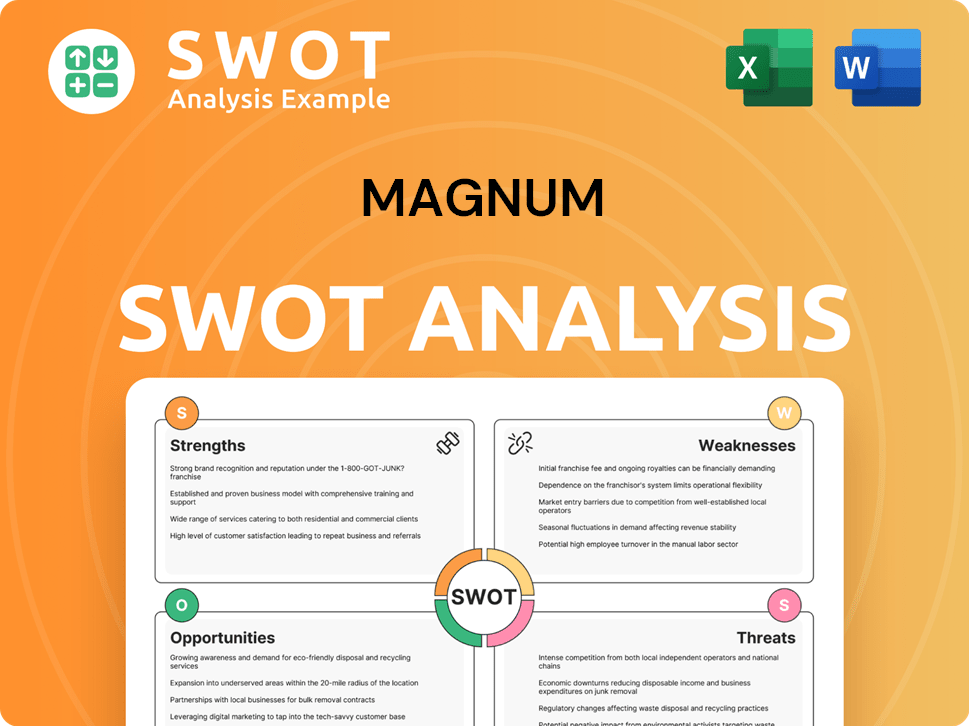

Magnum SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Magnum Bundle

What is included in the product

Analyzes Magnum's competitive position, highlighting strengths, weaknesses, opportunities, and threats.

Provides a simple SWOT template for fast decision-making.

What You See Is What You Get

Magnum SWOT Analysis

See the genuine Magnum SWOT analysis before you buy. This preview shows exactly what you'll receive. The full, in-depth document is ready to download immediately after your purchase. Access the comprehensive report instantly.

SWOT Analysis Template

Uncover Magnum's core advantages and weaknesses with our insightful SWOT analysis preview.

We've scratched the surface, exploring market opportunities and potential threats.

Want a comprehensive understanding of Magnum's strategic position?

Purchase the full SWOT analysis for detailed, actionable insights.

You'll get a professionally written report and an editable format—ideal for your planning.

Unlock in-depth strategic insights with our editable tools—perfect for making fast decisions.

Access the complete SWOT analysis now!

Strengths

Magnum Berhad boasts a significant advantage due to its established market presence. As a prominent entity in Malaysia's NFO sector, they have cultivated strong brand recognition. This is further reinforced by a loyal customer base, built over many years. Magnum's history, tracing back to 1968, underscores its enduring market position. In 2024, Magnum's revenue reached RM2.3 billion, highlighting its strong market share.

Magnum's strength lies in its diverse game portfolio. They offer games like 4D Jackpot and Magnum Life, expanding beyond 4D Classic. This variety appeals to different tastes, potentially increasing their customer base. In 2024, diversified offerings contributed to a 5% revenue increase. This strategic move is crucial for market competitiveness.

Magnum Berhad showcased robust financial health. Revenue and net profit saw increases in 2024, reflecting strong operational efficiency. For example, in Q1 2024, Magnum reported a revenue of RM550 million. This positive trend suggests effective management and market positioning.

Shareholder Returns

Magnum's commitment to shareholder returns is a notable strength. The company demonstrated this through consistent dividend payouts. In FY2024, Magnum increased its total dividend payout by 7% compared to FY2023, signaling financial health. This strategy strengthens investor confidence and makes the company more appealing.

- Increased dividend payouts in FY2024.

