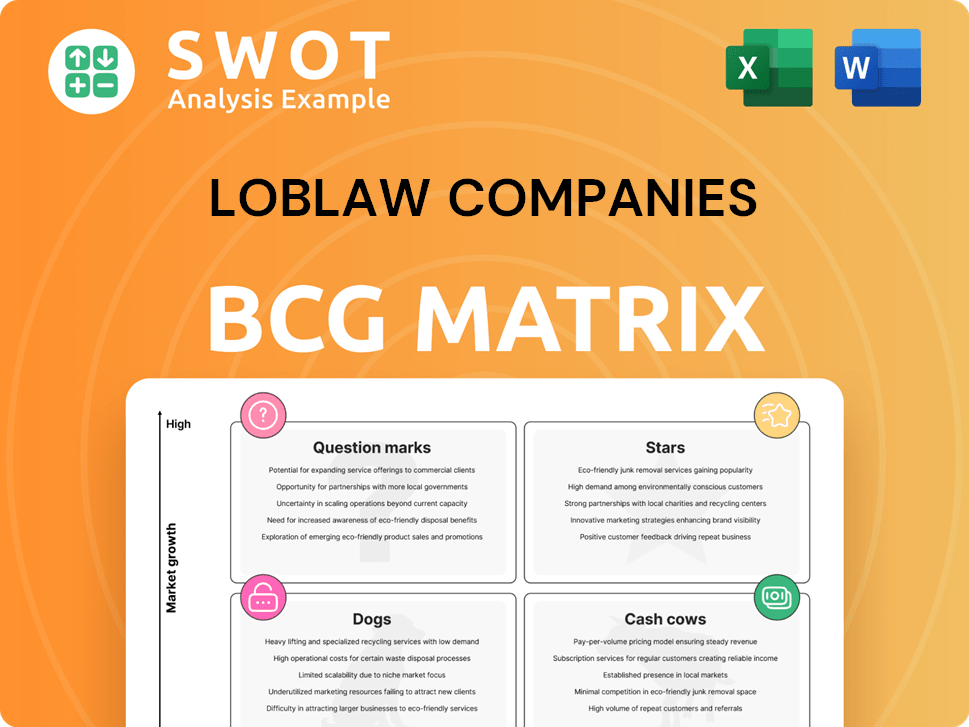

Loblaw Companies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Loblaw Companies Bundle

What is included in the product

Analysis of Loblaw's units within the BCG Matrix: Stars, Cash Cows, Question Marks, Dogs, and recommendations.

Loblaw's BCG Matrix offers a clean view, optimized for concise, C-level presentations about business performance.

Full Transparency, Always

Loblaw Companies BCG Matrix

The BCG Matrix preview showcases the identical Loblaw Companies analysis you'll receive after purchase. This comprehensive report, free of watermarks, offers immediate download and use for strategic decision-making.

BCG Matrix Template

Loblaw Companies juggles a diverse portfolio. Its popular President's Choice brand may be a strong Cash Cow. Other areas could be Question Marks or Dogs needing attention. This overview hints at the strategic complexities within. Purchase the full BCG Matrix for a complete analysis and smart investment and product decisions.

Stars

PC Optimum is a star for Loblaw, fostering loyalty and offering key data insights. The program has over 16 million active members, with more than a billion dollars in rewards annually. Personalized offers and promotions boost engagement and market share. Its success in 2024 is key to its continued growth.

Loblaw strategically expands hard discount stores like No Frills and Maxi, targeting value-focused shoppers. The company aims to add about 50 new hard discount stores by 2025. This growth boosts Loblaw's presence across Canada, serving more communities. This affordability focus is key, especially with current economic challenges. In 2024, Loblaw's revenue was approximately $60 billion, showing the scale of its operations.

Loblaw's pharmacy and healthcare services, led by Shoppers Drug Mart, are a star. Same-store sales in this segment grew by 6.3% in Q4 2024. The expansion of pharmacy care clinics, with 100 planned for 2025, boosts Loblaw's healthcare presence. This growth is fueled by an aging population and rising healthcare needs.

Loblaw Digital and E-commerce

Loblaw Digital, including PC Express, is a core growth area, and it received significant investment. E-commerce sales soared by 16.9% in 2024, hitting around $3.9 billion, showing strong digital engagement. Enhancements to these digital platforms are essential for Loblaw's ongoing expansion and customer satisfaction.

- Digital investments drive growth.

- E-commerce sales reached $3.9 billion in 2024.

- Customer engagement is a key advantage.

- Platform improvements are crucial.

Private Label Brands (President's Choice, No Name)

Loblaw's private label brands, like President's Choice and No Name, are Stars. These brands deliver quality products at competitive prices, boosting Loblaw's market share. The No Name brand expansion, offering products up to 20% cheaper, provides great value. These brands are key to keeping customers loyal and attracting budget-conscious shoppers.

