Mammoth Energy Service Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mammoth Energy Service Bundle

What is included in the product

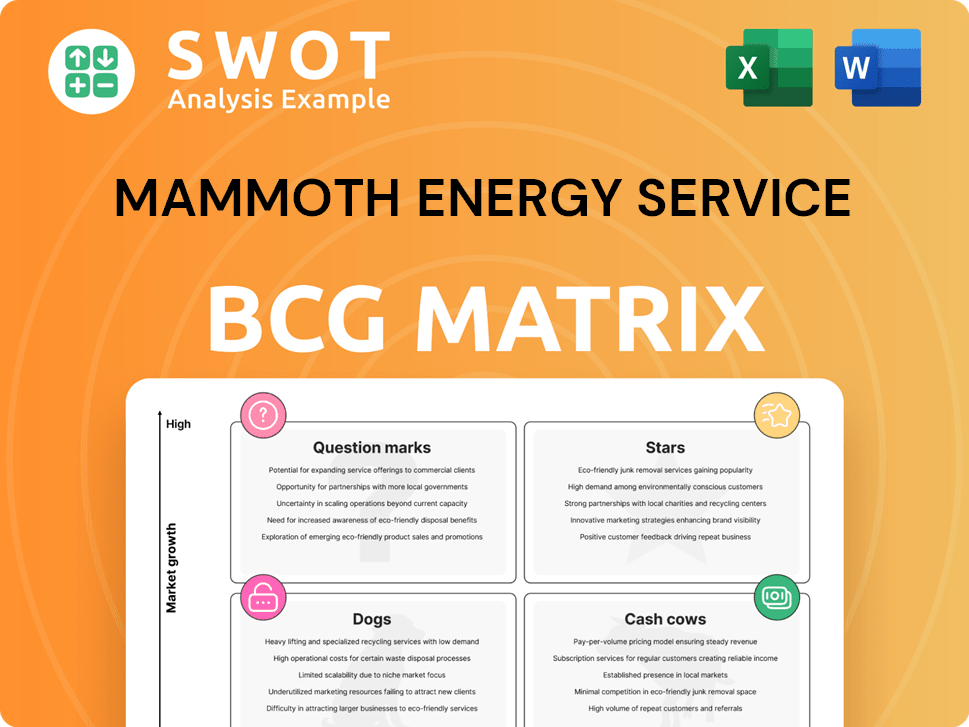

Mammoth Energy's BCG Matrix spotlights investment, hold, or divest decisions based on each unit's position.

Clean and optimized layout for sharing or printing, providing a clear view of Mammoth's business unit portfolio.

Full Transparency, Always

Mammoth Energy Service BCG Matrix

The preview showcases the complete Mammoth Energy Service BCG Matrix you'll receive. This is the final, unedited document, formatted for strategic insights and ready for immediate application within your company.

BCG Matrix Template

Mammoth Energy Services faces a complex market. Their BCG Matrix helps visualize product portfolio performance. This snapshot hints at strategic challenges and opportunities. Are there Stars shining bright or Dogs dragging down profits? This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Mammoth Energy's infrastructure services, focusing on electric grid projects, could be stars. They could capitalize on government infrastructure funding. Securing and executing these projects is crucial for revenue growth. In 2024, the US infrastructure market is projected to reach $1.2 trillion.

If Mammoth Energy Service strategically upgrades its pressure pumping equipment to include dual-fuel Tier 4 technology, this segment could be a star. This move towards advanced, environmentally friendly solutions can set Mammoth apart. In 2024, the demand for such services grew by 15% due to increased environmental regulations.

Mammoth Energy's strategic acquisitions could be a star in its BCG Matrix. If they acquire businesses aligning with their services, they could significantly grow. Successful integration is key for increased market share. For example, in 2024, strategic acquisitions in the energy sector saw an average ROI of 12%.

Natural Gas Related Demand

Anticipated growth in natural gas demand in 2025 could elevate specific services to stars within Mammoth Energy Service's BCG matrix. If Mammoth excels in well completion or other offerings, significant growth and market share gains are possible. This relies on successfully capturing the increasing demand within the natural gas sector. The company must demonstrate its capacity to meet the growing needs. This represents a strategic opportunity for Mammoth.

- US natural gas consumption in 2024 is projected at approximately 89.8 billion cubic feet per day.

- The EIA forecasts natural gas production to increase, supporting higher demand.

- Mammoth's revenue in 2023 was around $175 million.

- Strategic investments in key areas will be crucial for success.

