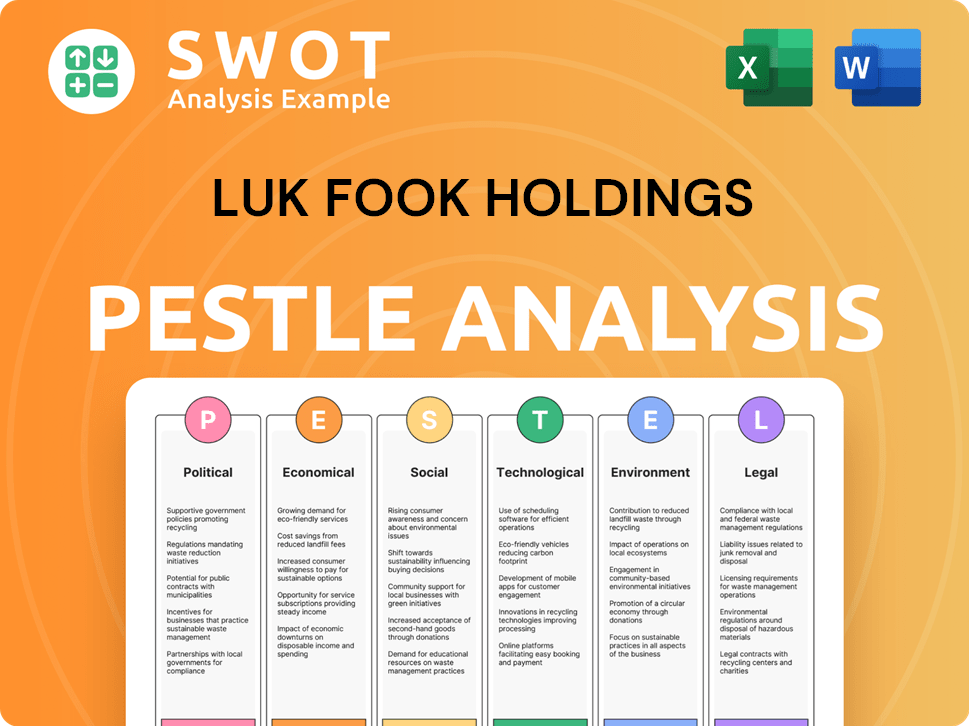

Luk Fook Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Luk Fook Holdings Bundle

What is included in the product

Evaluates external factors' impact on Luk Fook Holdings across Political, Economic, etc., dimensions. It is supported by data and trends.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview Before You Purchase

Luk Fook Holdings PESTLE Analysis

The preview provides the complete Luk Fook Holdings PESTLE analysis. The document's structure and content mirror the final product. This means you see everything included. Ready to download immediately, after buying.

PESTLE Analysis Template

Navigate the intricate world surrounding Luk Fook Holdings with our insightful PESTLE Analysis. We explore how political landscapes, economic shifts, social trends, technological advancements, legal frameworks, and environmental concerns are shaping the company. This analysis offers key insights, empowering you to understand risks and opportunities. Get the complete breakdown now for strategic decision-making.

Political factors

Government policies, especially in Hong Kong and Mainland China, are pivotal for Luk Fook. Trade agreements, import/export rules, and tariffs directly affect their business. Political stability is essential for consumer trust and smooth operations. In 2024, fluctuations in trade policies and political tensions in key markets influenced the company's performance. For instance, changes in import duties on gold in China impacted profitability margins.

Political stability is crucial for Luk Fook. Hong Kong's political climate, along with Mainland China and other regions, influences consumer confidence. Any geopolitical instability can disrupt supply chains. For example, in 2024, retail sales in Hong Kong saw fluctuations due to economic and political factors.

Luk Fook faces regulations on precious metals and gemstones sourcing. Compliance with anti-money laundering is crucial. In 2024, the global jewelry market reached $340 billion, highlighting regulatory impacts. Responsible sourcing is increasingly vital, affecting supply chains.

Taxation policies

Changes in taxation policies significantly affect Luk Fook's profitability and pricing. Fluctuations in import duties, sales tax, and corporate tax rates require careful financial planning. For example, Hong Kong's corporate tax rate is 16.5%, influencing Luk Fook's financial strategies. Tax reforms can lead to adjustments in product pricing and overall financial performance. These changes necessitate adaptable financial models to navigate varying tax landscapes.

- Hong Kong's corporate tax rate: 16.5%

- Impact on product pricing and financial performance

- Need for adaptable financial models

Government support for retail and tourism

Government backing for retail and tourism significantly affects Luk Fook's sales, especially in Hong Kong and Macau. Initiatives promoting tourism and spending boost revenue. For instance, Hong Kong's 2024-2025 budget allocated HKD 1.09 billion to tourism. Favorable policies encourage cross-border activities. This support directly impacts Luk Fook's performance.

