Marshalls PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marshalls Bundle

What is included in the product

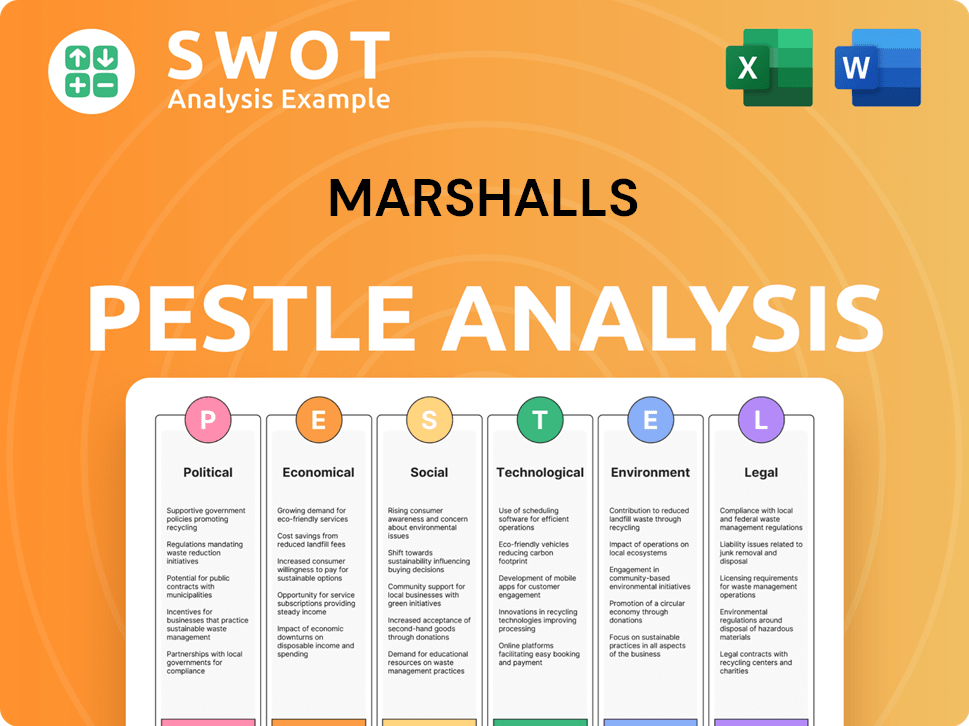

Explores external macro-environmental factors affecting Marshalls: Political, Economic, Social, Technological, etc.

Easily shareable summary ideal for quick team alignment on global economic forces and its challenges.

Same Document Delivered

Marshalls PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured, a PESTLE analysis on The Marshalls.

The analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Marshalls. You'll see clear headings, insightful analysis, and concise conclusions.

Expect the same document as shown here, meticulously organized for ease of understanding.

After purchasing, you will be able to download this comprehensive analysis in full.

PESTLE Analysis Template

Explore the external factors impacting Marshalls with our concise PESTLE Analysis. We examine Political, Economic, Social, Technological, Legal, and Environmental influences. This analysis identifies key market challenges and opportunities. Stay informed and gain a strategic advantage. Download the full PESTLE Analysis now!

Political factors

Government infrastructure spending significantly boosts demand for Marshalls' products. The UK government plans substantial infrastructure investments. This benefits Marshalls' commercial and infrastructure divisions. In 2024, infrastructure spending in the UK reached £78 billion. This trend is expected to continue into 2025.

Government housing targets significantly impact Marshalls. The UK aims to build 300,000 new homes annually. This target, if met, boosts demand for landscaping and construction products. In 2024, housing starts were around 230,000, showing a shortfall. This shortfall affects Marshalls' potential market size.

Building safety regulations, like the Building Safety Act, are crucial. These regulations directly affect construction materials and methods. Marshalls must adapt to these changing standards. This can present both hurdles and chances. For instance, the UK's construction output in Q1 2024 was £41.9 billion, showing the market's scope.

Procurement policies

Government procurement policies significantly shape Marshalls' business, especially with the upcoming Procurement Act of 2025. This act mandates companies to prove their environmental responsibility to win contracts. Marshalls must align its operations with these sustainability requirements to secure public sector projects. Failure to comply could limit access to a substantial portion of the market.

- The UK public sector spends over £300 billion annually on procurement.

- The Procurement Act 2025 emphasizes value for money, sustainability, and transparency.

- Companies must demonstrate compliance with environmental standards.

- Non-compliance may lead to exclusion from bidding processes.

