MercadoLibre Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MercadoLibre Bundle

What is included in the product

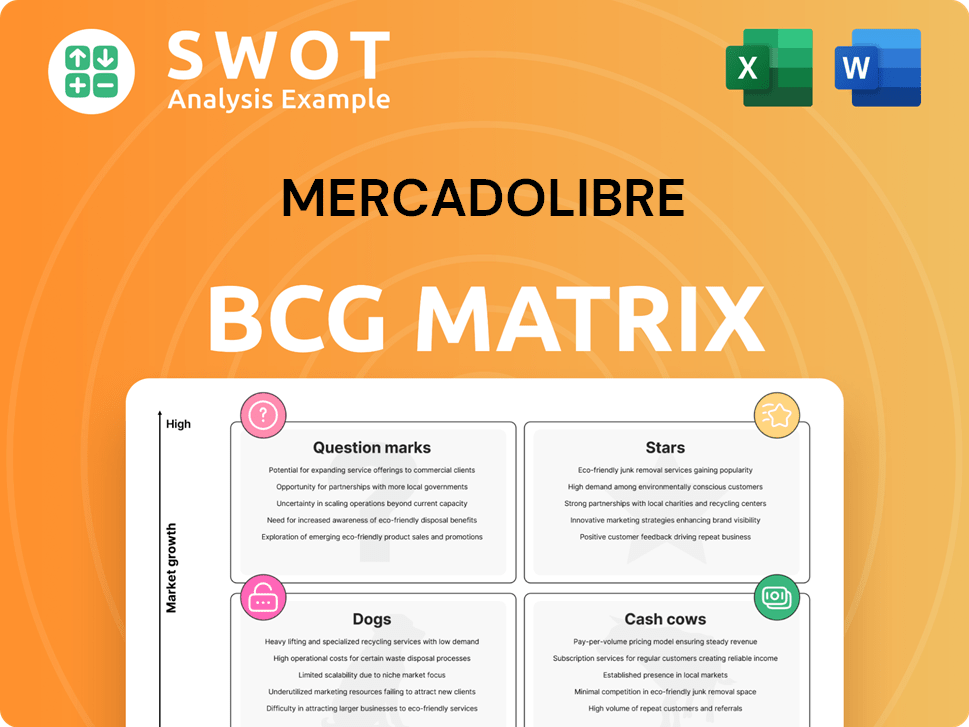

BCG Matrix breakdown for MercadoLibre's units: Stars, Cash Cows, Question Marks, and Dogs are analyzed.

Printable summary optimized for A4 and mobile PDFs, allowing for easy sharing and concise analysis.

Delivered as Shown

MercadoLibre BCG Matrix

The preview you're seeing is the complete MercadoLibre BCG Matrix you'll own after purchase. This strategic report is ready to use, offering insights for immediate application in your business planning.

BCG Matrix Template

MercadoLibre's BCG Matrix helps clarify its diverse offerings. It categorizes them into Stars, Cash Cows, Dogs, and Question Marks. This snapshot reveals which products drive growth and which ones may need reevaluation. See the initial quadrant assignments and preliminary insights. For a deeper dive, uncover detailed product placements and strategic recommendations. Purchase the full BCG Matrix for data-backed insights and a roadmap to smart decisions.

Stars

MercadoLibre's e-commerce platform shines as a "Star" in its BCG Matrix. It dominates Latin America's e-commerce, fueled by rising digital adoption. In Q4 2024, items sold jumped 27% YoY, confirming its robust growth. User experience enhancements and logistics investments boost its market lead.

Mercado Pago, a fintech division of MercadoLibre, is a star due to its rapid growth. It contributed 41% of MercadoLibre's consolidated revenue in Q3 2024. The platform's AUM surged 93% YoY, showing huge potential. Credit card TPV grew 166%, indicating a strong market presence.

MercadoLibre's advertising business shines as a "Star" in its BCG Matrix. Goldman Sachs forecasts ad revenue to hit $4 billion by 2028. MercadoLibre leads Latin America's retail media, with a 55% market share in 2023. This segment fuels both revenue and EBIT growth.

Credit Portfolio Expansion

MercadoLibre's credit portfolio is a "Star" in its BCG Matrix. The portfolio hit $6.6 billion in Q4 2024, a 74% year-over-year increase. Credit cards significantly fueled this expansion, showing strong growth. This success is due to better credit scoring and attractive offers.

- Credit portfolio reached $6.6B in Q4 2024.