- President's Choice and No Name brands contribute significantly to Loblaw's revenue.

- No Name products' price advantage drives sales volume.

- Customer loyalty is enhanced through the appeal of value-driven private labels.

- These brands help Loblaw maintain a strong market position.

Loblaw's success in 2024 stems from its diverse "Stars." These include PC Optimum, Shoppers Drug Mart, Loblaw Digital, and private label brands. These segments drive revenue and customer loyalty. Each contributes significantly to Loblaw's strong market position.

| Star Category | 2024 Performance Highlights | Strategic Focus |

|---|---|---|

| PC Optimum | 16M+ active members, $1B+ rewards | Personalized offers, data insights |

| Shoppers Drug Mart | Pharmacy sales up 6.3% in Q4 | Pharmacy care clinics expansion |

| Loblaw Digital | E-commerce sales: $3.9B, up 16.9% | Platform enhancements, customer engagement |

| Private Label Brands | No Name's value advantage | Customer loyalty, value-driven offerings |

Cash Cows

Loblaw's conventional grocery stores, like Loblaws and Real Canadian Superstore, are key cash cows, delivering steady revenue. These stores boast high market share and benefit from customer loyalty. In 2024, Loblaw reported strong financial results, with revenue increasing due to solid performance in its retail business. The company's focus on refining its retail network ensures continuous productivity and profitability.

Shoppers Drug Mart's front store is a cash cow, generating consistent revenue. In 2024, front store sales saw growth, especially in beauty. This steady income stream is thanks to an established customer base. High-margin product focus ensures continued profitability.

PC Financial Services, encompassing credit cards and banking, bolsters Loblaw's cash flow. This segment profits from the PC Optimum loyalty program, boosting customer spending. It offers a steady revenue stream, even without explosive growth. In Q3 2023, Loblaw's financial services revenue was $162 million. Enhancements to PC Optimum can improve efficiency, increasing cash flow.

Apparel (Joe Fresh)

Joe Fresh, Loblaw's apparel brand, is a cash cow. It offers affordable fashion and family apparel. Available in Joe Fresh stores, online, and Shoppers Drug Mart, it generates consistent revenue. Value and quality focus drives steady sales, supporting Loblaw's revenue. In 2024, apparel sales remained stable, contributing to overall profitability.

- Consistent Revenue: Joe Fresh contributes steadily to Loblaw's revenue stream.

- Brand Presence: It has a broad presence through various retail channels.

- Customer Value: Focus on affordable fashion drives sales.

- Financial Stability: Provides a stable financial base for Loblaw.

Real Estate (Choice Properties REIT)

Choice Properties REIT is a "Cash Cow" for Loblaw, generating steady cash flow. Loblaw is the majority unitholder, ensuring alignment. The REIT's properties, leased to Loblaw stores, provide consistent income. Strategic real estate management boosts long-term value. In Q3 2024, Choice Properties reported $303.5 million in revenue.

- Stable income from Loblaw leases.

- Majority ownership by Loblaw.

- Supports Loblaw's retail network.

- Focus on long-term value.

Cash cows like Loblaw's grocery stores generate stable revenue, holding a large market share. Shoppers Drug Mart's front store sales also contribute steadily. PC Financial and Joe Fresh provide consistent income. Choice Properties REIT offers stable cash flow via Loblaw leases.

| Cash Cow Segment | Revenue Source | 2024 Data Highlights |

|---|---|---|

| Loblaws Stores | Grocery Sales | Retail revenue increase due to solid performance. |

| Shoppers Drug Mart (Front Store) | Health & Beauty | Front store sales growth, especially in beauty. |

| PC Financial Services | Credit Cards, Banking | Q3 2023 revenue: $162M, driven by loyalty. |

| Joe Fresh | Apparel Sales | Stable apparel sales contribute to profit. |

| Choice Properties REIT | Loblaw Leases | Q3 2024 revenue: $303.5M, benefiting from Loblaw leases. |

Dogs

Wellwise by Shoppers Drug Mart was acquired by Verillium Health Care in January 2025. This decision indicates Wellwise wasn't a primary growth driver for Loblaw. Loblaw's move to sell it enables a focus on its core retail and pharmacy businesses. This strategy aligns with Loblaw's goal to streamline its portfolio, potentially boosting profitability. In 2024, Loblaw's revenue was $59.9 billion.

Loblaw's decision to remove some electronics from Shoppers Drug Mart front stores, a move reflecting a strategic shift in the BCG matrix. This change, which began in late 2023, was driven by lower profit margins in electronics. By focusing on higher-margin categories like beauty, Loblaw aims to boost overall profitability, a strategy that aligns with the company's goal to increase its operating income, which reached $3.2 billion in 2024.

