Lululemon Athletica PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lululemon Athletica Bundle

What is included in the product

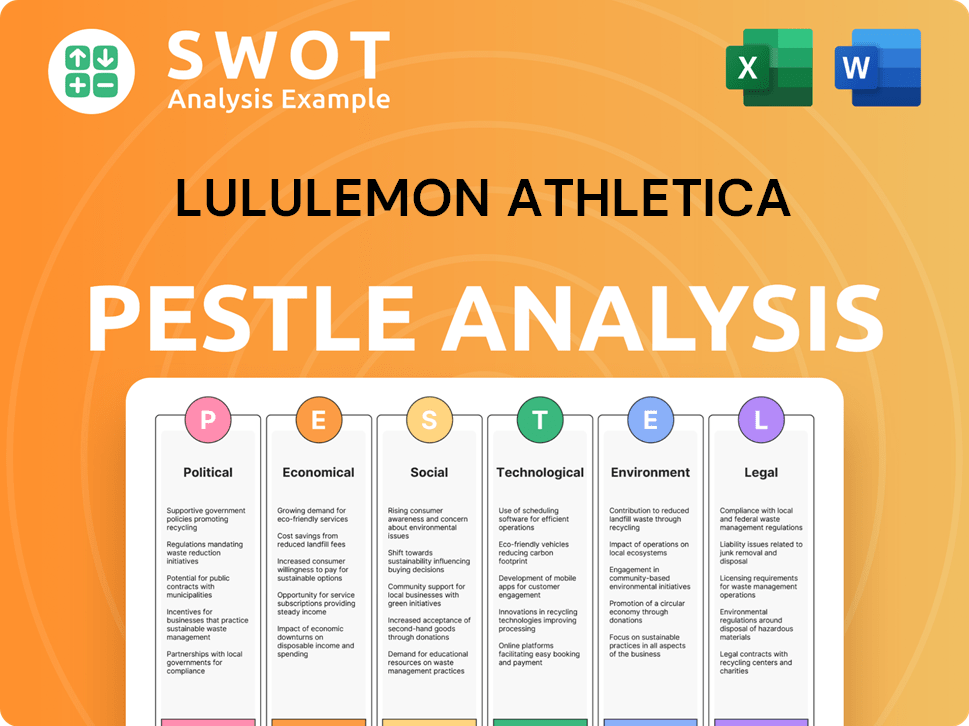

Uncovers the external forces shaping Lululemon, examining Political, Economic, Social, Tech, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

Lululemon Athletica PESTLE Analysis

See the Lululemon Athletica PESTLE Analysis now. This detailed preview accurately represents the file you’ll download.

The strategic layout, data points, and overall format seen here mirror your post-purchase file.

Expect no changes. Your ready-to-use document has already been created for instant access.

Upon purchase, the very analysis shown is exactly what you get. Enjoy!

PESTLE Analysis Template

Lululemon Athletica thrives on a carefully constructed market position, constantly shaped by external factors. A PESTLE analysis unveils the complex interplay of political decisions affecting trade and tariffs, and the economic shifts impacting consumer spending. Social trends, such as wellness and athleisure demand, fuel growth, while technological innovations in fabric and retail offer advantages. Explore the impact of environmental sustainability and legal compliance within Lululemon’s ecosystem. Unlock strategic foresight; download the full PESTLE analysis today.

Political factors

Lululemon faces trade policy impacts globally. US-China tensions, crucial for sourcing and operations, affect costs and efficiency. In 2024, tariffs could increase production expenses. Monitoring and diversifying sourcing are key strategies. The company's adaptability to trade shifts is essential for profitability.

Political stability significantly impacts Lululemon's global operations. Instability in regions with stores or factories, like potential civil unrest, can disrupt supply chains. For example, a sudden change in government could alter trade policies. Lululemon's 2024 annual report highlights the need to manage risks linked to political environments. Any disruption can influence market access and sales.

