Manpower Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manpower Bundle

What is included in the product

Examines Manpower's competitive forces: threats, suppliers, buyers, and rivals.

Instantly spot opportunities and threats with dynamic force visualizations.

Same Document Delivered

Manpower Porter's Five Forces Analysis

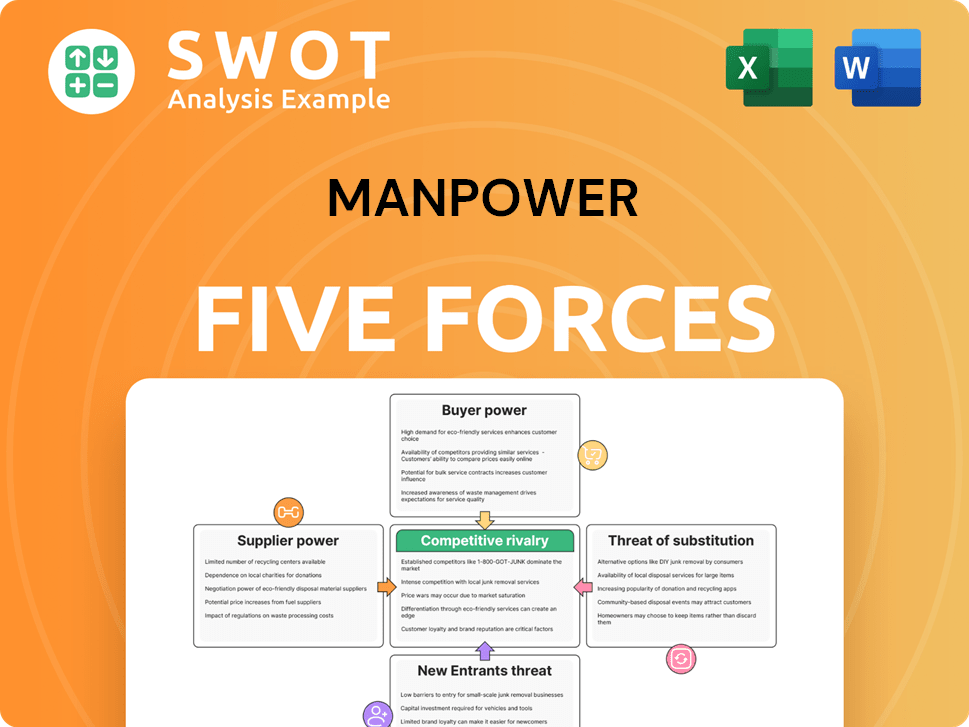

This preview illustrates the comprehensive Manpower Porter's Five Forces analysis. It examines the competitive landscape, evaluating key forces. The document covers threats of new entrants and substitutes, competitive rivalry, and supplier/buyer power. You’re looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file.

Porter's Five Forces Analysis Template

Manpower's competitive landscape is shaped by forces impacting its profitability. Supplier power influences costs, impacting margins. Buyer power, especially from large clients, affects pricing and contracts. New entrants face high barriers in this established staffing industry. Substitute services, like automation, pose a growing threat. Competitive rivalry is fierce, with numerous staffing agencies vying for talent and clients.

Unlock the full Porter's Five Forces Analysis to explore Manpower’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of specialized recruiters significantly affects ManpowerGroup. Limited supply of skilled talent acquisition specialists can elevate their power, potentially increasing labor costs. This is crucial given the rising need for niche skills across industries. In 2024, the staffing industry's growth was projected at 3.5%, showing the importance of securing talent.

ManpowerGroup heavily uses recruitment tech for talent sourcing and management. Limited tech providers could hike prices, affecting operational costs. This dependence might constrain ManpowerGroup's tech capabilities. For example, in 2024, the HR tech market is valued at over $30 billion.

Suppliers of training and assessment programs exert influence over ManpowerGroup. High-quality, relevant programs are vital for workforce skill alignment. Limited options for top-tier programs may inflate costs. In 2024, the global training market reached $370 billion, highlighting supplier importance.

Industry-Specific Certifications

In some sectors, specific certifications are essential for workers, granting suppliers notable influence. If these certifications are legally required, the suppliers' position strengthens. The expense and availability of these certifications directly impact ManpowerGroup's capacity to supply qualified personnel. For instance, in 2024, the demand for certified IT professionals surged, with certifications like AWS Certified Solutions Architect commanding premium wages and influencing supplier power.

