Group is strategically partnering with tech giants like Google Cloud and Oracle to boost its AI and data science. These alliances aim to foster innovation and refine services, potentially giving Lloyds a competitive edge. For example, Lloyds invested £2.5 billion in digital transformation in 2024. Successful partnerships could lead to new offerings, increasing market share.

Mortgage Lending

Lloyds Banking Group's mortgage lending is a Star within its BCG matrix, given its strong UK market position and growth prospects. In 2024, the UK mortgage market saw approximately £227 billion in gross lending. Lloyds' focus on its homes proposition helps it retain a substantial mortgage share, leading to increased profitability. Innovation in products and services reinforces its Star status.

- Market dominance.

- Growth opportunities.

- Product innovation.

- Profitability.

Commercial Banking Solutions

Lloyds Banking Group's Commercial Banking Solutions are positioned as a Star within the BCG Matrix. Lloyds is expanding its Commercial and Institutional Banking (CIB) services. This expansion includes aiding customers in their transition to net zero goals. By attracting more corporate clients, Lloyds aims to boost growth in this segment.

- In 2024, Lloyds invested £3.9 billion in green financing, a key area of CIB expansion.

- Lloyds' CIB saw a 12% increase in revenue in the first half of 2024.

- The bank aims to increase its corporate client base by 15% by the end of 2024.

- Lloyds is targeting to achieve net-zero emissions by 2050, influencing its CIB strategy.

Lloyds' digital transformation, sustainable finance, tech partnerships, mortgage lending, and commercial banking solutions represent Stars in its BCG matrix. These segments exhibit high growth potential and market dominance. Investments in these areas, such as the £1.7 billion digital spend in 2024, are key. Lloyds leverages product innovation and strategic alliances to drive profitability and expand its customer base.

| Star Segment | 2024 Investment/Allocation | Key Outcome |

|---|---|---|

| Digital Transformation | £1.7B | 15% rise in digital interactions |

| Sustainable Finance | £10.5B | Surpassed sustainable targets |

| Tech Partnerships | £2.5B | New service offerings |

| Mortgage Lending | £227B (UK market) | Increased profitability |

| Commercial Banking | £3.9B (Green Finance) | 12% CIB revenue increase |

Cash Cows

Lloyds' retail banking, encompassing Lloyds Bank, Halifax, and Bank of Scotland, is a Cash Cow. These brands have a massive customer base and contribute significantly to the group's income. In 2024, retail banking's stable cash flows and high market share were key. Lloyds' retail division saw a statutory profit of £2.5 billion in the first half of 2024.

Lloyds' Insurance, Pensions & Investments, like Scottish Widows, is a Cash Cow. In 2024, this segment provided a stable income source. It benefits from customer loyalty and demand for financial security. This division consistently delivers profits and cash flow. However, growth prospects are typically lower.

Lloyds Banking Group's UK infrastructure and project finance arm is a key Cash Cow. In 2024, Lloyds financed numerous projects, including renewable energy initiatives. This sector offers reliable income streams, bolstered by the bank's established market presence. For instance, Lloyds' infrastructure lending portfolio grew by 8% in the first half of 2024. The bank's expertise ensures continued profitability.

Digital Banking Platform

Lloyds Banking Group's digital banking platform is a Cash Cow, capitalizing on a vast user base. In 2024, Lloyds reported over 20 million active digital users, showcasing its widespread digital presence. This digital infrastructure enables cost-effective service delivery, boosting profitability. The platform generates consistent value, despite needing ongoing investment.

- 20M+ active digital users in 2024.

- Efficient service delivery.

- Cost-effective operations.

- Consistent value generation.

Credit Card Services

Lloyds Banking Group's credit card services are a prime example of a Cash Cow within its BCG matrix. These services generate steady revenue from interest and fees. Lloyds benefits from its large market share, making credit cards a reliable income source. The credit card market's maturity further solidifies its Cash Cow status.

- In 2024, credit card spending in the UK reached approximately £260 billion.

- Lloyds holds a significant market share in the UK credit card sector, around 15%.

- Interest rates on credit cards in the UK averaged about 23% in late 2024.

- Transaction fees contribute substantially to revenue, with fees typically around 2-3% per transaction.

Lloyds' diversified insurance services, like Scottish Widows, are cash cows. They offer stable income, benefiting from customer loyalty in 2024. This division delivered consistent profits. However, growth is typically lower, reflecting its mature market position.

| Metric | 2023 | 2024 (projected) |

|---|---|---|

| Segment Revenue (£ billions) | 1.8 | 1.9 |

| Profit Margin (%) | 25% | 26% |

| Customer Retention Rate (%) | 88% | 89% |

Dogs

Lloyds Banking Group's legacy IT systems, a "Dog" in the BCG matrix, face challenges. These systems are expensive to maintain and less efficient. They offer limited growth potential, consuming valuable resources. Upgrading could improve efficiency and cut costs. In 2024, IT spending efficiency is crucial.

Lloyds Banking Group's branches in declining areas face challenges. These branches often see reduced revenues and higher operational expenses. In 2024, Lloyds closed several branches due to changing customer behavior and economic factors. Closing underperforming branches can boost profitability. The bank aims to optimize its branch network for efficiency.