Lululemon faces labor law scrutiny globally. The company must comply with varying regulations regarding wages, working conditions, and worker rights. Failure to comply can lead to reputational damage and financial penalties. In 2024, the apparel industry saw increased focus on ethical sourcing. Lululemon's commitment to fair labor practices is essential.

Government funding for athletics and wellness

Government support for sports and wellness initiatives can boost demand for Lululemon's products. Increased funding often leads to greater participation in fitness activities, directly benefiting the athletic apparel market. In 2024, the U.S. government allocated over $100 million towards community health and wellness programs. This increased investment suggests a growing market for fitness and wellness products, like those offered by Lululemon. The company could see its sales rise as more people engage in sports and fitness.

- Increased funding often leads to greater participation in fitness activities.

- In 2024, the U.S. government allocated over $100 million towards community health and wellness programs.

Data privacy regulations

Lululemon faces significant political considerations related to data privacy. With its growing online presence and global sales, the company must adhere to diverse data privacy regulations. These regulations, such as GDPR in Europe and CCPA in California, mandate how businesses collect, use, and protect consumer data. Compliance is crucial for maintaining customer trust and avoiding hefty fines. In 2024, non-compliance penalties can reach up to 4% of global revenue.

- GDPR fines can reach up to €20 million or 4% of annual global turnover.

- CCPA violations can result in fines of up to $7,500 per record.

- Lululemon's e-commerce sales accounted for over 40% of total revenue in fiscal year 2024.

Lululemon navigates global trade impacts and political stability risks. Labor law compliance and ethical sourcing are vital for brand reputation. Data privacy regulations, like GDPR and CCPA, pose compliance challenges.

Government funding for wellness boosts market demand. The company must adapt to evolving political landscapes for continued growth.

| Factor | Impact | 2024/2025 Considerations |

|---|---|---|

| Trade Policies | Tariffs, sourcing costs | Monitor US-China tensions, diversify suppliers |

| Political Stability | Supply chain disruption | Assess & mitigate risks in store/factory locations |

| Labor Laws | Compliance, reputational damage | Ensure ethical sourcing and fair labor practices |

Economic factors

Lululemon, as a premium brand, heavily relies on consumer discretionary spending. Economic shifts, inflation, and interest rate changes directly affect consumers' ability to purchase high-end athletic wear. Recent data shows a slowdown in U.S. market growth, reflecting these sensitivities. In 2024, consumer spending patterns will be key to watch. For instance, in Q1 2024, Lululemon's revenue increased by 10%.

Inflation, a key economic factor, can significantly impact Lululemon by raising production costs. In 2024, the U.S. inflation rate was around 3.1%. Higher interest rates, which stood at 5.25%-5.50% in late 2024, also influence consumer spending. Lululemon must optimize pricing and operations to navigate these financial pressures. Effective strategies are crucial to maintain profitability amid economic fluctuations.

Lululemon's global presence makes it vulnerable to exchange rate volatility. Currency fluctuations affect reported revenue and profits. For example, a stronger U.S. dollar can reduce the value of international sales. In Q4 2023, Lululemon's net revenue increased by 16% to $3.2 billion, but currency impacts are always a factor.

Disposable income levels

Disposable income is crucial for Lululemon, as its premium pricing strategy relies on consumers' ability to spend. High disposable income levels typically translate to increased spending on discretionary items, like Lululemon's activewear. Conversely, economic downturns or inflation can squeeze disposable incomes, potentially leading to decreased demand for the brand. In 2024, U.S. personal income rose, signaling continued consumer spending power.

- U.S. personal income increased by 0.3% in March 2024.

- Lululemon's Q4 2023 revenue increased by 16% to $3.2 billion.

- Inflation remains a key factor, with the Consumer Price Index (CPI) at 3.5% in March 2024.

Global economic growth and recessions

Global economic growth and potential recessions significantly influence Lululemon's international performance. Strong economic growth in regions like Asia-Pacific, which saw a 5.2% GDP growth in 2023, can boost sales. Conversely, economic downturns in areas like Europe, with a projected 0.8% growth in 2024, may hinder growth. Lululemon must adjust its strategies, such as pricing and marketing, based on regional economic conditions.