- Mandatory certifications in sectors like healthcare and construction elevate supplier power.

- High certification costs and limited training availability can restrict ManpowerGroup's candidate pool.

- Regulatory mandates amplify the bargaining power of suppliers offering essential certifications.

- Specialized certifications often lead to higher wages for certified workers.

HR Consulting Services

ManpowerGroup, like other large firms, leverages external HR consultants. The bargaining power of these consultants is influenced by their specialized skills. Factors like high demand and limited supply can drive up consulting fees. For instance, in 2024, the HR consulting market was valued at approximately $40 billion globally.

- Specialized expertise commands higher fees.

- Limited supply increases bargaining power.

- Market size: HR consulting, $40B (2024).

- Demand fluctuations impact pricing.

Suppliers of essential services like specialized recruiters and HR consultants wield considerable influence over ManpowerGroup's operations.

Limited supply and high demand in areas like IT certifications boost supplier bargaining power, directly impacting costs and service offerings.

Mandatory certifications and consulting fees significantly influence ManpowerGroup's operational expenses and ability to deliver qualified personnel. In 2024, HR tech market valued over $30 billion.

| Supplier Type | Impact | 2024 Data |

|---|---|---|

| Recruiters | Labor Costs | Staffing industry growth: 3.5% |

| Tech Providers | Operational Costs | HR tech market: $30B+ |

| Training Programs | Skill Alignment | Global training market: $370B |

Customers Bargaining Power

Large corporations, demanding workforce solutions in large volumes, wield significant bargaining power. These clients frequently negotiate for volume discounts and tailored service arrangements. In 2024, ManpowerGroup reported that key account clients represented a substantial portion of their revenue. This can squeeze ManpowerGroup's profit margins.

SMEs, though individually smaller, collectively form a sizable customer base for ManpowerGroup. These businesses are frequently more price-conscious, with budget constraints influencing their workforce solutions decisions. In 2024, the SME sector accounted for approximately 60% of private sector employment globally. ManpowerGroup must balance service quality with affordability, considering the competitive landscape, and the price sensitivity of this customer segment. In 2024, ManpowerGroup's revenue was approximately $20.4 billion, reflecting the importance of serving diverse customer needs.

Government agencies, major consumers of workforce solutions, wield substantial bargaining power due to strict procurement rules. These agencies, managing significant budgets, often drive down prices. For example, in 2024, U.S. federal spending on contracts reached over $700 billion, highlighting their influence. Compliance with regulations, crucial for contractors, further strengthens the agencies' position.

Project-Based Hiring

The rise in project-based hiring gives customers more choices. This shift lets them negotiate better deals with companies like ManpowerGroup. Customers gain power because they can choose from many staffing solutions. In 2024, project-based work grew, with about 40% of companies using it. This boosts customer bargaining power.

- Project-based hiring offers flexibility.

- Customers can seek alternative solutions.

- Negotiating favorable terms becomes easier.

- Buyer power is enhanced.

In-House HR Departments

The rise of in-house HR departments strengthens customer bargaining power. Companies increasingly manage talent internally, reducing reliance on external services. This trend impacts workforce solutions providers like ManpowerGroup. To compete, they must offer more specialized, high-value services.

- In 2024, internal HR departments are growing, with an estimated 60% of companies expanding their in-house capabilities.

- ManpowerGroup's revenue decreased by 4% in the third quarter of 2024, reflecting the impact of this shift.

- Specialized services, such as AI-driven talent acquisition, are becoming crucial for workforce solutions.

Customer bargaining power significantly influences ManpowerGroup's profitability. Large clients leverage volume for discounts, impacting margins. SMEs' price sensitivity and project-based hiring options heighten customer influence. In-house HR departments also reduce reliance on external services.

| Customer Segment | Bargaining Power Drivers | Impact on ManpowerGroup |

|---|---|---|

| Large Corporations | Volume discounts, tailored services | Margin pressure |

| SMEs | Price sensitivity, budget constraints | Requires balancing quality and affordability |

| Government Agencies | Strict procurement rules, budget size | Price reduction |

Rivalry Among Competitors

Robert Half stands as a formidable rival to ManpowerGroup, both vying for dominance in staffing and recruitment. Their service offerings mirror each other, covering temporary staffing and permanent placement. The competition heightens, with both firms constantly adjusting pricing and service models. In 2024, Robert Half's revenue reached $7.1 billion, reflecting the industry's competitive landscape.