- 74% YoY growth in credit portfolio.

- Credit cards are the main growth driver.

- Improved credit scoring models.

Logistics Network

MercadoLibre's logistics network shines as a star in its BCG matrix, driving exceptional efficiencies and market penetration. In 2024, the company launched ten new fulfillment centers, significantly boosting its operational capabilities. This expansion supported a record number of new buyers, fueled by enhanced free shipping options. Over 95% of shipments are now managed internally, ensuring swift and dependable delivery.

- New Fulfillment Centers: 10 in 2024

- Managed Shipments: Over 95%

- Key Differentiator: Logistics Network

MercadoLibre's e-commerce, fintech, advertising, credit, and logistics are "Stars" in its BCG Matrix. These segments drive revenue and market expansion. All show high growth and market dominance, supported by strategic investments. They contribute to MercadoLibre's success.

| Segment | Key Metric | 2024 Data |

|---|---|---|

| E-commerce | Items Sold YoY Growth | +27% |

| Mercado Pago | AUM YoY Growth | +93% |

| Advertising | Market Share (2023) | 55% |

| Credit Portfolio | Portfolio Value | $6.6B |

| Logistics | Internal Shipments | +95% |

Cash Cows

Brazil is MercadoLibre's largest market, generating 55% of its total revenue in Q3 2024. The Brazilian e-commerce market is mature, and MercadoLibre holds a significant market share. This dominance positions Brazil as a cash cow for MercadoLibre. The company's growth strategies and market penetration are capitalizing on rising e-commerce adoption.

Mexico is a cash cow for MercadoLibre, showing robust growth. In Q4 2024, GMV in Mexico surged by 28% (FX-neutral). MercadoLibre holds a strong market share, benefiting from Mexico's expanding e-commerce sector. This consistent performance underscores its leading market position.

MercadoLibre dominates Argentina's e-commerce. Despite economic hurdles, it remains a cash cow. In 2024, MercadoLibre saw strong user growth in Argentina. This is due to high customer loyalty. The company's revenue continues to grow steadily.

Payment Processing Services

Mercado Pago, a core part of MercadoLibre, acts as a cash cow through its robust payment processing services, the largest fintech acquirer in Latin America by TPV. The company's acquiring TPV hit $42 billion in Q4 2024, reflecting a 20% YoY increase. This growth underscores Mercado Pago's solid market position and its ability to generate consistent revenue. These services are key for attracting and keeping merchants.

- Mercado Pago's TPV in Q4 2024: $42 billion.

- TPV YoY growth: 20%.

- Mercado Pago is the largest fintech acquirer by TPV in Latin America.

- Focus on attracting and retaining merchants.

Digital Financial Services

MercadoLibre's digital financial services are a cash cow, offering digital accounts, investments, and insurance. These services consistently generate revenue, boosting overall profitability within Latin America. By providing financial access, MercadoLibre strengthens its fintech leadership. In 2024, Fintech revenue grew significantly, reaching $1.8 billion, marking a 30% year-over-year increase.

- Fintech revenue reached $1.8 billion in 2024.

- Year-over-year growth was 30%.

- Digital financial services contribute significantly to profitability.

- Provides financial access to a large user base.

MercadoLibre's cash cows are in mature markets and strong services. Brazil, Mexico, and Argentina are cash cows due to their market dominance. Mercado Pago and fintech services also act as cash cows.

| Cash Cow | Key Metrics (2024) | Contribution |

|---|---|---|

| Brazil | 55% of revenue | Dominant e-commerce market share |

| Mexico | GMV up 28% (Q4) | Strong market position, expanding e-commerce |

| Argentina | Strong user growth | Steady revenue despite economic challenges |

| Mercado Pago | TPV: $42B (Q4), YoY +20% | Largest fintech acquirer in Latin America |

| Fintech | Revenue: $1.8B, YoY +30% | Digital accounts, investments, and insurance |

Dogs

MercadoLibre's classifieds business faces challenges. Its market share and growth lag behind core e-commerce and fintech. Turning it around may need substantial investment. Classifieds' revenue contribution is limited. Considering low growth and share, it's likely a dog.

Some product categories on MercadoLibre might struggle with low growth and market share. These underperforming categories might not be a strategic focus for the company. In 2024, categories with slower sales growth could be considered dogs. These segments may see limited profitability.

