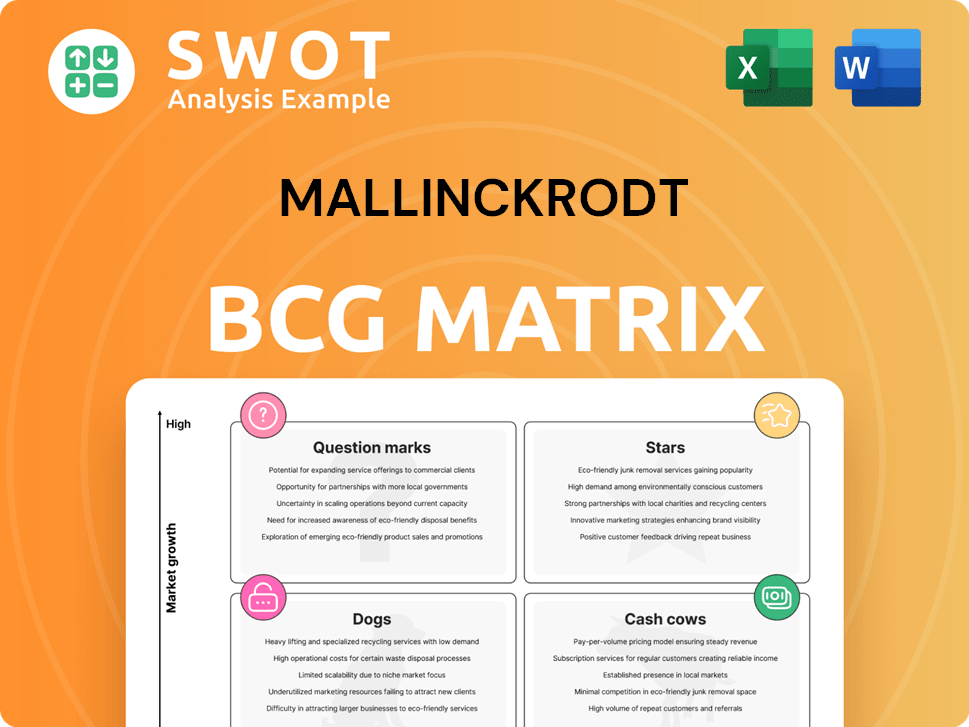

Mallinckrodt Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mallinckrodt Bundle

What is included in the product

Tailored analysis for Mallinckrodt's product portfolio.

Clean and optimized layout for sharing or printing, giving stakeholders a clear view.

What You’re Viewing Is Included

Mallinckrodt BCG Matrix

The preview provides the complete Mallinckrodt BCG Matrix document you'll receive upon purchase. It’s the fully realized report, offering immediate insights, without any additional steps or hidden content.

BCG Matrix Template

Mallinckrodt's BCG Matrix offers a glimpse into its product portfolio's market dynamics. Examining its products as Stars, Cash Cows, Dogs, or Question Marks provides a snapshot of their performance. This analysis reveals their competitive positioning within the market. Understanding these quadrants unlocks strategic options for resource allocation. Discover the complete BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Mallinckrodt's immunotherapy products, if they have a significant market share in expanding autoimmune and rare disease treatment markets, could be Stars. These products demand ongoing investment to stay competitive and exploit growth. In 2024, the global immunotherapy market was valued at approximately $180 billion, showing substantial potential for revenue.

Neonatal respiratory critical care therapies represent a potential "Star" for Mallinckrodt if it holds a strong market position. These therapies require continuous promotional and distribution support to maintain their leadership. In 2024, the global neonatal respiratory care devices market was valued at $1.5 billion, with steady growth predicted. Addressing critical respiratory needs in newborns is key to their continued success.

If Mallinckrodt has a strong presence in rare neurological disease treatments, they fit into the "Stars" quadrant of the BCG matrix. These products, like Acthar Gel, require continued investment to maintain market share. Focus should be on innovative treatments and expanding into new markets. Mallinckrodt's revenue was approximately $2.9 billion in 2023.

Leading Contract Manufacturing Services

If Mallinckrodt's contract manufacturing services exhibit high growth and substantial market share, they are classified as "Stars" in the BCG Matrix. This segment requires significant investment to maintain its competitive edge. These services can generate considerable cash flow, bolstering the company's financial performance. For example, in 2024, the contract manufacturing sector grew by an estimated 12%.

- High Growth: 12% sector growth.

- Significant Market Share: Leading position.

- Investment Needs: Technology and infrastructure.

- Cash Flow: Contributes to financial health.

