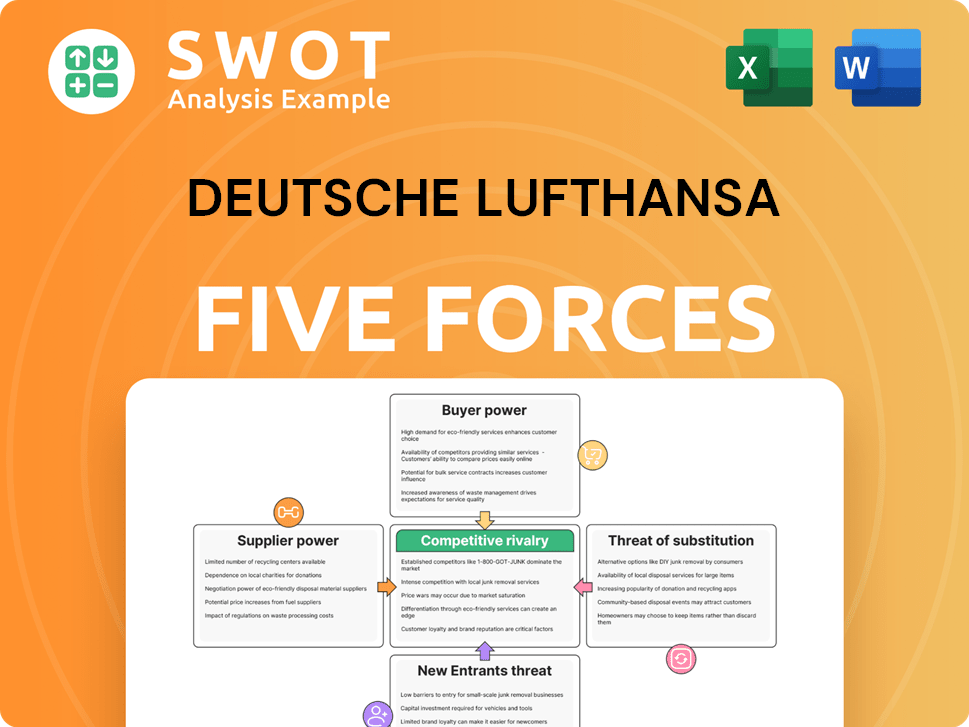

Deutsche Lufthansa Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutsche Lufthansa Bundle

What is included in the product

Tailored exclusively for Deutsche Lufthansa, analyzing its position within its competitive landscape.

Instantly understand strategic pressure with a powerful spider/radar chart.

What You See Is What You Get

Deutsche Lufthansa Porter's Five Forces Analysis

This is the complete, ready-to-use analysis file. The Porter's Five Forces analysis preview for Deutsche Lufthansa is identical to the purchased document. You'll receive the fully formatted analysis immediately after purchase. The document offers an in-depth look. It covers all five forces impacting the airline, ready for your use. The preview is what you get.

Porter's Five Forces Analysis Template

Deutsche Lufthansa faces significant competitive pressures in the airline industry. The bargaining power of buyers (passengers) is heightened by readily available price comparisons and alternative travel options. Supplier power, especially fuel and aircraft manufacturers, poses a constant cost challenge. The threat of new entrants, while moderated by high barriers, still exists. Intense rivalry among existing airlines, including budget carriers, further complicates the landscape.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Deutsche Lufthansa.

Suppliers Bargaining Power

Boeing and Airbus, the dominant aircraft manufacturers, wield considerable power. Their control limits Lufthansa's choices, potentially increasing costs and restricting contract flexibility. In 2022, Airbus delivered 661 aircraft, and Boeing delivered 340, illustrating their strong market position. This duopoly creates a significant power imbalance during negotiations.

High aircraft financing costs significantly influence Lufthansa's supplier bargaining power. The airline's long-term relationships with suppliers are shaped by substantial capital commitments. In 2024, a new wide-body aircraft's average cost exceeded $300 million. Penalties for contract breaches can reach 10% of the contract value, raising switching costs.

Fuel suppliers wield substantial power over Lufthansa due to the airline's heavy reliance on fuel. In 2022, fuel expenses comprised about 27% of Lufthansa's operational costs, showcasing their impact. Geopolitical events and market dynamics drive volatile fuel prices, directly affecting Lufthansa's financial performance. These fluctuations can squeeze profit margins significantly.