MercadoLibre's presence spans 18 Latin American countries. Some, like Uruguay and Ecuador, show slower growth compared to giants like Brazil and Mexico. These smaller markets might not boost overall revenue much. Considering their limited growth and market share, they fit the "dog" category. For example, in 2024, MercadoLibre's revenue growth in Argentina lagged behind Brazil's.

Legacy Technology

MercadoLibre's older tech infrastructure might be a dog in the BCG matrix. These systems could be costly to maintain and upgrade. Their performance may not match newer platforms. Such legacy tech might hinder efficiency, as seen in other firms. Consider that in 2024, tech upgrades cost MercadoLibre a lot.

- High maintenance costs can strain resources.

- Outdated tech may limit innovation speed.

- Upgrades require substantial capital.

- Performance lags behind competitors.

Non-Core Business Ventures

MercadoLibre's "Dogs" represent underperforming non-core ventures. These ventures, potentially requiring substantial investment, may have limited revenue contributions. Low growth and market share characterize these businesses. For instance, ventures outside core e-commerce and fintech may be considered "Dogs."

- Investments in non-core ventures may not yield expected returns.

- Limited revenue contribution compared to core segments.

- Low market share and growth rates indicate underperformance.

- Examples could include specific, less successful expansions.

Dogs in MercadoLibre's BCG matrix denote underperforming segments with low growth and market share. These include classifieds and potentially slower-growing countries. Older tech infrastructure also fits this description due to high maintenance costs. Non-core ventures with limited revenue are also "Dogs".

| Category | Characteristics | Examples |

|---|---|---|

| Market Share | Low compared to competitors | Classifieds sector |

| Growth Rate | Slower than core segments | Specific Latin American countries |

| Financial Impact | Limited revenue contribution | Older tech infrastructure |

Question Marks

Expansion into new Latin American geographies positions MercadoLibre as a question mark in its BCG matrix. These markets, offering high growth potential, require significant investment for market share gains. Currently, MercadoLibre's net revenue growth in Latin America was 36.7% in 2024. The company's strategic focus includes expanding its FinTech services, which can be key for growth.

MercadoLibre is actively innovating with new fintech products, including crypto and blockchain. These initiatives have high growth potential, but currently possess low market share. Significant R&D investment is needed to boost market share and transform these into "stars." In Q3 2024, Mercado Pago's total payment volume (TPV) reached $41.6 billion, a 30.9% year-over-year increase, showing growth potential.

MercadoLibre expanded into insurance in Latin America, a high-growth market. However, its current market share is likely low compared to established insurers. Gaining ground will need substantial investment in marketing and distribution. In 2024, the Latin American insurance market saw $150 billion in premiums.

Digital Streaming Services

MercadoLibre's foray into digital streaming services positions it as a "Question Mark" in its BCG Matrix. Although the digital streaming market is experiencing substantial growth, MercadoLibre's market share faces strong competition. To compete effectively, significant investments in content and technology are essential. However, this involves considerable risk and uncertainty.

- Market growth: The global streaming market is projected to reach $1.09 trillion by 2029.

- Competition: Netflix and Spotify dominate the streaming industry.

- Investment: Content acquisition costs can be extremely high.

- MercadoLibre's market share: It is currently low compared to major competitors.

SME Financing

MercadoLibre's foray into SME financing positions it within the BCG matrix as a potential "question mark." This is because the SME financing market holds significant growth potential. However, MercadoLibre's initial market share in this sector might be low. Substantial investments in credit scoring and risk management are essential for capturing market share. These investments aim to establish a strong presence in SME financing.

- Market Growth: The SME lending market in Latin America is expanding, with a projected value of $26.3 billion by 2024.

- MercadoLibre's Strategy: It is offering loans and credit solutions to SMEs.

- Investment Needs: Significant investment is necessary for credit scoring models.

- Risk Management: Proper risk management is crucial for sustainable growth.

MercadoLibre’s streaming services, positioned as "Question Marks," operate in a rapidly growing market. However, they face stiff competition, requiring significant investment to increase market share. The global streaming market is forecast to hit $1.09 trillion by 2029, indicating immense growth potential.

| Aspect | Details | Financial Data (2024) |

|---|---|---|

| Market Growth | Global streaming market expansion | Projected $1.09T by 2029 |

| Competition | Key players: Netflix, Spotify | Netflix had ~$33.7B revenue in 2023 |

| Investment | Content & Technology | Content costs are high. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data: MercadoLibre's financial statements, market analysis, and competitor assessments to ensure strategic decisions.