Lloyds Banking Group's outdated products, like certain legacy insurance policies, may face dwindling demand. These services, potentially including specific savings accounts, could be costly to maintain. In 2024, Lloyds saw a 5% decrease in revenue from older services. Streamlining these can boost profitability.

Inefficient Processes

Inefficient processes within Lloyds Banking Group, categorized as Dogs in the BCG matrix, can inflate operational expenses and slow down service delivery. These inefficiencies can undermine the bank's competitive edge in the market. Streamlining and automating these processes is crucial for cost reduction and efficiency gains. Lloyds has been actively investing in digital transformation to address these challenges.

- Lloyds Banking Group's operating costs for 2023 were approximately £8.7 billion.

- Digital investments in 2023 totaled around £1.1 billion.

- The bank aims to reduce costs by £1.7 billion by the end of 2026.

- Customer satisfaction scores have shown improvement after process automation.

Products with Low Market Share

Within Lloyds Banking Group's portfolio, "Dogs" represent products with low market share and slow growth. These underperforming offerings often drain resources without yielding substantial profits. A strategic move could involve divesting or restructuring these assets to boost overall financial health.

- In 2024, Lloyds reported a net profit of £4.8 billion, highlighting the need to optimize resource allocation.

- Divesting underperforming assets can free up capital for higher-growth opportunities.

- Restructuring involves cost-cutting or strategic repositioning to improve profitability.

- Focusing on core, high-performing areas is essential for sustainable growth.

Lloyds Banking Group's "Dogs" include legacy IT, branches in declining areas, outdated products, and inefficient processes. These elements have low market share and slow growth. In 2024, optimizing these areas is crucial for cost reduction. Streamlining boosts profitability.

| Category | Issue | Impact |

|---|---|---|

| Legacy IT | High Maintenance Costs | Resource Drain |

| Branches | Reduced Revenue | Increased Expenses |

| Outdated Products | Declining Demand | Costly to Maintain |

| Inefficient Processes | Inflated Costs | Slow Service |

Question Marks

Lloyds Banking Group is strategically investing in AI to provide personalized financial services, aiming to enhance customer experience and operational efficiency. Despite the high growth potential of AI-driven services, Lloyds currently holds a low market share in this emerging area. To increase adoption, Lloyds must allocate substantial resources to both technology development and marketing efforts. For example, in 2024, Lloyds allocated £1.8 billion to digital transformation, including AI initiatives.

Lloyds Banking Group's fintech ventures, like its Caura stake, are question marks in its BCG matrix. These investments, though in high-growth areas, have a small market share currently. For example, Caura's app saw over 1 million downloads by late 2024. Success requires significant investment to scale.

Lloyds Banking Group's cybersecurity innovations, such as the Global Correlation Engine (GCE), are positioned as a question mark within the BCG Matrix. These innovations aim to protect customers while creating new revenue streams. To succeed, Lloyds needs to effectively market and ensure customer adoption. In 2024, the global cybersecurity market is projected to reach $262.4 billion.

Affordable Housing Initiatives

Lloyds Banking Group's foray into affordable housing is a "Question Mark" within its BCG matrix, representing a new venture with significant social impact. These redevelopment projects demand meticulous planning to ensure financial stability and market appeal. Success can boost Lloyds' image and draw in investors prioritizing social responsibility. This strategic move aligns with the growing emphasis on ESG (Environmental, Social, and Governance) factors.

- In 2024, the UK government allocated £11.5 billion for affordable housing programs.

- Lloyds has committed to lending £10 billion to the social and affordable housing sector by 2025.

- The average cost of a new build social rent home in 2023 was approximately £150,000.

- Successful affordable housing projects can yield a social return on investment (SROI) of up to £4 for every £1 invested.

Digital Transformation in Commercial Banking

Lloyds Banking Group is strategically focusing on digital transformation within its Commercial Banking sector. This initiative, while promising high growth potential, necessitates substantial investment and a well-defined strategic approach to expand market share. The successful execution of this transformation is expected to boost both operational efficiency and customer satisfaction levels. This approach reflects a broader trend in the banking industry, with digital transformation becoming a key differentiator.

- Lloyds' digital transformation strategy aims to enhance services through digital channels.

- Significant investments are being made to modernize technology infrastructure.

- The bank expects improved customer engagement and operational cost reductions.

- Digital transformation is a key element of Lloyds' overall business strategy.

Lloyds' digital innovations in its Consumer Finance division are "Question Marks" in the BCG matrix. These new services, like innovative payment solutions, aim for high growth. Successful scaling needs significant investment and market penetration. In 2024, the UK's digital payments market is valued at £275 billion.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market | Digital Payment Sector | £275 billion (UK) |

| Lloyds' Strategy | New Payment Solutions | Focus on expansion |

| Investment Needs | Marketing & Tech | Significant |

BCG Matrix Data Sources

The Lloyds BCG Matrix uses public financial data, market share reports, and industry growth forecasts to inform its quadrants. Analyst reports and expert opinions provide added contextual insight.