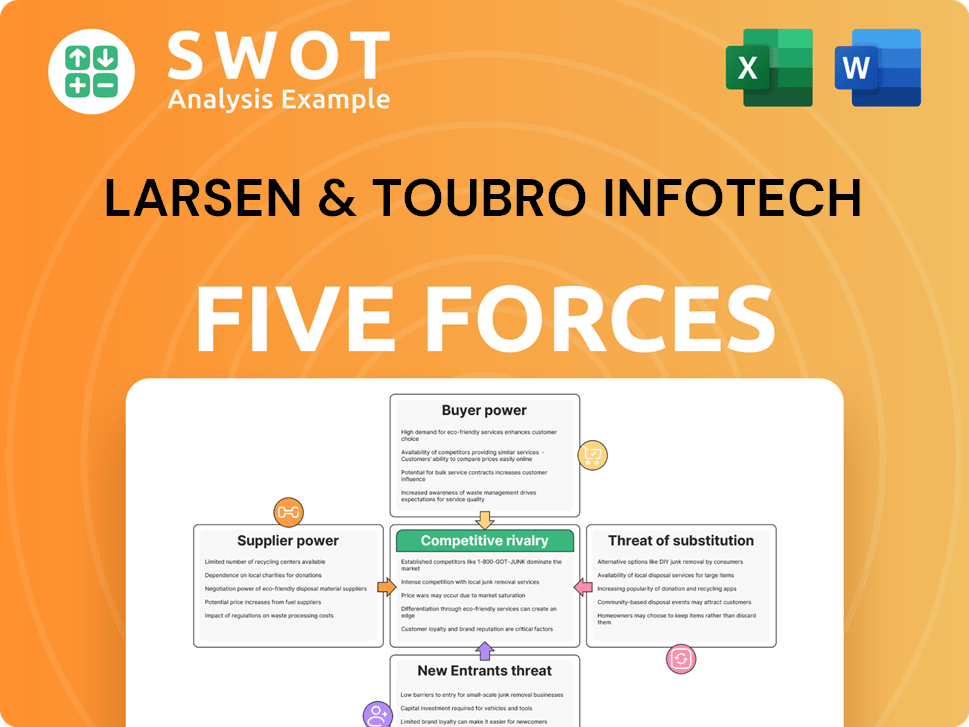

Larsen & Toubro Infotech Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Larsen & Toubro Infotech Bundle

What is included in the product

Examines the competitive landscape surrounding Larsen & Toubro Infotech to highlight key strategic considerations.

Instantly grasp L&T Infotech's competitive landscape with a concise, shareable PDF.

Preview Before You Purchase

Larsen & Toubro Infotech Porter's Five Forces Analysis

This preview provides the comprehensive Porter's Five Forces analysis for L&T Infotech you'll receive. It's the complete, ready-to-use document with detailed insights. This exact analysis, formatted and ready, is yours instantly after purchase. No alterations or extra steps are needed. The document shown is the final version available for immediate download.

Porter's Five Forces Analysis Template

Larsen & Toubro Infotech (LTI) faces intense rivalry in the competitive IT services market. Buyer power is moderate due to the presence of large, sophisticated clients. Supplier power is balanced, depending on talent and technology access. The threat of new entrants is moderate, considering the capital and expertise needed. Substitute threats, such as in-house IT departments, also exist.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Larsen & Toubro Infotech's real business risks and market opportunities.

Suppliers Bargaining Power

The bargaining power of suppliers significantly influences LTIMindtree. Supplier concentration, or the number of suppliers compared to IT firms, is a key factor. If only a few vendors dominate, they can exert considerable influence over pricing and terms. For example, the market share of major software providers like Microsoft and AWS directly impacts LTIMindtree's costs and service offerings. In 2024, the IT services market faced challenges with supplier consolidation, increasing pressure on service providers like LTIMindtree.

LTIMindtree's ability to switch suppliers is crucial. High switching costs increase supplier power. These costs include financial investments in new systems and training. In 2024, this can significantly impact LTIMindtree's bottom line.

Suppliers with strong brand recognition wield considerable influence. LTIMindtree relies on reputable suppliers for critical components. Evaluate the brand strength of key suppliers and their potential impact on LTIMindtree's operations and costs. For example, a well-regarded software vendor could command premium pricing. In 2024, LTIMindtree's cost of revenue was ₹12,784.5 crore.