- Hong Kong's 2024-2025 budget allocated HKD 1.09 billion to tourism.

- Cross-border travel and spending policies are beneficial.

Luk Fook is influenced by government actions in key markets like Hong Kong and Mainland China. Trade policies and political stability impact consumer confidence and operations. The jewelry market reached $340B in 2024, reflecting the need for adaptability.

| Aspect | Impact | Data Point |

|---|---|---|

| Trade Policies | Affects import/export and tariffs | Changes in import duties influence margins. |

| Political Stability | Influences consumer trust & operations. | HK's political climate affects sales. |

| Government Support | Boosts tourism, increasing revenue | HK allocated HKD 1.09B for tourism (2024-2025). |

Economic factors

Economic growth and consumer spending are crucial for Luk Fook. Strong economies and high disposable incomes boost jewelry demand. Downturns, like the 2023-2024 slowdown, reduce spending on luxury goods. In 2024, Hong Kong's retail sales saw fluctuations impacting Luk Fook's performance.

Luk Fook Holdings faces risks from precious metal and gemstone price swings. Gold prices, for example, have seen fluctuations; in 2024, they ranged from $1,900 to $2,400 per ounce. Platinum and diamond prices also fluctuate, affecting the cost of goods sold. These fluctuations can squeeze profit margins if not offset by price adjustments.

Luk Fook, operating internationally, faces exchange rate risks, particularly between the Hong Kong Dollar (HKD) and the Chinese Yuan (CNY). Fluctuations impact revenue translation. For instance, a weaker CNY against HKD reduces reported revenue in HKD. In 2024, the HKD/CNY exchange rate averaged approximately 0.91, influencing sales and profitability.

Inflation rates

High inflation poses a significant challenge to Luk Fook Holdings, potentially diminishing consumer spending and raising operational expenses. Increased costs, including rent and labor, can squeeze profit margins and negatively impact sales. In 2024, Hong Kong's inflation rate is projected to be around 2.2%, according to the IMF. This economic pressure can reduce the demand for discretionary items like luxury jewelry. This necessitates strategic adjustments for Luk Fook to maintain profitability.

- 2024 Hong Kong inflation: projected 2.2% (IMF)

- Rising costs impacting profitability.

- Reduced consumer purchasing power.

Interest rates and availability of credit

Interest rates significantly affect consumer spending and Luk Fook's financial costs. High rates can curb consumer borrowing for luxury items like jewelry, impacting sales. Increased borrowing costs also affect the company's ability to finance expansion and manage operations.

- In 2024, the Hong Kong prime rate fluctuated, affecting borrowing costs.

- A rise in interest rates could lead to decreased consumer confidence.

- Luk Fook must carefully manage its debt levels to mitigate these risks.

Luk Fook faces economic risks including inflation and interest rates. Inflation, at a projected 2.2% in 2024 (Hong Kong, IMF), raises costs, impacting profits and consumer spending on jewelry. Interest rate fluctuations affect consumer borrowing and expansion funding.

| Factor | Impact | 2024 Data/Projection |

|---|---|---|

| Inflation | Reduces consumer spending, raises costs | 2.2% (Hong Kong, IMF projection) |

| Interest Rates | Impacts borrowing costs, consumer confidence | Fluctuated; influenced debt management. |

| Exchange Rates | Affects revenue, profitability. | HKD/CNY ~0.91 (avg 2024) |

Sociological factors

Consumer preferences and fashion trends significantly impact jewelry demand. Luk Fook must monitor evolving tastes. In 2024, the global jewelry market was valued at approximately $300 billion, with trends shifting towards personalized and sustainable pieces. Staying current ensures competitiveness. Adapting designs and offerings is crucial for success.

In Mainland China and Hong Kong, jewelry's cultural value is considerable, especially for weddings and gifting. Luk Fook must understand these cultural preferences to thrive. In 2024, China's jewelry market was valued at approximately $90 billion. Hong Kong's market also shows strong demand, with a focus on gold and gemstone jewelry.

Demographic shifts significantly influence Luk Fook's market. An aging population may favor classic designs, while rising middle-class incomes in regions like Mainland China, where Luk Fook has a strong presence, boost demand for luxury goods. In 2024, China's middle class expanded, driving jewelry sales up 8% in some areas. Lifestyle changes, such as increased online shopping, also affect distribution strategies.

Consumer confidence and sentiment

Consumer confidence significantly influences luxury spending, as overall economic sentiment and personal financial outlooks directly affect purchasing decisions. When consumer confidence wanes, individuals are more likely to delay or forgo discretionary purchases like jewelry. Recent data shows consumer confidence in Hong Kong fluctuating, impacting retail sales.

- Hong Kong's consumer confidence index stood at 82.6 in March 2024, a slight decrease from 83.1 in February, reflecting ongoing economic uncertainties.

