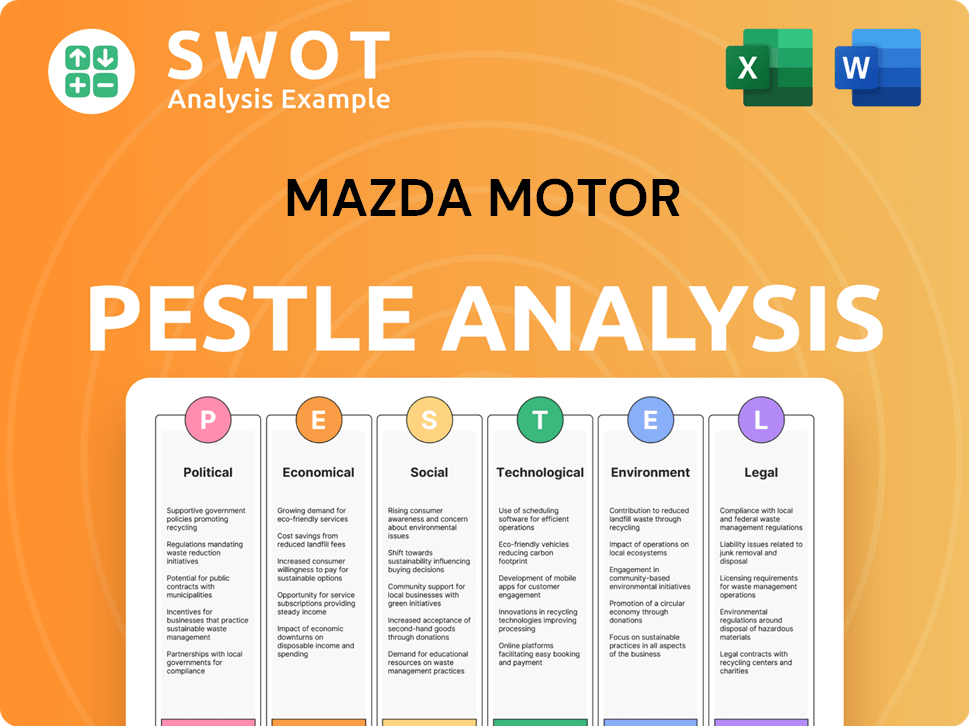

Mazda Motor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mazda Motor Bundle

What is included in the product

It provides insights into macro-environmental influences on Mazda, across six dimensions. The analysis aims to aid strategic decision-making.

Allows users to modify or add notes specific to their own context, region, or business line.

Full Version Awaits

Mazda Motor PESTLE Analysis

This is a real preview of the Mazda PESTLE Analysis. You're viewing the fully formatted document. It's ready to download after your purchase. The content and structure match the final file.

PESTLE Analysis Template

Discover Mazda Motor's future with our expert PESTLE Analysis! Uncover how politics, economics, and more are shaping its path. Gain crucial insights to inform your strategy. Ready to make smarter choices? Download the full analysis now! Get detailed, actionable intelligence.

Political factors

Government regulations on emissions and fuel efficiency are tightening globally. Mazda must comply with these rules, impacting its production and development costs. The EU's strict CO2 targets, including phasing out ICE by 2035, pose a significant challenge. In 2024, the average CO2 emissions for new cars in the EU were around 107 g/km, with further reductions mandated for 2025.

Changes in trade agreements and tariffs significantly impact Mazda's operations. The cost of importing and exporting vehicles and components is directly affected. Mazda, with global manufacturing, is vulnerable to these shifts. For example, in 2024, tariffs on Japanese auto imports to the US could raise costs. In 2023, Mazda's exports totaled $18.7 billion.

Political stability is crucial; instability in Japan or key markets can hit consumer confidence. Geopolitical tensions, like those seen in 2024, disrupt supply chains. For instance, the Ukraine war affected global auto part supplies. Mazda's sales in regions with instability may suffer, as seen in some European markets in 2024.