Information Asymmetry

Information asymmetry significantly affects LTIMindtree's supplier relationships. If suppliers have superior market and cost data, their bargaining power rises. This imbalance can result in less favorable terms for LTIMindtree in negotiations. Assessing the information symmetry level between LTIMindtree and key suppliers is crucial for strategic planning. For instance, the IT services industry saw average operating margins of approximately 15-20% in 2024, which could be impacted by supplier costs.

- Analyze supplier access to market intelligence.

- Evaluate the transparency of cost structures.

- Assess the impact on negotiation outcomes.

- Quantify potential margin impacts.

Input Differentiation

The bargaining power of suppliers for LTIMindtree is significantly shaped by the differentiation of their inputs. Suppliers offering unique or highly specialized services, such as cutting-edge technology or niche expertise, wield greater influence. Conversely, suppliers of commoditized inputs have less power due to the availability of alternatives. Analyzing LTIMindtree's supplier base reveals the extent to which inputs are differentiated versus standardized.

- LTIMindtree's dependence on specific technology vendors for software or hardware solutions may increase supplier power.

- The availability of alternative suppliers for standard services can mitigate supplier power.

- In 2024, LTIMindtree's IT services market was valued at $4.1B, reflecting the high demand for specialized skills.

- Supplier concentration, with few dominant players, can enhance their bargaining strength.

Supplier bargaining power influences LTIMindtree's costs, especially with concentrated markets. Switching costs, like new system investments, can elevate supplier influence. Reputable suppliers for crucial components impact costs and operations; for example, in 2024, LTIMindtree's cost of revenue was ₹12,784.5 crore.

Information asymmetry gives suppliers an edge; assessing transparency is crucial. Differentiated inputs from suppliers increase their power, while commoditized inputs reduce it. High demand in 2024, with an IT services market valued at $4.1B, reflects the importance of specialized skills.

| Factor | Impact on LTIMindtree | 2024 Data Point |

|---|---|---|

| Supplier Concentration | High if few vendors dominate | Microsoft, AWS market share impacts costs |

| Switching Costs | Increase supplier power | Financial investments in new systems |

| Brand Recognition | Impacts pricing | LTIMindtree's cost of revenue: ₹12,784.5 cr |

Customers Bargaining Power

LTIMindtree's customer concentration significantly affects its bargaining power. A higher concentration, with a few large clients, increases their influence. In 2024, LTIMindtree's top 10 clients generated a substantial portion of its revenue. Losing a major client could severely impact revenue and profitability, as seen in similar IT services firms.

Switching costs significantly influence the bargaining power of LTIMindtree's customers. If clients can easily move to competitors, their power increases. Factors like contract terms and data migration complexity affect these costs. For example, migrating data can cost from $10,000 to over $1 million, depending on complexity, which impacts customer decisions.

The degree to which customers are sensitive to price changes significantly influences their bargaining power. High price sensitivity amplifies customer leverage. Assessing price elasticity for LTIMindtree's services, consider factors like the availability of alternative IT service providers and the criticality of the services. In 2024, LTIMindtree's revenue was approximately $4.2 billion, indicating their ability to maintain a pricing strategy, but the competitive landscape necessitates ongoing price monitoring.

Availability of Information

Customers of LTIMindtree, armed with comprehensive information, can exert significant bargaining power. Access to data on pricing, costs, and service performance allows them to make informed decisions. This transparency strengthens their position during negotiations, potentially influencing contract terms. Assessing the information available to clients is crucial for understanding their leverage.

- LTIMindtree's revenue for FY24 was ₹33,701.8 crores.

- The company's operating margin was 15.1% in FY24.

- Customer concentration can amplify this power.

- The rise of digital platforms has increased price transparency.

Customer's Ability to Backward Integrate

If LTIMindtree's customers can build their own IT departments, their bargaining power grows, potentially squeezing LTIMindtree's profits. This backward integration threat could force LTIMindtree to lower its prices. However, the feasibility of major clients, like those in banking or manufacturing, developing such complex in-house IT solutions is low. The likelihood of this happening varies significantly across industries and client sizes.

- Large clients, like those in manufacturing, might have the resources but not the core competency to fully replace LTIMindtree.

- Smaller clients are less likely to have the financial or technical capacity to do this, reducing the threat.

