L'Occitane SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

L'Occitane Bundle

What is included in the product

Identifies key growth drivers and weaknesses for L'Occitane. Also analyses potential threats & opportunities.

Facilitates interactive planning with a structured, at-a-glance view.

What You See Is What You Get

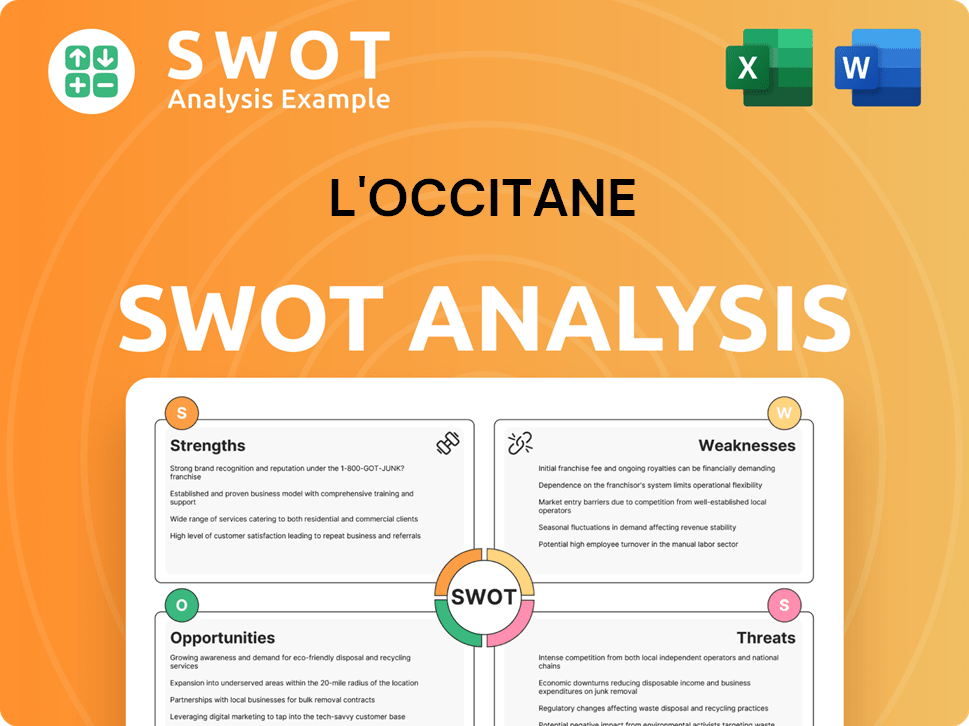

L'Occitane SWOT Analysis

See the exact SWOT analysis you'll receive. The preview showcases the complete document structure and information.

The full, in-depth report, viewable now in a simplified format, becomes instantly available after purchase.

This is what you’ll download – no changes or extras! Your final SWOT document is exactly as you see it here.

After checkout, the entire report will be instantly ready to access. No editing to get to the report!

SWOT Analysis Template

L'Occitane, a beloved brand, faces a complex market. This sneak peek explores their strengths, like loyal customers, and weaknesses, such as limited online presence. Opportunities involve expanding into new markets. Threats include competitors.

Want to see the full strategic breakdown? The complete SWOT analysis offers a deeper dive! It's ideal for making smart, fast business decisions.

Strengths

L'Occitane's brand is recognized globally, emphasizing natural ingredients and well-being. This strong brand identity, rooted in Provence traditions, appeals to consumers seeking authenticity. In fiscal year 2024, L'Occitane's net sales reached approximately EUR 2.1 billion, showing brand strength. The focus on natural ingredients gives L'Occitane a distinct market position.

L'Occitane's global footprint spans Europe, Asia, and the Americas. This widespread presence boosts market penetration and customer access. Strategic acquisitions like Sol de Janeiro and Elemis diversify the brand. In FY2024, Sol de Janeiro's sales soared, contributing significantly to growth. This diversification reduces reliance on L'Occitane en Provence.

L'Occitane's dedication to sustainability is a key strength. It aims to use 100% recycled PET in bottles by 2025. The company plans to trace 90% of raw materials by FY2026. These goals, along with B Corp certification, boost its ethical image. This commitment resonates with environmentally conscious consumers.

Growing E-commerce and Digital Strategy

L'Occitane's expanding e-commerce and digital strategy is a key strength. This focus has boosted sales, especially when physical stores faced difficulties. Digital membership cards and platforms like LINE in Japan boost online engagement and sales. They're also using AI for personalized customer interactions.

- E-commerce sales grew, representing a significant portion of total revenue in 2024.

