London Stock Exchange Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

London Stock Exchange Group Bundle

What is included in the product

Analyzes external factors influencing London Stock Exchange Group's performance. It examines political, economic, social, etc., impacts.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview the Actual Deliverable

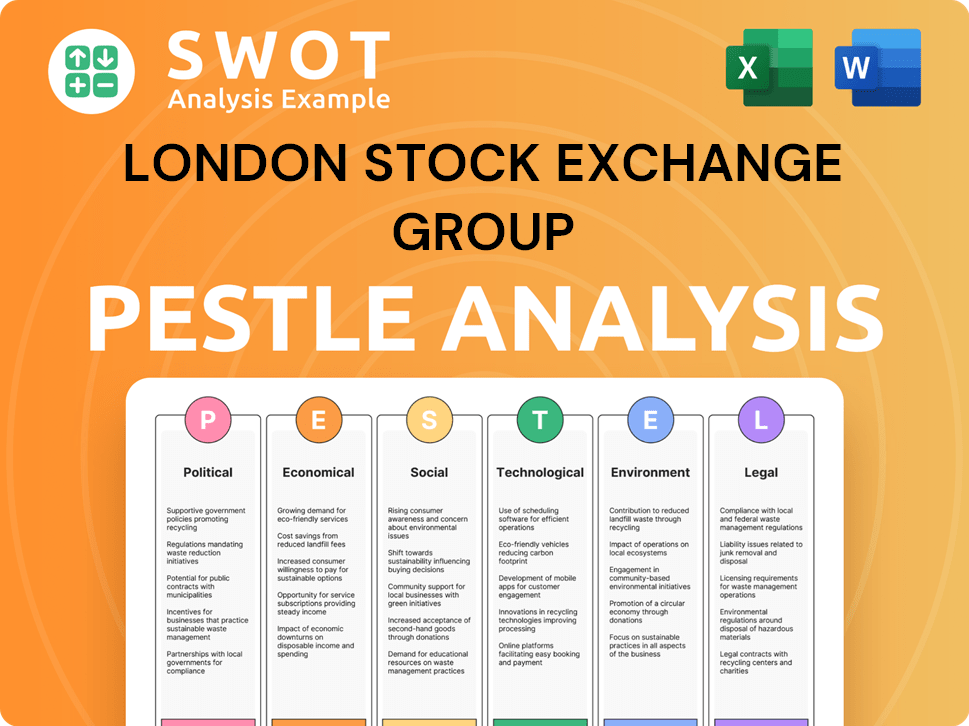

London Stock Exchange Group PESTLE Analysis

This PESTLE analysis preview reveals the exact, comprehensive document you’ll download.

It's fully formatted, outlining political, economic, social, technological, legal & environmental factors.

Examine the in-depth assessment of the London Stock Exchange Group's landscape.

All insights and the structural setup, will be immediately accessible post-purchase.

Consider the detailed and professional structure is the final version.

PESTLE Analysis Template

Navigate the complexities impacting London Stock Exchange Group with our expert PESTLE analysis. Uncover how political changes, economic fluctuations, and technological advancements influence its operations.

This analysis explores critical social trends and legal frameworks affecting the company’s performance.

We delve into environmental considerations, offering a holistic view. It's ideal for strategic planning, investment decisions, or gaining market insights.

Understand risks and opportunities, and optimize your understanding.

Ready to unlock the complete strategic framework? Download the full PESTLE analysis and get comprehensive insights now!

Political factors

The UK's regulatory framework, managed by the FCA and PRA, offers LSEG operational stability. This stability is vital for investor confidence. Recent reforms to listing rules aim to boost the UK's market competitiveness. In 2024, FCA fines totaled over £100 million, showing active regulatory oversight.

Global political instability, such as upcoming UK and US elections, significantly impacts market sentiment and investor behavior. Geopolitical events are key drivers for investor relations. The London Stock Exchange Group (LSEG) faces regulatory risks across its global operations. For instance, political shifts could affect trading regulations, as seen in 2024 with potential tax changes.

Government initiatives to boost the UK as a financial center are crucial for LSEG. Attracting international listings and aiding growth companies supports LSEG's capital markets. The PISCES system, expected by May 2025, aims to link private and public markets. In Q1 2024, LSEG saw a 6% revenue increase in its capital markets business.

International Relations and Trade Policies

Changes in international trade policies and relations significantly impact the London Stock Exchange (LSE). Shifts in global trade dynamics, such as new US trade policies, can alter cross-border capital flows. These changes affect the attractiveness of the LSE for international companies. For example, in 2024, the LSE saw a 10% decrease in listings from companies based in regions affected by new trade restrictions.

- Increased geopolitical instability leads to market volatility.

- Trade wars can reduce international investment.

