Mars Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mars Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Visually appealing template for quick analysis

What You’re Viewing Is Included

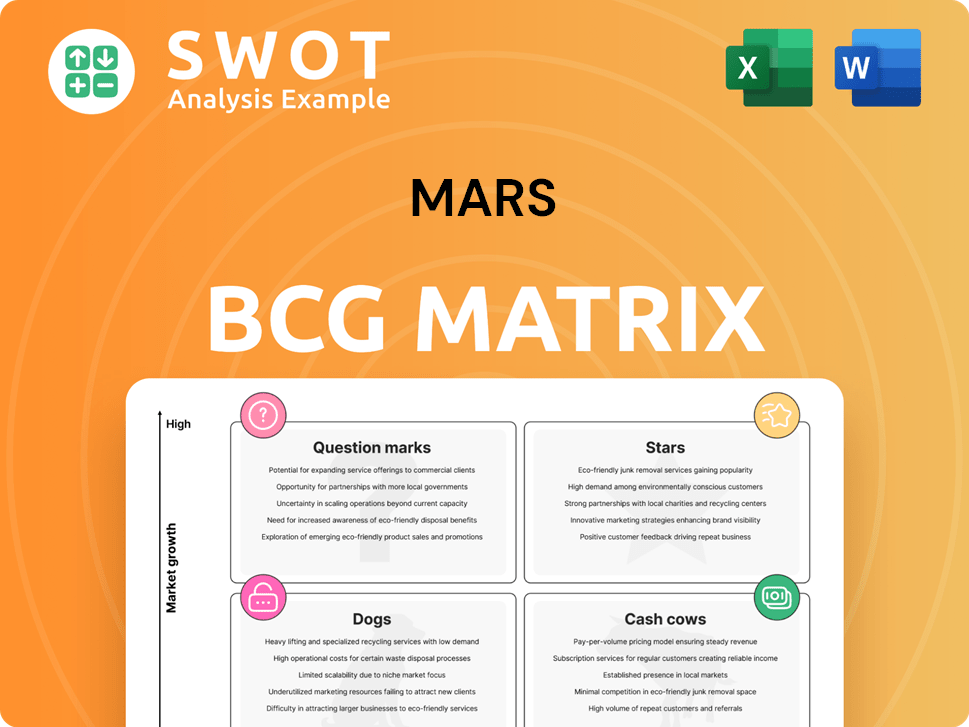

Mars BCG Matrix

The Mars BCG Matrix preview displays the identical document you'll obtain after purchasing. This comprehensive report is fully editable, offering strategic insights and tailored for your business strategy. Download the complete, ready-to-use file, which is designed for clear data interpretation and quick implementation.

BCG Matrix Template

Mars's product portfolio is a vibrant mix, with iconic brands playing different roles. We see potential "Stars" like M&M's, enjoying high market share and growth. Snickers could be a "Cash Cow," generating strong cash flow. Others might be "Question Marks" needing strategic investment decisions. Some brands possibly face "Dog" status, calling for portfolio adjustments. Dive deeper into Mars's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

M&M's and Snickers are key chocolate brands for Mars Wrigley, dominating a significant portion of the US confectionery market, which reached over $83.54 billion in 2024. Their success stems from strong consumer demand for indulgent treats, especially during peak seasons. To stay competitive, ongoing innovation in flavors, such as dark chocolate and vegan options, and unique limited-edition offerings are vital.

Pedigree, a key player in the global pet food market, aligns with the "Stars" quadrant of the BCG Matrix. The pet food market was valued at USD 128.21 billion in 2024, reflecting strong growth. Pedigree's focus on health needs positions it well in the dog food segment, a major driver of growth. This segment benefits from increasing pet ownership and humanization trends.

Mars Veterinary Health, a part of Mars, Inc., operates within the growing veterinary healthcare market, which is estimated to reach $210.91 billion in 2024. This segment is expected to grow to $227.13 billion in 2025 due to increased pet ownership and rising demand for veterinary services. Telemedicine and digital health tools are also revolutionizing animal health, enhancing accessibility. Mars Veterinary Health is well-positioned to capitalize on these trends.

Innovation in Mars Edge

Mars Edge, focusing on personalized nutrition, is positioned for growth in the packaged food market. Consumer demand for functional foods and health-beneficial products is rising. This trend allows Mars Edge to innovate and cater to health-conscious consumers. Leveraging technology for tailored dietary needs can lead to significant market share gains.

- The global functional food market was valued at $267.9 billion in 2023.

- Plant-based food sales in the U.S. reached $8.0 billion in 2023.