- Digital initiatives boosted customer engagement rates by 15% in key markets.

- AI-driven personalization increased conversion rates by 10%.

Focus on Quality and Supply Chain Control

L'Occitane's dedication to product quality is a significant strength, crucial in a competitive landscape. They prioritize a dependable supply chain, often using locally sourced ingredients. This approach supports product authenticity and brand reputation. Their focus on tracing raw materials highlights their commitment to quality and ethical sourcing. The company's strategy helps maintain customer trust and brand loyalty.

- In FY2024, L'Occitane reported a gross profit margin of 78.1%.

- L'Occitane sources ingredients from regions like Provence, enhancing product uniqueness.

- Traceability initiatives ensure ingredient origin and ethical practices.

L'Occitane’s recognized brand drives global appeal, supported by a focus on quality and natural ingredients. A strong global presence, aided by acquisitions like Sol de Janeiro, boosts market reach and reduces dependency on its core brand. Sustainability initiatives, including recycled packaging targets for 2025, enhance its brand image. Expanding e-commerce and AI-driven personalization also boosts sales, conversion and customer engagement rates.

| Feature | Details |

|---|---|

| Brand Strength | Net sales approx. EUR 2.1B in FY2024. |

| Global Presence | Present in Europe, Asia, Americas |

| Sustainability | Aim: 100% recycled PET by 2025. |

Weaknesses

L'Occitane's reliance on core brands poses a weakness. In FY2024, L'Occitane en Provence accounted for a large portion of revenue. Slower growth in key brands could impact overall financial performance. This dependence creates vulnerability to brand-specific issues. The company is actively diversifying, but the risk remains.

L'Occitane faces tough competition from bigger companies in the skincare and cosmetics market. To stay ahead, they must spend heavily on marketing, which can squeeze profits. The expense of attracting new customers, especially in China, is rising. In 2024, L'Occitane's marketing expenses reached $350 million, reflecting these challenges.

L'Occitane's investments in areas like marketing and IT are affecting profit margins. These investments are crucial for long-term growth, but they strain profitability currently. In fiscal year 2024, L'Occitane reported a gross profit margin of approximately 77.5%. These strategic expenditures could lead to short-term margin pressures.

Challenges in Penetrating Emerging Economies

L'Occitane faces challenges in emerging economies, where its market presence might be less established compared to larger competitors. This can restrict growth, especially in rapidly expanding markets. The company's focus on premium products could make it harder to compete with more affordable brands popular in these regions. In 2024, L'Occitane's sales in Asia represented approximately 30% of total sales, indicating room for expansion. Penetration strategies must consider local preferences and economic conditions.

Sensitivity to Travel Retail Fluctuations

L'Occitane's revenue is notably affected by how well travel retail does. Recent data shows a mixed bag in this sector, with some brands thriving. However, L'Occitane en Provence has faced downturns in travel retail sales. Such fluctuations can significantly impact the company's overall financial results.

- Travel retail sales are a key revenue stream for L'Occitane, making it sensitive to changes in this channel.

- Declines in travel retail can lead to lower overall sales figures.

- Market data from 2024/2025 shows varied performance across travel retail, creating uncertainty.

L'Occitane’s dependence on core brands creates vulnerabilities. Heavy marketing expenses impact profit margins; in 2024, these reached $350 million. Fluctuations in travel retail further challenge stability.

| Weakness | Impact | Data (2024) |

|---|---|---|

| Brand Dependence | Vulnerability to brand-specific issues | L'Occitane en Provence represents significant revenue. |

| Marketing Costs | Margin pressure | Marketing expenses: ~$350M |

| Travel Retail Volatility | Sales fluctuation | Mixed performance in travel retail. |

Opportunities

L'Occitane sees major growth in key markets like China. In fiscal year 2024, China sales rose, driven by brand popularity. The company aims to open more stores and boost its brands in China. This expansion strategy is backed by a strong financial foundation, with a focus on sustainable growth.

L'Occitane's multi-brand approach, especially with acquisitions like Sol de Janeiro and Elemis, is a major growth driver. These brands attract younger consumers, broadening the customer base. In FY2024, Sol de Janeiro's sales surged, demonstrating this strategy's effectiveness. Expanding these brands globally will boost revenue significantly.

L'Occitane benefits from rising demand for natural products. This trend aligns with its values and product lines. Sales of natural beauty products are up. In 2024, the global market reached $60 billion. This offers L'Occitane a chance to attract eco-minded consumers.

