Medexus Pharma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medexus Pharma Bundle

What is included in the product

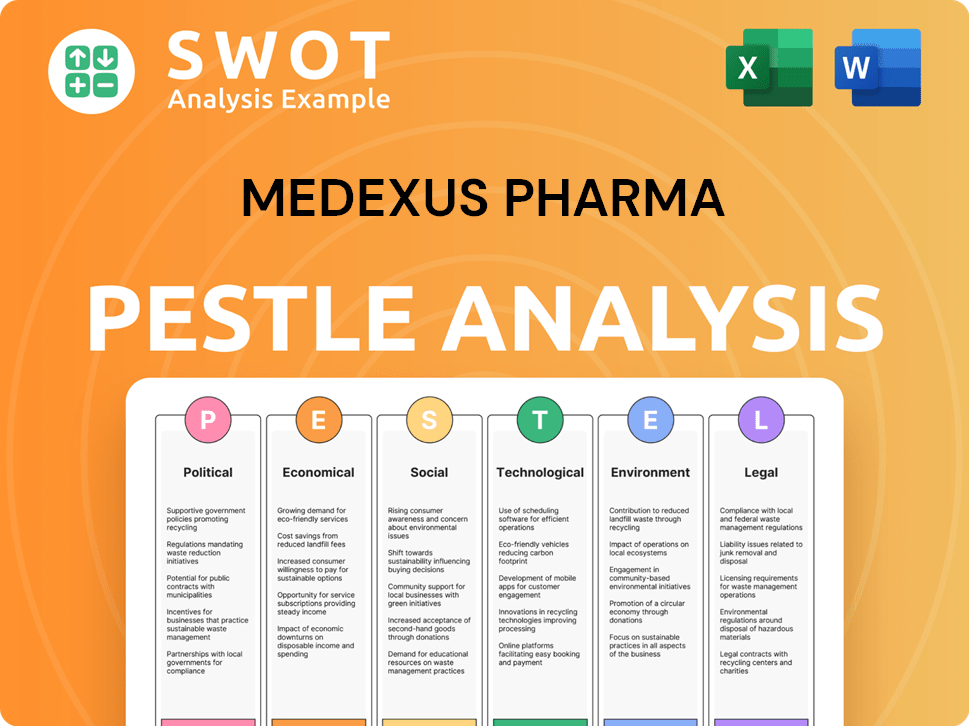

Analyzes Medexus Pharma's external factors: Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise summary enabling rapid strategy discussions and decision-making.

Preview the Actual Deliverable

Medexus Pharma PESTLE Analysis

The Medexus Pharma PESTLE Analysis preview is identical to your final download. You'll receive this comprehensive analysis instantly after purchase. Examine the detailed examination of political, economic, social, technological, legal, and environmental factors. What you see now is precisely what you’ll download, ready to be used.

PESTLE Analysis Template

Navigating the pharmaceutical landscape demands understanding. Our PESTLE Analysis, crafted for Medexus Pharma, reveals key external forces impacting its trajectory. Discover how regulations, economic factors, social trends, and more are reshaping the company’s future. Uncover hidden opportunities and mitigate potential risks. Gain a strategic edge: download the full analysis now for in-depth insights.

Political factors

Government healthcare policies are crucial for Medexus Pharma, affecting drug pricing, market access, and reimbursement. Policy changes, like those in U.S. Medicare and Medicaid, directly influence profitability. For instance, in 2024, the Inflation Reduction Act's drug price negotiation could impact Medexus. These policies can also influence the accessibility of Medexus's products, impacting patient care and revenue streams. The company must navigate these evolving regulations to maintain market competitiveness.

Regulatory hurdles significantly shape Medexus Pharma's market entry. The FDA and Health Canada's approval processes are key. Delays, like those for Treosulfan, affect revenue. In 2024, FDA reviews averaged 10-12 months; Health Canada, 12-18 months. These timelines directly impact Medexus's financial forecasts.