Political and economic stability

Political and economic stability significantly impacts investor confidence and construction activity, crucial for Marshalls' performance. Geopolitical events and market uncertainty can influence demand in their end markets. For instance, the UK's construction output in Q4 2023 decreased by 0.9%, reflecting economic volatility. Globally, the IMF projects world economic growth at 3.2% for 2024, a factor that could influence Marshalls' international operations.

- UK construction output decreased by 0.9% in Q4 2023.

- IMF projects 3.2% world economic growth for 2024.

Political factors significantly shape Marshalls' operations and market access, including government spending and construction regulations.

The UK's infrastructure spending, which reached £78 billion in 2024, is pivotal for Marshalls' commercial divisions.

Compliance with the Procurement Act 2025, focusing on sustainability, is essential for securing public sector contracts. Overall, UK construction output in Q4 2023 decreased by 0.9% showing impact of political shifts.

| Factor | Impact | Data |

|---|---|---|

| Infrastructure Spending | Boosts demand for products. | £78 billion (2024) |

| Procurement Act 2025 | Requires environmental compliance. | £300 billion public procurement market |

| Construction Output (Q4 2023) | Reflects economic stability. | -0.9% |

Economic factors

The UK's economic health, crucial for construction, faces recession risks. Construction is expected to grow in 2025 after a potential 2024 decline. UK GDP growth is projected at 0.7% in 2024, rising to 1.3% in 2025. This impacts building material demand.

Rising inflation, especially in building materials and energy, impacts Marshalls' costs. In 2024, the UK's construction material prices rose, affecting profitability. Marshalls has focused on cost management to mitigate these impacts. For instance, in 2024, the company saw some increases, but also implemented efficiency measures.

Interest rate fluctuations directly affect Marshall's borrowing costs and consumer spending. Rising rates increase costs for developers, potentially slowing new construction and renovations. Conversely, lower rates can stimulate investment. In late 2024, the Federal Reserve's actions and inflation data significantly influenced these rates. For example, in December 2024, the average 30-year fixed mortgage rate was around 6.61%, impacting housing affordability.

Consumer spending and confidence

Consumer spending and confidence are vital for Marshalls, especially in the private housing repair, maintenance, and improvement (RMI) market. Currently, subdued activity is observed in this sector. The Office for National Statistics (ONS) reported a 0.2% decrease in UK retail sales volumes in March 2024, indicating potential caution among consumers. This suggests a challenging environment for Marshalls.

- UK retail sales volumes decreased by 0.2% in March 2024 (ONS).

- Subdued activity in private housing RMI.

Labor costs and availability

Labor costs and availability significantly influence Marshall's operations. Shortages of skilled labor in the construction sector, a key area for Marshall's growth, drive up wage costs. This can lead to project delays and impact profitability. The construction industry faces a persistent skilled labor gap, as seen in 2024 data.

- The Bureau of Labor Statistics reported a 5.2% increase in construction labor costs in the last year.

- Industry experts predict the skilled labor shortage will persist through 2025.

- Marshall's needs to manage labor costs to maintain competitive pricing.

The UK's economic outlook includes risks of recession affecting construction, with potential growth in 2025. GDP is expected to grow by 0.7% in 2024, rising to 1.3% in 2025, impacting building material demand. Inflation, especially in construction materials, affects costs and profitability for Marshalls, with efforts on cost management in place.

| Key Economic Indicators | 2024 (Projected/Data) | 2025 (Projected) |

|---|---|---|

| UK GDP Growth | 0.7% | 1.3% |

| Average 30-year fixed mortgage rate (Dec 2024) | ~6.61% | |

| Construction Labor Cost Increase (last year) | 5.2% |

Sociological factors

Population shifts in the UK significantly impact housing and infrastructure needs. The Office for National Statistics projects the UK population to reach 70 million by mid-2029, fueling demand. This growth supports ongoing commitments to build new homes to accommodate the increasing population.

Lifestyle shifts and housing trends significantly influence Marshall's market. The demand for landscaping and building products fluctuates with evolving home preferences. Energy-efficient homes and sustainable practices drive demand, reflecting a growing environmental consciousness. In 2024, approximately 60% of new homes incorporated sustainable features.

Public perception significantly impacts the construction industry. Safety concerns and environmental effects shape community relations and recruitment. The industry is increasingly focused on enhancing safety measures and promoting sustainability. For example, the UK construction sector saw a 25% decrease in major injuries between 2020 and 2023, reflecting improved safety efforts. Public trust and support are crucial.