Enhancing Digital and Omnichannel Experiences

L'Occitane can boost sales by investing more in e-commerce, digital marketing, and omnichannel experiences. Personalized AI outreach strengthens customer relationships and loyalty, potentially increasing repeat purchases. Digital sales are growing; in Q3 FY2024, e-commerce sales rose, contributing significantly to overall revenue. This shift is crucial, as online retail continues to expand, with the global e-commerce market projected to reach $6.3 trillion in 2024.

- E-commerce investments are key to sales growth.

- AI-driven personalization improves customer engagement.

- Omnichannel strategies create seamless experiences.

- The e-commerce market is experiencing rapid expansion.

Innovation in Product Development and Packaging

L'Occitane can boost appeal by developing new products and innovating in sustainable packaging. This includes using recycled materials and offering refill options. Focusing on traceable raw materials builds product integrity and consumer trust. In 2024, the global sustainable packaging market was valued at $317.9 billion, expected to reach $440.9 billion by 2029.

- Market growth: The sustainable packaging market is rapidly expanding.

- Consumer demand: Consumers increasingly prefer sustainable products.

- Brand differentiation: Innovation helps set L'Occitane apart.

- Trust: Traceable materials enhance consumer confidence.

L'Occitane has growth opportunities in key markets, especially China, which saw boosted sales in fiscal year 2024, fueled by the brand's rising popularity.

The multi-brand approach with acquisitions such as Sol de Janeiro is another growth opportunity, with Sol de Janeiro's sales increasing. E-commerce investments and sustainable practices create potential for boosting profits.

The growth of the global e-commerce market projected to $6.3 trillion in 2024 and sustainable packaging at $317.9 billion, by 2029 to $440.9 billion.

| Opportunity | Description | Data |

|---|---|---|

| China Market | Expansion in key markets such as China. | FY2024 sales increased in China. |

| Multi-Brand Strategy | Leveraging brands like Sol de Janeiro. | Sol de Janeiro's sales surge |

| E-commerce | Investing in e-commerce, digital marketing. | E-commerce market projected to reach $6.3T in 2024. |

| Sustainable Practices | Development of sustainable packaging. | $317.9B in 2024, to $440.9B by 2029 |

Threats

L'Occitane faces strong competition from giants like L'Oréal and Estée Lauder. These larger companies have greater resources for marketing and product development. This can lead to price wars, affecting L'Occitane's profit margins. In 2024, L'Oréal's sales reached €41.18 billion, highlighting the scale of the competition.

Economic uncertainties, including inflation, pose a threat to L'Occitane. Rising inflation in key markets like the U.S. (3.5% as of March 2024) can curb consumer spending. A potential economic slowdown could further reduce demand for non-essential beauty products. This impacts sales and profitability, as seen in similar luxury goods sectors.

L'Occitane's reliance on global sourcing and natural ingredients exposes it to supply chain disruptions. Climate change intensifies these risks, potentially increasing raw material costs. In FY2024, supply chain issues and inflation affected margins. The company is actively diversifying suppliers to mitigate these threats, as reported in its 2024 financial statements. Fluctuations in ingredient costs, like shea butter, directly impact profitability.

Changing Consumer Preferences and Trends

Changing consumer preferences pose a significant threat to L'Occitane. The beauty industry is highly susceptible to rapid shifts in trends and social media influence. Staying current is crucial, with the global skincare market projected to reach $185.2 billion by 2027. L'Occitane must continuously innovate.

- Adapt product offerings and marketing.

- Embrace digital marketing and e-commerce.

- Monitor social media trends closely.

Potential Negative Impact of Privatization Efforts

The push for privatization by L'Occitane's majority owner poses risks. Uncertainty could arise, affecting day-to-day operations and long-term strategies. A successful privatization, for instance, could lead to changes in leadership or financial structure. Any shifts could disrupt the company's growth trajectory, potentially impacting its market performance.

- The privatization could impact the company's stock liquidity.

- Changes in financial strategy after privatization.

- Potential shifts in management.

- Uncertainty in the short term.

L'Occitane encounters formidable competitive pressures, with industry giants like L'Oréal boasting significantly larger resources for marketing. Economic downturns and inflation, hitting 3.5% in the U.S. as of March 2024, further endanger consumer spending. Supply chain issues and changing consumer preferences, along with the privatization push, add instability.

| Threat | Impact | Data Point |

|---|---|---|

| Intense Competition | Reduced Margins | L'Oréal's 2024 sales: €41.18B |

| Economic Instability | Decreased Demand | U.S. Inflation (March 2024): 3.5% |

| Supply Chain Disruptions | Increased Costs | Shea Butter Price Fluctuation |

SWOT Analysis Data Sources

This analysis relies on financial reports, market research, and industry publications, combined with expert opinions for a comprehensive view.