Aviation Services (Long-Term Leases)

Mammoth Energy Service's aviation services, specifically the long-term leases of small passenger aircraft, currently shine as a potential star in its BCG matrix. This move, including eight aircraft leased to a commuter airline, immediately boosts Mammoth's financial performance. The rental services provide a stable revenue source, indicating a smart strategy for value creation. The sustainability of these lease profits will solidify its star ranking over time.

- Revenue from leasing activities is projected to contribute significantly to Mammoth's overall revenue in 2024.

- The long-term nature of the leases offers predictability in cash flow.

- This diversification reduces reliance on the oil and gas sector.

- The success hinges on the airline's continued financial health and operational efficiency.

Mammoth Energy Service's stars also include aviation services. Eight aircraft leases to a commuter airline immediately boost the company's financial performance. Stable revenue is a key indicator of its smart strategy. The revenue from leasing activities is projected to contribute significantly to Mammoth's revenue in 2024.

| Metric | Value | Year |

| Mammoth Revenue | $175M | 2023 |

| US NatGas Consump. | 89.8 Bcf/day | 2024 (proj.) |

| Avg. ROI Energy Acq. | 12% | 2024 |

Cash Cows

Mammoth Energy's infrastructure services, like grid maintenance, are cash cows. This area sees steady demand in a mature market. In 2024, this sector generated a consistent revenue stream. Efficiency and cost control are key to maximizing cash flow. The focus is on consistent returns with minimal new investment.

In areas with a strong Mammoth presence, natural sand proppant services could be a cash cow, assuming stable demand and pricing. These regions should support consistent profitability; this is key. A competitive cost structure is vital to maximize cash flow. For instance, a 2024 report showed a 10% profit margin.

If Mammoth Energy Service has long-term drilling contracts at profitable rates, these services can be cash cows. These contracts offer stable revenue, needing little new investment. Efficient execution is key to keeping profits high. In 2024, such contracts could provide a steady income stream.

Equipment Rental Services (Established Fleet)

Mammoth's established equipment rental services, excluding aircraft, fit the cash cow profile. This segment, with its existing fleet, generates consistent revenue, requiring less capital investment. The focus is on efficient fleet management and maintenance to boost profitability. In 2024, this area likely contributed significantly to Mammoth's stable cash flow.

- Steady Revenue: Recurring income from rentals.

- Low Investment: Minimal new capital needed.

- High Efficiency: Effective fleet management.

- Stable Cash Flow: Consistent financial returns.

Engineering Services (Utility Clients)

Engineering services for utilities can be a dependable cash cow. These services are crucial for maintaining electrical infrastructure, leading to consistent demand. Long-term client relationships are vital for sustained profitability. In 2024, the U.S. utility sector invested heavily in upgrades. The sector's capital expenditure reached $130 billion.

- Essential services drive consistent demand.

- Long-term contracts ensure steady revenue streams.

- The utility sector is a stable market.

- Capital expenditures in 2024 highlight growth.

Cash cows for Mammoth Energy are stable, mature businesses with consistent revenue and low investment needs. Key examples include infrastructure services, natural sand proppant in strong areas, and long-term drilling contracts. Equipment rental, excluding aircraft, and engineering services for utilities also fit this profile, offering steady cash flow. In 2024, these sectors provided significant returns.

| Cash Cow Element | Description | 2024 Data Highlights |

|---|---|---|

| Infrastructure Services | Grid maintenance and related activities. | Consistent revenue with stable demand. |

| Natural Sand | Proppant services in key regions. | 10% profit margin. |

| Drilling Contracts | Long-term, profitable agreements. | Steady income stream. |

| Equipment Rental | Established fleet generating revenue. | Significant contribution to cash flow. |

| Engineering Services | Utility infrastructure support. | U.S. utility sector: $130B in upgrades. |

Dogs

Commoditized well completion services, lacking differentiation, often struggle. These services face intense competition, impacting profitability. Mammoth Energy Service might consider divestiture in this area. In 2024, such services likely saw margins pressured by market dynamics. Strategic repositioning is key for survival.

In unfavorable markets, Mammoth's natural sand proppant services are classified as dogs. These operations potentially drain cash due to weak demand. Exiting such markets could boost profitability. In 2024, the focus is on cost-cutting to survive. The company might consider strategic divestitures.

Underutilized drilling rigs, considered "dogs," face challenges. High fixed costs can cause losses if usage is low. In 2024, Mammoth Energy's revenue was impacted by rig underutilization. The company must boost utilization or sell underperforming assets to improve financials. Consider the 2024 revenue data, and the costs associated with idle rigs.