Medexus benefits from political stability in North America. Stable trade relations with Western Europe are critical. In 2023, the pharmaceutical industry saw a 5% increase in trade with Europe. Changes in trade policies could disrupt Medexus's supply chain. Political uncertainty could impact market access and regulatory processes.

Government Funding and Budget Allocation

Government funding significantly impacts the pharmaceutical industry. Increased healthcare spending, as seen with a 6.3% rise in U.S. healthcare expenditures in 2023, can boost demand. Budget allocations for specific therapeutic areas like oncology, where Medexus has interests, are crucial. Shifts in funding can alter market opportunities, influencing R&D and product adoption rates.

- U.S. healthcare spending reached $4.7 trillion in 2023.

- Oncology drugs market is projected to reach $300 billion by 2025.

Intellectual Property Protection Policies

Intellectual property (IP) protection, including patents and regulatory exclusivity, is critical for Medexus Pharma. Strong IP safeguards innovative products and ensures market exclusivity, protecting revenue streams. Any alterations or challenges to these policies could significantly affect Medexus. The pharmaceutical industry heavily relies on these protections to foster innovation and recoup investments. For example, in 2024, the US granted over 30,000 pharmaceutical patents.

- Patent laws: vital for protecting innovative products.

- Regulatory exclusivity: grants market protection.

- Policy changes: could affect Medexus's revenue.

- Industry reliance: IP supports innovation and investment.

Political factors profoundly influence Medexus Pharma. Government healthcare policies like the Inflation Reduction Act affect drug pricing. Regulatory approvals from the FDA and Health Canada impact market entry. Stable trade relations and IP protection are vital.

| Factor | Impact | Data |

|---|---|---|

| Drug Pricing | Influenced by policies | US Medicare drug negotiations |

| Market Access | Dependent on regulations | FDA reviews (10-12 months in 2024) |

| Trade | Critical for supply chain | Pharma trade with Europe (5% up in 2023) |

Economic factors

Healthcare spending levels significantly impact Medexus's product demand. In 2024, total U.S. healthcare spending reached approximately $4.8 trillion, with projections showing continued growth. Reimbursement rates from payers, both public and private, heavily influence the accessibility and profitability of Medexus's drugs. Decisions by entities like the Centers for Medicare & Medicaid Services (CMS) directly affect patient access and the company's revenue streams.

Medexus faces pricing pressures due to managed care and government programs. The company must show its drugs offer good value for money. In 2024, the pharmaceutical industry saw price controls in several markets. This impacts profitability. Competition also adds to these pricing challenges.

Economic growth and stability significantly impact Medexus Pharma. General economic conditions, including inflation and interest rates, affect operational costs. A robust economy could increase healthcare spending. In 2024, the US GDP grew by 3.1%, influencing healthcare investments. Market volatility also plays a role.

Currency Exchange Rates

As a Canadian entity with U.S. operations, Medexus is exposed to currency exchange rate risks. The Canadian dollar's value against the U.S. dollar directly affects revenue and profitability. For instance, a stronger U.S. dollar boosts reported earnings when converting U.S. sales. Conversely, a weaker U.S. dollar reduces the value of U.S. sales in Canadian dollar terms.

- In 2024, the CAD/USD exchange rate fluctuated, impacting financial results.

- A 1% change in the exchange rate can significantly affect net income.

- Medexus uses hedging strategies to mitigate these risks.

Competition and Market Access

Competition and market access significantly affect Medexus Pharma's economic standing. The pharmaceutical sector faces intense competition, including from generics, influencing pricing and market share. Medexus must navigate this landscape strategically to sustain its revenue streams. Gaining and keeping market access for its products is crucial for its financial health.

- Generic drugs account for roughly 90% of prescriptions in the US, intensifying competition.

- Market access is determined by factors such as payer coverage, which has a direct impact on sales.

- Medexus's financial reports for 2024 showed a focus on strategic partnerships to enhance market access.