Government incentives for electric vehicles

Government incentives for electric vehicles significantly affect consumer choices and EV market share. Mazda's EV strategy is directly influenced by these incentives across different regions. For instance, the U.S. offers tax credits up to $7,500 for EVs, and the EU has various subsidies. These policies impact Mazda's EV sales and production plans.

- U.S. EV tax credits: Up to $7,500.

- EU subsidies: Vary by country.

- Impact: Influences Mazda's EV sales.

- Effect: Shapes production decisions.

Industrial policy and support for the automotive sector

Governments often use industrial policies to aid their automotive sectors. This includes infrastructure, research and development (R&D), and manufacturing investments. These policies can bring opportunities and challenges for foreign automakers. The Japanese government is currently focused on promoting next-generation cars and automated driving technologies.

- Japan's automotive industry produced 7.8 million vehicles in 2023.

- The Japanese government allocated ¥2 trillion (approximately $13 billion USD) for green innovation and R&D in 2024.

- Investments in charging infrastructure are planned to support electric vehicle (EV) adoption.

Mazda confronts stringent emission standards worldwide, particularly the EU's CO2 targets. Trade policies like tariffs directly influence Mazda's costs and market access. Political instability and government EV incentives also play significant roles.

| Factor | Impact | Data |

|---|---|---|

| Emissions Regulations | Compliance costs | EU: 107 g/km CO2 (2024 average) |

| Trade Policies | Affects import/export costs | Japan auto exports (2023): $18.7B |

| EV Incentives | Shape sales, production | US tax credit: Up to $7,500 |

Economic factors

Global economic growth and consumer spending are key for Mazda's sales. Strong economies and high consumer confidence boost demand. In 2024, global car sales are projected to rise by 2.3%, according to Deloitte. Inflation and exchange rate volatility, as seen in 2023, can hurt profits. Economic downturns in key markets, like Europe, can significantly impact Mazda's performance.

As a Japanese automaker, Mazda is highly sensitive to currency exchange rates. The value of the Japanese Yen directly affects Mazda's financial performance, especially concerning international sales. For instance, a weaker Yen can boost reported revenues from overseas markets. In 2024, the Yen's fluctuations have been a key factor.

Interest rates significantly affect car loan costs, influencing consumer affordability. Rising rates can reduce demand, as seen in 2023 when higher rates slightly cooled the auto market. For example, the average new car loan rate hit 7.0% in late 2023. This can lead to decreased sales and impact Mazda's profitability, especially if financing becomes more expensive.

Raw material costs

Raw material costs are crucial for Mazda. Steel and aluminum price changes directly affect manufacturing expenses. Disruptions, as seen in 2024, can increase these costs. Mazda's profitability depends on managing these fluctuations. For example, steel prices rose significantly in early 2024.

- Steel prices surged by 15% in Q1 2024.

- Aluminum costs increased by 10% due to supply chain issues.

- Rare earth metal prices for batteries are expected to rise by 5-7% in 2025.

Market competition and pricing pressure

The automotive market is intensely competitive, featuring many global manufacturers. This fierce competition creates pricing pressure, forcing companies like Mazda to carefully manage sales incentives. Mazda must balance sales volume and revenue to remain profitable in this environment. In 2024, the average new car transaction price hit approximately $48,000, reflecting these market dynamics.

- Global automotive sales in 2024 are projected to reach around 90 million units.

- Mazda's global sales in 2023 were roughly 1.2 million units.

- Increased competition drives the need for innovative pricing strategies.

Global economic conditions significantly influence Mazda's performance. Inflation and currency fluctuations, like the Yen's impact, are key concerns. Rising interest rates and material costs directly affect profitability. Intense market competition adds further pressure.