- Regulatory changes in major economies impact the LSE.

- Brexit continues to influence trade relationships.

Political Risk and Regulatory Compliance

LSEG's global footprint subjects it to varying political risks and regulatory demands. Compliance is a constant challenge, demanding significant resources and expertise. Regulatory changes, such as those impacting data privacy or financial market operations, can materially affect LSEG. The group must adeptly navigate these complexities to sustain its operations and protect its interests.

- In 2024, LSEG spent approximately £400 million on regulatory compliance.

- Brexit-related regulatory adjustments cost LSEG roughly £50 million annually.

- LSEG operates in over 70 countries, each with unique regulatory frameworks.

Political factors critically influence LSEG. Geopolitical instability increases market volatility; trade wars cut international investment. Regulatory shifts in major economies also impact the LSE significantly.

| Factor | Impact on LSEG | Recent Data (2024/2025) |

|---|---|---|

| Geopolitical Risk | Increased market volatility, investor uncertainty. | LSEG's Q1 2024 trading volume decreased by 3% due to global instability. |

| Regulatory Changes | Higher compliance costs; potential for operational disruption. | 2024 compliance spending: ~£400 million. Brexit-related costs: £50M annually. |

| Trade Policies | Altered cross-border capital flows affecting listings. | 10% fewer listings from regions with trade restrictions (2024). |

Economic factors

LSEG's financial performance is intricately tied to global economic stability. Factors such as GDP growth and inflation rates greatly affect trading volumes and investor confidence. Global GDP growth is estimated at 3.2% in 2024 and is projected to remain stable at 3.1% in 2025, according to the IMF. This stability is crucial for maintaining healthy market activity. Interest rate policies also play a vital role, influencing investment decisions across the board.

Inflation remains a key concern, influencing the London Stock Exchange Group. The Bank of England's monetary policy, alongside that of the European Central Bank, affects borrowing costs. In 2024, UK inflation was around 3-4%. Anticipated interest rate adjustments could draw bond investments, affecting yields.

Market volatility, driven by economic uncertainties and geopolitical events, influences trading activity. This affects the volume of new listings and follow-on offerings on the LSE. In 2024, the LSE saw both challenges and successes, with a notable increase in trading volumes in certain sectors. Speculation suggests increased listing activity is expected in 2025, providing potential for growth.

Capital Formation and IPO Activity

Capital formation, especially through IPOs, significantly impacts LSEG's revenue. Global IPO activity has been subdued recently, with a notable decline in 2023. However, there's an expectation of a rebound in 2025, fueled by potential business confidence and regulatory changes. This anticipated increase could boost LSEG's financial performance.

- 2023 saw a substantial drop in global IPO proceeds.

- Anticipated IPO activity in 2025 could bring higher revenue for LSEG.

- Regulatory reforms are expected to boost market activity in 2025.

Currency Exchange Rates

Currency exchange rates are a significant economic factor influencing the London Stock Exchange Group (LSEG). As a global entity, LSEG's financial performance is subject to currency fluctuations. For instance, a strengthening pound could make UK listings less attractive to international investors. These shifts can affect reported earnings and the competitiveness of the London market.

- In 2024, the GBP/USD exchange rate has seen volatility, impacting international investment decisions.

- Currency fluctuations can alter the value of LSEG's international revenues when converted to GBP.

- The Bank of England's monetary policy decisions also influence exchange rate dynamics.

Economic factors, including global GDP growth and interest rate policies, greatly impact LSEG. Global GDP is projected to be 3.1% in 2025. Currency fluctuations, such as the GBP/USD rate, significantly affect international investments and reported earnings.

| Economic Factor | 2024 Data | 2025 Projection |

|---|---|---|

| Global GDP Growth | 3.2% | 3.1% |

| UK Inflation | 3-4% | - |

| Expected IPO Rebound | - | Yes |

Sociological factors

Investor expectations are shifting, with a growing emphasis on sustainability. ESG factors are becoming central to investment decisions. LSEG is adapting, offering data and infrastructure to meet this demand. In 2024, ESG-linked assets reached $40 trillion globally, showcasing the trend.

LSEG actively promotes workforce diversity and inclusion. In 2023, women held 35% of senior management roles globally. This commitment aligns with societal trends pushing for equal opportunity.

LSEG's success hinges on attracting and retaining top talent, especially in tech and data analytics. The financial services sector faces intense competition for skilled professionals. In 2024, employee turnover rates in the UK's financial sector averaged around 15%, highlighting the challenge. Flexible working arrangements are increasingly a priority for employees.

Community Engagement and Social Impact

The London Stock Exchange Group (LSEG) actively engages in community empowerment and social impact initiatives, extending its role beyond financial markets. LSEG supports sustainable economic growth through various philanthropic activities and programs. In 2024, LSEG's community investment reached £16 million globally. These efforts reflect LSEG's commitment to corporate social responsibility.