Healthcare expenditure and reimbursement rates significantly affect Medexus Pharma's demand and revenue streams. Economic conditions, including interest rates and market volatility, play a crucial role in its operational costs and investment decisions. Currency exchange rates pose risks. In 2024, the fluctuation of CAD/USD rates substantially affected Medexus's financial results.

| Factor | Impact | 2024 Data |

|---|---|---|

| Healthcare Spending | Impacts product demand | US spending: ~$4.8T |

| Pricing Pressures | Affects profitability | Pharma price controls increased |

| Exchange Rates | Affects revenue, profitability | CAD/USD volatility |

Sociological factors

The aging North American population fuels demand for Medexus's treatments. Autoimmune diseases and hematology are key areas benefiting from this trend. Data from 2024 shows a growing elderly population. The sustained demand offers Medexus a solid market. This supports long-term growth prospects.

Patient advocacy groups amplify awareness of conditions and therapies, potentially boosting demand for Medexus's offerings. These groups influence healthcare policies and reimbursement, crucial for Medexus. For example, the National Organization for Rare Disorders (NORD) advocates for rare disease treatments. In 2024, NORD supported over 300 rare disease patient organizations. Their efforts impact market access and sales.

Healthcare is shifting towards personalized medicine and patient-centric care. This affects demand for targeted therapies, a Medexus strength. The global personalized medicine market is projected to reach $750.7 billion by 2028. Medexus's specialty focus aligns with this trend. Patient preferences for convenience and access are also key. Telehealth use grew significantly, with 37% of US adults using it in 2024.

Public Perception and Trust

Public perception significantly influences Medexus Pharma's market success. Trust in pharmaceutical companies fluctuates; ethical conduct and product safety are paramount. Negative perceptions can hinder product adoption by patients and physicians. Maintaining a positive image through transparency and accountability is crucial for Medexus.

- In 2024, the pharmaceutical industry's reputation scores varied, with some companies facing scrutiny.

- Patient trust directly correlates with product uptake and market share.

- Ethical practices, including fair pricing and transparent clinical trials, boost public trust.

Lifestyle Factors and Disease Prevalence

Lifestyle significantly shapes disease prevalence, directly impacting Medexus's market. For instance, rising obesity rates correlate with increased demand for treatments related to diabetes and cardiovascular issues. Shifts in dietary habits or exercise levels can alter disease incidence, affecting product demand. Understanding these lifestyle trends is crucial for Medexus's strategic planning.

- Obesity rates in the U.S. have reached approximately 42.4% as of 2024.

- The global diabetes market is projected to reach $79.9 billion by 2029.

- Cardiovascular diseases cause approximately 800,000 deaths annually in the U.S.

An aging population in North America drives Medexus's market. Patient advocacy groups influence policies, impacting market access. Personalized medicine and patient-centric care are crucial trends. Public perception, ethical conduct, and product safety are paramount.

| Sociological Factor | Impact on Medexus | Data/Example (2024-2025) |

|---|---|---|

| Aging Population | Increased demand | Elderly population grew; autoimmune and hematology markets expand. |

| Patient Advocacy | Influences market access | NORD supported over 300 rare disease organizations. |

| Personalized Medicine | Aligns with Medexus's strength | Global personalized medicine market projected at $750.7B by 2028. |

| Public Perception | Affects product adoption | Pharma reputation varied; trust impacts market share. |

| Lifestyle Trends | Shapes disease prevalence | U.S. obesity rate ~42.4%; diabetes market ~$80B by 2029. |

Technological factors

Technological advancements in drug discovery, development, and manufacturing are crucial. Medexus can use tech to improve treatments, and expand its portfolio. In 2024, AI and machine learning sped up drug development by 20%. Partnering could boost innovation, and potentially increase revenue by 15% in the next 2 years.

Medexus Pharma's reliance on third-party manufacturers and distributors means technological integration in manufacturing and supply chain is vital. Advanced technologies are essential for maintaining product quality and operational efficiency. In 2024, the global pharmaceutical supply chain market was valued at $117.1 billion. The market is expected to reach $166.8 billion by 2029.

