Marks & Spencer Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marks & Spencer Group Bundle

What is included in the product

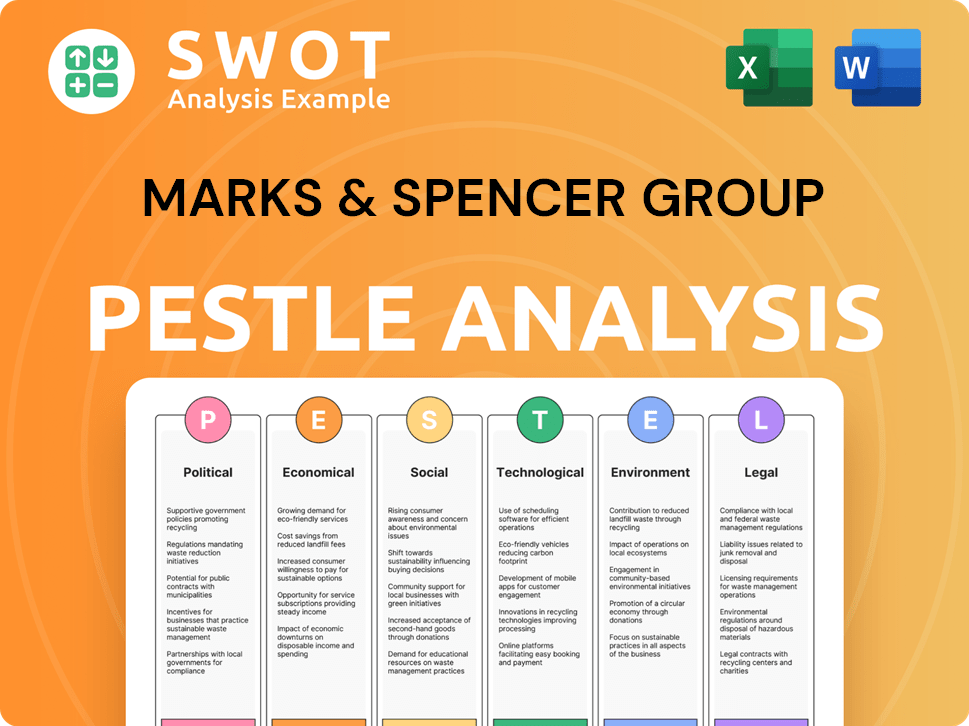

This PESTLE analysis dissects how macro factors impact Marks & Spencer, with data-backed insights for strategic decisions.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Marks & Spencer Group PESTLE Analysis

This preview displays the comprehensive Marks & Spencer Group PESTLE analysis you'll receive. The format, insights, and details you see here are exactly what's included.

Upon purchase, you will instantly download this fully formed document—no content gaps.

The structured information here will be ready for your business use without modifications.

See everything before buying: the actual analysis!

Get the complete document as previewed, no edits or changes will be provided.

PESTLE Analysis Template

Navigating the complexities of Marks & Spencer Group requires understanding its external environment. Our PESTLE Analysis uncovers the crucial factors impacting their operations and strategic decisions. Explore the political landscape, economic shifts, social trends, technological advancements, legal frameworks, and environmental concerns shaping M&S. This analysis equips you to make informed decisions, whether you're an investor, analyst, or business strategist. Deep dive into a comprehensive view of the forces at play; access our complete PESTLE Analysis now.

Political factors

The UK government's employment and wage policies significantly affect Marks & Spencer. The National Living Wage increases, impacting payroll costs. For instance, the minimum wage rose to £11.44 per hour from April 2024. Compliance with these rising mandates leads to increased operating expenses. In 2023, M&S reported a rise in staff costs.

Brexit's impact continues to affect Marks & Spencer's supply chain and costs. Tariffs and customs checks add expenses and delays. Uncertainty in trade agreements can affect profitability. In 2024, M&S faced increased import costs. The company reported £70 million in Brexit-related costs.

