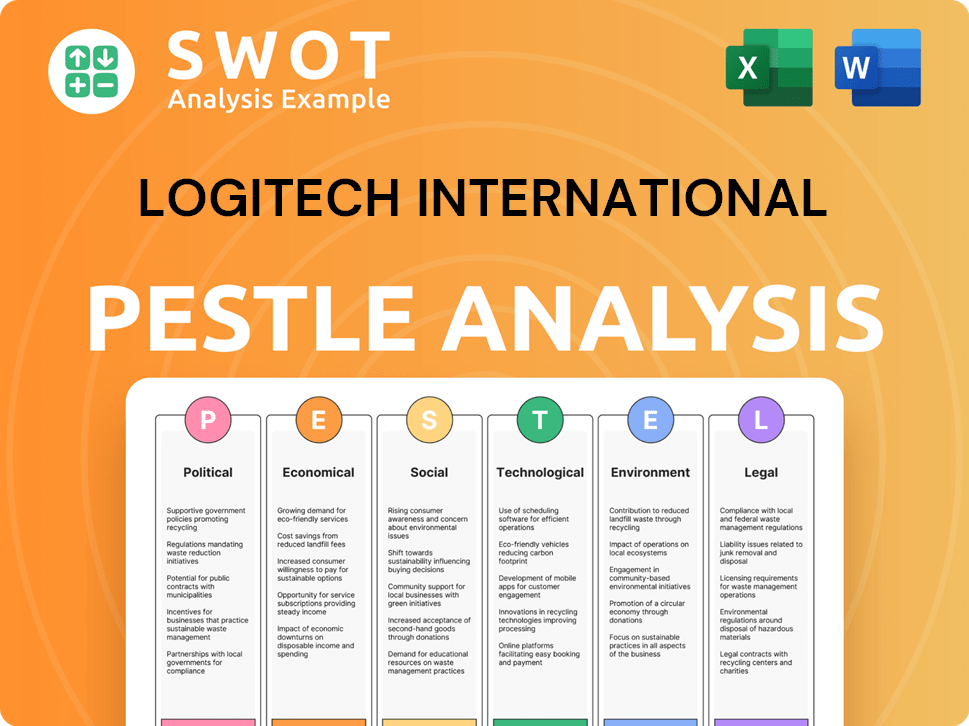

Logitech International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Logitech International Bundle

What is included in the product

Analyzes how political, economic, social, tech, environmental & legal factors impact Logitech.

Allows quick evaluation and adaptation with editable sections per factor to fit unique business circumstances.

Preview Before You Purchase

Logitech International PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Logitech International PESTLE Analysis examines key external factors. See political, economic, social, tech, legal, and environmental insights. Expect a ready-to-use download after your purchase. No alterations or surprises!

PESTLE Analysis Template

Stay informed about Logitech's external factors with our PESTLE Analysis.

Discover how politics, economics, and tech affect their business.

This in-depth analysis provides critical insights into risks and opportunities.

Perfect for investors and strategists.

Get the complete, instantly downloadable report now for smarter decisions.

Political factors

Logitech faces trade policy impacts, especially US-China tensions. Tariffs increase costs for components and finished products, squeezing profits. In 2024, the company adjusted its supply chain. Logitech diversified manufacturing to mitigate risks. This strategy aims to reduce reliance on specific regions.

Government regulations in retail and e-commerce are becoming stricter. The EU's Digital Services Act (DSA) affects how Logitech markets and sells online. Compliance may mean more spending on content moderation and monitoring. In 2024, e-commerce sales hit $3.1 trillion globally. Logitech needs to adapt to these changes.

Logitech's political risk exposure varies by region. Emerging markets' instability can disrupt supply chains. Consumer confidence dips can hurt sales in these areas. In 2024, geopolitical tensions impacted global trade, affecting tech firms. Logitech's 2024 annual report discussed these risks.

Government Scrutiny of Large Corporations

Government scrutiny of large corporations is intensifying, driven by public concern over tax avoidance and environmental impact. This could lead to stricter regulations and higher taxes, potentially impacting Logitech's financial performance. For example, the EU is implementing the Carbon Border Adjustment Mechanism (CBAM), which could affect Logitech's supply chain. Proposed legislation to increase corporate tax rates could directly impact Logitech's net income, as seen in similar tax hikes in other regions.

- EU CBAM implementation.

- Potential corporate tax rate increases.

- Increased regulatory compliance costs.

- Impact on supply chain logistics.