- Luxury goods sales in Hong Kong decreased by 14% year-on-year in Q1 2024, indicating a direct correlation between sentiment and spending.

- Analysts predict that an improvement in consumer sentiment could boost Luk Fook's sales by up to 10% in the coming year.

Social responsibility and ethical consumerism

Consumers increasingly prioritize ethical sourcing, sustainability, and corporate social responsibility, impacting purchasing choices. Brands showcasing responsible supply chain practices gain favor. In 2024, ethical consumerism grew, with 70% of consumers considering a company's values. Luk Fook, by adopting CSR, can enhance brand loyalty. This trend is fueled by younger generations, like Gen Z, who are more likely to support businesses with strong ethical stances.

- 70% of consumers consider company values (2024)

- Gen Z drives ethical consumerism

- CSR enhances brand loyalty

Fashion trends greatly impact jewelry demand; Luk Fook must stay updated. In 2024, the jewelry market was about $300B. Cultural values, like in China and Hong Kong, influence sales.

Consumer confidence impacts luxury spending, affecting purchases. Hong Kong's Q1 2024 luxury sales decreased by 14%. Ethical sourcing is crucial; 70% of consumers consider company values.

| Factor | Impact | Data (2024) |

|---|---|---|

| Fashion Trends | Influence demand | Global market $300B |

| Cultural Values | Drive sales | China's jewelry market: $90B |

| Consumer Confidence | Affects spending | HK luxury sales down 14% (Q1) |

Technological factors

E-commerce and online retail are transforming how jewelry is bought. Luk Fook must boost its online presence. Online sales are rising; in 2024, e-commerce grew by 15% in the luxury goods sector. This expansion opens new markets, but also heightens competition.

Advancements in technologies like CAD/CAM and 3D printing are transforming jewelry design and manufacturing. Luk Fook can leverage these to offer personalized products and streamline production. For instance, 3D printing can reduce prototyping time by up to 70% and costs by 50%. In 2024, the global 3D-printed jewelry market was valued at $1.2 billion.

Luk Fook must leverage digital marketing. In 2024, digital ad spending reached $800B globally. Social media engagement, like Instagram, offers high ROI. Data analytics personalize customer experiences. This drives brand loyalty and sales growth.

Supply chain technology and logistics

Luk Fook can leverage technology to optimize its supply chain, inventory, and logistics. Implementing technologies such as AI-driven demand forecasting and blockchain for traceability can enhance efficiency. This reduces costs and improves responsiveness to market changes. According to a 2024 report, supply chain technology investments are projected to increase by 15% annually.

- AI-powered inventory management can reduce holding costs by up to 20%.

- Blockchain can improve product traceability and reduce counterfeiting risks.

- Real-time tracking systems enhance delivery efficiency.

Adoption of in-store technology

Luk Fook Holdings can leverage technological advancements to enhance in-store experiences. Implementing interactive displays and virtual try-on features can significantly improve customer engagement and satisfaction, potentially boosting sales. Furthermore, upgrading payment systems to include mobile and contactless options can streamline transactions. These technologies can provide valuable data on customer preferences and buying habits, allowing for more targeted marketing efforts. For instance, in 2024, retailers saw a 15% increase in sales from implementing such technologies.

- Interactive displays can increase customer engagement by up to 20%.

- Virtual try-on experiences can boost conversion rates by 10-15%.

- Contactless payments can reduce transaction times by 30%.

- Data analytics from these systems can lead to a 5-10% increase in marketing efficiency.

E-commerce and digital marketing are vital. In 2024, global digital ad spend hit $800B. Technology, like CAD/CAM and 3D printing, boosts design. Inventory tech and supply chain solutions reduce costs.

| Technology Area | Impact | 2024 Data |

|---|---|---|

| E-commerce/Online Retail | Expanded market reach, increased competition | 15% growth in luxury e-commerce sales |

| 3D Printing | Personalized products, streamlined production | $1.2B market valuation |

| Digital Marketing | Higher ROI, data-driven marketing | $800B global ad spending |

Legal factors

Luk Fook Holdings faces the legal challenge of adhering to diverse business and commercial laws across its global operations. This includes company law, contract law, and consumer protection laws, varying by region. For example, in 2024, the company had to update its compliance protocols in response to new consumer data privacy regulations in several markets. Non-compliance can lead to significant financial penalties and reputational damage.

Luk Fook Holdings must adhere to stringent regulations regarding the sourcing and trading of precious materials, encompassing metals and gemstones. These rules are in place to combat illicit activities and uphold ethical standards. Compliance is essential for all operations, including import and export procedures. In 2024, the global jewelry market was valued at approximately $279 billion, underscoring the significance of regulatory compliance.