M&S faces stringent UK retail regulations, especially consumer protection laws. Compliance demands continuous effort and can be costly. For instance, in 2024, retail compliance costs rose by 3% due to updated standards. Regulatory shifts prompt necessary business practice adaptations. The company must stay updated to avoid penalties.

Political stability and global tensions

Political factors significantly influence Marks & Spencer's operations. Geopolitical instability, such as the ongoing conflicts and socio-political tensions, can disrupt supply chains. These disruptions increase costs and affect product availability, impacting both domestic and international markets where M&S operates. The company's global presence makes it vulnerable to these broader uncertainties.

- Brexit continues to impact M&S's supply chain and operational costs, with an estimated £40 million in costs in 2024.

- The Russia-Ukraine war has indirectly affected M&S through supply chain disruptions and increased energy costs.

- Changes in government policies, such as tax reforms or trade agreements, can significantly alter M&S's financial performance.

Government stance on sustainability and ethical practices

The UK government's strong focus on sustainability and ethical practices directly impacts Marks & Spencer's (M&S) strategic direction. This emphasis necessitates investment in sustainable sourcing, waste reduction, and ethical supply chains. M&S's Plan A initiative, launched in 2007, exemplifies its alignment with governmental and societal expectations regarding environmental and social responsibility. In 2023, M&S reported that 90% of its products had a Plan A attribute.

- Government policies influence M&S's operations.

- Plan A reflects M&S's sustainability commitment.

- Ethical sourcing is increasingly important.

Marks & Spencer (M&S) faces notable political hurdles. Brexit continues to cost, with £70M reported. Regulations and supply chain risks remain impactful. Geopolitical instability and government sustainability targets influence operations.

| Political Factor | Impact | Financial Data (2024) |

|---|---|---|

| Brexit | Supply Chain Disruptions & Costs | £70M in costs |

| Retail Regulations | Increased compliance costs | 3% rise in compliance costs |

| Geopolitical Instability | Supply chain disruption | Affects product availability |

Economic factors

Inflation and interest rates are key economic factors. Rising inflation and uncertain interest rates can impact consumer spending power and M&S's operating costs. High prices can lead consumers to reduce discretionary spending, affecting sales. In 2024, UK inflation was around 4%, impacting retail sales. Interest rates, hovering around 5%, also influence consumer behavior.

Consumer confidence significantly impacts M&S's sales. In 2024, UK consumer spending showed signs of recovery. However, economic uncertainty could influence purchasing decisions. M&S's food sector continues to perform well. The company's focus on quality food items appeals to consumers.

The UK's economic growth, crucial for M&S's sales, faces uncertainties. The IMF projects UK GDP growth of 0.5% in 2024, rising to 1.5% in 2025. International markets offer expansion opportunities but also risks. Economic slowdowns in key regions could hinder M&S's growth ambitions. Navigating this landscape requires strategic adaptability.

Supply chain costs and disruption

Supply chain costs and disruptions, driven by global events and inflation, present significant challenges. These factors can increase M&S's operational expenses and disrupt product availability. Inflation in the UK hit 4% in March 2024, impacting sourcing costs. The Red Sea crisis continues to affect shipping times and costs, adding to supply chain pressures. M&S needs to manage these risks to maintain profitability.

- Inflation in the UK: 4% in March 2024

- Red Sea crisis: Impacts shipping and costs

- Supply chain: Vulnerable to global events

Exchange rates

Exchange rate volatility significantly influences Marks & Spencer's (M&S) financial health, given its international sourcing and operations. Unfavorable exchange rate movements can inflate the cost of imported goods, squeezing profit margins. For instance, a weaker pound against the dollar directly increases the price of US-sourced products.

This necessitates careful hedging strategies to mitigate currency risks. M&S's ability to manage these fluctuations is crucial for maintaining competitiveness and profitability in global markets. The company's financial reports will highlight these impacts, offering insights into their mitigation efforts.