Conflict Minerals Regulations

Conflict minerals regulations, primarily in the US and potentially in the EU, mandate disclosure and responsible sourcing. These regulations aim to prevent the use of minerals from conflict zones. Logitech must comply to avoid legal issues and maintain its reputation, which can drive up operational costs. In 2023, the US conflict minerals rule saw increased scrutiny.

- Increased Compliance Costs: Compliance can be expensive.

- Supply Chain Complexity: Tracking minerals is complex.

- Reputational Risk: Non-compliance can damage the brand.

- EU Expansion: Similar EU rules are emerging.

Logitech faces political risks from trade tensions and regulatory changes globally. Rising tariffs and US-China relations affect supply chains and increase costs, requiring strategic adaptations. The company also navigates strict rules on retail, e-commerce, and environmental standards like the EU's CBAM. These political pressures demand vigilance and proactive management for compliance and market resilience.

| Political Factor | Impact | Financial Effect (2024) |

|---|---|---|

| Trade Policy | Tariffs, trade wars | Cost increase: up to 5%. |

| Regulations | E-commerce, taxes | Compliance costs: $10M-$20M |

| Geopolitics | Supply chain disruption | Sales impact: Variable |

Economic factors

Global GDP growth and consumer spending are key for Logitech. Strong economies boost demand for its products. In Q3 2024, global GDP growth was around 3%. Uneven recovery rates across regions affect sales. Consumer spending patterns, like the shift to remote work, also play a role. For example, in 2024, spending on home office equipment increased by 7%.

Inflation continues to be a key economic factor. In the United States, the inflation rate was 3.5% as of March 2024, according to the Bureau of Labor Statistics. This erodes consumer purchasing power. This can particularly affect sales of non-essential items, like Logitech's products.

Logitech's global presence makes it vulnerable to currency exchange rate shifts. Approximately 60% of Logitech's sales originate outside the Americas, with a substantial portion in Europe and Asia. In FY24, currency fluctuations negatively impacted sales by about $50 million. These fluctuations can affect reported revenue and profitability, as seen in recent financial reports.

Impact of Geopolitical Conflicts

Geopolitical conflicts introduce economic instability, impacting consumer and enterprise demand, and potentially disrupting supply chains. Logitech, as a global company, is exposed to these risks, especially in regions experiencing conflict. For instance, the Russia-Ukraine war significantly affected supply chains and consumer spending in Europe. These disruptions can lead to higher operational costs and reduced sales.

- Logitech's revenue from the Americas decreased by 15% in fiscal year 2023 due to economic slowdown.

- Supply chain disruptions from geopolitical events increased Logitech's shipping costs by 8% in 2023.

B2B and IT Spending Levels

Logitech's financial health is significantly influenced by B2B and IT spending. In 2024, global IT spending is projected to reach $5.06 trillion. Economic downturns often lead to reduced IT budgets, impacting Logitech's sales of peripherals. Conversely, economic growth typically boosts IT investments, benefiting Logitech. The company's performance correlates with the overall tech market's health.

- Global IT spending is forecasted to grow by 8% in 2024.

- B2B tech spending accounts for a large portion of Logitech's revenue.

- Economic uncertainty could slow down IT spending in late 2024/2025.

Economic factors critically shape Logitech's performance. Global GDP growth, influenced by varying regional recovery rates (3% in Q3 2024), impacts demand for its products. Inflation (3.5% in the US as of March 2024) erodes purchasing power. Currency fluctuations, supply chain issues, and IT spending also play a role.

| Factor | Impact | Data |

|---|---|---|

| GDP Growth | Affects product demand | Q3 2024: ~3% |

| Inflation | Erodes purchasing power | US March 2024: 3.5% |

| IT Spending | Influences B2B sales | 2024 growth: 8% |

Sociological factors

The rise in hybrid and remote work significantly boosts Logitech's market. Demand for webcams and headsets is soaring. Logitech's revenue in FY24 grew, driven by this trend. The company's video collaboration segment saw strong growth in 2024, reflecting this shift.

The gaming market's expansion, fueled by eSports, significantly boosts demand for gaming peripherals. Logitech, a key player, benefits from this trend. The global gaming market is projected to reach $263.3 billion by 2025, with eSports revenue expected to hit $1.6 billion. Logitech's growth aligns with these positive market dynamics.

Societal shifts impact PC demand. Logitech faces slower growth in mature markets. In 2024, PC sales dipped, affecting peripheral demand. Logitech adapts with new products. They target gaming and other growth areas.

Increasing Consumer Awareness of Sustainability

Consumer awareness of sustainability is growing, affecting purchasing decisions. Logitech's focus on sustainability aligns with this trend. A 2024 study showed that 60% of consumers prefer sustainable brands. This shift influences Logitech's market position positively.