Urbanization and development

Urbanization continues, spurring construction demands for housing and infrastructure. This boosts the construction sector, with significant investments. For instance, in 2024, the U.S. saw over $1.9 trillion in construction spending. These projects create jobs and fuel economic growth.

- Construction spending reached $1.9 trillion in 2024.

- Urbanization drives housing and infrastructure needs.

- Increased demand boosts the construction sector.

- These developments create jobs and stimulate economic growth.

Skills gap and workforce attractivenes

The construction industry faces a significant skills gap, impacting its workforce attractiveness, particularly among younger generations. Attracting new talent is vital to combat labor shortages and ensure project success. Addressing negative perceptions of construction jobs is key to drawing in fresh recruits. In 2024, the industry faces a 10% shortage of skilled workers, with projections indicating a worsening trend by 2025.

- Skills shortages impact project timelines and costs.

- Attracting young workers requires modernizing perceptions.

- Investment in training and apprenticeships is crucial.

- The industry must adapt to changing workforce expectations.

Sociological trends profoundly impact Marshall's business landscape. Shifting demographics, like UK population growth towards 70 million by 2029, shape demands. Public perception affects safety and sustainability, driving the need for enhancements. Skill shortages remain a challenge, necessitating modern recruitment.

| Sociological Factor | Impact | Data |

|---|---|---|

| Population Growth | Increased demand for housing/infrastructure | UK population to 70M by 2029 |

| Public Perception | Affects community relations/recruitment | 25% decrease in major injuries 2020-2023 in UK construction |

| Skills Gap | Labor shortages; impacts projects | 10% skilled worker shortage in construction in 2024 |

Technological factors

The construction industry's shift towards Building Information Modeling (BIM) and digital tools is accelerating. This can boost efficiency and cut costs. Marshalls should consider adopting these technologies. In 2024, BIM adoption in the UK construction sector rose to 65%, according to a report by NBS. This indicates a clear trend.

Advanced manufacturing techniques are reshaping industries. Automation, AI, and 3D printing boost efficiency and innovation. Smart factories and cognitive automation are growing. The global automation market is projected to reach $195 billion by 2025. These technologies affect Marshalls' production and product development.

Technological advancements are vital for Marshalls. They can lead to innovative, sustainable materials. Demand for eco-friendly options is rising. The global green building materials market is projected to reach $478.1 billion by 2028, growing at a CAGR of 10.8% from 2021.

Digital product passports

The EU's digital product passports, effective January 2025, demand new data systems for construction products, encompassing environmental data. Marshalls must adapt to these changes, particularly for products sold in the EU. Environmental requirements begin in January 2026, adding to the urgency of compliance. This regulatory shift could affect supply chain management and product information accessibility.

- Compliance costs could reach up to 1% of revenue.

- Data management system investments might range from $500,000 to $2 million.

- Expected increase in operational efficiency is 5-10% through streamlined data.

E-commerce and digital sales channels

E-commerce and digital sales are transforming retail. Online platforms and digital channels are crucial for sales and distribution, influencing Marshalls' strategy. In 2024, e-commerce accounted for about 16% of total U.S. retail sales, a figure that continues to rise. This shift demands that Marshalls enhance its online presence to stay competitive and reach a wider customer base.

- E-commerce sales grew 8.8% in 2024.

- Mobile commerce is also increasing.

- Digital marketing is key for customer engagement.

Marshalls faces significant technological shifts. Digital tools, like BIM, can boost efficiency. Adapting to advanced manufacturing and e-commerce is essential.

EU's digital product passports require data system updates. E-commerce, reaching ~16% of retail sales in 2024, is crucial.

| Technology Factor | Impact on Marshalls | Data/Fact |

|---|---|---|

| BIM Adoption | Enhance efficiency, reduce costs | UK BIM adoption reached 65% in 2024 |

| Advanced Manufacturing | Boost production efficiency | Automation market projected to $195B by 2025 |

| Digital Product Passports | Compliance & data system changes | EU requirements starting January 2025 |

Legal factors

Marshalls must adhere to building regulations and standards across the UK. These regulations mandate product compliance, influencing design and manufacturing. Recent updates focus on energy efficiency and safety, directly impacting product specifications. For example, the UK's new building safety regulations, post-2023, require enhanced material testing, increasing compliance costs.

Compliance with environmental laws and regulations is vital for Marshalls, covering emissions, waste, and biodiversity. The latest UK data indicates a 20% increase in environmental fines for non-compliance in 2024. New requirements, such as mandatory Biodiversity Net Gain, affect development projects. Failure to meet these standards can lead to significant penalties and reputational damage. The Environment Agency’s 2024 report highlights increased scrutiny on waste management practices.