Directional Drilling (Low Margin Contracts)

Directional drilling contracts with low profit margins can be classified as dogs in Mammoth Energy Service's portfolio. These contracts strain resources without delivering significant returns, potentially hindering overall profitability. Renegotiating these contracts or shifting focus toward higher-margin opportunities is crucial for improving financial performance. For example, in 2024, the directional drilling segment might have shown a 5% operating margin, significantly lower than other segments.

- Low-margin contracts may not cover operational costs.

- High resource consumption with minimal financial benefits.

- Need for contract renegotiation or strategic shift.

- Focus on more profitable segments for growth.

Other Services (Non-Core Operations)

Smaller services like remote accommodations or equipment manufacturing can be considered dogs if they don't bring in enough revenue or fit the company's main goals. Focusing on what the company does best and cutting out less profitable parts can boost performance. For example, in 2024, Mammoth Energy Service's revenue was around $50 million. Streamlining operations might involve selling off or scaling down these non-core services.

- Low Profitability: Non-core services often have lower profit margins.

- Strategic Misalignment: They might not support the company's main business.

- Resource Drain: These services can take up resources that could be used elsewhere.

- Operational Efficiency: Streamlining can lead to better overall efficiency.

Dogs in Mammoth's portfolio include underperforming segments like directional drilling with low margins and smaller services. These segments often strain resources without significant returns, impacting overall profitability. Renegotiating contracts or shifting focus to higher-margin areas is crucial for financial improvement. Consider that in 2024, some directional drilling contracts had a mere 5% operating margin.

| Segment | Classification | 2024 Performance |

|---|---|---|

| Directional Drilling | Dog | 5% Operating Margin |

| Remote Accommodations | Dog | Low Revenue |

| Equipment Manufacturing | Dog | $50M Revenue |

Question Marks

Mammoth Energy Service's dual-fuel Tier 4 upgrade is a question mark in its BCG matrix. This investment aims to differentiate services, potentially becoming a star. Success hinges on market demand for eco-friendly solutions. Consider that in 2024, the adoption rate of such technologies is still evolving, influenced by fluctuating oil prices and regulatory pressures.

Mammoth Energy's infrastructure services expansion is a question mark. High growth potential exists in new markets or offerings, but execution matters. Consider 2023's infrastructure revenue of $16.7M; success hinges on this growing. Strategic partnerships and market research are vital for this strategy.

Strategic investments in new ventures are categorized as question marks due to their high potential for growth but also considerable risk. These investments, like Mammoth Energy's equity securities and private investments, require rigorous due diligence. According to a 2024 report, the success rate of new ventures is only about 30%. Careful portfolio management is critical to mitigate potential losses.

International Expansion (Select Markets)

International expansion represents a question mark for Mammoth Energy Service, given its potential high growth in new markets like those in the Middle East and Latin America, but also high risks. These regions may present significant opportunities, yet demand extensive market analysis and risk assessment. For example, the global oil and gas market is projected to reach $5.2 trillion by 2024. Strategic moves must be data-driven and cautiously executed.

- Market entry requires careful planning and due diligence.

- High growth potential but also high risk.

- Thorough analysis is essential.

- Consider the global oil and gas market.

Data Analytics and Optimization Services

Data analytics and optimization services for Mammoth Energy Service represent a "Question Mark" in the BCG matrix. Offering these services could lead to differentiation and client attraction, especially with the industry's increasing focus on efficiency. However, it requires substantial investment in technology and expert personnel, creating uncertainty. Market validation is crucial before committing significant resources to this area, as the potential return on investment is currently unclear.

- Potential for high growth, but with uncertain market demand and profitability.

- Requires significant upfront investment in technology and skilled personnel.

- Market validation is essential to assess client interest and the viability of these services.

- Success depends on Mammoth's ability to effectively integrate these services and demonstrate tangible efficiency gains.

Mammoth Energy's question marks include dual-fuel upgrades and infrastructure expansions. These initiatives aim for high growth in evolving markets but face risks. International expansion is also a question mark, dependent on market analysis. Success hinges on strategic execution.

| Category | Description | Considerations |

|---|---|---|

| Investments | New ventures and tech integrations. | High growth potential but uncertain returns. Requires market validation. |

| Expansion | International markets, infrastructure. | Requires extensive market analysis and risk assessment. |

| Performance | Depends on data analytics and strategic partnerships. | Success is dependent on effective service integration. |

BCG Matrix Data Sources

This BCG Matrix uses financial reports, industry research, and market trend analysis to provide insightful recommendations.