Adecco is a major global competitor in workforce solutions. They directly rival ManpowerGroup, especially in Europe and North America. For example, in 2024, Adecco's revenue was approximately €25.3 billion. This intensifies the need for strategic investments to compete effectively. Continuous improvement is crucial for ManpowerGroup.

Randstad is a significant rival to ManpowerGroup, offering extensive HR services like staffing and consulting. The competition between them pushes Manpower to specialize and enhance customer service. Randstad's global reach means both companies compete across many sectors. In 2024, Randstad's revenue reached approximately €28 billion, highlighting the intensity of the rivalry.

Korn Ferry

Korn Ferry, a key competitor, specializes in executive search and leadership consulting. This overlaps with ManpowerGroup's Right Management services, increasing competitive pressure. ManpowerGroup must highlight its unique value to succeed. In 2024, the global talent management market was valued at approximately $400 billion, indicating a substantial competitive landscape.

- Korn Ferry's focus on executive search creates direct competition.

- Right Management faces pressure in talent management and transition.

- ManpowerGroup needs to differentiate its services effectively.

- The talent management market is large, with significant competition.

Technological Disruption

The surge of digital platforms and AI-driven recruitment tools has amplified competitive rivalry within the staffing industry. Companies that effectively use technology to refine their recruitment procedures and improve candidate matching gain a competitive advantage. For example, in 2024, the global market for AI in HR was valued at $2.1 billion. ManpowerGroup needs to continually invest in and adapt to new technologies to remain competitive in this dynamic environment.

- Digital transformation is crucial for staying ahead.

- AI-driven tools enhance matching and streamline processes.

- Investment in technology is key to maintaining competitiveness.

- The market for AI in HR is rapidly expanding.

Competitive rivalry in the staffing industry is intense, driven by key players like Robert Half, Adecco, and Randstad, each with substantial 2024 revenues. Digital platforms and AI further escalate this rivalry, forcing companies to innovate. ManpowerGroup faces pressure to differentiate its services and invest in technology to stay ahead.

| Rival | Revenue (2024) | Key Focus |

|---|---|---|

| Robert Half | $7.1B | Staffing and Recruitment |

| Adecco | €25.3B | Workforce Solutions |

| Randstad | €28B | HR Services |

SSubstitutes Threaten

Online freelance platforms, such as Upwork and Fiverr, provide an alternative to traditional staffing agencies. They allow companies to directly hire independent contractors, reducing reliance on services like ManpowerGroup. This ease of access and flexibility poses a threat to ManpowerGroup's temporary staffing services. In 2024, the global freelance market is valued at over $455 billion, showing the growing appeal of this substitute.

AI-driven recruitment tools are a growing threat. These tools automate resume screening and initial assessments. This reduces the need for human recruiters. ManpowerGroup faces competition from these AI solutions. The global AI in HR market was valued at $1.2 billion in 2023 and is projected to reach $3.6 billion by 2028.

The rise of in-house recruitment poses a significant threat to ManpowerGroup. Large corporations are increasingly building their own recruitment teams. This shift reduces their dependence on external agencies. For instance, in 2024, 45% of Fortune 500 companies enhanced their internal recruitment capabilities.

This trend necessitates ManpowerGroup to offer more specialized services. To stay competitive, ManpowerGroup must focus on value-added services. These services include strategic workforce planning or executive search. This helps to offset the loss of revenue from basic staffing.

Outsourcing to BPOs

Companies increasingly outsource processes to BPOs, which can incorporate workforce management. This outsourcing model acts as a substitute for specialized staffing solutions like ManpowerGroup's. The global BPO market was valued at $385.6 billion in 2023. This includes services that compete directly with traditional staffing. BPO's comprehensive offerings can fulfill similar needs.

- 2023 Global BPO Market: $385.6 billion.

- BPOs offer end-to-end workforce solutions.