Certain general merchandise in Loblaw's stores might be underperforming, showing low growth and market share. These items can tie up capital without big returns. Consider divesting or minimizing these categories to better allocate resources. In 2024, Loblaw's gross profit increased, but some areas need improvement. Focus on high-demand, high-margin products to optimize inventory.

Smaller, Less Profitable Store Formats

Some smaller Loblaw store formats, like certain urban locations or discount stores, might struggle due to shifts in consumer shopping habits or rising competition. These stores could demand hefty investments to boost performance, but success isn't assured. Closing or merging these underperforming locations can enhance overall efficiency and cut costs. Loblaw's strategic focus on optimizing its store network ensures resources are channeled into the most profitable areas.

- Loblaw's Q3 2023 report showed a focus on "network optimization."

- In 2024, Loblaw plans to open 40 new stores, with a focus on larger, more profitable formats.

- Closing underperforming stores is part of an ongoing strategy to improve profitability.

- The company aims to allocate capital to the most promising growth areas.

Outdated Supply Chain Technologies

Outdated supply chain technologies at Loblaw could be classified as "dogs" in the BCG Matrix, dragging down performance. These legacy systems cause inefficiencies and inflate operational costs, as seen in 2024 with supply chain expenses representing a significant portion of their operational budget. Loblaw is actively modernizing its supply chain, including investments in automation, to boost efficiency and cut costs. Replacing outdated systems is crucial for maintaining a competitive edge.

- Inefficient legacy systems increase operational costs.

- Supply chain modernization is a key investment area.

- Automation helps to improve operational efficiency.

- Modernization efforts reduce overall expenses.

Outdated supply chain technologies fit the "dogs" category within Loblaw's BCG Matrix, dragging down efficiency. Legacy systems cause operational inefficiencies and increased costs. Loblaw is modernizing its supply chain, including automation, to reduce expenses.

| Metric | 2024 Data | Impact |

|---|---|---|

| Supply Chain Costs | Significant % of OPEX | Reduced profitability |

| Automation Investment | Ongoing | Efficiency gains |

| System Modernization | Strategic priority | Cost reduction |

Question Marks

Loblaw's 2024 entry into the U.S. market with T&T Supermarkets positions it as a question mark in its BCG matrix. The initial investment in the U.S. market requires substantial marketing and operational costs. Success depends on brand recognition and market penetration. Failure could result in financial losses.

Loblaw's PC Insiders, a subscription program for PC Optimum members, is positioned as a question mark in their BCG Matrix. The program's success hinges on attracting and retaining subscribers, with added value being key. As of late 2023, PC Insiders offered perks like free grocery delivery and bonus PC Optimum points. The program's future success depends on its ability to evolve and meet customer expectations.

Loblaw is testing "No Name" ultra-discount stores, a new initiative with a curated product range and a focus on affordability. This strategy aims to capture budget-minded shoppers, leveraging low operational expenses. Success hinges on customer acceptance and efficient cost management. If it works, Loblaw could expand nationally, boosting growth; in 2024, Loblaw reported a revenue of $61.8 billion.

Expansion into Healthcare Services

Loblaw is growing in healthcare services, focusing on pharmacy clinics and wellness programs. Success hinges on drawing in patients and proving worth to healthcare providers and employers. This requires substantial investment in facilities and staff. A win here could be a big revenue boost; a loss, wasted funds.

- Loblaw's pharmacy segment saw a 7.3% increase in revenue in 2024.

- They've invested over $100 million in healthcare expansions.

- The market for pharmacy services is projected to grow by 5% annually through 2028.

- Approximately 20% of Loblaw's overall revenue comes from its healthcare divisions.

New Technology and IT Systems

Investments in new technology and IT systems represent question marks in Loblaw's BCG matrix. Their success hinges on effective implementation and adoption by both employees and customers. If successful, these systems could significantly boost efficiency and customer satisfaction. However, failure could lead to wasted resources and missed opportunities.

- Loblaw invested $1.65 billion in capital expenditures in 2023, including IT and technology upgrades.

- These investments aim to enhance both in-store and online customer experiences.

- The company's digital sales grew by 15% in Q4 2023, indicating some success.

- Poor adoption or integration could hinder these improvements.

Loblaw's ventures face uncertainties. Expansion into new markets, like the U.S. with T&T, requires significant investment and carries inherent risks. Success depends on factors like brand recognition and market penetration. Failure could lead to financial losses.

| Initiative | Investment | Risk |

|---|---|---|

| U.S. Expansion | Significant, marketing & ops | Brand Recognition |

| PC Insiders | Subscription model costs | Subscriber retention |

| "No Name" Stores | Operational setup | Customer acceptance |

| Healthcare Services | Facility & staff | Attracting patients |

BCG Matrix Data Sources

The BCG Matrix is crafted using Loblaw's financial filings, industry reports, competitor analyses, and market growth data for accurate positioning.