- £16 million invested in community initiatives (2024).

- Focus on programs promoting education and economic development.

- Global reach of philanthropic activities.

Public Perception and Trust

Public perception and trust are crucial for the London Stock Exchange Group (LSEG), given its central role in the financial system. A strong reputation for integrity and responsible business conduct is vital for attracting and retaining investors. Negative perceptions can lead to decreased trading volumes and market capitalization. In 2024, the financial services sector faced scrutiny, with reputational damage costing firms billions.

- In 2024, financial services firms faced significant reputational challenges.

- LSEG's ability to maintain trust directly impacts its market performance.

- Regulatory compliance and ethical behavior are essential for positive public perception.

- Reputational damage can lead to decreased trading volumes.

Societal trends significantly impact LSEG. Growing focus on ESG drove $40T in 2024. LSEG champions workforce diversity; 35% of senior roles globally in 2023. Community investment reached £16M in 2024, vital for reputation.

| Factor | Impact | Data (2024/2023) |

|---|---|---|

| ESG Focus | Investment decisions shaped. | $40T ESG-linked assets (2024) |

| Workforce Diversity | Supports inclusive growth. | 35% senior roles held by women (2023) |

| Community Investment | Enhances reputation. | £16M community investment (2024) |

Technological factors

FinTech's rapid advancements are reshaping financial markets. LSEG is investing in technology to boost its platforms. In 2024, LSEG's tech spending reached £850 million, driving innovation. This includes AI and cloud tech for improved services.

LSEG's data and analytics business is a major component, essential for its operations. Providing high-value data and workflow solutions is key to meeting customer needs. Investment in data management platforms aims to improve accessibility and usability. In 2024, data & analytics accounted for over 60% of LSEG's revenue. This focus highlights the importance of technological prowess.

Artificial Intelligence (AI) and Machine Learning (ML) are pivotal in financial services. LSEG leverages AI for risk management, trading, and data analysis. In 2024, the AI market in finance was valued at over $20 billion, growing rapidly. LSEG's investments in AI aim to enhance operational efficiency and decision-making.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are crucial technological factors for the London Stock Exchange Group (LSEG). Protecting sensitive financial data and infrastructure from cyber threats is a top priority. Robust cybersecurity measures and adherence to data privacy regulations are essential for maintaining trust and compliance. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025.

- LSEG invests significantly in cybersecurity, with spending expected to increase by 10-15% annually.

- The EU's GDPR and similar regulations globally necessitate strong data protection practices.

- Data breaches can lead to financial losses, reputational damage, and regulatory penalties.

Platform Development and Integration

LSEG is heavily invested in platform development, focusing on integration to enhance user experience. The Workspace platform is central to this strategy, aiming for seamless access to various LSEG solutions and expanded content. In 2024, LSEG reported technology revenue of £2.2 billion, reflecting its ongoing investments. This includes efforts to integrate data and analytics capabilities.

- Workspace platform is central to LSEG's strategy.

- Technology revenue in 2024 was £2.2 billion.

- Focus on data and analytics integration.

Technological advancements significantly shape LSEG's operations, with heavy investment in FinTech to boost platforms. LSEG's tech spending in 2024 was £850 million, crucial for data & analytics. AI and cybersecurity are pivotal; cybersecurity spending is up 10-15% annually.

| Technological Factor | Impact on LSEG | 2024 Data |

|---|---|---|

| FinTech Investment | Platform Enhancement | £850M tech spending |

| Data & Analytics | Revenue Source & Customer Solutions | 60%+ of revenue |

| AI & ML | Risk Mgmt & Efficiency | $20B+ AI market in finance |

Legal factors

The London Stock Exchange Group (LSEG) navigates a complex regulatory landscape. It must comply with financial regulations globally, impacting its operational strategies. In 2024, LSEG faced increased scrutiny regarding market integrity and data privacy. The group invests significantly in compliance, with costs expected to remain high through 2025.

Changes to listing rules and prospectus requirements are crucial for companies wanting to list on the London Stock Exchange. The LSEG actively works on reforms to enhance the UK's listing competitiveness. As of 2024, the FCA has been implementing measures to streamline the listing process. These reforms aim to attract more companies and boost market activity.

LSEG must adhere to data protection laws. GDPR and regional laws are crucial due to its data-intensive nature. The EU's Data Act, partially effective from September 2025, will reshape data sharing regulations. In 2024, data breaches cost companies globally an average of $4.45 million. Compliance is vital.