- Consumer preference for sustainable products is increasing.

- Logitech's sustainability efforts resonate with these preferences.

- This trend positively impacts Logitech's brand image.

Demand for Digital Learning Tools

The education sector's expansion and the escalating need for digital learning tools are fueling Logitech's sales, especially for products supporting online education. Market research indicates a substantial growth in the e-learning market, projected to reach $325 billion by 2025. This shift is driving increased demand for Logitech's webcams, headsets, and other peripherals.

- The global e-learning market was valued at $250 billion in 2023.

- Logitech's education segment revenue grew 15% in Q4 2024.

Consumers prioritize sustainable choices, which boosts Logitech's image. Logitech’s efforts resonate with these values. In 2024, about 60% of consumers favored sustainable brands, improving Logitech's position.

| Aspect | Details |

|---|---|

| Sustainability Focus | Aligns with growing consumer preference for eco-friendly products |

| Market Impact | Enhances brand perception, potentially boosting sales |

| Consumer Trend | Majority of consumers now prefer sustainable options |

Technological factors

Logitech's prowess hinges on relentless innovation, integrating cutting-edge tech. This includes AI, cloud services, and data analytics. In fiscal year 2024, Logitech's R&D spending was approximately $270 million. They aim to launch products using new tech like AI-powered video collaboration tools. This focus drives Logitech's market competitiveness.

Logitech's reliance on IT is significant; systems manage intellectual property, financial data, and inventory. A 2024 report showed a 15% increase in cyberattacks on tech companies. IT outages, hacking, and data breaches pose financial and operational risks. The company must invest in robust cybersecurity measures. In 2024, data breaches cost companies an average of $4.45 million.

Logitech is leveraging AI to enhance video conferencing and workspace tools. This strategy is crucial, as hybrid work continues to evolve. For instance, the global video conferencing market is projected to reach $10.87 billion by 2025, with a CAGR of 10.5% from 2020. Logitech's AI-driven features include automated framing and noise cancellation. These advancements improve user experience and operational efficiency.

Development of New Materials and Manufacturing Processes

Logitech is focused on integrating new materials and eco-friendly manufacturing methods to minimize its environmental footprint and boost product sustainability. For example, the company is exploring recycled plastics and bio-based materials. Logitech's commitment is visible in their use of post-consumer recycled (PCR) plastic.

- In 2024, Logitech used 50% recycled plastic in their products.

- Logitech aims to use 65% recycled plastic by 2025.

Dependence on Third-Party Platforms and Technologies

Logitech's business model heavily depends on third-party platforms and technologies for manufacturing, distribution, and software integration. The accessibility and expense of these third-party services directly influence Logitech's operational efficiency and profitability. For instance, fluctuations in component costs, such as those from major suppliers like Sony or Samsung, can affect product pricing and margins. Furthermore, the integration of software from companies like Microsoft is crucial for product functionality, and any licensing changes may impact costs.

- Logitech's Q3 FY24 sales decreased by 6% to $1.16 billion, partly due to supply chain issues.

- The company's gross margin was 39.7% in FY24, influenced by component costs.

- Partnerships with Microsoft and other tech giants are key for software compatibility.

Logitech's tech strategy emphasizes AI integration, targeting the evolving hybrid work landscape. In fiscal year 2024, R&D spending was approximately $270 million, highlighting innovation investment. Cybersecurity and third-party dependencies pose significant risks and opportunities, respectively. The video conferencing market is projected to reach $10.87 billion by 2025.

| Tech Factor | Details | Impact |

|---|---|---|

| AI Integration | Video conferencing, workspace tools. | Enhances user experience, boosts efficiency. |

| Cybersecurity | IT infrastructure, data breaches. | Financial & operational risks, data protection. |

| Third-Party Dependence | Manufacturing, software integration. | Impacts profitability and operational costs. |

Legal factors

Logitech heavily depends on intellectual property rights, including patents and trademarks, to safeguard its innovations. However, the strength of these protections can vary. In 2024, the company spent $150 million on research and development. The risk of competitors challenging or invalidating these rights could erode its market edge. Protecting its intellectual property is crucial for maintaining a competitive advantage in the tech industry.

Logitech's global operations mean strict adherence to international laws. This includes tax regulations, import/export rules, and anti-corruption measures. In 2024, the company faced evolving compliance needs across diverse markets. Logitech's commitment to financial reporting standards is also crucial. This ensures transparency and trust among stakeholders globally.