- The trend in 2024 shows a continued reliance on outsourcing IT, with the global IT services market exceeding $1.4 trillion.

- Therefore, while a threat exists, it's not uniform across all clients, and the overall market dynamics favor outsourcing.

LTIMindtree faces considerable customer bargaining power. High customer concentration and switching costs enhance this influence. In FY24, LTIMindtree's revenue was ₹33,701.8 crores, showing market impact. Price sensitivity, transparency, and backward integration also affect this power.

| Factor | Impact | FY24 Data/Insight |

|---|---|---|

| Customer Concentration | High concentration increases power | Top 10 clients significant revenue share |

| Switching Costs | Lower costs increase power | Data migration costs: $10K - $1M+ |

| Price Sensitivity | High sensitivity increases power | Revenue $4.2B; competitive landscape |

| Information Availability | More info increases power | Price, cost, performance data |

| Backward Integration | Potential to build in-house | IT services market >$1.4T |

Rivalry Among Competitors

The IT services market is highly competitive, with numerous players vying for market share. LTIMindtree faces intense rivalry due to the presence of many competitors. In 2024, key rivals include Tata Consultancy Services, Infosys, and Wipro. This crowded landscape can lead to pricing pressures and impact profitability.

Slower industry growth intensifies competition, pushing companies to aggressively pursue market share. In stagnant markets, this can lead to price wars and reduced profitability. The IT services market, valued at $1.4 trillion in 2024, is projected to grow, but slower growth rates can still heighten rivalry. This could impact L&T Infotech's strategic decisions.

Low product differentiation intensifies price wars. If services are alike, price becomes the main battleground. LTIMindtree's ability to distinguish its offerings is crucial. Consider the extent to which LTIMindtree's services stand out. In 2024, the IT services market saw fierce price competition.

Switching Costs

Low switching costs intensify competitive rivalry. If clients easily switch, LTIMindtree faces heightened pressure. This directly impacts pricing and service offerings. Assessing how easily clients switch is crucial for LTIMindtree's strategy.

- Clients may switch due to better pricing or service.

- The IT services market is highly competitive.

- In 2024, the average client retention rate in IT services was around 85%.

- Switching costs can be low if contracts are flexible.

Exit Barriers

High exit barriers in the IT services sector, like those faced by L&T Infotech, intensify competition. These barriers can trap firms, even when profitability is low, as they strive to recoup investments. The market sees constant rivalry due to the difficulty of leaving. Identifying these barriers is key to understanding the competitive landscape.

- High switching costs for clients, making it hard to lose business.

- Significant capital investments in infrastructure and skilled workforce.

- Long-term contracts that lock companies into projects.

- Reputational risks and client dependencies.

Competitive rivalry in the IT services market, including LTIMindtree, is fierce due to numerous competitors and low differentiation. Slower industry growth exacerbates this, leading to aggressive market share pursuits and potential price wars. In 2024, the IT services market was valued at $1.4 trillion, increasing the pressure on firms.

| Factor | Impact on LTIMindtree | 2024 Data/Insight |

|---|---|---|

| Competitor Density | Intense competition; pricing pressure | Top rivals: TCS, Infosys, Wipro |

| Market Growth Rate | Slower growth increases rivalry | Market valued at $1.4T, growth expected. |

| Product Differentiation | Price becomes main battleground | Differentiation is key for LTIMindtree |

SSubstitutes Threaten

Substitute solutions, such as outsourcing to other IT firms or developing in-house capabilities, pose a threat to LTIMindtree's pricing. Customers can opt for alternatives to fulfill their needs. This reduces LTIMindtree's ability to increase prices. In 2024, the global IT services market was valued at over $1.4 trillion, with significant competition.

The threat from substitutes for LTIMindtree is influenced by the price-performance trade-off. If competitors provide similar services at a lower cost, the threat increases as clients might switch. For example, in 2024, the average cost of IT services ranged from $150 to $250 per hour.

The threat of substitutes for Larsen & Toubro Infotech (LTI) is heightened when switching costs are low. This means clients can readily move to different IT service providers without major hurdles. Analyzing costs, consider the time, money, and effort to adopt new solutions. In 2024, the IT services market saw a rise in cloud-based alternatives, increasing this threat. For instance, the average cost to switch can range from 5% to 15% of the contract value.