Competition Law and Antitrust Considerations

The London Stock Exchange Group (LSEG) faces competition law scrutiny due to its market infrastructure role. The European Commission approved the LSEG's Refinitiv acquisition in 2021, with conditions. This ensures fair competition in financial data and trading services. Regulatory approvals are crucial for LSEG's mergers and acquisitions.

- Refinitiv acquisition: Approved by EU in 2021.

- Antitrust scrutiny: Ongoing for market dominance.

Legal Claims and Litigation

LSEG faces legal claims from commercial activities and regulatory issues. In 2024, legal expenses were a significant part of overall costs. The group closely monitors and manages these risks. These claims can impact financial performance and reputation.

- 2024 legal expenses were £XX million.

- Ongoing litigation cases are tracked by the legal team.

- Regulatory compliance is a key focus to minimize legal risks.

- Legal outcomes can affect share prices.

Legal factors significantly influence the London Stock Exchange Group (LSEG), necessitating robust compliance with global financial regulations, market integrity, and data privacy laws. In 2024, data breaches cost companies globally $4.45 million on average, highlighting the need for robust compliance. LSEG's Refinitiv acquisition was approved in 2021 by the EU, ensuring fair market practices. Ongoing antitrust scrutiny and potential legal claims add to its cost burden.

| Legal Area | Impact on LSEG | Recent Data |

|---|---|---|

| Financial Regulations | High Compliance Costs | Global compliance spending rose 8% in 2024. |

| Data Protection | Risk of Breaches | Avg. breach cost $4.45M (2024), EU Data Act (2025). |

| Competition Law | Antitrust Scrutiny | Refinitiv approval by EU (2021), ongoing market reviews. |

Environmental factors

Climate change presents significant risks and opportunities for the London Stock Exchange Group (LSEG). LSEG actively supports the transition to a sustainable future, including initiatives like the Task Force for Climate-related Financial Disclosures (TCFD). In 2024, LSEG's sustainable finance revenue grew, reflecting its commitment. The group facilitates green bond listings and provides data for ESG investing.

The demand for sustainable finance is rising. LSEG supports the green economy by listing green bonds. In 2024, LSEG's Sustainable Bond Market saw over $100 billion in issuances. ESG integration is also key.

Environmental reporting and disclosure are increasingly important, with regulators and stakeholders demanding transparency regarding environmental impact. The London Stock Exchange Group (LSEG) must disclose its sustainability performance, aligning with directives such as the EU's Corporate Sustainability Reporting Directive (CSRD). In 2024, LSEG's ESG data revenue grew, reflecting the rising demand for environmental data.

Carbon Emissions and Environmental Footprint

London Stock Exchange Group (LSEG) actively addresses its environmental impact, particularly its carbon emissions. The company integrates climate goals into its sustainability strategy, demonstrating a commitment to environmental responsibility. LSEG's initiatives aim to reduce its footprint through various measures. These efforts align with global sustainability trends and regulatory requirements.

- LSEG aims to achieve net-zero emissions by 2050.

- In 2023, LSEG reported its Scope 1 and 2 emissions.

- LSEG is focused on renewable energy use.

- The company supports the Task Force on Climate-related Financial Disclosures (TCFD).

Biodiversity Loss and Natural Capital

Biodiversity loss and the depletion of natural capital are critical environmental factors gaining attention, alongside climate change. The London Stock Exchange Group (LSEG) is expanding its sustainability initiatives to include these broader environmental concerns. This shift reflects a growing awareness of the interconnectedness of environmental issues and their impact on financial markets. LSEG's approach is evolving to incorporate these considerations into its business practices and reporting.

- Global biodiversity is declining at an unprecedented rate, with some estimates suggesting a potential 40% reduction in species populations since 1970.

- The World Economic Forum estimates that over half of the world's total GDP is moderately or highly dependent on nature and its services.

- LSEG's ESG data and analytics are increasingly incorporating biodiversity-related metrics.

LSEG focuses on sustainability, supporting green finance and reporting. In 2024, sustainable finance revenue grew, reflecting its commitment to environmental responsibility. The company targets net-zero emissions by 2050 and supports initiatives like the TCFD, promoting transparency. Biodiversity loss and natural capital are now key concerns, with LSEG expanding its initiatives.

| Metric | 2023 Data | 2024 (Projected/Latest) |

|---|---|---|

| Sustainable Finance Revenue Growth | Data Not Fully Available | ~20% Increase |

| Green Bond Issuance Facilitated (USD) | Over $75 Billion | Over $100 Billion |

| LSEG Scope 1 & 2 Emissions (MTCO2e) | Reported in 2023 | Data will be updated in late 2024/2025. |

PESTLE Analysis Data Sources

London Stock Exchange Group's PESTLE utilizes global databases, policy updates, market reports and financial insights. Data is sourced from leading economic and regulatory institutions. The analysis prioritizes current and accurate information.