Limited Airport Slot Availability

Deutsche Lufthansa faces supplier bargaining power challenges, particularly with limited airport slot availability. Airports, controlling these crucial slots, wield significant influence, impacting Lufthansa's operations. Major airports like Frankfurt and Munich often have restricted capacity, with slots sometimes as scarce as 40 per hour. This scarcity directly affects Lufthansa's route expansion and operational flexibility.

- Limited Slots: Frankfurt Airport handles around 1,300 flights daily.

- Operational Constraints: Slot restrictions can lead to delays and higher operational costs.

- Strategic Impact: Lufthansa's ability to compete in key markets is affected.

- Market Dynamics: Supply and demand imbalances increase airport bargaining power.

Maintenance and Repair Services

Specialized maintenance, repair, and overhaul (MRO) services are essential for Lufthansa's operations. A few large providers significantly influence these services. Lufthansa Technik, a subsidiary, offers these services, but external dependencies still exist. The global MRO market is highly consolidated, increasing supplier power. In 2024, the MRO market was valued at approximately $85 billion, with further consolidation expected.

- Consolidated Market: The MRO market is dominated by a few key players.

- Dependency: Lufthansa relies on both internal and external MRO providers.

- Cost Impact: Supplier power can influence maintenance costs.

- Market Value: The global MRO market was worth around $85 billion in 2024.

Lufthansa faces supplier power from aircraft makers like Boeing and Airbus. Fuel costs are a major pressure, with fuel making up about 27% of operational costs in 2022. Airport slot scarcity, especially in Frankfurt and Munich, restricts flexibility.

| Supplier Type | Impact on Lufthansa | 2024 Data |

|---|---|---|

| Aircraft Manufacturers | High costs, limited choices | Boeing and Airbus dominance |

| Fuel Suppliers | Volatile prices, margin squeeze | ~27% of op. costs in 2022 |

| Airport Slots | Operational constraints, strategic impact | Frankfurt: ~1,300 flights/day |

Customers Bargaining Power

Customers show high price sensitivity, driven by the growth of budget airlines. Low-cost carriers significantly challenge Lufthansa's pricing power. In India, Indigo and SpiceJet offer fares 45%-50% lower than traditional airlines. This forces Lufthansa to compete on price, impacting profitability. This pressure is particularly evident in routes where budget airlines have a strong presence.

Online comparison tools significantly boost customer bargaining power by simplifying price comparisons. Platforms like Google Flights and Skyscanner allow customers to quickly assess fares. This transparency compels Lufthansa to offer competitive pricing to attract customers. In 2024, these tools influenced over 60% of flight bookings globally, enhancing customer leverage.

Lufthansa's loyalty programs significantly influence customer bargaining power, requiring constant attractiveness. Airlines leverage these programs for customer retention. In 2024, Lufthansa's Miles & More program had 30+ million members. These programs lock in customers, but maintaining appeal needs ongoing investment.

Influence of Environmental Concerns

Customers' environmental awareness significantly shapes their bargaining power. In 2024, travelers increasingly prioritize sustainability, impacting airline choices. A 2022 study by the World Travel & Tourism Council showed 75% consider carbon footprints. This trend can shift demand towards greener alternatives.

- Growing demand for sustainable travel options.

- Impact on airline selection based on environmental policies.

- Potential shift towards lower-emission alternatives.

- Increased customer scrutiny of airline sustainability efforts.

Service Expectations

Customers' service expectations significantly impact Lufthansa's profitability. Failing to meet these high standards can lead to customers choosing competitors. Lufthansa's premium service and reputation are vital for customer retention in the competitive airline industry. Maintaining top-tier service is essential for sustained success.

- In 2024, Lufthansa's passenger satisfaction scores remained high, but operational challenges caused some service disruptions.

- Premium class offerings, like Lufthansa's First Class, continue to be a significant revenue driver.

- Customer loyalty programs, such as Miles & More, are crucial for retaining high-value customers.

- Investments in staff training and in-flight amenities are ongoing to meet and exceed service expectations.

Customer bargaining power significantly influences Lufthansa's pricing. Budget airlines and online comparison tools empower customers. Loyalty programs and service expectations further shape customer influence, impacting Lufthansa's profitability.

| Factor | Impact | Data (2024) |

|---|---|---|

| Budget Airlines | Lower Prices | Indigo/SpiceJet fares 45-50% lower |

| Online Tools | Price Transparency | 60%+ bookings influenced |

| Loyalty Programs | Customer Retention | Miles & More: 30M+ members |

Rivalry Among Competitors

The airline industry is incredibly competitive, with many airlines fighting for customers. Lufthansa faces stiff competition from major players like Air France-KLM and British Airways. These airlines battle on routes, services, and pricing to attract travelers. In 2024, the global airline industry's competitive landscape remains fierce, with pricing wars and route expansions.