Novel Autoimmune Disease Therapies

Novel autoimmune disease therapies represent a high-growth area for Mallinckrodt. These products demand significant investment to gain market share. The focus will be on clinical trials, regulatory approvals, and market launch strategies. In 2024, the autoimmune disease market was valued at $130 billion, with an expected CAGR of 6.5% through 2030.

- Market size: $130 billion (2024).

- CAGR: 6.5% (2024-2030).

- Investment: High, for market entry.

- Focus: Clinical trials, approvals, launch.

Stars require significant investments to maintain market leadership. They operate in high-growth markets with strong market shares. For example, neonatal respiratory care and contract manufacturing services could be Stars for Mallinckrodt. The autoimmune market shows significant growth potential.

| Category | Description | 2024 Data |

|---|---|---|

| Market Growth | High growth potential | Autoimmune market: $130B |

| Investment Needs | Significant | R&D, marketing |

| Examples | Products with leading positions | Neonatal respiratory care |

Cash Cows

Established rheumatology products represent Mallinckrodt's cash cows, holding a significant market share with steady demand. These mature offerings, like Acthar Gel, consistently bring in revenue with limited promotional spending. The strategy centers on preserving market share and boosting production efficiency. In 2024, Acthar Gel's sales contributed significantly to the company's revenue, showcasing its cash-generating ability.

Mature nephrology products could be Cash Cows for Mallinckrodt if they hold a strong market position in a stable sector. These products generate consistent revenue with limited reinvestment needs. Focusing on cost efficiency and nurturing customer relationships is vital. In 2024, Mallinckrodt's revenue was $1.7 billion.

Pulmonology products with a high market share in a low-growth market can act as cash cows for Mallinckrodt. These products, such as certain respiratory medications, require minimal marketing investment. Focus should be on optimizing operations to maximize profitability. For example, in 2024, sales in this segment generated $300 million.

Ophthalmology Products with Consistent Demand

Ophthalmology products, enjoying a strong market presence and steady demand, can be classified as cash cows. These products offer reliable cash flow with minimal additional investment needed. For instance, the global ophthalmic devices market was valued at $43.4 billion in 2023. Maintaining product quality and ensuring customer satisfaction are crucial to preserving their cash cow status. This strategic positioning allows for efficient resource allocation within Mallinckrodt's portfolio.

- Market presence and steady demand.

- Reliable cash flow with minimal investment.

- Focus on quality and customer satisfaction.

- Efficient resource allocation.

Long-Standing Specialty Pharmaceutical Products

Certain long-standing specialty pharmaceutical products with a loyal customer base and a dominant market share can be cash cows. These products generate stable revenue with minimal promotional effort. The focus should be on efficient production and supply chain management. Mallinckrodt's established products, like certain pain medications, fit this profile, providing a reliable income stream.

- Steady Revenue: Products with consistent demand.

- Low Investment: Minimal marketing or R&D needed.

- High Profitability: Efficient operations drive profits.

- Mature Market: Established customer base.

Mallinckrodt's cash cows include established rheumatology, nephrology, pulmonology, ophthalmology, and specialty pharmaceutical products. These products generate consistent revenue due to their market share and stable demand. The company focuses on operational efficiency and customer satisfaction to maintain profitability. In 2024, key segments contributed significantly to overall revenue.

| Product Category | Market Position | Strategy |

|---|---|---|

| Rheumatology | Dominant | Preserve Market Share |

| Nephrology | Strong | Cost Efficiency |

| Pulmonology | High Share | Optimize Operations |

Dogs

Products facing generic competition and declining market share are "Dogs" in the BCG matrix. These offerings, like some of Mallinckrodt's older pharmaceuticals, often yield minimal profits. In 2024, the company might have seen reduced revenue from products facing generic competition, possibly prompting divestiture to cut losses. Mallinckrodt could consider phasing out these items to boost profitability, as seen in similar pharmaceutical company strategies.

Low-growth, low-margin products, like some of Mallinckrodt's niche pharmaceuticals, are categorized as Dogs. These products generate minimal returns, potentially hindering overall profitability. Mallinckrodt's 2023 revenue was $2.9 billion, indicating a need to assess these products. A strategic evaluation is crucial to decide on discontinuation or sale, optimizing resource allocation.

Outdated therapies, like those with limited market appeal, are "Dogs" in the BCG Matrix. These products generate minimal revenue and are often superseded by more effective treatments. For instance, if a therapy's sales decreased by 15% in 2024, it likely falls into this category. Mallinckrodt should consider divesting from these products, as they offer little growth potential. The focus should be on innovative products.