- Mars Edge could capitalize on the growing $7 billion personalized nutrition market.

- The health and wellness food market is projected to reach $1 trillion by 2027.

Strategic Partnerships for Sustainability

Mars' focus on sustainability through strategic partnerships is a key aspect of its business. Their commitment to ethical sourcing and reducing environmental impact resonates with consumers. This approach boosts their brand image and strengthens customer loyalty. Such initiatives are vital in today's market.

- Mars aims to achieve 100% sustainable cocoa by 2025.

- The company has invested over $1 billion in sustainable sourcing and climate action.

- Mars has reduced its packaging footprint by 25% since 2017.

Pedigree, Mars Veterinary Health, and Mars Edge are "Stars" in Mars' portfolio, indicating high growth potential. These segments benefit from increasing pet ownership, veterinary services demand, and personalized nutrition trends. The veterinary healthcare market is projected to reach $227.13 billion in 2025.

| Segment | Market | 2024 Market Value |

|---|---|---|

| Pedigree (Pet Food) | Global Pet Food | $128.21 billion |

| Mars Veterinary Health | Veterinary Healthcare | $210.91 billion |

| Mars Edge (Nutrition) | Personalized Nutrition | $7 billion |

Cash Cows

Mars Wrigley's gum and mints, like Orbit and Extra, are cash cows due to their strong market presence and stable demand. This segment's slower growth allows for lower promotional spending, boosting cash flow. In 2024, the global chewing gum market was valued at approximately $28 billion. The focus is on maintaining market share and generating profits efficiently.

Ben's Original, formerly Uncle Ben's, is a cash cow within Mars' portfolio, offering consistent revenue. Its established market presence ensures high sales, requiring minimal reinvestment. The brand's focus is on operational efficiency and leveraging its legacy. In 2024, the global rice market was valued at $45 billion, with brands like Ben's Original capturing a significant share.

The dry pet food segment is a cash cow in the pet food market due to its affordability and convenience. Mars Petcare's Pedigree is a prime example, generating consistent revenue. Maintaining market share and operational efficiency are key to sustaining this cash flow. In 2024, the global pet food market was valued at over $100 billion, with dry food accounting for a substantial portion.

Mars Global Services

Mars Global Services acts as a reliable cash cow within the Mars BCG matrix. It offers shared services that benefit from internal demand and operational efficiencies. The focus is on cost optimization and service excellence, ensuring consistent value. Minimal new investments are needed to maintain productivity.

- In 2024, Mars Global Services likely contributed significantly to Mars's overall profitability through its efficient operations.

- This segment supports various Mars divisions, providing them with essential services.

- Mars's focus on operational excellence ensures stable returns from this segment.

- The company's strategy includes maintaining a high level of service quality.

Core Chocolate Confectionery in Mature Markets

Mars' core chocolate confectionery thrives in mature markets, like North America and Europe, requiring limited marketing. These products act as cash cows, consistently generating revenue because of strong consumer loyalty. The focus is on optimizing production and distribution to boost profitability, as seen in 2024 sales figures. For example, in 2024, the chocolate market in North America reached $24.5 billion.

- Steady Revenue Streams

- Minimal Marketing Needs

- Emphasis on Efficiency

- Market Dominance

Mars' cash cows, like chocolate and pet food, ensure stable income. These segments boast strong market positions and loyal consumers, needing minimal marketing. The focus is on cost efficiency and maximizing profits from established brands. In 2024, Mars' chocolate revenue hit $24.5B in North America.

| Segment | Characteristics | 2024 Performance Highlights |

|---|---|---|

| Chocolate Confectionery | Mature market, strong loyalty | North American Market: $24.5B in sales |

| Pet Food (Dry) | High market share, recurring revenue | Global Market: Over $100B, substantial share |

| Gum and Mints | Stable demand, established presence | Global Chewing Gum Market: ~$28B |

Dogs

Some confectionery lines, like certain seasonal treats, might be considered "Dogs" due to their limited market share and slow growth, fitting the Mars BCG Matrix. Considering divestiture or discontinuation is key to free up resources. In 2024, Mars reported a 5% decrease in sales for underperforming segments.

Products like certain pet food items, perceived as less healthy, face headwinds. For instance, in 2024, premium pet food sales grew, while some traditional options saw slower growth. If these products have low market share and are in declining markets, Mars should consider their future.

In the Mars BCG Matrix, outdated pet food formulas, such as those without natural or grain-free options, are classified as dogs. These products struggle to compete with evolving consumer preferences. For instance, the global pet food market reached $119.5 billion in 2023, with significant growth in natural and specialized diets. Reformulating or minimizing these dog products is crucial for maintaining market share. This approach aligns with the market's shift towards healthier pet food options.