Digital health, data analytics, and AI are transforming pharma. Medexus is integrating AI, potentially boosting efficiency. The global digital health market is projected to reach $660 billion by 2025. AI can accelerate drug discovery, reduce costs, and improve patient outcomes. This impacts Medexus's R&D, marketing, and patient support.

Patient Monitoring and Delivery Technologies

Technological factors significantly influence Medexus Pharma. Advancements in patient monitoring and drug delivery enhance treatment and patient experience. Medexus might integrate these technologies. The global patient monitoring market is projected to reach $41.5 billion by 2029. This presents opportunities for Medexus.

- Smart devices can improve patient adherence.

- Drug delivery systems can enhance efficacy.

- Telemedicine integration expands reach.

Information Technology and Data Security

Medexus Pharma must prioritize robust IT systems and data security. This is crucial for safeguarding patient and company data, and for regulatory compliance. The healthcare industry faces increasing cyber threats; in 2024, healthcare data breaches cost an average of $11 million per incident. Strong cybersecurity measures are vital to maintain operational integrity and patient trust.

- Data breaches in healthcare have increased by 74% since 2019.

- The average cost of a healthcare data breach in 2024 is $11 million.

- Compliance with regulations like HIPAA is essential to avoid penalties.

Technological advancements shape Medexus Pharma's prospects. AI and machine learning accelerate drug development; digital health and data analytics are transforming pharma, and by 2025, the digital health market could hit $660 billion. Moreover, robust IT systems and cybersecurity are critical for safeguarding data. The industry saw a 74% increase in data breaches since 2019.

| Technology Aspect | Impact | Financial Data |

|---|---|---|

| AI in Drug Development | Speeds up R&D | Potentially boosts revenue by 15% in 2 years |

| Digital Health Market | Transforming Patient Care | Projected $660B market by 2025 |

| Cybersecurity Needs | Protecting Data and Operations | $11M average cost of healthcare breach in 2024 |

Legal factors

Medexus faces stringent regulations across Canada and the U.S. These rules oversee drug development, production, and sales. Compliance is crucial for market access. Non-compliance can lead to hefty fines or market restrictions. Regulatory changes can impact drug approvals and timelines.

Drug pricing and reimbursement laws are crucial for Medexus. Regulations from government programs and private insurers affect the company's revenue. In 2024, changes in drug pricing policies could impact profitability. For example, the Inflation Reduction Act of 2022 continues to reshape drug pricing. These changes require constant adaptation by Medexus.

Intellectual property (IP) laws, including patents and trademarks, are crucial. These laws safeguard Medexus's innovative products. For instance, in 2024, the pharmaceutical industry faced about $80 billion in losses due to patent expirations. Strong IP protection is vital to fend off generic competition and maintain market share. These laws significantly impact Medexus's financial performance and strategic planning.

Healthcare Fraud and Abuse Laws

Medexus Pharma must adhere to stringent healthcare fraud and abuse laws, including the Anti-Kickback Statute and the False Claims Act, to prevent illegal activities. These regulations aim to safeguard against unethical practices such as improper inducements and fraudulent claims submissions. Non-compliance can lead to severe penalties, including substantial fines and potential exclusion from government healthcare programs. In 2024, the Department of Justice (DOJ) recovered over $1.8 billion in settlements and judgments in False Claims Act cases, highlighting the importance of compliance.

- The False Claims Act allows whistleblowers to file lawsuits on behalf of the government, receiving a portion of the recovered funds.

- The Anti-Kickback Statute prohibits offering or receiving remuneration to induce referrals for items or services reimbursed by federal healthcare programs.

- Healthcare fraud is a significant concern, with the Centers for Medicare & Medicaid Services (CMS) estimating billions of dollars in improper payments annually.