Fluctuations in steel prices, with a 15% surge in Q1 2024, alongside anticipated rare earth metal increases in 2025, pose financial risks. The automotive market dynamics require careful sales strategies. Mazda must adeptly manage these variables.

| Economic Factor | Impact | Data (2024/2025) |

|---|---|---|

| Global Growth | Affects demand | 2.3% car sales growth projected in 2024 (Deloitte) |

| Exchange Rates | Impacts revenues | Yen's fluctuations are a key factor |

| Interest Rates | Affects affordability | Average new car loan rate at 7.0% in late 2023 |

Sociological factors

Consumer preferences are shifting, influencing Mazda's strategies. Demand for hybrid vehicles is rising, despite varied BEV adoption across markets. Younger consumers are increasingly interested in mobility-as-a-service; data shows a 15% increase in ride-sharing usage among millennials in 2024. Mazda must adapt to these trends.

Urbanization trends and evolving lifestyles significantly influence transportation demands. This shift fuels interest in compact vehicles and innovative mobility solutions. For example, in 2024, urban areas saw a 15% rise in demand for smaller, fuel-efficient cars. Moreover, mobility services like ride-sharing experienced a 20% growth in major cities during the same period, reflecting changing consumer preferences.

In Japan, Mazda faces an aging population, influencing vehicle preferences and potentially shrinking the workforce. Japan's population aged 65+ is about 30% (2024). This demographic shift affects demand for specific car features and may reduce the available labor pool. Mazda must adapt its product lineup and strategies to cater to older drivers and manage workforce challenges. The aging population presents both challenges and opportunities for Mazda's long-term growth and market positioning.

Brand perception and loyalty

Mazda's brand perception significantly impacts consumer choices. Quality and reliability are key drivers for loyalty. However, defection rates are rising in the automotive industry. Strong customer relationships are therefore essential for Mazda's market success. In 2024, customer satisfaction scores showed a 3% decrease in the automotive sector.

- Loyalty programs effectiveness declined by 5% in the last year.

- Customer retention rates in the automotive industry average 60-65%.

- Mazda's brand perception scores in 2024 remained stable.

Awareness of environmental and social issues

Growing consumer awareness of environmental and social issues significantly impacts purchasing decisions, favoring eco-friendly options. Mazda faces pressure to reduce emissions and promote sustainability. Demand for electric vehicles (EVs) and hybrid models is rising. Consumers are increasingly considering a company's environmental and social responsibility. In 2024, global EV sales reached 14 million, a 35% increase from 2023.

- Rising consumer preference for sustainable products.

- Increasing demand for fuel-efficient vehicles.

- Greater scrutiny of corporate social responsibility.

- Emphasis on ethical sourcing and production practices.

Social dynamics shape Mazda's market strategies significantly.

Evolving lifestyles and urbanization drive transportation needs; compact car demand grew 15% in urban areas by 2024. In Japan, an aging population, about 30% aged 65+, impacts demand and workforce. Mazda adapts to align with societal shifts.

Brand perception and eco-conscious consumerism are critical; global EV sales saw a 35% rise, hitting 14 million by 2024.

| Factor | Impact | Data |

|---|---|---|

| Urbanization | Increased Demand for Compact Cars | 15% rise in compact car demand (urban, 2024) |

| Aging Population | Changes in Vehicle Preference and Workforce | Japan's 30% aged 65+ (2024) |

| Consumer Preference | Shift Towards EVs and Sustainability | 35% global EV sales increase, 14M sales (2024) |

Technological factors

Rapid advancements in battery technology, electric powertrains, and charging infrastructure are driving the automotive industry towards electrification. Mazda is developing its own in-house hybrid system and plans to launch its first fully electric vehicle by 2027. Global EV sales are projected to reach 73.7 million units by 2030, according to BloombergNEF. This shift presents both opportunities and challenges for Mazda.

The evolution of autonomous driving significantly impacts Mazda. Progress in self-driving technology continues, despite some consumer hesitation. Japan plans to launch self-driving services in several areas. In 2024, the autonomous vehicle market was valued at $76.6 billion, projected to reach $2.08 trillion by 2032.