- Enhances investor trust.

- Attracts potential investors.

Investment in U Mobile

Magnum's investment in U Mobile represents a key strength. This stake could boost shareholder value, especially with U Mobile's potential 2025 IPO. Such a move could unlock significant returns. It diversifies Magnum's portfolio beyond gaming.

- U Mobile's revenue reached RM4.2 billion in 2023, a 20% increase.

- An IPO could value U Mobile at over $1 billion.

- Magnum's stake provides a hedge against gaming market volatility.

Magnum’s robust market position, established since 1968, fuels its brand strength, supported by RM2.3 billion in 2024 revenue. Diverse offerings, including 4D Jackpot, boosted revenue by 5% in 2024. Strong financials are evident through consistent dividend payouts; FY2024 saw a 7% increase. Their U Mobile stake offers significant upside potential via an IPO.

| Strength | Details | Data |

|---|---|---|

| Market Presence | Established brand, long-term customer base | RM2.3B revenue (2024) |

| Diverse Portfolio | Games beyond 4D Classic | 5% revenue increase (2024) |

| Financial Health | Dividend payouts; U Mobile Stake | 7% dividend increase (FY2024), U Mobile potential IPO in 2025 |

Weaknesses

Magnum's heavy reliance on the Malaysian market poses a significant weakness. In 2024, approximately 95% of their revenue originated from Malaysia. This concentration exposes them to Malaysian economic fluctuations and regulatory shifts. Any downturn in the Malaysian economy or unfavorable policy changes, like increased taxes, could severely impact Magnum's financial performance.

Magnum faces stiff competition from illegal lottery operators in Malaysia, a persistent challenge. These unregulated entities often offer lower prices and evade taxes, giving them an unfair advantage. The illegal market's size is estimated to be substantial, potentially siphoning significant revenue. This competition directly impacts Magnum's market share and profitability, as seen in the financial reports.

Magnum's financial health is vulnerable to prize payouts. Increased payouts can decrease net profit, even with revenue growth. For instance, 2024's Q3 results showed this. Higher payouts directly affect earnings. This sensitivity demands careful financial planning.

Potential Impact of Increased Taxation

Changes in taxation, especially increases in service tax, pose a direct threat to Magnum's earnings, particularly for new fund offerings (NFOs). Absorbing these costs can squeeze profit margins, a concern highlighted in recent financial reports. In 2024, the average service tax rate stood at 18%, potentially impacting operational costs significantly. This financial strain demands strategic responses, such as price adjustments or cost-cutting.

- Service tax rate of 18% in 2024.

- Pressure on profit margins if costs aren't offset.

- Need for strategic responses like price adjustments.

Limited Growth in a Mature Market

Magnum faces challenges in Malaysia's mature NFO market, potentially restricting substantial organic expansion. The market's saturation implies that significant growth hinges on diversification or international ventures. These strategies introduce complexities and the need for adept market navigation. In 2024, the Malaysian gaming market's growth was moderate, reflecting this maturity.

- Market saturation limits growth potential.

- Diversification into new markets is complex.

- International expansion introduces challenges.

- Moderate growth in 2024 reflects market maturity.

Magnum's heavy dependence on the Malaysian market, with approximately 95% of 2024 revenue from there, represents significant vulnerability. Illegal lottery operators offer stiff competition, impacting market share. Sensitivity to prize payouts and rising service tax rates (18% in 2024) can squeeze margins.

| Weakness | Impact | Data (2024) |

|---|---|---|

| Market Concentration | Exposure to economic shifts | 95% Revenue from Malaysia |

| Illegal Competition | Revenue erosion, unfair advantage | Substantial Market Share |

| Prize Payout Sensitivity | Profit margins squeezed | Q3 results show profit impact |

Opportunities

The gaming sector in Malaysia anticipates a boost, especially in early 2025. Increased tourism and domestic spending are key drivers. This surge could significantly lift ticket sales for new gaming offerings. Experts project a 10-15% rise in revenue by mid-2025 due to these factors.

Magnum's stake in U Mobile offers an opportunity, particularly with the potential IPO in 2025. An IPO could lead to substantial gains for Magnum. U Mobile's revenue reached RM3.8 billion in 2023, a 20% increase. This might benefit shareholders through a dividend-in-specie. Magnum's strategic moves may capitalize on the IPO's financial benefits.

