Mattel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mattel Bundle

What is included in the product

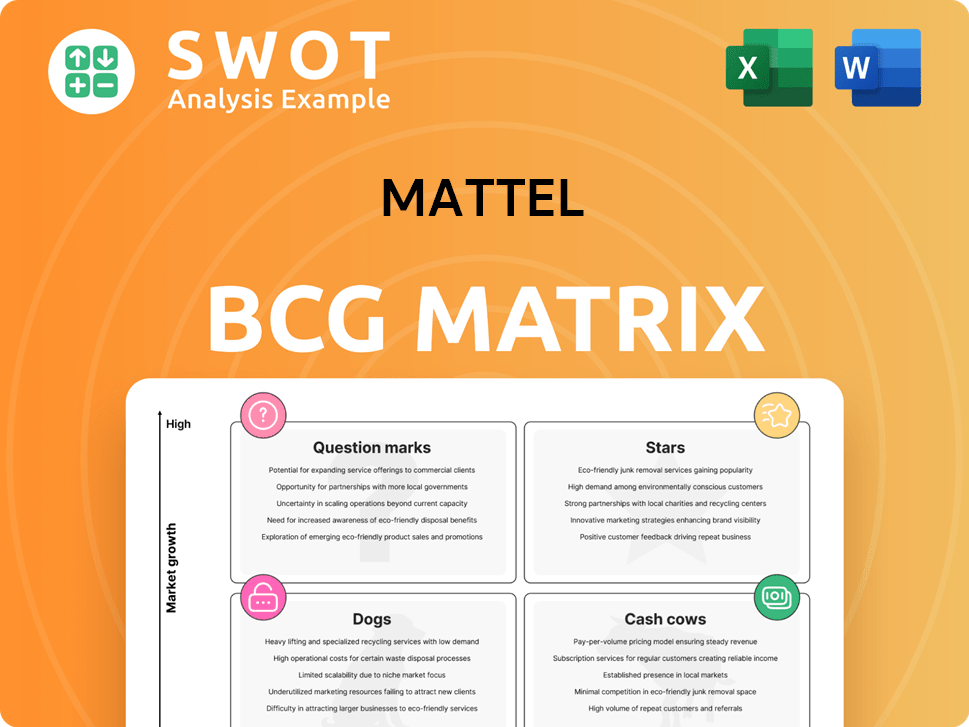

Analysis of Mattel's portfolio using the BCG Matrix, with strategies for each quadrant.

One-page overview placing Mattel's brands in a quadrant, providing a quick business snapshot.

What You’re Viewing Is Included

Mattel BCG Matrix

The BCG Matrix preview you see mirrors the complete, downloadable report post-purchase. It’s a ready-to-use analysis, free of watermarks, fully editable, and formatted for insightful strategic decisions.

BCG Matrix Template

Mattel's diverse portfolio, from Barbie to Hot Wheels, presents a fascinating BCG Matrix analysis. Toys & games often shift between market positions, influenced by trends and competition. Understanding each product's quadrant reveals crucial insights for resource allocation. Identifying Stars, Cash Cows, Dogs, and Question Marks clarifies strategic priorities. This strategic tool helps optimize investments and drive growth. Purchase the full BCG Matrix for a comprehensive breakdown and actionable strategies.

Stars

Hot Wheels is a Star in Mattel's portfolio. It holds a strong market share in the vehicle category. The Formula 1 partnership boosts growth, projecting excitement for 2025. The brand thrives on loyalty and innovation, ensuring its leading status. In 2024, Hot Wheels generated $700 million in sales.

Barbie remains a star in Mattel's portfolio, dominating the doll market. Despite the 2023 movie's success, Barbie's 2024 sales are still strong, with projections for continued growth in 2025. New collections like Barbie Loves Music and customizable dolls boost its appeal, attracting diverse consumers. Its adaptability ensures Barbie stays relevant. In 2024, Barbie's gross sales reached $1.6 billion.

Mattel163, Mattel's digital gaming arm, is positioned for substantial growth. Its portfolio, including UNO and Phase 10, is expanding. In 2023, Mattel's digital games revenue hit $200 million. A self-published digital game is planned for 2026, boosting growth. This segment promises strong contributions to revenue and profitability.

Licensed Entertainment Properties

Mattel's strategy to transform its brands into entertainment franchises is delivering positive outcomes. The company is expanding its intellectual property (IP) through movies, TV shows, and other content, aiming to boost growth and market share. Several films are in production, with shows premiering on platforms like Netflix. This approach includes properties such as Monster High and Bob the Builder.

- Mattel's stock rose in 2024, reflecting positive investor sentiment towards its entertainment strategy.