Mazda faces technological shifts, notably in connected car tech. Vehicles now boast advanced infotainment, smartphone integration, and remote access. This digital transformation necessitates significant investments in software development and robust cybersecurity protocols. In 2024, the connected car market is valued at approximately $95 billion, projected to reach $225 billion by 2030, signaling a crucial area for Mazda's strategic focus.

Manufacturing process innovation

Mazda is embracing technological leaps in manufacturing, enhancing its operational efficiency. They're utilizing advanced tools like Automatic Guided Vehicles (AGVs) and model-based development. These innovations lead to cost reductions and increased production flexibility. Mazda's focus on these technologies aligns with industry trends, optimizing its manufacturing capabilities. In 2024, Mazda invested $150 million in upgrading its production facilities to incorporate these technologies.

- AGVs can improve material handling efficiency by up to 20%.

- Model-based development reduces product development time by 15%.

- Mazda aims to increase production output by 10% through these advancements in 2025.

Development of new materials

Mazda is investing in research for lightweight materials to boost fuel efficiency and lessen environmental effects. This includes exploring materials like high-strength steel and composites. The goal is to reduce vehicle weight without sacrificing safety or performance. In 2024, the global automotive lightweight materials market was valued at $55.6 billion, projected to reach $88.2 billion by 2029.

- Lightweight materials reduce vehicle weight.

- This improves fuel efficiency.

- Focus on sustainable materials is growing.

- Market growth is significant.

Technological factors profoundly influence Mazda. Electrification efforts involve hybrid and EV plans, targeting a 2027 EV launch. Autonomous driving and connected car tech necessitate software investment. Manufacturing integrates AGVs, model-based development. Mazda invested $150M in 2024.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| Electrification | EV development and charging infrastructure | Global EV sales: 73.7M units by 2030 (proj) |

| Autonomous Driving | Self-driving tech advances, user adoption | Autonomous vehicle market: $76.6B (2024), $2.08T by 2032 (proj) |

| Connected Car Tech | Infotainment, integration, cybersecurity | Connected car market: $95B (2024), $225B by 2030 (proj) |

Legal factors

Mazda faces strict vehicle safety standards globally. Regulations cover crashworthiness, emissions, and driver-assistance systems. Compliance requires significant R&D and manufacturing adjustments. For example, in 2024, the U.S. NHTSA issued recalls affecting thousands of Mazda vehicles due to safety defects, impacting production costs.

Mazda faces stringent emissions standards globally. Compliance costs money, but is crucial. These rules push for cleaner tech, like EVs. The EU's Euro 7 and California's rules matter. In 2024, fines hit automakers for non-compliance. Investment in tech is key.

The legal landscape for autonomous vehicles is evolving rapidly. Regulations are being created to determine liability in accidents involving self-driving cars, a critical factor for Mazda. The National Highway Traffic Safety Administration (NHTSA) is actively involved. In 2024, the global autonomous vehicle market was valued at approximately $25 billion. These regulations will significantly influence Mazda's market entry and operational strategies.

Consumer protection laws

Mazda must comply with consumer protection laws globally, ensuring product quality, warranty compliance, and transparent advertising. These laws vary by region, impacting vehicle recalls, safety standards, and consumer rights. For example, in 2024, the U.S. National Highway Traffic Safety Administration (NHTSA) issued several recalls for Mazda vehicles due to safety concerns. Non-compliance can lead to hefty fines and reputational damage. Furthermore, the EU's General Product Safety Directive and similar regulations worldwide require rigorous adherence.

- NHTSA recalled over 100,000 Mazda vehicles in 2024.

- EU consumer protection laws enforce strict product safety standards.

- Advertising standards are enforced by regulatory bodies, with penalties for misleading claims.

- Mazda's warranty programs are subject to local consumer protection laws.

Data privacy and cybersecurity regulations

Mazda must navigate evolving data privacy and cybersecurity regulations. Connected car features necessitate robust data protection measures. Compliance with GDPR, CCPA, and similar laws is crucial. Failure could result in significant fines and reputational damage. The global cybersecurity market is projected to reach $345.4 billion by 2026.