- Asia-Pacific GDP Growth (2023): 5.2%

- Europe GDP Growth (Projected 2024): 0.8%

Economic factors significantly impact Lululemon's performance. Consumer spending is crucial, and the brand is sensitive to inflation and interest rates. Currency fluctuations affect revenue, while disposable income influences sales of premium products. Q1 2024 saw Lululemon's revenue grow by 10%.

| Factor | Impact | 2024 Data |

|---|---|---|

| Consumer Spending | Directly affects sales | Q1 Revenue Growth: 10% |

| Inflation | Raises production costs | US CPI (Mar 2024): 3.5% |

| Exchange Rates | Impacts international revenue | USD Impact on Intl. Sales |

Sociological factors

Athleisure and wellness continue to drive Lululemon's success. The global wellness market reached $7 trillion in 2024, highlighting the demand for related products. Lululemon's focus aligns with these trends, reflected in its 2024 revenue of $9.6 billion. Innovation is vital to meet evolving consumer needs.

Lululemon thrives on community and experiences, hosting in-store fitness classes to boost brand loyalty. This strategy boosts customer engagement, crucial for sales. In 2024, Lululemon's community-focused events saw a 15% rise in attendance. This approach drives deeper customer connections, boosting long-term brand strength.

Consumer preferences in athletic wear are dynamic, with rapid shifts in style, functionality, and brand perception. Lululemon must consistently innovate its product offerings to align with these evolving tastes. In 2024, the athleisure market is valued at $400 billion, demonstrating the scale of consumer interest. Staying current involves agile marketing strategies and understanding emerging trends.

Demand for sustainable and ethical products

Growing consumer awareness and demand for sustainable and ethical products significantly influence buying habits, impacting Lululemon's brand perception. The company must showcase responsible sourcing, manufacturing, and environmental practices to attract eco-conscious consumers. In 2024, the sustainable apparel market is projected to reach $19.8 billion, reflecting this trend. Lululemon's ability to meet these expectations is vital for maintaining its market position and appealing to a broader consumer base. This includes transparency in its supply chain and adopting eco-friendly materials.

- The global market for sustainable fashion is expected to reach $9.81 billion by 2024.

- Lululemon's commitment to sustainability is increasingly important for its brand image.

- Consumers are willing to pay a premium for sustainable products.

- The demand for ethical sourcing is growing annually.

Diversity and inclusion

Societal focus on diversity and inclusion significantly shapes brand perception and consumer loyalty. Lululemon's dedication to these values influences its marketing and product development strategies. In 2024, companies with strong DEI initiatives saw a 15% increase in positive brand sentiment. Lululemon's internal practices also play a key role in attracting and retaining a diverse workforce.

- DEI efforts boost brand perception.

- Marketing and product strategies are key.

- Internal practices drive workforce diversity.

- Positive brand sentiment grew by 15% in 2024.

Lululemon must align with evolving social values. Consumers increasingly prioritize brands with robust diversity, equity, and inclusion (DEI) initiatives. Companies with strong DEI programs saw a 15% rise in positive brand sentiment in 2024.

| Sociological Factor | Impact | 2024 Data |

|---|---|---|

| DEI Initiatives | Boosts Brand Perception & Loyalty | 15% rise in positive sentiment |

| Community Engagement | Enhances Customer Connections | 15% increase in event attendance |

| Sustainability | Influences Buying Habits | Sustainable apparel market at $19.8B |

Technological factors

Lululemon's e-commerce growth is crucial, with online sales contributing significantly to its revenue. In fiscal year 2024, digital revenue rose, representing about 40% of total sales. A robust online platform, including its mobile app, is key to customer reach and sales growth. The company continues to invest in its digital infrastructure to enhance the customer experience.

Lululemon leverages tech for fabric and design innovations. Their R&D fuels moisture-wicking and performance materials, crucial for their edge. In Q4 2024, R&D spending rose, reflecting this focus. This continuous investment in tech is vital. The company's success hinges on staying ahead in materials science.