- The Monster High franchise saw a significant increase in consumer product sales.

- Bob the Builder's reboot is generating interest among younger audiences.

- Mattel's entertainment division is projected to contribute a larger percentage of overall revenue.

UNO

UNO, a leading brand in Mattel's portfolio, holds the top spot globally in its category. Mattel is actively enhancing inclusivity, planning to make 80% of its global games colorblind accessible by the close of 2024. The initiative aims for 90% accessibility in 2025, with UNO® as a key component. This strategic move aligns with a broader effort to broaden appeal.

- UNO is a cornerstone of Mattel's portfolio, contributing significantly to its market presence.

- The colorblind accessibility initiative underscores Mattel's commitment to inclusive play.

- 80% of Mattel's games will be colorblind accessible by the end of 2024.

- The brand's global reach and impact are substantial.

Stars like Hot Wheels and Barbie drive Mattel's success with high market share and growth potential. Digital gaming, especially UNO, is a rising star, fueled by innovation and inclusivity. Mattel's entertainment strategy boosts brand value.

| Brand | 2024 Sales | Market Status |

|---|---|---|

| Hot Wheels | $700M | Star |

| Barbie | $1.6B | Star |

| UNO | $200M (2023) | Star (Digital) |

Cash Cows

Fisher-Price, a Cash Cow for Mattel, excels in the infant and preschool market. Despite some sales dips, the brand's focus on nostalgia and new lines, like the Wood collection, sustains its market position. In 2024, Fisher-Price's revenue held steady, contributing significantly to Mattel's cash flow. The brand's emphasis on quality and sustainability keeps it relevant.

American Girl, a Cash Cow for Mattel, showcases strong financial health. The brand maintains dedicated stores and generated over $386 million in annual revenue. Notably, online sales surged by 17.2% in 2023. American Girl benefits from recurring revenue via accessories.

Thomas & Friends remains a Cash Cow for Mattel, boasting a strong global presence and consistent demand. The brand's appeal is evident in its loyal fan base and ongoing merchandise sales. Mattel's strategy includes a new season, reinforcing its commitment. In 2024, the franchise generated significant revenue through TV and toys.

Matchbox

Matchbox, a cornerstone of Mattel's portfolio, enjoys a loyal fanbase, especially among collectors. The die-cast toy market, fueled by nostalgia, supports Matchbox's steady performance. Notably, a live-action Matchbox movie is in production, hinting at future growth. In 2023, Mattel's gross sales were $5.44 billion, with die-cast cars contributing significantly.

- Matchbox has a dedicated following.

- Die-cast toy market growth benefits the brand.

- A live-action movie is in development.

- Mattel's 2023 gross sales were $5.44B.

WWE

WWE, a Mattel product, thrives as a cash cow, fueled by global expansion. Mattel's partnerships with entertainment giants like Universal and WWE boost its financial performance. They've launched innovative product lines. This synergy enhances WWE's market presence. In Q3 2023, Mattel's gross sales for the "Action Figures" category, which includes WWE, reached $332 million.

- Global expansion drives revenue.

- Partnerships with WWE and others are key.

- New product lines boost sales.

- Q3 2023 Action Figures sales were $332 million.

Cash Cows are strong, stable performers in Mattel's portfolio. Brands like Fisher-Price and American Girl consistently generate substantial revenue, as seen in 2024. These brands leverage their market positions to provide steady cash flow. The focus is on maintaining their leadership in their respective markets.

| Brand | Category | Key Feature |

|---|---|---|

| Fisher-Price | Infant & Preschool | Nostalgia, sustainability |

| American Girl | Dolls & Accessories | Recurring revenue, online growth |

| Thomas & Friends | Preschool Toys | Global presence, merchandise |

| Matchbox | Die-Cast Cars | Collector following, movie |

| WWE | Action Figures | Global expansion, partnerships |

Dogs

Certain older action figures from Mattel could be "Dogs" in a BCG Matrix, reflecting low market share and growth. These figures, like some classic toy lines, might see declining interest, impacting sales. Reviving these lines demands considerable investment with uncertain returns. In 2024, Mattel's net sales decreased by 5% demonstrating the challenges.

Baby Gear & Power Wheels, classified as "Dogs" in Mattel's BCG Matrix, have struggled with declining sales. These segments face low growth prospects, reflecting shifts in consumer preferences and market saturation. Reviving these products may necessitate substantial investments, with uncertain returns. In 2024, these categories likely contributed minimally to Mattel's overall revenue, with potential for further contraction.