Product Liability and Litigation

Medexus Pharma, like all pharmaceutical companies, is exposed to product liability risks and litigation concerning its product's safety and effectiveness. These legal challenges can result in significant financial burdens, including substantial legal fees, settlements, and potential damage to the company's reputation. Strict adherence to stringent quality control and safety protocols is critical to mitigate these risks. In 2024, the pharmaceutical industry saw a surge in product liability lawsuits, with settlements averaging $300 million.

- 2024 saw an increase in product liability lawsuits.

- Average settlements in 2024 were around $300 million.

- Compliance with safety standards is crucial for risk mitigation.

- Legal costs can significantly impact profitability.

Medexus must navigate strict healthcare laws, including anti-kickback and fraud regulations, facing potential DOJ fines. Intellectual property rights, crucial for protecting its products, are constantly under pressure, particularly with generic competition. Product liability risks remain a concern.

| Aspect | Details | Impact |

|---|---|---|

| Healthcare Fraud | DOJ recovered $1.8B in 2024. | Compliance is critical; hefty fines. |

| IP Protection | ~$80B losses from expirations (2024). | Needs strong patent protection. |

| Product Liability | Avg. $300M settlements (2024). | Financial burden; reputation risk. |

Environmental factors

Medexus, outsourcing manufacturing, faces environmental regulations impacting partners and costs. The pharmaceutical industry sees stricter rules. For example, the EPA's 2024 regulations target emissions. Compliance costs in 2024 rose 10-15% for some manufacturers. These costs may indirectly affect Medexus.

Medexus must comply with stringent regulations for pharmaceutical waste disposal, affecting its operations and customer practices. The global pharmaceutical waste management market was valued at USD 11.5 billion in 2023, expected to reach USD 17.2 billion by 2028. Proper disposal methods are crucial to protect the environment and public health. These measures include safe handling and disposal practices for expired or unused medications, impacting costs and logistics.

Medexus faces environmental scrutiny due to its supply chain. Transportation from European suppliers contributes to its carbon footprint. The pharmaceutical industry's logistics generate significant emissions. In 2024, supply chain emissions accounted for up to 80% of some pharma companies' total footprint. Medexus must address these impacts.

Corporate Environmental Responsibility

Medexus Pharma faces growing pressure regarding environmental responsibility. Investors and consumers increasingly prioritize sustainability. This could mean adopting eco-friendly practices. For example, the pharmaceutical industry's carbon footprint is under scrutiny. In 2024, the global green pharmaceuticals market was valued at $45.2 billion.

- Increased demand for sustainable packaging.

- Need for eco-friendly manufacturing processes.

- Potential for higher operational costs.

- Opportunities for green initiatives.

Climate Change and Extreme Weather Events

Climate change and extreme weather pose indirect risks to Medexus's operations. Disruptions in the supply chain, due to events like hurricanes or floods, could affect the availability of raw materials or finished products. Increased frequency of severe weather events globally, as observed in 2024 and projected for 2025, could lead to logistical challenges.

- The World Bank estimates that climate change could push over 100 million people into poverty by 2030, potentially impacting healthcare access.

- In 2024, the U.S. experienced 28 weather/climate disaster events, each exceeding $1 billion in losses.

- Supply chain disruptions have increased by 40% due to extreme weather in 2024.

Environmental factors significantly impact Medexus. Stricter regulations on emissions and waste disposal raise compliance costs, affecting its outsourced manufacturing partners. Increased focus on sustainability drives demand for green practices and eco-friendly packaging. Climate change and extreme weather pose supply chain risks, potentially impacting operations and profitability.

| Aspect | Impact | Data |

|---|---|---|

| Regulations | Increased costs, operational changes | EPA regs. caused 10-15% cost rise in 2024. |

| Waste | Higher disposal costs, logistics challenges | Pharma waste mkt: $11.5B (2023), $17.2B (2028). |

| Sustainability | New market demands and scrutiny | Green pharma mkt. value: $45.2B (2024). |

PESTLE Analysis Data Sources

The analysis uses data from public financial reports, market research, and healthcare regulatory bodies. We integrate economic forecasts and industry-specific news.