Lululemon utilizes data analytics and AI to understand customer behavior, refine product development, and optimize marketing. In 2024, the company invested heavily in AI-driven personalization, boosting online sales by 15%. This tech supports inventory management, reducing waste and improving efficiency. Lululemon's strategic use of AI enhances decision-making across all operations.

Supply chain technology and efficiency

Lululemon leverages technology to streamline its supply chain. This includes inventory management and predictive analytics to boost efficiency. Such systems help in cutting costs and quickly adapting to customer demand. For example, Lululemon's inventory turnover rate was 3.6 in 2024.

- Inventory management systems.

- Predictive analytics.

- Supply chain optimization.

- Cost reduction.

Integration of technology in products (e.g., connected apparel)

Lululemon can innovate by integrating technology into athletic apparel, like sensors for performance tracking. They've explored this via partnerships, such as with MIRROR. The global smart clothing market is projected to reach $6.5 billion by 2025. This tech integration can boost product appeal and data collection. This approach aligns with consumer demand for personalized fitness solutions.

- Smart apparel market growth.

- Partnership with MIRROR.

- Data collection opportunities.

- Personalized fitness.

Lululemon focuses on technology for e-commerce, contributing significantly to its revenue with digital sales. The company leverages tech innovations in fabric and design, investing in R&D. Data analytics and AI further refine product development, inventory management and enhance marketing, with a 15% increase in online sales in 2024 due to AI.

| Technological Aspect | Details | Financial/Statistical Data (2024) |

|---|---|---|

| E-commerce & Digital Sales | Enhancing customer reach and experience via mobile app. | Digital revenue represents ~40% of total sales |

| Fabric and Design Innovations | R&D fuels moisture-wicking and performance materials. | R&D spending increased in Q4. |

| Data Analytics and AI | Used for customer behavior, product development, and marketing. | AI boosted online sales by 15% |

Legal factors

Lululemon heavily relies on intellectual property to protect its unique designs and branding. Patents, trademarks, and copyrights are essential tools in preventing counterfeiting. Despite these protections, Lululemon has faced legal challenges regarding intellectual property, highlighting the ongoing need for vigilance. In fiscal year 2023, Lululemon's total assets were approximately $4.7 billion.

Lululemon faces intricate international trade and retail regulations due to its global presence. Compliance is crucial to prevent legal problems and ensure smooth operations in diverse markets. For instance, in 2024, Lululemon expanded its presence into several new countries, increasing its exposure to varied regulatory frameworks. Non-compliance can lead to significant financial penalties and operational disruptions. Adapting to these regulations is key to sustainable growth.

Lululemon must comply with rigorous product quality and safety regulations across its global operations. Non-compliance can trigger costly product recalls, legal battles, and severe reputational harm. For instance, in 2024, recalls cost companies an average of $10 million. The company faces scrutiny regarding its materials and manufacturing processes, especially in markets with strict consumer protection laws. Maintaining high standards is crucial for customer trust and avoiding financial penalties that can significantly impact profitability.

Advertising and marketing regulations

Lululemon's advertising and marketing strategies are under constant legal scrutiny. They must adhere to truth-in-advertising laws and consumer protection regulations globally. Inaccurate claims about product benefits or environmental sustainability can lead to legal issues and damage brand reputation. For example, in 2024, the Federal Trade Commission (FTC) closely monitored greenwashing claims.

- Compliance with regulations is essential to avoid penalties.

- Accuracy in product claims and environmental impact is crucial.

- Monitoring and adapting to changing legal standards is a must.

- Failure to comply can lead to fines and legal action.

Labor and employment laws

Lululemon must adhere to labor and employment laws in all operational countries, covering hiring, wages, and employee relations. This includes ensuring fair practices not just in manufacturing but also in retail and corporate settings. Compliance is crucial to avoid legal issues and maintain a positive brand image. The company's commitment to its employees is reflected in its human rights policy. In 2024, Lululemon's global workforce was approximately 34,000 employees.