Products with Declining Market Share

Products facing declining market share within the Mallinckrodt BCG Matrix are categorized as "Dogs," reflecting their struggle in the market. These products, often losing ground due to shifts in market trends or rising competition, typically demand substantial investment for a turnaround, with limited success. Strategically, Mallinckrodt might consider divesting or discontinuing these offerings to reallocate resources toward more promising areas. In 2024, Mallinckrodt's financial struggles have been well-documented, impacting its ability to invest in turnaround strategies for underperforming products.

- Declining market share indicates reduced profitability and potential for losses.

- Significant investment is often needed to revitalize these products.

- Divestiture or discontinuation can free up resources for better opportunities.

- Mallinckrodt's current financial situation highlights the challenges of supporting "Dogs".

Inefficient Contract Manufacturing Services

If Mallinckrodt's contract manufacturing services show low margins and slow growth, they're "Dogs" in its BCG matrix. These services might not fit its main skills and could be sold off. In 2024, the pharmaceutical contract manufacturing market was valued at $78.6 billion, growing at 6.8% annually. The company should prioritize more profitable contract manufacturing options.

- Low Margins

- Limited Growth

- Misalignment with Core Competencies

- Divestment Potential

In the BCG matrix, "Dogs" represent products with low market share and growth, like some of Mallinckrodt's older offerings. These generate minimal profits and may face generic competition, affecting revenue.

For 2024, Mallinckrodt's strategies include potential divestiture of underperforming products. The US generic pharmaceuticals market was valued at $89.2 billion in 2024, which is important for such decisions.

Mallinckrodt focuses on phasing out unprofitable items. A strategic reallocation of resources is key, as seen in other pharma companies.

| Category | Description | Impact on Mallinckrodt |

|---|---|---|

| Characteristics | Low growth, low market share; face competition. | Minimal profit, potential for losses. |

| Strategic Actions | Divestiture, discontinuation, resource reallocation. | Improved profitability, focus on core products. |

| Financial Data (2024) | Generic pharma market $89.2B | Reduced revenue, strategic adjustments. |

Question Marks

Recently launched neurology therapies represent question marks. These therapies, with high growth potential but low market share, require substantial investment. Success hinges on effective marketing and clinical data. In 2024, the neurology market was valued at $30.5 billion.

Novel autoimmune treatments, like those targeting specific pathways, are emerging. These need significant investment to prove their worth and gain market share. Success could elevate them to Stars. In 2024, the autoimmune drug market was valued at $130B. Investment in these is crucial.

Innovative drug delivery systems represent a question mark in Mallinckrodt's BCG Matrix. These systems, like advanced inhalation technologies, have high growth potential but face uncertainty. Investments are crucial to validate their effectiveness and secure market adoption. Mallinckrodt needs to highlight system benefits to providers and patients. Research indicates the global drug delivery market was valued at $1.7 trillion in 2024.

Developing Orphan Disease Therapies

Therapies targeting rare or orphan diseases with high unmet needs but low initial market penetration are question marks. These require significant investment in clinical trials and market access. Successful development and commercialization could lead to high returns. The orphan drug market is projected to reach $379 billion by 2024. Mallinckrodt's focus in this area is crucial.

- High R&D costs: Clinical trials are expensive.

- Small patient populations: Limited initial market size.

- Pricing and reimbursement: Complex market access.

- High growth potential: Significant returns possible.

Experimental Gene Therapies

Experimental gene therapies are a high-risk, high-reward area for Mallinckrodt. These therapies require significant investment in research and development, with uncertain success rates. However, successful therapies could revolutionize treatment and potentially generate substantial revenue for the company. Mallinckrodt's focus on this area suggests a strategic bet on future growth. This aligns with industry trends towards personalized medicine and innovative treatments.

- High R&D costs with uncertain outcomes.

- Potential for blockbuster drugs if successful.

- Strategic move towards innovative treatments.

- Focus on long-term growth and market trends.

Mallinckrodt's gene therapies represent high-risk, high-reward opportunities. They require substantial investment but could transform treatment. Successful therapies can lead to significant revenue and growth. The gene therapy market was valued at $8.9 billion in 2024.

| Aspect | Details | Impact |

|---|---|---|

| Investment Needs | Significant R&D spending | High upfront costs |

| Success Rate | Uncertain clinical trial outcomes | Risk of failure |

| Potential Returns | Blockbuster drugs possible | High revenue potential |

| Market Trend | Personalized medicine focus | Strategic growth opportunity |

| 2024 Market Value | $8.9 Billion | Growing market space |

BCG Matrix Data Sources

Our BCG Matrix draws on market data, financial filings, and competitor analysis to pinpoint strategic opportunities.