- Outsourcing can replace internal staffing functions.

- BPO growth indicates a shift in business practices.

Automation and Robotics

Automation and robotics pose a significant threat to ManpowerGroup. The rise of machines in sectors like manufacturing and logistics reduces the demand for human workers, impacting staffing needs. Companies are increasingly opting for automation to cut costs and boost efficiency, a trend that could decrease the demand for temporary and permanent staffing services. ManpowerGroup must focus on roles that require uniquely human skills, like strategic thinking.

- According to the International Federation of Robotics, the operational stock of industrial robots grew by 13% in 2023, reaching approximately 3.9 million units globally.

- In 2024, the global market for industrial automation is projected to be worth over $200 billion.

- ManpowerGroup's revenue for Q3 2024 was $4.8 billion, showing the scale of the staffing industry.

Substitute threats include online freelance platforms, AI recruitment, and in-house recruitment, which offer alternative ways to acquire talent, decreasing the need for ManpowerGroup's services. Business process outsourcing (BPOs) is also a substitute, providing comprehensive workforce management. Automation and robotics are reducing the demand for human workers in some sectors.

| Substitute | Description | Data (2024) |

|---|---|---|

| Freelance Platforms | Online marketplaces connecting companies with independent contractors. | Global freelance market valued over $455B. |

| AI Recruitment | Tools automating resume screening and initial assessments. | AI in HR market projected to reach $3.6B by 2028. |

| In-House Recruitment | Companies building their own recruitment teams. | 45% of Fortune 500 enhanced internal recruitment. |

Entrants Threaten

The staffing industry sees low barriers to entry, especially in niches, making it easier for new firms to compete. This intensifies competition for ManpowerGroup. New entrants can quickly gain ground by targeting specific sectors or skills. For example, the global staffing market was valued at $617.7 billion in 2023.

The rise of digital platforms significantly cuts entry barriers. Startups use these tools to compete without huge initial costs. LinkedIn's 2024 revenue reached $15 billion, showing the power of online recruitment. This digital shift boosts the threat of new competitors.

Local and regional staffing firms are a constant threat, especially due to their market knowledge. These firms provide personalized services, building strong local business relationships. In 2024, the staffing industry saw a 5% increase in regional firm market share. This growth highlights their competitive advantage.

Economic Conditions

Economic conditions significantly influence the threat of new entrants in the staffing industry. Downturns often lead to layoffs, potentially pushing experienced HR professionals and recruiters to launch their own firms. These individuals possess valuable industry knowledge and existing networks, enabling them to rapidly enter the market. This influx can intensify competition and exert downward pressure on pricing.

- In 2024, the U.S. unemployment rate remained relatively stable, hovering around 3.7% to 3.9%, potentially limiting the pool of experienced professionals seeking to start new staffing firms.

- However, economic uncertainties, such as rising interest rates, could increase the risk of layoffs, thereby boosting the threat of new entrants.

- The staffing industry's revenue in the U.S. was projected to reach $172.3 billion in 2024, indicating a large market that could attract new entrants.

- In 2023, the global staffing market was valued at $677 billion, signaling a competitive landscape.

Specialized Niche Players

Specialized niche players, like those focusing on IT staffing or executive search, represent a threat. These companies often possess specialized expertise, allowing them to attract clients seeking specific skills. This targeted approach can erode ManpowerGroup's market share in certain segments. For example, in 2024, niche IT staffing firms saw a 15% increase in demand.

- Niche players offer specialized expertise.

- This can attract clients seeking specific skills.

- It poses a threat to broader service offerings.

- IT staffing demand grew 15% in 2024.

New staffing firms easily enter the market, increasing competition. Digital platforms and niche players lower entry barriers, intensifying the threat. Economic conditions also influence this, with downturns potentially increasing new entrants.

| Factor | Impact | Data (2024) |

|---|---|---|

| Market Size | Attracts new entrants | U.S. revenue: $172.3B |

| Digital Platforms | Reduce entry barriers | LinkedIn revenue: $15B |

| Niche Players | Specialized competition | IT Staffing demand: +15% |

Porter's Five Forces Analysis Data Sources

This analysis employs data from labor market reports, government statistics, competitor profiles, and industry research to assess competitive dynamics.