- Compliance with employment laws is essential for legal and reputational reasons.

- The company's human rights policy reflects its commitment to employees.

- Lululemon had approximately 34,000 employees worldwide in 2024.

Legal factors are vital for Lululemon’s global operations.

Intellectual property rights like patents, and trademarks protect their designs, as non-compliance can lead to penalties and legal action. The company's compliance costs can reach millions of dollars. Advertising and marketing strategies undergo scrutiny regarding product claims.

| Legal Aspect | Impact | 2024 Data/Fact |

|---|---|---|

| Intellectual Property | Protecting designs, branding | Total assets approx. $4.7B in 2023 |

| Trade Regulations | Ensuring smooth global ops | Expansion to new countries in 2024 |

| Product Safety | Maintaining high standards | Average recall cost in 2024 was $10M |

Environmental factors

Lululemon faces scrutiny regarding material sourcing sustainability. The company is challenged to adopt eco-friendly materials such as recycled polyester and responsibly sourced cotton. In 2024, Lululemon aimed to increase its use of sustainable materials. Exploring bio-based nylon offers innovation. This shift can enhance brand image and appeal to environmentally conscious consumers.

Lululemon faces scrutiny regarding its carbon footprint. The company aims to decrease emissions, but expansion may offset these efforts. In 2023, Lululemon's Scope 1 and 2 emissions were 11,000 tonnes of CO2e. Critics point to the need for more aggressive strategies to curb rising emissions. Lululemon is working on sustainable materials and production.

Water usage is a significant environmental issue for the apparel industry. Lululemon recognizes this and has set goals to decrease freshwater consumption throughout its manufacturing processes. The company is investing in water-saving dyeing technologies. For instance, the textile industry accounts for about 20% of global wastewater.

Waste management and circularity

Waste management and circularity pose both challenges and opportunities for Lululemon. The company is addressing waste across its product lifecycle and aiming for a circular business model. This involves initiatives like resale programs, which generated $10 million in revenue in 2023, recycling programs, and repair services. These efforts aim to reduce environmental impact and enhance brand value.

- Resale program revenue: $10M (2023)

- Focus: Reducing waste, promoting circularity

- Initiatives: Resale, recycling, repair

Chemicals and environmental impact of production

The textile industry's chemical use poses environmental risks. Lululemon's production relies on chemicals, necessitating careful management. They must monitor their supply chain to reduce harmful substances. Exploring and adopting less impactful alternatives is crucial for sustainability. In 2024, the company invested $10 million in sustainable material research.

- Chemicals in textile processes can lead to water pollution and soil contamination.

- Lululemon's commitment involves setting chemical management standards for suppliers.

- They are investigating sustainable dyeing and finishing technologies.

- The goal is to minimize the environmental footprint of their products.

Lululemon prioritizes sustainable materials like recycled polyester. In 2024, Lululemon aimed to boost sustainable material usage to decrease its carbon footprint, with its 2023 emissions at 11,000 tonnes of CO2e. The company focuses on water reduction and waste management to promote circularity, with its resale program generating $10 million in revenue in 2023.

| Environmental Aspect | Lululemon's Initiatives | 2023/2024 Data |

|---|---|---|

| Sustainable Materials | Use of recycled materials; exploration of bio-based nylon | $10M investment in sustainable material research (2024) |

| Carbon Footprint | Reduce emissions; sustainable production | 11,000 tonnes CO2e (Scope 1&2 emissions, 2023) |

| Water Usage | Decrease freshwater consumption; water-saving dyeing | Textile industry accounts for 20% of global wastewater |

| Waste Management | Resale programs; recycling; repair services | $10M Resale Revenue (2023) |

| Chemicals | Chemical management standards for suppliers; sustainable dyeing and finishing | Focus on minimizing product footprint |

PESTLE Analysis Data Sources

Lululemon's PESTLE Analysis uses market reports, financial databases, government publications, and industry-specific research for accurate insights.