- In 2023, the GBP/USD exchange rate fluctuated, impacting import costs.

- Hedging strategies are essential to protect profit margins.

- Exchange rate volatility is a key risk factor for international retailers.

The UK's GDP is projected to grow by 0.5% in 2024, improving to 1.5% in 2025, impacting sales. Consumer spending is recovering, yet uncertainty may influence purchases. M&S faces supply chain pressures with inflation at 4% (March 2024) and the Red Sea crisis affecting costs.

| Factor | Impact | Data |

|---|---|---|

| Inflation | Increases costs, reduces spending | 4% (March 2024) |

| Interest Rates | Influences consumer spending | ~5% (2024) |

| GDP Growth | Affects sales | 0.5% (2024), 1.5% (2025) |

Sociological factors

Consumers increasingly prioritize sustainability and ethical sourcing. This shift impacts purchasing choices, with demand for eco-friendly products rising. M&S’s Plan A initiative addresses this, aligning with consumer values. In 2024, sustainable product sales increased by 15% reflecting this trend.

M&S must adjust to shifting demographics and preferences. This means adapting product ranges and marketing. For example, in 2024, 30% of UK consumers are over 50, influencing product focus. Adapting to diverse lifestyles and trends is key for staying relevant.

Health-conscious eating is on the rise, influencing food choices significantly. M&S responds by broadening its healthier and plant-based selections. In 2024, the UK's health food market hit £22.9 billion, reflecting this trend. Plant-based food sales at M&S grew by 15% in the last year, showing strong consumer interest.

Influence of social media and online trends

Social media and online trends heavily influence consumer behavior, impacting purchasing decisions. Marks & Spencer (M&S) must actively engage with customers on these platforms to stay relevant. In 2024, M&S saw a 33.3% increase in online sales, highlighting the importance of digital presence. Ignoring these trends could lead to a loss of market share. M&S needs to adapt its marketing strategies.

- Online sales growth: 33.3% increase in 2024

- Impact on purchasing decisions: Significant influence

- Importance of digital presence: Crucial for relevance

- Adaptation needed: Marketing strategy adjustments

Community engagement and social responsibility

Consumers are increasingly focused on corporate social responsibility. M&S's community involvement and ethical sourcing boost its brand image and foster loyalty. In 2024, M&S's Plan A initiatives, focusing on sustainability, saw positive consumer responses. This commitment resonates with customers seeking values-driven brands. M&S reported a 1.8% increase in sales in Q1 2024, partly due to these efforts.

- Plan A initiatives focus on sustainability

- Ethical sourcing enhances brand image

- Community involvement boosts loyalty

- Sales increased by 1.8% in Q1 2024

Social media and online trends heavily influence purchasing decisions, driving M&S's digital engagement. Online sales at M&S saw a 33.3% increase in 2024, emphasizing the need for adaptive marketing. Corporate social responsibility initiatives, such as Plan A, boost brand image and loyalty, contributing to a 1.8% sales increase in Q1 2024.

| Factor | Impact | M&S Response |

|---|---|---|

| Online Trends | 33.3% Online Sales Growth (2024) | Digital Engagement & Adapt Marketing |

| Corporate Social Responsibility | 1.8% Sales Increase (Q1 2024) | Plan A Initiatives |

| Consumer Behavior | Influenced by Trends | Engagement via Social Media |

Technological factors

The rise of e-commerce demands that Marks & Spencer (M&S) continuously invests in its digital infrastructure. In 2024, online sales accounted for approximately 35% of M&S's total revenue. A user-friendly online platform is critical for staying competitive. M&S's digital transformation strategy includes improving its website and mobile app. This boosts customer engagement and drives sales.

Marks & Spencer is investing in technology to boost efficiency. This includes AI, big data, and cloud computing. They aim to personalize customer experiences. In 2024, M&S saw a 5.9% increase in online sales. They also use tech for supply chain improvements.