Low-Performing Regional Brands

Low-performing regional brands in the Mars BCG matrix are those with limited geographic presence and low market share. These brands often struggle to compete effectively. For example, a regional candy brand might only hold a 2% market share in its area. Thorough evaluation is needed to decide if a turnaround is feasible.

- Limited Geographic Reach: Brands confined to specific regions.

- Low Market Share: Struggles to gain significant market presence.

- Turnaround Plans: Requires careful assessment for viability.

- Financial Performance: Often faces revenue and profit challenges.

Segments Facing Intense Competition

In the Mars BCG matrix, "dogs" represent segments with fierce competition, small market shares, and limited growth. This can lead to a difficult business environment. For example, in 2024, the pet food market was highly competitive. Mars might consider selling or partnering with other companies to manage these underperforming segments.

- Highly competitive markets limit growth.

- Small market share indicates a weak position.

- Divestiture or partnerships are potential strategies.

- Mars faces challenges in these segments.

Dogs in the Mars BCG Matrix represent low-growth, low-share products, like some confectionery lines or pet food. These products struggle in competitive markets, potentially requiring divestiture. In 2024, underperforming segments saw decreased sales, emphasizing the need for strategic decisions.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Confectionery | Seasonal treats, limited market share | Divestiture, discontinuation |

| Pet Food | Outdated formulas, low consumer appeal | Reformulation, minimize |

| Regional Brands | Limited presence, low share | Evaluate turnaround, consider sale |

Question Marks

Mars' plant-based confectionery is a question mark due to the high investment needed for a new market. The company faces challenges in gaining market share. For instance, the global vegan confectionery market was valued at $713.1 million in 2023. Success depends on innovation and marketing to transform these products into stars.

Functional pet food is a question mark for Mars, given the growing market for health-focused pet products. Investment in research and development is crucial to innovate and compete. The global pet food market was valued at $109.1 billion in 2023. Marketing is essential to capture market share in this evolving segment.

Mars can capitalize on the premium pet treat trend by offering unique, high-end products. This strategy demands substantial upfront investment to establish a market presence and stand out. Globally, the pet food market was valued at $116.2 billion in 2024. Premium treats could boost Mars's revenue, but success hinges on effective marketing and differentiation, and sales might be around $1.5 billion.

Subscription-Based Pet Food Services

Subscription-based pet food services represent a Question Mark for Mars, capitalizing on the DTC trend. This involves significant investment in tech, logistics, and marketing to establish a subscriber base. The pet food market is valued at approximately $50 billion in the US, with DTC sales growing. To succeed, Mars must navigate the challenges of customer acquisition and retention in a competitive landscape.

- Market size: US pet food market around $50 billion.

- DTC growth: Direct-to-consumer pet food sales are increasing.

- Investment: Requires investment in tech and logistics.

- Competition: Subscription services face market competition.

International Expansion in Emerging Markets

Venturing into new international markets, especially in emerging economies, positions Mars as a question mark in the BCG matrix. This involves assessing the market size and growth potential, which can be volatile. Adaptation of existing products to local tastes is crucial for success, requiring significant investment. Mars must also invest in distribution networks and marketing campaigns tailored to the local culture and consumer behavior.

- Emerging markets offer high growth potential but come with increased risk. For example, the Asia-Pacific region's food and beverage market is expected to reach $3.1 trillion by 2024.

- Product adaptation might include adjusting flavors or packaging. For example, Mars' Snickers bars have been adapted to include local ingredients in some markets.

- Marketing strategies must consider local preferences and media consumption habits. Digital marketing spending in Southeast Asia is projected to reach $13.8 billion in 2024.

- Distribution challenges often require partnerships with local distributors. Mars has established distribution networks in various emerging markets to enhance product accessibility.

Question Marks for Mars require significant investment and carry high uncertainty. These ventures, like plant-based confectionery and subscription services, need substantial resources. Success hinges on strategic marketing and differentiation in competitive markets to achieve growth.

| Category | Examples | Challenges |

|---|---|---|

| Products | Plant-based confectionery, premium pet treats | High investment, market share gain |

| Services | Subscription pet food, new international markets | Customer acquisition, adaptation |

| Strategy | DTC sales, Emerging markets expansion | Competition, marketing effectiveness |

BCG Matrix Data Sources

Our Mars BCG Matrix utilizes reliable data from market analysis, consumer behavior, and competitor strategies for comprehensive and strategic insights.