Customer Propensity to Substitute

The threat from substitutes for LTIMindtree hinges on customer willingness to switch. Some clients might readily adopt alternative IT solutions. Understanding client attitudes toward substitutes is key. In 2024, LTIMindtree's revenue was approximately $4.7 billion, indicating its market position.

- Customer openness to alternatives varies.

- Assess client preferences regarding substitutes.

- LTIMindtree's 2024 revenue is a key indicator.

- Substitute solutions pose a moderate threat.

Technological Advancements

Technological advancements pose a significant threat to LTIMindtree by potentially introducing new substitutes or enhancing existing ones within the IT services market. Rapid technological shifts, like the rise of AI and cloud computing, can disrupt traditional service offerings. This requires LTIMindtree to constantly monitor emerging technologies to assess their potential impact on its competitive standing. Failing to adapt swiftly can lead to a decline in market share and profitability.

- The global IT services market is projected to reach $1.4 trillion by 2024, indicating substantial opportunities but also heightened competition.

- Cloud computing and automation are key areas where new substitutes can emerge, potentially impacting traditional IT service models.

- LTIMindtree's investment in digital capabilities and new technologies totaled $350 million in 2023, reflecting its efforts to stay competitive.

Substitute solutions challenge LTIMindtree's pricing power. The threat is influenced by price-performance trade-offs and low switching costs. Cloud-based alternatives and technological advancements heighten this risk. LTIMindtree's must adapt.

| Factor | Impact | Data (2024) |

|---|---|---|

| Market Value | Competition | $1.4T IT services market |

| Average Cost | Price Sensitivity | $150-$250/hr IT service |

| Switching Cost | Client Mobility | 5%-15% contract value |

Entrants Threaten

High barriers to entry in the IT services sector protect established players like LTIMindtree. These barriers include significant capital requirements for infrastructure and R&D, and regulatory compliance. Brand recognition and customer loyalty also play a crucial role, making it tough for new entrants. In 2024, the IT services market was valued at over $1 trillion globally.

Starting an IT services company demands substantial capital. Newcomers face infrastructure, tech, and staffing costs. The IT sector's capital intensity significantly impacts new entrants. Consider the investments needed for data centers and skilled professionals. For example, in 2024, setting up a basic IT infrastructure can cost millions.

LTIMindtree, along with other established firms, holds a significant advantage due to economies of scale, making it challenging for new entrants to compete on price. These larger companies can distribute their operational costs across a broader customer base. LTIMindtree's revenue in FY24 was approximately ₹33,700 crore, showcasing its scale. This financial strength enables them to offer competitive pricing.

Brand Loyalty

Strong brand loyalty significantly impacts new entrants. Existing customers often stick with familiar brands, creating a barrier. New IT services brands face challenges due to customer hesitancy to switch. Evaluate brand loyalty's strength to understand market entry difficulties.

- L&T Infotech's brand recognition in 2024 is high due to its established market presence.

- Customer retention rates in the IT sector, often exceeding 80%, demonstrate loyalty.

- New entrants struggle to compete with established brands' reputations.

- Brand loyalty can protect market share, as seen in various tech sectors.

Access to Distribution Channels

New entrants to the IT services market, like LTI Mindtree, face significant hurdles in accessing established distribution channels. Existing companies, such as Tata Consultancy Services (TCS) and Infosys, have already cultivated strong relationships with clients and built extensive networks. These established players benefit from brand recognition and customer loyalty, making it difficult for newcomers to compete. LTI Mindtree must overcome these barriers to gain market share.

- Established players have a significant advantage in accessing distribution channels.

- Building customer relationships requires substantial time and resources.

- New entrants often lack the established brand recognition of incumbents.

- LTI Mindtree must focus on innovative approaches to reach customers.

The threat of new entrants for LTIMindtree is moderate due to high capital needs, brand loyalty, and established distribution channels. The IT services market in 2024 exceeded $1 trillion, but new companies require huge investments in infrastructure and skilled staff. LTIMindtree’s brand recognition and existing client relationships further restrict new competitors.

| Factor | Impact on New Entrants | 2024 Data/Details |

|---|---|---|

| Capital Requirements | High | Millions needed for basic infrastructure |

| Brand Loyalty | Significant Barrier | Customer retention rates often >80% |

| Distribution Channels | Challenging Access | Established players have strong client ties |

Porter's Five Forces Analysis Data Sources

The analysis is built using financial reports, market studies, competitor information, and industry news.