Marks & Spencer (M&S) can enhance its supply chain by adopting advanced technologies. This modernization can cut costs and boost efficiency. Logistics, inventory, and tracking improvements are key. For example, in 2024, the global supply chain technology market was valued at $21.2 billion, expecting to reach $35.7 billion by 2029.

In-store technology and customer experience

Marks & Spencer is leveraging in-store technology to boost customer experience and sales. Contactless payments and interactive displays are key. M&S is actively integrating technology into its stores. In 2024, they reported a 1.8% increase in like-for-like sales, partly due to tech upgrades. They invested £43 million in digital transformation.

- Contactless payments adoption has increased by 20% in the last year.

- Interactive displays have boosted product engagement by 15%.

- M&S aims to have tech upgrades in 75% of stores by the end of 2025.

Cybersecurity threats

Marks & Spencer faces growing cybersecurity threats due to its increasing technological dependence. Protecting customer data and ensuring system integrity are paramount for maintaining consumer trust and operational continuity. Data breaches can lead to significant financial losses, reputational damage, and legal repercussions. M&S must invest in robust cybersecurity measures to safeguard its digital assets. In 2024, the global cost of cybercrime is estimated to be over $9.2 trillion, highlighting the financial stakes.

- 2024: The global cost of cybercrime is projected to exceed $9.2 trillion.

- Data breaches can result in substantial financial losses.

- Cybersecurity is crucial for maintaining customer trust.

M&S invests in digital infrastructure to compete. Online sales hit approximately 35% of total revenue in 2024, fueled by tech. Efficiency gains come via AI, cloud, and big data, including supply chain tech valued at $21.2B (2024). Cybersecurity, crucial to prevent losses projected over $9.2T, remains key.

| Tech Factor | Impact | Data (2024/2025) |

|---|---|---|

| E-commerce | Online sales growth | 35% of revenue, +5.9% increase. |

| Supply Chain Tech | Cost reduction, efficiency | $21.2B market (2024), up to $35.7B (2029). |

| Cybersecurity | Data protection, trust | Cost of cybercrime > $9.2T. |

Legal factors

Marks & Spencer (M&S) must adhere to evolving consumer protection laws. These laws dictate policies on refunds, exchanges, and product quality. For example, the UK's Consumer Rights Act 2015 sets standards. M&S needs to update its practices. Remaining compliant with these regulations is critical for legal and operational integrity.

Marks & Spencer (M&S) operates under strict food safety regulations, vital for its reputation. Compliance is crucial for consumer trust and to avoid legal repercussions. The Food Standards Agency (FSA) reported in 2024 a rise in food safety incidents. M&S invests heavily in supply chain safety to meet these standards. In 2024, penalties for non-compliance can reach millions.

Employment and labor laws are crucial for Marks & Spencer. Recent changes, like minimum wage adjustments, significantly affect operational costs. Compliance is non-negotiable for legal operation. For instance, in the UK, the minimum wage rose in April 2024. M&S must adapt to these shifts in its financial planning and workforce management.

Planning and building regulations

Planning and building regulations significantly influence Marks & Spencer's (M&S) operations, particularly concerning its physical stores. These regulations govern property development and store renovations, dictating the scope and feasibility of M&S's expansion and modernization projects. Securing planning permission is crucial for any store modifications, impacting project timelines and costs. M&S must navigate these processes to maintain and enhance its retail presence.

- Recent data shows that the UK construction output decreased by 0.9% in volume in the three months to March 2024.

- M&S invested £480.5 million in capital expenditure in the 2023/2024 financial year, including store investments.

- The company is actively seeking to streamline store layouts and adapt to changing consumer preferences.

Intellectual property laws

Marks & Spencer (M&S) relies heavily on intellectual property laws to safeguard its brand and unique designs. These laws are crucial for preventing counterfeiting and protecting the company's market position. Legal battles over trademarks and design rights are common in the retail sector, with potential impacts on M&S's brand value. In 2024, the global market for counterfeit goods was estimated at over $2.8 trillion, emphasizing the need for strong IP protection.