Luk Fook relies heavily on intellectual property (IP) to safeguard its brand and designs. Strong IP protection, including trademarks and copyrights, is essential to combat counterfeit goods. In 2024, the global counterfeit market was estimated at $3.2 trillion, highlighting the importance of IP enforcement. Robust IP strategies helped Luk Fook maintain its brand image.

Labor laws and employment regulations

Luk Fook Holdings faces legal obligations regarding labor laws and employment regulations across its operational regions, including Hong Kong, Macau, Mainland China, and other international locations. These laws dictate standards for wages, working hours, and employee benefits, impacting operational costs. For example, in Hong Kong, the minimum wage was HK$40 per hour as of May 2024. Furthermore, adherence to these regulations is crucial to avoid legal penalties and maintain a positive brand image.

- Minimum wage in Hong Kong was HK$40 per hour as of May 2024.

- Compliance is vital to avoid penalties and maintain brand reputation.

Data privacy and protection regulations

Luk Fook Holdings must adhere to data privacy laws, like GDPR, to safeguard customer data collected both online and offline. Non-compliance can lead to hefty fines and reputational damage. In 2024, GDPR fines reached over €1.6 billion. Robust data protection measures are crucial for maintaining customer trust and avoiding legal issues.

Luk Fook Holdings must comply with diverse global business and commercial laws, covering company law, contracts, and consumer protection. Compliance with regulations for sourcing precious materials and intellectual property protection is also critical. Labor laws, including minimum wage (HK$40/hour in Hong Kong, May 2024), and data privacy (GDPR, with €1.6B+ fines in 2024) are additional key legal considerations.

| Legal Aspect | Description | 2024/2025 Impact |

|---|---|---|

| Compliance | Diverse laws across global operations. | Risk of fines and damage to reputation. |

| Precious Materials | Sourcing and trading of metals/gemstones. | Affects ethical sourcing. |

| Intellectual Property | Protecting trademarks, and designs. | Maintain brand image; avoid counterfeiting. |

Environmental factors

Luk Fook must address the environmental impact of its materials sourcing. This involves ethical and sustainable supply chain practices. In 2024, the global demand for responsibly sourced gold increased by 15%. The company should prioritize suppliers committed to environmental stewardship. This protects brand reputation and meets consumer expectations.

Luk Fook Holdings must adhere to environmental rules concerning waste, emissions, and energy use across its manufacturing and retail outlets. In 2024, the jewelry sector faced increased scrutiny, with costs for environmental compliance rising by approximately 8-10%. Specifically, waste management costs rose by 12% due to stricter regulations. Energy consumption is a key factor, as retail locations and factories are under pressure to adopt sustainable practices.

Climate change poses significant risks to Luk Fook's supply chain. Extreme weather events, like floods and droughts, could disrupt the sourcing of materials and increase costs. In 2024, the jewelry industry faced a 10% rise in raw material prices due to climate-related disruptions. These events can also impact transportation, potentially delaying deliveries and affecting Luk Fook's profitability.

Consumer demand for sustainable products

Consumer demand for sustainable products is rising. This shift impacts Luk Fook. It may influence product development and sourcing. The company might focus on recycled metals or ethically sourced gemstones. Sales of sustainable products are projected to increase by 10-15% annually through 2025.

- Ethically sourced gold demand rose 12% in 2024.

- Consumer interest in lab-grown diamonds increased by 8% in Q1 2025.

- Luk Fook's 2024 sustainability report highlighted eco-friendly packaging.

Energy consumption and carbon footprint

Luk Fook Holdings faces growing pressure to manage energy use and shrink its carbon footprint. This is driven by global environmental concerns and potential new regulations. Reducing emissions can improve brand image and operational efficiency. For example, in 2024, businesses globally allocated an average of 10-15% of their operational budgets to sustainability initiatives.

- Energy-efficient lighting and equipment upgrades can significantly lower energy consumption.

- Implementing renewable energy sources like solar panels at store locations.

- Monitoring and reporting on energy usage to identify areas for improvement.

- Adopting sustainable sourcing practices for materials and supplies.

Luk Fook should prioritize eco-friendly sourcing due to rising demand and regulations. Environmental compliance costs for jewelry rose by 8-10% in 2024. Consumer interest in lab-grown diamonds increased 8% by Q1 2025. Businesses allocated 10-15% of 2024 budgets to sustainability.

| Aspect | Details | 2024 Data |

|---|---|---|

| Ethical Sourcing | Demand for responsibly sourced gold | Up 15% |

| Compliance Costs | Jewelry sector compliance costs | Increased 8-10% |

| Consumer Trend | Interest in lab-grown diamonds | Up 8% by Q1 2025 |

PESTLE Analysis Data Sources

This PESTLE analysis uses data from economic reports, legal updates, and market research firms. It integrates consumer behavior trends and policy changes from reliable sources.