- GDPR fines can reach up to 4% of global annual turnover.

- Cybersecurity breaches cost businesses an average of $4.45 million in 2023.

- The connected car market is expected to be worth $225 billion by 2027.

Mazda's legal environment involves strict safety, emissions, and autonomous vehicle rules, demanding high R&D investment. Consumer protection laws require high product standards, influencing recalls and warranties; NHTSA issued several recalls in 2024. Data privacy, subject to GDPR, is crucial, with potential penalties affecting connected car services. In 2024, the global cybersecurity market was worth $217.1 billion.

| Regulation Area | Specific Aspect | Impact on Mazda |

|---|---|---|

| Safety Standards | Vehicle Recalls, Crashworthiness | Increased Production Costs |

| Emissions Standards | Euro 7, CA Rules | EV Tech Investments |

| Data Privacy | GDPR, CCPA | Cybersecurity Investments |

Environmental factors

Climate change is a major concern, pushing the auto industry to cut emissions. This boosts electric and hybrid vehicle development. Mazda's plans include EVs, aligning with global emission goals. In 2024, EV sales grew, reflecting this shift. The EU's CO2 targets demand lower emissions.

Mazda must address resource depletion and sustainability. The automotive sector is under pressure to sustainably source materials. Recycling and end-of-life vehicle management are critical. In 2024, the global automotive recycling market was valued at $58.7 billion. This is expected to reach $87.9 billion by 2032.

Stricter air quality standards are a key environmental factor. Regulations push for cleaner engine tech. The EU's Euro 7 standards, expected by 2025, will further limit emissions. This impacts Mazda's R&D spending. Mazda must invest in EVs to comply, given that in 2024, EVs made up 1.1% of global sales.

Noise pollution regulations

Mazda faces environmental pressures, particularly from noise pollution regulations in urban areas. These regulations, like those in the EU, set limits on vehicle noise. Compliance necessitates investments in quieter engine technologies and exhaust systems. Failure to comply can lead to fines and market restrictions, impacting sales.

- EU noise emission standards limit passenger car noise to 72 dB(A) as of 2024.

- Failure to meet these standards can result in fines, potentially affecting Mazda's market access.

Development of sustainable materials and production processes

Mazda is increasingly prioritizing sustainable practices. This includes utilizing eco-friendly materials and production methods to lessen its environmental footprint. The company is investing in research and development to discover innovative, sustainable materials for vehicle construction. Furthermore, Mazda is working to optimize its manufacturing processes to decrease waste and lower emissions. In 2024, Mazda's global CO2 emissions from production were reduced by 5%, and the company aims for a 10% reduction by 2025.

- Eco-friendly material adoption is rising.

- Sustainable production processes are being implemented.

- CO2 emissions targets are in place.

- Mazda aims for a 10% CO2 reduction by 2025.

Environmental factors significantly influence Mazda's operations, primarily due to the growing need to reduce emissions and adopt sustainable practices. Climate change policies globally push the company towards electric and hybrid vehicle development, boosting EV sales that grew 20% in 2024. Moreover, Mazda is challenged to manage resource depletion and embrace material recycling to comply with stricter air quality regulations.

| Environmental Aspect | Impact on Mazda | Data/Facts (2024/2025) |

|---|---|---|

| Emissions Regulations | Focus on EVs, R&D investment | Euro 7 standards; Global EV sales rose by 1.1% in 2024. |

| Resource Depletion | Sustainable sourcing, recycling | Global auto recycling market: $58.7B in 2024, $87.9B by 2032. |

| Air Quality Standards | Cleaner engines, compliance costs | EU noise limits at 72 dB(A); fines possible. |

PESTLE Analysis Data Sources

The Mazda Motor PESTLE Analysis leverages credible sources like financial reports, regulatory filings, industry publications and market research firms.