Marshalls faces stringent health and safety regulations, especially in manufacturing and on construction sites. Compliance is crucial for protecting workers and consumers. For instance, in 2024, the UK's HSE reported over 60,000 non-fatal injuries in the construction sector. This necessitates continuous investment in safety measures. Recent data shows that failing to comply can lead to significant fines and legal repercussions.

Planning Laws and Approvals

Planning laws and approvals significantly influence construction timelines for Marshalls. Changes in these regulations can affect project start and completion dates. Reforms to the planning system directly impact the company's output capacity. The government's initiatives to streamline planning applications are crucial for Marshalls' operational efficiency.

- In 2024, the UK government aimed to accelerate planning decisions.

- The average time for planning applications varied regionally.

Employment Law

Employment law changes, especially concerning contracts and worker rights, directly impact Marshalls' operational costs and HR strategies. For instance, rising National Insurance contributions have noticeably increased expenses. These legal adjustments necessitate careful financial planning and adaptation in workforce management. Staying compliant with these evolving regulations is crucial for Marshalls' financial health.

- The UK's National Insurance contributions rose in early 2024, impacting labor costs.

- Changes in employment law can affect the structure of Marshalls' contracts.

- Compliance with worker rights legislation demands ongoing HR adjustments.

Marshalls navigates UK legal landscapes, focusing on compliance and operational strategies. Construction material specifications must adhere to building regulations. Environmental regulations affect operations.

| Legal Area | Impact on Marshalls | 2024-2025 Data/Trends |

|---|---|---|

| Building Regulations | Product compliance, design | Increased material testing. |

| Environmental Laws | Emissions, waste, Biodiversity | 20% rise in environmental fines. |

| Health & Safety | Worker & consumer protection | 60,000+ non-fatal construction injuries. |

Environmental factors

The UK's net-zero goal by 2050 impacts Marshalls. This boosts demand for sustainable construction. Marshalls is responding with its own net-zero goals. In 2023, the construction industry's carbon emissions totaled 50 million metric tons of CO2e in the UK.

Sustainability is a major factor, with increasing demand for green building and eco-friendly products. This influences product development and how companies position themselves in the market. Green building practices are also becoming increasingly vital. The global green building materials market is projected to reach $463.4 billion by 2025.

Environmental factors and regulations affect raw material availability and cost, crucial for construction. For example, the price of aggregates rose by 8% in 2024. Responsible sourcing and efficient resource use are vital for cost management. The industry faces growing pressure to reduce its environmental footprint, influencing material choices and supply chains.

Waste management and circular economy

Waste management and the circular economy are increasingly crucial for companies like Marshalls. Regulations and initiatives push for waste reduction and circular practices, influencing manufacturing and product disposal. The construction industry, a significant waste generator, is under pressure to minimize its environmental impact. For example, the UK government's 2024 waste strategy targets reducing construction waste by 15% by 2030.

- Marshalls may need to invest in recycling technologies.

- Product design changes could facilitate reuse and recycling.

- Partnerships with waste management companies are important.

- Compliance with stricter environmental standards is essential.

Biodiversity and natural habitat protection

Environmental factors, particularly biodiversity and natural habitat protection, are increasingly critical. Legislation and a growing emphasis on safeguarding biodiversity and natural habitats directly impact development sites. This often necessitates developers to adopt biodiversity net gain measures, influencing landscaping and project designs. The implementation of mandatory Biodiversity Net Gain, effective from February 2024, underscores this shift. For instance, in 2024, the UK government mandated a minimum 10% biodiversity net gain for new developments.

- Mandatory Biodiversity Net Gain introduced in February 2024.

- UK government mandated a minimum 10% biodiversity net gain for new developments in 2024.

Environmental factors significantly influence Marshalls through regulations and sustainability trends. The UK's net-zero goal by 2050 and growing demand for eco-friendly products boosts the sustainable construction materials market. Regulations regarding waste management and biodiversity are key for operations and product design. The global green building materials market is expected to reach $463.4 billion by 2025.

| Aspect | Impact | Data |

|---|---|---|

| Sustainability | Demand for green building materials. | Market to $463.4B by 2025 |

| Waste Management | Push for waste reduction, circular economy. | UK aims 15% waste reduction by 2030. |

| Biodiversity | Biodiversity Net Gain mandates affect designs. | 10% minimum net gain, from Feb 2024. |

PESTLE Analysis Data Sources

Our analysis draws from industry reports, economic data, and governmental sources to assess Marshalls' external environment. We use credible global data to ensure our findings' validity.