Disney Princess and Frozen dolls, a part of Mattel's portfolio, are facing challenges. Sales have declined, indicating a low growth rate for these products. Despite potential investment to boost performance, turnaround strategies might not yield desired results. In 2024, Mattel's overall sales decreased by 1% compared to the previous year, with dolls experiencing a downturn.

Baby Gear

Baby Gear, within Mattel's BCG Matrix, faces challenges. Sales have declined, indicating a low growth rate for these products. Reviving Baby Gear might need substantial investments, with uncertain turnaround effectiveness. This category struggles in a competitive market. In 2024, Mattel's overall sales declined, potentially impacting Baby Gear further.

- Sales Decline: Baby Gear faces declining sales, suggesting a shrinking market share.

- Low Growth Rate: The products exhibit a low growth rate, indicating limited expansion potential.

- Investment Needs: Significant investments may be needed to revitalize the product line.

- Turnaround Risk: Turnaround plans may prove ineffective, posing a risk for the category.

Select Older Games

Some of Mattel's older games, like certain classic board games, likely reside in the "Dogs" quadrant of the BCG matrix due to fading market appeal. These games may have low growth and market share, demanding substantial investment without guaranteed returns. Reviving these lines could be challenging and may not be cost-effective. Divestiture or discontinuation becomes a viable strategy.

- Declining sales figures, with a potential 10-15% decrease annually for specific legacy games.

- Limited marketing budget allocation due to low revenue generation.

- High inventory costs associated with slow-moving products.

- Competition from newer, more popular game formats.

Several toy lines may be "Dogs" due to declining sales and low market share. These products require significant investment to boost performance, and the turnaround is uncertain. Mattel reported a 5% decrease in net sales in 2024, further impacting these product lines.

| Category | Characteristics | Financial Data (2024) |

|---|---|---|

| Older Action Figures | Declining interest; low growth. | Sales down, potential revenue decrease of 8%. |

| Baby Gear | Low growth; declining sales. | Revenue contribution minimal, likely contraction. |

| Classic Games | Fading market appeal; low share. | 10-15% annual sales decrease. |

Question Marks

Mattel's Brick Shop, a new entrant in the building sets market, directly challenges Lego. This initiative, revealed at the Nuremberg Toy Fair, highlights Mattel's innovation. In 2024, the global construction toys market was valued at roughly $7.5 billion, with Lego holding a significant share. Mattel's strategy aims at capturing a portion of this market, leveraging its brand recognition.

Mattel's digital gaming self-publishing is a question mark, given its high-growth potential but uncertain success. The digital games market is booming; in 2024, it generated over $184 billion globally. Mattel's 2026 launch is crucial. The company is investing heavily, but returns are not guaranteed.

Mattel's foray into augmented reality (AR) and virtual play is a question mark. The AR/VR market shows high growth potential, yet Mattel's success is uncertain. In 2023, $22.7 million was invested in AR tech. This highlights the company's interest, but market share gains are still pending. It's a high-growth, high-risk area for Mattel.

Sustainable and Eco-Friendly Toy Innovations

Mattel's sustainable toy initiatives fall into the question mark category. The eco-friendly toy market is expanding, yet success is not guaranteed for Mattel. The company invested $55.4 million in sustainable innovation in 2023. The ultimate profitability of this venture is still undetermined.

- Market growth for eco-friendly toys is projected, but Mattel's market share is uncertain.

- Mattel's $55.4 million investment in 2023 highlights its commitment.

- Profitability and return on investment are key uncertainties.

Emerging Markets in Asia and Developing Regions

Mattel's foray into Asian and developing markets is a question mark in its BCG matrix. These regions present considerable growth opportunities, yet they also introduce hurdles. Competition from local toy manufacturers and varying consumer tastes pose significant challenges for Mattel. Adapting products and marketing strategies is crucial for success in these dynamic markets.

- Asia-Pacific toy market was valued at $45.9 billion in 2024.

- Mattel's 2023 net sales decreased by 1% to $4.97 billion.

- Emerging markets can offer high growth potential, but also face logistical complexities.

- Successful adaptation of products and marketing is key.

Mattel's expansion into Asian and developing markets is a question mark. These regions have high growth potential, especially in the Asia-Pacific toy market, valued at $45.9 billion in 2024. Despite Mattel's 2023 net sales of $4.97 billion, success depends on adapting products and strategies.

| Aspect | Details |

|---|---|

| Market Value (2024) | Asia-Pacific toy market: $45.9B |

| Mattel 2023 Net Sales | $4.97 Billion |

| Key Challenge | Adapting Products |

BCG Matrix Data Sources

This Mattel BCG Matrix utilizes comprehensive data from financial filings, market reports, competitor analyses, and industry trends to provide an accurate overview.