Low-cost carriers (LCCs) significantly impact fare structures. Airlines like SpiceJet and GoAir offer competitive pricing. Domestic fares are approximately 15-20% lower than full-service airlines. This compels Lufthansa to manage pricing while upholding service quality. In 2024, LCCs continue to grow, increasing competitive pressures.

Lufthansa faces intense rivalry from global airlines with extensive networks. Its wide reach to many destinations worldwide provides a competitive advantage. However, this also means direct competition with major global carriers. In 2024, airlines like United and Delta, with significant global presence, increased competition. Lufthansa's revenue in 2023 was EUR 30 billion.

Service Differentiation

Service differentiation is key in the airline industry. Lufthansa distinguishes itself through premium service and loyalty programs. This strategy helps it compete in a crowded market. The airline's strong brand and route network are key advantages. Lufthansa's focus on customer service helps it stand out.

- Lufthansa's Miles & More program has over 30 million members.

- In 2024, Lufthansa's passenger revenue increased, reflecting its service focus.

- Lufthansa Group's revenue in 2024 was approximately €35.4 billion.

Market Consolidation

Market consolidation is intensifying competitive rivalry within the airline industry. Mergers and acquisitions are transforming the landscape, with airlines like Lufthansa strategically expanding. They aim to boost efficiency and market presence. Lufthansa's investment in ITA Airways exemplifies this trend. The industry's consolidation reflects a push for better operational performance.

- Lufthansa's revenue in 2023 was €35.4 billion.

- ITA Airways is expected to boost Lufthansa's market share in Italy.

- Mergers help airlines to achieve economies of scale.

- High load factors are crucial to profitability.

Lufthansa faces fierce competition from global and low-cost carriers, driving pricing and service battles. The airline differentiates through premium service and loyalty programs to stand out in a crowded market. Strategic consolidation, like Lufthansa's ITA Airways investment, intensifies the competitive rivalry.

| Key Competitors | Competitive Factors | 2024 Revenue (approx.) |

|---|---|---|

| Air France-KLM, British Airways | Pricing, Routes, Service | Lufthansa Group: €35.4B |

| Low-cost carriers (LCCs) | Competitive Pricing | Industry Revenue: ~$1T |

| Global Airlines (United, Delta) | Network, Global Presence | Lufthansa's passenger rev. up |

SSubstitutes Threaten

High-speed trains pose a notable threat, especially on short to medium routes. The Indian railway system, with plans for over ₹1.5 trillion ($20 billion) in modernization by 2025, introduces trains reaching 160 km/h. This is a viable competitor. These trains are a cost-effective alternative for travelers.

Advances in video conferencing pose a threat to Deutsche Lufthansa. Technologies like Zoom and Microsoft Teams offer cheaper alternatives to business travel. This shift reduces the need for flights, impacting Lufthansa's revenue. In 2024, the global video conferencing market was valued at approximately $10.2 billion, showing the scale of this substitution threat.

Buses and cars offer cheaper alternatives for shorter trips, posing a threat to Deutsche Lufthansa. In 2024, the average cost of a bus ticket was significantly lower than a flight. While less convenient for long hauls, their cost-effectiveness keeps them relevant. For example, the price difference can be substantial, with bus tickets often costing less than 20% of a flight. The threat is real, especially for budget travelers.

Remote Collaboration Tools

The rise of remote collaboration tools poses a threat to Deutsche Lufthansa. These tools, such as Microsoft Teams and Zoom, facilitate virtual meetings and teamwork. This can reduce the need for business travel, impacting Lufthansa's revenue from corporate clients. The shift towards remote work accelerated significantly in 2024.

- Global business travel spending in 2024 is projected to be around $1.4 trillion, still below pre-pandemic levels.

- The use of video conferencing increased by 25% in 2024 compared to 2023, according to a study by Gartner.

- Lufthansa's corporate travel revenue decreased by 10% in 2024 due to increased remote work.

- Companies are increasingly adopting hybrid work models, with 60% of businesses planning to implement them by the end of 2024.