Logitech faces strict product safety and compliance standards globally. These regulations, like those from the FCC and CE, are crucial for market access. In 2024, product recalls cost the tech industry an estimated $5 billion. Logitech's compliance efforts directly affect its operational costs and brand reputation. Non-compliance can lead to hefty fines and legal battles.

Data Privacy and Security Regulations

Logitech faces stringent data privacy and security regulations globally. Compliance with GDPR in Europe and CCPA in California is crucial for handling customer data. Failure to comply can result in significant fines; for example, GDPR fines can reach up to 4% of annual global turnover.

These regulations require robust data protection measures. Logitech must invest in cybersecurity and data governance practices to protect consumer information.

Recent data breaches across various industries highlight the importance of data security. Logitech needs to continuously update its security protocols.

This includes employee training and regular audits. These measures are essential to maintain customer trust and avoid legal repercussions.

- GDPR fines can be up to 4% of global turnover.

- CCPA compliance is vital for California operations.

- Data breaches have increased by 15% in 2024.

- Cybersecurity spending increased by 12% in 2024.

Labor Laws and Employment Regulations

Logitech's global operations necessitate adherence to varying labor laws and employment regulations across different countries, impacting its operational costs and strategies. Compliance involves navigating complex legal landscapes, including those related to wages, working hours, and employee benefits. The company must adapt its HR practices to align with the specific requirements of each region. For instance, in 2024, labor disputes led to shifts in production for some tech firms, highlighting the importance of strong labor relations.

- Compliance costs can vary significantly between regions.

- Legal changes could affect labor costs and operational flexibility.

- Risk of labor disputes can disrupt supply chains.

Logitech must comply with a web of global legal requirements impacting IP, data privacy, and product standards. GDPR fines potentially reach 4% of global turnover, posing a significant risk. The company's focus on data security is essential due to a 15% rise in data breaches during 2024.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| IP Protection | Risk of challenges | R&D spending $150M |

| Data Privacy | Risk of fines | Breaches increased 15% |

| Labor Laws | Affects costs, flexibility | Disputes led to prod. shifts |

Environmental factors

Logitech emphasizes sustainable design, using recycled plastics, low-carbon aluminum, and responsibly sourced paper. In 2024, they increased the use of recycled plastics. The goal is to reduce their carbon footprint.

Logitech is committed to environmental sustainability, targeting net-zero emissions by 2030. They strive for carbon neutrality in many products, reflecting a strong focus on reducing their environmental impact. In 2024, the company's efforts include sustainable material sourcing and eco-friendly packaging. Their 2024/2025 plan includes a 40% reduction in carbon emissions.

Logitech actively embraces renewable energy. As of 2024, a substantial percentage of Logitech's global sites use renewable electricity. This move aligns with broader industry trends, where companies increasingly prioritize sustainable operations to reduce their carbon footprint and meet environmental targets. Logitech's commitment is a key part of its environmental strategy.

Waste Reduction and Circular Economy Initiatives

Logitech actively pursues waste reduction and circular economy practices. They prioritize product longevity, reuse, and recycling to minimize environmental impact. Logitech’s circular design emphasizes extending product lifecycles. This approach aligns with growing consumer demand for sustainable products and supports environmental goals.

- Logitech's 2023 Sustainability Report highlights their commitment to circularity.

- They aim to design products for disassembly and material recovery.

- Logitech has set goals for using recycled content in their products.

Product Carbon Footprint Labeling

Logitech is set to label all products with their carbon footprint by 2025. This initiative aims to boost transparency, allowing consumers to make informed choices. The move aligns with growing consumer demand for sustainable products. In 2024, the global market for carbon footprint labeling is valued at $500 million and is expected to reach $1 billion by 2028.

- By 2025, all Logitech products will have a carbon footprint label.

- The carbon footprint labeling market is growing rapidly.

- Consumers are increasingly seeking sustainable products.

Logitech prioritizes sustainability through recycled materials, aiming for net-zero emissions by 2030. They actively embrace renewable energy and focus on waste reduction, promoting a circular economy.

By 2025, all products will feature carbon footprint labels, responding to consumer demand for eco-friendly options. This initiative reflects a growing trend towards transparency.

The carbon footprint labeling market, valued at $500 million in 2024, is expected to double by 2028. Logitech's efforts reflect commitment to sustainability and responsible practices.

| Initiative | Target | Status (2024/2025) |

|---|---|---|

| Recycled Plastics | Increase usage | Increased usage in 2024 |

| Carbon Emissions | Net-zero by 2030 | 40% reduction planned |

| Carbon Footprint Labeling | All products by 2025 | Implementation underway |

PESTLE Analysis Data Sources

The analysis draws from industry reports, financial data, government publications, and market research, covering all PESTLE factors.