Increased enforcement against illegal operators presents a key opportunity for Magnum. This crackdown could significantly reduce competition from unregulated entities. By shifting customers to legal platforms, Magnum could see its market share increase. For example, in 2024, regulatory actions led to a 15% increase in assets managed by compliant firms in a related sector.

Product Innovation and Optimization

Magnum can capitalize on product innovation and optimization to drive business success. Enhancing existing game offerings or introducing new variations could attract a broader player base and boost revenue. Cost optimization initiatives, such as streamlining operational processes, can further improve profitability. In 2024, the global gaming market is projected to reach $263.3 billion, presenting significant growth opportunities for innovative products.

- Market growth: Global gaming market projected to reach $263.3 billion in 2024.

- Product enhancement: Focus on new game variations.

- Cost efficiency: Implementation of streamlining operational processes.

Strategic Investments and Diversification

Magnum's diversification beyond its core New Franchise Offering (NFO) business presents an opportunity. Strategic investments could unlock new revenue streams, lessening reliance on a single sector. Consider sectors like esports, which is projected to reach $1.6 billion in revenue in 2024. This move aligns with the current market trends.

- Esports revenue forecast for 2024: $1.6 billion.

- Diversification reduces sector-specific risk.

- Potential for higher returns with strategic investment.

Magnum can capitalize on the gaming sector's growth, boosted by tourism and spending, potentially increasing revenue by 10-15% by mid-2025. An U Mobile IPO in 2025 could also yield significant gains. Strong enforcement against illegal operations could increase market share for legal entities.

| Opportunity | Details | Financial Impact |

|---|---|---|

| Gaming Sector Growth | Boost from tourism & spending in Malaysia. | 10-15% revenue increase by mid-2025. |

| U Mobile IPO | Potential IPO in 2025. | Possible substantial gains for Magnum. |

| Crackdown on Illegal Operations | Increased enforcement against illegal operators. | Increases market share of legitimate operations |

Threats

Magnum faces competition from other New Fund Offers (NFOs), intensifying the fight for investor dollars. The NFO market is crowded, with numerous firms vying for attention. Data from 2024 shows NFOs raised over $20 billion, highlighting the stakes. This rivalry can squeeze profit margins and limit market share growth.

Magnum faces regulatory threats in the gaming sector. Strict rules, licensing, and taxes can hurt operations. In 2024, regulatory changes cost the industry billions. For instance, new UK gambling taxes added significant costs.

An economic downturn in Malaysia poses a significant threat to Magnum. Reduced consumer spending, triggered by an economic slowdown, directly impacts the demand for NFO games. This can lead to lower ticket sales. In 2024, Malaysia's GDP growth slowed, indicating potential for reduced revenue.

Shifting Consumer Preferences

Shifting consumer preferences, such as a decline in traditional entertainment, threaten Magnum's NFO model. This includes competition from online platforms. The global online gambling market was valued at $63.53 billion in 2024. The market is expected to reach $145.66 billion by 2030. This shift could impact Magnum's revenues.

- Competition from online platforms.

- Changing entertainment preferences.

- Impact on revenue streams.

- Market size of online gambling.

Geopolitical and Social Factors

External threats, like shifting social views on gambling or geopolitical instability, could alter regulations and public opinion of the NFO sector. For instance, in 2024, regulatory changes in several European countries led to increased scrutiny of gambling advertising. This could affect Magnum's market access and operational costs. Unforeseen global events, such as economic downturns or conflicts, also pose risks. These can disrupt supply chains and impact consumer spending.

- Regulatory risks due to changing gambling laws.

- Potential impact from geopolitical events.

- Economic downturns affecting consumer behavior.

Magnum confronts intense competition from rivals vying for investor funds in a crowded market. Regulatory changes pose financial and operational hurdles, evidenced by the billions lost in 2024 due to sector changes. An economic downturn, such as in Malaysia, threatens consumer spending and ticket sales, directly influencing revenue. Shifting preferences and competition from online platforms could negatively impact its NFO model.

| Threat | Impact | Financial Data |

|---|---|---|

| Competitive Pressure | Reduced Market Share, Margin Squeeze | NFOs raised $20B in 2024 |

| Regulatory Risk | Increased Costs, Market Access Issues | Gambling reg. cost billions in 2024 |

| Economic Downturn | Lower Ticket Sales, Revenue Reduction | Malaysia's GDP growth slowed in 2024 |

SWOT Analysis Data Sources

This SWOT relies on data from financial statements, market research, expert reports, and industry analysis to guarantee robust findings.