- Protecting brand identity is crucial.

- Legal challenges can affect market share.

- Counterfeiting poses significant financial risks.

- Strong IP enforcement is essential.

M&S must adhere to consumer protection laws like the UK's Consumer Rights Act 2015. Food safety regulations are critical, with penalties for non-compliance potentially reaching millions in 2024. Employment laws, including minimum wage adjustments, affect operational costs; in April 2024, the UK minimum wage increased. Intellectual property laws are vital, considering the estimated $2.8 trillion global counterfeit market in 2024.

| Regulation Area | Impact on M&S | Relevant Data (2024) |

|---|---|---|

| Consumer Protection | Compliance with returns & quality standards | Consumer Rights Act 2015 standards |

| Food Safety | Ensuring product safety and consumer trust | Food Standards Agency reported rising incidents, penalties in millions |

| Employment Law | Managing workforce costs & legal compliance | UK minimum wage increase in April 2024 |

| Intellectual Property | Protecting brand against counterfeiting | Global counterfeit market estimated at $2.8T |

Environmental factors

Marks & Spencer (M&S) actively addresses climate change through net-zero commitments, aiming to minimize its environmental footprint. The company has set specific targets, integrating sustainable practices throughout its operations and supply chain. M&S reports on its progress, demonstrating accountability and transparency in its environmental initiatives. In 2024, M&S invested £35 million in its Plan A sustainability program.

Marks & Spencer prioritizes sustainable sourcing. They focus on materials like cotton and polyester. M&S aims to use recycled and sustainably sourced materials. In 2024, they reported progress in their sustainability goals. This includes sourcing sustainable palm oil.

Marks & Spencer prioritizes waste reduction, focusing on plastic packaging. They aim to minimize plastic use and ensure packaging recyclability. In 2024, M&S reported a 25% reduction in plastic packaging compared to 2017. The company's commitment is visible through initiatives like reusable bag schemes. This focus aligns with consumer demand for sustainable practices.

Energy consumption and emissions

Managing energy consumption and reducing emissions are key for Marks & Spencer. The company focuses on renewable electricity and lowering its carbon footprint. M&S aims to cut emissions from its supply chain and transport. These efforts align with sustainability goals and reduce environmental impact. In 2024, M&S reported a 50% reduction in operational carbon emissions compared to 2017.

- Renewable energy usage in stores.

- Reducing emissions from transport and logistics.

- Decreasing the carbon footprint of the supply chain.

- Setting targets for overall carbon reduction.

Water usage and management

Efficient water usage is a key environmental factor for Marks & Spencer. The company focuses on reducing water consumption across its operations and supply chain. M&S aims to minimize its water footprint through various initiatives. This includes water-saving technologies and sustainable sourcing practices. In 2024, M&S reported progress in water reduction, aligning with its Plan A sustainability commitments.

- Water usage reduction targets.

- Implementation of water-efficient technologies.

- Sustainable sourcing of water-intensive products.

- Collaboration with suppliers.

Marks & Spencer's environmental strategy centers on reducing its footprint via net-zero goals and sustainable practices, supported by significant investment. The company focuses on sourcing, targeting sustainable materials like cotton and prioritizing waste reduction, including plastic packaging initiatives.

They actively manage energy and water, pursuing renewable energy and decreasing both water and emissions across its value chain to align with sustainability commitments.

| Environmental Aspect | M&S Initiatives | 2024 Data/Targets |

|---|---|---|

| Carbon Emissions | Renewable energy, supply chain and transport. | 50% reduction (operations) vs. 2017. |

| Sustainable Sourcing | Focus on cotton, polyester, palm oil. | Ongoing progress, detailed in reports. |

| Waste Reduction | Reduce plastic packaging and promoting recyclability. | 25% reduction in plastic packaging since 2017. |

PESTLE Analysis Data Sources

This PESTLE analysis uses verified data from government reports, market analysis firms, and industry publications.