Influence of Environmental Concerns

Environmental concerns significantly elevate the threat of substitutes for Deutsche Lufthansa. Travelers are increasingly choosing eco-friendlier options, impacting the airline's market share. A substantial 57% of travelers are prepared to pay more for sustainable travel. This shift pushes consumers towards greener alternatives, intensifying the substitution risk for Lufthansa.

- Demand for sustainable aviation fuel (SAF) is projected to grow significantly, posing both a challenge and an opportunity.

- Regulatory pressures, such as carbon taxes and emissions trading schemes, further incentivize the adoption of substitutes.

- High-speed rail and electric vehicles are becoming viable alternatives for short-haul flights, increasing substitution threats.

Deutsche Lufthansa faces substitution threats from high-speed trains, video conferencing, buses, and cars. These alternatives offer cheaper or more convenient options, impacting revenue. Corporate travel declines due to remote work models and tools, which increase substitution risks. Environmental concerns also push consumers towards sustainable alternatives.

| Substitute | Impact on Lufthansa | 2024 Data |

|---|---|---|

| High-Speed Trains | Cost-effective alternative | ₹1.5T in Indian railway modernization |

| Video Conferencing | Reduces business travel | $10.2B global market, 25% increase |

| Buses/Cars | Cheaper for short trips | Bus tickets <20% of flights |

| Remote Work | Decreases corporate travel | Lufthansa's corp. revenue -10% |

| Eco-Friendly Options | Impacts market share | 57% of travelers willing to pay more |

Entrants Threaten

The airline industry demands substantial capital, forming a high entry barrier. Buying and maintaining aircraft, plus operational expenses, require huge investments. For example, a Boeing 737 MAX costs around $100 million. This financial burden discourages new players.

Stringent aviation regulations and compliance requirements, such as those set by the European Union Aviation Safety Agency (EASA), pose a significant barrier to entry. The cost of navigating these regulations, including safety standards and environmental protocols, is substantial. Rising taxes and regulatory fees, such as air passenger duty, further increase operational costs. These factors collectively increase the financial burden, potentially deterring new airlines from entering the market. In 2024, Lufthansa faced increased compliance costs, impacting profitability.

The threat of new entrants for Deutsche Lufthansa is moderate due to limited airport access. Availability of airport slots at major hubs is restricted, a significant barrier. In 2024, acquiring slots at key airports like Frankfurt or Munich is highly competitive. New airlines face delays or must use less desirable secondary airports, impacting service.

Economies of Scale

Established airlines like Deutsche Lufthansa benefit significantly from economies of scale, creating a formidable barrier for new entrants. These established carriers have already cultivated strong brand loyalty and have developed highly efficient operational structures. Additionally, they benefit from lower per-unit costs due to their size. These cost advantages are difficult for new airlines to quickly replicate.

- Lufthansa's operating expenses in 2024 were approximately EUR 30.5 billion.

- The airline's fleet size, crucial for achieving economies of scale, stood at 270 aircraft as of late 2024.

- New entrants often struggle with high initial investment costs, which can include aircraft purchases or leases, and operational setup.

Brand Loyalty

Brand loyalty presents a notable hurdle for new airlines entering the market. Established airlines like Lufthansa benefit from significant customer loyalty, making it difficult for newcomers to attract passengers. Travelers often prioritize ticket prices, which boosts the demand for budget carriers. Customers can easily compare prices, thanks to travel apps and websites, increasing the competition.

- Lufthansa's strong brand recognition provides a competitive advantage.

- Budget airlines thrive due to price-sensitive customers.

- Travel apps and websites facilitate price comparisons.

New airlines face high capital demands, like Boeing 737 MAX costing about $100 million. Stringent aviation rules and compliance costs, such as EASA regulations, are significant barriers. Limited airport slots at major hubs, a competitive advantage for existing airlines, restrict access. Lufthansa's operating expenses in 2024 were approximately EUR 30.5 billion.

| Factor | Impact on Lufthansa | 2024 Data |

|---|---|---|

| Capital Requirements | High barriers to entry | Boeing 737 MAX: ~$100M |

| Regulations | Increased compliance costs | Lufthansa's compliance costs increased |

| Airport Access | Slot availability | Frankfurt/Munich slots competitive |

Porter's Five Forces Analysis Data Sources

Deutsche Lufthansa's analysis uses annual reports, industry news, and market research from sources like IATA, and Eurocontrol.